PowerPoint Slides 8

FIN 468: Intermediate

Corporate Finance

Topic 8 –Cost of Capital

Larry Schrenk, Instructor

1 (of 22)

Topics

Excel: Linear Regression

Project Review

Cost of Capital

Equity

Debt

Preferred Shares

Excel:

Linear Regression

3 (of 36)

Excel Features: Linear Regression

Linear regression finds the line that best fits a series of points. In finance, it is often used to find the beta ( b ) of a firm’s equity.

In our example, we shall find the beta of MMM using the S&P 500 as a proxy for the market.

Since we want to know the sensitivity of the return on MMM to changes in the return on the

S&P 500, the return on MMM is the dependent variable (y axis) and the return on the S&P 500 the independent variable (x-axis).

Excel Features: Linear Regression

1) You need to have the returns of the assets arranged in columns:

Excel Features: Linear Regression

2) Click on Data Analysis under the ‘Tools’ dropdown menu to open the Data Analysis window.

Then select ‘Regression’ and click on ‘OK’.

Excel Features: Linear Regression

3) The Regression window will appear.

Excel Features: Linear Regression

4) In the regression window, input the cells for the y variable (MMM) and the x variable (S&P 500). Click on the ‘Line Fit Plots’ box and click on ‘OK’.

Excel Features: Linear Regression

5) A new worksheet will appear with the results and a graph.

Excel Features: Linear Regression

6) The blue squares are data points and the pink squares are the corresponding points on the best-fit line.

Excel Features: Linear Regression

7) Here is the same graph with a dashed line drawn though the points.

Excel Features: Linear Regression

8) The summary statistics provide a wealth of information about the regression. In particular the beta is the coefficient of the x variable.

Project Review

13 (of 36)

Project Review I

Provide a brief discussion of the company’s products, markets, and competitors.

Provide a brief discussion of the top management, their qualifications, experience, and how long they have been with the company. Are any of the managers considered a key person that would hurt the firm if they left?

Provide a brief discussion of any risks the firm may face such as competitive pressure, product obsolescence, lawsuits etc.

14 (of 70)

Project Review II

Perform a ratio analysis of at least the last 3 years.

Comparative industry

Trends over time

Explain major changes and deviations from industry

Create a pro-forma 5 year income forecast

Calculate FCF over next five years and a terminal value

Estimate firm’s cost of equity capital using one or more of the following methods:

CAPM

Discounted Cash Flow

Own-Bond-Yield-Plus-Risk-Premium

15 (of 70)

Cost of Capital

16 (of 36)

17

Cost of Capital

Rate of return that the suppliers of capital – bondholders and stockholders require as compensation for their contributions of capital

Leverage and Marginal Cost

18

As firms take on more debt, financial leverage increases increasing the riskiness of the firm and causing lenders to require a greater return

Additional debt may therefore increase cost of capital

The marginal cost is the cost to raise the additional funds for the potential investment project

19

Firm vs. Project Cost of Capital

Cost of capital for entire company

Important for firm/security valuation

Cost of capital for a specific project

WACC must be adjusted for the riskiness of the project

20

Target Weights

Assume current capital structure is correct

Estimate capital structure based on historical trends

Use average of comparable companies capital structure

21

Choosing the Discount Rate

The numerator focuses on project cash flows.

NPV

CF

0

CF

1

( 1

r )

CF

2

( 1

r )

2

CF

3

( 1

r )

3

...

( 1

CF

r

N

)

N

The denominator is the discount rate.

Reflect the opportunity costs of the firm’s investors.

The denominator should:

Reflect the project’s risk.

Be derived from market data.

Cost of Equity Capital

22 (of 36)

Where Do We Stand?

Earlier chapters on capital budgeting focused on the appropriate size and timing of cash flows.

This chapter discusses the appropriate discount rate when cash flows are risky.

24

Asset Betas and Project Discount

Rates

When a firm uses no leverage, its equity beta equals its asset beta.

An unlevered beta simply tells us how risky the equity of a company might be if it used no leverage at all.

25

Finding the Right Discount Rate

1.

2.

When an all-equity firm invests in an asset similar to its existing assets, the cost of equity is the appropriate discount rate to use in NPV calculations.

When a firm with both debt and equity invests in an asset similar to its existing assets, the

WACC is the appropriate discount rate to use in NPV calculations.

The Cost of Equity Capital

From the firm’s perspective, the expected return is the Cost of Equity Capital:

i

r rf

i

(

M

r rf

)

• To estimate a firm’s cost of equity capital, we need to know three things:

1. Risk Free Rate

2. Risk Premium r rf

M

r rf

3. Beta

β i

Example

Suppose the stock of Stansfield Enterprises, a publisher of PowerPoint presentations, has a beta of

2.5. The firm is 100 percent equity financed.

Assume a risk-free rate of 5 percent and a market risk premium of 10 percent.

What is the appropriate discount rate for an expansion of this firm?

i

r rf

i

(

M

E

i

E

= 5% + 2.5 × 10%

i

__ ___

r rf

)

Example

B

C

Suppose Stansfield Enterprises is evaluating the following independent projects. Each costs $100 and lasts one year.

Project Project b Project’s

Estimated

Cash Flows

Next Year

IRR NPV at

30%

A 2.5

$150 50% $15.38

2.5

2.5

$130

$110

30%

10%

$0

-$15.38

Using the Security Market Line

SML

Good project

A

30% B

C

Bad project

5%

Firm’s risk (beta)

2.5

An all-equity firm should accept projects whose IRRs exceed the cost of equity capital and reject projects whose IRRs fall short of the cost of capital.

Estimation of Beta

Market Portfolio - Portfolio of all assets in the market. In practice, a broad stock market index, such as the S&P Composite, is used to represent or proxy the market.

Beta - Sensitivity of a stock’s return to the return on the market portfolio.

Estimation of Beta

• Problems

1. Betas may vary over time.

2. The sample size may be inadequate.

3. Betas are influenced by changing financial leverage and business risk.

• Solutions

– Problems 1 and 2 can be moderated by more sophisticated statistical techniques.

– Problem 3 can be lessened by adjusting for changes in business and financial risk.

– Look at average beta estimates of comparable firms in the industry.

Stability of Beta

Most analysts argue that betas are generally stable for firms remaining in the same industry.

That’s not to say that a firm’s beta can’t change due to …

Changes in production

Changes in operating leverage

Deregulation

Changes in financial leverage

Using an Industry Beta

It is frequently argued that one can better estimate a firm’s beta by involving the whole industry.

If you believe that the operations of the firm are similar to the operations of the rest of the industry, you should use the industry beta.

If you believe that the operations of the firm are fundamentally different from the operations of the rest of the industry, you should use the firm’s beta.

Don’t forget about adjustments for financial leverage.

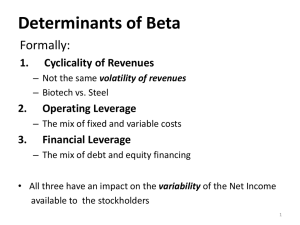

Determinants of Beta

Business Risk

Cyclicality of Revenues

Operating Leverage

Financial Risk

Financial Leverage

Cyclicality of Revenues

Highly cyclical stocks have higher betas.

Empirical evidence suggests that retailers and automotive firms fluctuate with the business cycle.

Transportation firms and utilities are less dependent upon the business cycle.

Note that cyclicality is not the same as variability – stocks with high standard deviations need not have high betas.

Movie studios have revenues that are variable, depending upon whether they produce “hits” or “flops,” but their revenues may not especially dependent upon the business cycle.

Operating Leverage

The degree of operating leverage measures how sensitive a firm (or project) is to its fixed costs.

Operating leverage increases as fixed costs rise and variable costs fall.

Operating leverage magnifies the effect of cyclicality on beta.

The degree of operating leverage is given by:

DOL

EBIT Sales

EBIT

Sales

Operating Leverage

EBIT

$

Fixed costs

Fixed costs

Sales

Operating leverage increases as fixed costs rise and variable costs fall.

Sales

Financial Leverage and Beta

Operating leverage refers to the sensitivity to the firm’s fixed costs of production.

Financial leverage is the sensitivity to a firm’s fixed costs of financing.

The relationship: b asset

Debt

Debt

Equity b debt

Equity

Debt

Equity b equity

• Financial leverage always increases the equity beta relative to the asset beta.

Example

Consider Grand Sport, Inc., which is currently all-equity financed and has a beta of 0.90.

The firm has decided to lever up to a capital structure of 1 part debt to 1 part equity.

Since the firm will remain in the same industry, its asset beta should remain 0.90.

However, assuming a zero beta for its debt, its equity beta would become twice as large: b

Asset

= 0.90 =

1

1 + 1

× b

Equity b

Equity

= 2 × 0.90 = 1.80

The Firm versus the Project

Any project’s cost of capital depends on the use to which the capital is being put –not the source.

Therefore, it depends on the risk of the project and not the risk of the firm.

Capital Budgeting & Project Risk

SML

The SML can tell us why:

Incorrectly accepted negative NPV projects

Hurdle rate

R

F

β

FIRM

( R

M

R

F

) r f

Incorrectly rejected positive NPV projects

Firm’s risk (beta) b

FIRM

A firm that uses one discount rate for all projects may over time increase the risk of the firm while decreasing its value. Why?

Capital Budgeting & Project Risk

Suppose the Conglomerate Company has a cost of capital, based on the

CAPM, of 17%. The risk-free rate is 4%, the market risk premium is 10%, and the firm’s beta is 1.3.

17% = 4% + 1.3 × 10%

This is a breakdown of the company’s investment projects:

1/3 Automotive Retailer b

= 2.0

1/3 Computer Hard Drive Manufacturer b

= 1.3

1/3 Electric Utility b

= 0.6

average b of assets = 1.3

When evaluating a new electrical generation investment, which cost of capital should be used?

Capital Budgeting & Project Risk

SML

24%

17%

10%

Investments in hard drives or auto retailing should have higher discount rates.

Project’s risk ( b

)

0.6

1.3

2.0

r = 4% + 0.6

× (14% – 4% ) = 10%

10% reflects the opportunity cost of capital on an investment in electrical generation, given the unique risk of the project.

Using Peers to Find Cost of

Equity

Two approaches

Find all equity peers

Delevering betas

44 (of 70)

Beta of Debt

Possibilities

0

0.1-0.3

Use debt ratio and beta of debt to delever

Find b

Asset from b

Equity

45 (of 70)

Delevering Betas

Data

b

Equity

= 1.1

Equity = $2,000,000

Debt = $1,000,000

Assume b

Equity

= 0.1

b asset

Debt

Debt

Equity b debt

Equity

Debt

Equity b equity b asset

1

3

0.1

2

3

0.7333

7.666

46 (of 70)

47

Cost of Equity

Capital Asset Pricing Model (CAPM)

Peer Comparison

Dividend discount model approach

Bond yield plus risk premium approach

Cost of Debt

48 (of 36)

The Cost of Capital with Debt

The Weighted Average Cost of Capital is given by: r

WACC

Debt

Debt

Equity r debt

1

t c

Equity

Debt

Equity r equity

• Because interest expense is deductable, we multiply the last term by (1 – t

C

).

Example: International Paper

First, we estimate the cost of equity and the cost of debt.

We estimate an equity beta to estimate the cost of equity.

We can often estimate the cost of debt by observing the return on the firm’s debt.

Second, we determine the WACC by weighting these two costs appropriately.

Example: International Paper

The industry average beta is 0.82, the risk free rate is 3%, and the market risk premium is 8.4%.

Thus, the cost of equity capital is:

i

r rf

i

(

M

r rf

)

= 3% + 0.82

× 8.4%

=

______

Example: International Paper

The yield on the company’s debt is 8%, and the firm has a 37% marginal tax rate.

The debt to value ratio is 32% r

WACC

=

S

S + B

× r

S

+

S

B

+ B

× r

B

× (1 – T

C

)

= 0.68 × 9.89% + 0.32 × 8% × (1 – 0.37)

=

______

This is International’s cost of capital. It should be used to discount any project where one believes that the project’s risk is equal to the risk of the firm as a whole and the project has the same leverage as the firm as a whole.

53

Cost of Debt

Yield-to-maturity approach

Calculate firm’s yield-to-maturity on existing bonds

Debt-rating approach

Find the yield on comparably rated bonds for maturities that closely match existing debt

Calculate weighted average interest rate on long-term debt from notes in 10-K

54

Issues in Estimating Cost of Debt

Fixed vs. floating rate debt

Convertible debt

Nonrated debt

Leasing

Cost of Preferred Shares

55 (of 36)

56

Cost of Preferred Stock

Easiest component to estimate

P p

D p r p

r p

D p

P p

57

Example

Firm has existing preferred stock outstanding with a price of $50 a share that pays $4 dividend and wishes to issue new preferred stock with a floatation cost of 2.5%. What is the cost to the firm for the new issue?

r p

50 .

00

4 .

00

1

0 .

025

4 .

00

48 .

75

8 .

21 %

Estimating WACC

WACC

E

E

D

P r e

E

D

D

P r d

E

P

D

P r p

An example....

Sherwin Co.

Total value =

211.5 million

WACC

Has 10,000,000 common shares; price = $15/share; r e

= 15%.

Has 500,000 preferred shares, 8% coupon, price =

$25/share, $12.5 million value.

Has $40 million long term debt, fixed rate notes with 8% coupon rate, but 7% YTM. Notes sell at premium and worth $49 million.

150

211 .

5

15 %

49

211 .

5

7 %

12 .

5

211 .

5

8 %

12 .

73 %