Expected cash flow estimation

advertisement

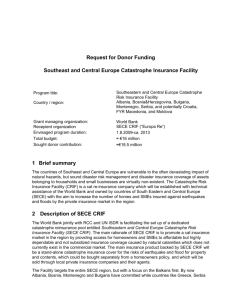

Riservato e confidenziale Loan Portfolio Fair Value Assessment CDS’ experience from banking practice Istanbul - May 2013 AGENDA Background Life time default estimation - Analytical framework Main Results Expected cash flow estimation - Analytical framework Discount rates Early repayment rate Portfolio pricing Benchmark analysis Conclusions |2| Strictly confidential 29/05/2013 WHY CONSIDER LOAN PORTFOLIO VALUATION? Internal securitization Provision estimation Asset Disposal Due diligence Benchmarking Banks are using these operations as a vehicle get funds from the ECB: the securitized portfolio is eligible as collateral from ECB. The complementary application of Life time cash flow estimation is the provision for credit losses estimation. Provisions can be set on the basis of the current portfolio status (default, not default) although many banks are starting to determine provisions also on the basis of estimation. This is a classical method that Banks and Financial houses use to get funds. The crisis has created a very interesting disposal market fed by companies specialized in debt collection. Expected cash flows can be used to review the credit portfolio governance and management, and get preliminary estimates of pricing and profitability of the portfolio, in accordance with Group portfolio management strategy (i.e. run-off) Banks, especially at the Headquarter level, need to benchmark a loan portfolio’s lifetime estimation versus the system, aiming to verify the robustness of the estimation, or to highlight particular characteristics of the managed portfolio. |3| 3 Strictly confidential 29/05/2013 CASE STUDY: BUSINESS NEEDS Internal securitization Provision estimation Asset Disposal Due diligence Benchmarking The Bank requested to CRIF to support them in a value assessment of their consumer loan portfolio, prior to an internal securitization operation. The complementary application of Life time cash flow estimation is the provision for credit losses estimation. Provisions can be set on the basis of the current portfolio status (default, not default) although many banks are starting to determine provisions also on the basis of estimation. This is a classical method that Banks and Financial houses use to get funds. The crisis has created a very interesting disposal market fed by companies specialized in debt collection. Expected cash flows can be used to review the credit portfolio governance and management, and get preliminary estimates of pricing and profitability of the portfolio, in accordance with Group portfolio management strategy (i.e. run-off) Banks, especially at the Headquarter level, need to benchmark a loan portfolio’s lifetime estimation versus the system, aiming to verify the robustness of the estimation, or to highlight particular characteristics of the managed portfolio. |4| 4 Strictly confidential 29/05/2013 PROJECT APPROACH Project objectives Project activities 1 Life time default (LTD) estimation Customer: Italian subsidiary of leading international banking group In order to estimate the life time risk on the securitized portfolio, CRIF defined a framework that, through the Markov chain approach, makes possible the LTD estimation on a time window of 10 years. In order to estimate the securitized portfolio value we estimated the future cash flows splitting the portfolio by product (personal loans, consumer loans and auto loans) and level of risk (tranching). The specific LTD, LGD and early repayment rate estimations together with the discount rates have contributed to determine the future cash flow estimation Main goal: Calculating portfolio’s expected value & pricing before undertaking the decision if running or not the securitization (by the HQ) 2 Expected cash flow estimation Assessing the impact of the cost of funding of the bank into the expected value of the portfolio Identifying high/low performing tranches of the portfolio, leveraging even on external data (CRIF Credit Bureau) 3 |5| Benchmarking parameter estimation 5 To build similar portfolios based on generic samples retrieved from the Italian Credit Bureau. On the basis of these samples we computed the benchmarking LTD curves. Strictly confidential 29/05/2013 AGENDA Background Life time default estimation - Analytical framework Main Results Expected cash flow estimation - Analytical framework Discount rates Early repayment rate Portfolio pricing Benchmark analysis Conclusions |6| Strictly confidential 29/05/2013 LIFE TIME DEFAULT ESTIMATION: ANALYTICAL FRAMEWORK The Life Time Default (LTD) estimation is part of the multiperiod estimation problems, in which the evolution from an initial state to a final state passes through "n" intermediate observable states, precisely, over several periods. The technique used by CRIF is based on "Markov chains". Credit scoring uses snapshots of historical information, observations and outcomes, to develop a risk-ranking tool. For behavioral-risk scoring, most models will use a one-year outcome. Then to determine the probability of an account going bad, or defaulting, over any given period, historical information is again used to work out the rates. But what if percentages are needed within, or beyond, the one-year period, or whatever period which was used for the scorecard? Markov chain allows the business to predict the future distribution (default/non default) using only the current distribution (without default) and a transition matrix indicating the expected movements between states. Risk Multi period frame |7| 7 Strictly confidential 29/05/2013 LIFE TIME DEFAULT ESTIMATION-ANALITICAL FRAMEWORK 1 Objective 2 Methodological foundations Starting from the reference date of December 2012 the objective was of estimating LTD on the outstanding loans present at that time in the “customer” portfolio. The base of Markov chain estimation consists of building transition matrices that, on the basis of the past experience, can be used in order to extrapolate the future risk The life time risk extrapolation is based on two simple assumptions: When a contract is classified as defaulted do not change the status any more. The probability to change status along the life time is constant and the transition represents these probabilities. 3 Data sources matrix Therefore the simple iteration of the transition matrix per the number of periods that cover the whole residual life of the securitized loan portfolio is able to estimate the LTD. For the “customer” were developed two transition processes able to estimate the marginal default probabilities over a time frame of 10 years (120 months) both for the personal loans and the auto loan portfolios. The analysis was realized on the loan portfolios provided by the “customer” , who provided the payment history of each loan useful to set the transition matrices on the basis of an internal default definition. CRIF has integrated the “customer” historical loan portfolios with Credit Bureau Score in order to define a robust risk tranching and coherent with the benchmarking activity. The definition of default has been established on the basis of the following two variables: Risk Class (number of insolvency in each period) Contract Status (issued, closed, early pay off, write off, into areas, DBT) |8| Strictly confidential 29/05/2013 LIFE TIME DEFAULT ESTIMATION-ANALYSIS AND DELIVERABLES Performed Analysis Deliverables Default rate Initially, it is analyzed the distribution of Perform Not defaulted personal loan portfolio at 06/2012 with performance at 12/2012 with respect the default rate defined as the target variable Bonis Crif Bureau Score The default status and the Credit Bureau Score tranches represented the possible moving statutes of each contract Trantion matrix % # 1,077 5.93% 372 745 4.11% 104 initial peaks more pronounced for riskier classes. |9| 1,449 7.60% 25.67% 66.58 11.34% 849 4.45% 12.25% 7.36 0.65 C (D,E) 1,982 10.92% 126 13.74% 2,108 11.06% 5.98% D (F,G) 749 4.13% 33 3.60% 782 4.10% 4.22% 0.07 E (H,I) 4,640 25.57% 108 11.78% 4,748 24.91% 2.27% 10.69 F (L,M,N,O) 7,361 40.56% 149 16.25% 7,510 39.39% 1.98% 22.25 G (P) 1,593 8.78% 25 2.73% 1,618 8.49% 1.55% 7.07 18,147 100% 917 100% 19,064 100% 4.81% 114.67 Transition June 2012 – December 2012 Default A B C D E F G Totale A B C D E F G 25.7% 12.2% 6.0% 4.2% 2.3% 2.0% 1.5% 55.9% 23.1% 9.3% 2.8% 2.4% 1.0% 0.3% 7.5% 33.5% 11.3% 3.7% 2.3% 1.0% 0.7% 9.9% 25.4% 52.1% 8.6% 4.0% 1.6% 0.5% 0.2% 1.8% 7.2% 29.7% 4.2% 0.8% 0.5% 0.3% 2.4% 5.4% 37.2% 57.6% 11.7% 2.2% 0.4% 1.4% 7.6% 11.5% 26.8% 72.5% 29.2% 0.1% 0.2% 1.0% 2.3% 0.4% 9.4% 65.1% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 1,449 849 2,108 782 4,748 7,510 1,618 The The curve shows a decreasing trend with an 40.57% (A,B) (C) PP a tranche “A” contract in June 2012 has a 25.7% probability of going after six months in default, has a 55.9% probability of staying in tranche “A” additional loans at that time reaches the default status. IV % Personal loan portfolio transition matrix (06/2012 – 12/2012) loans portfolio is reported in the table. The matrix represents the transition probabilities of a contract on score tranches or the default status between two periods: Each point represents the percentage of Default rate # B The transition matrix of the performing personal two graphs show the evolution of marginal probabilities of default for each risk class, Total % A Total Rsik measurement Default # LTD curves Personal Loans 30% 20% 10% 10% 5% 0% giu-12dec12 jun13 dec13 jun14 dec14 jun15 dec15 jun16 dec16 jun17 dec17 jun18 dec18 jun19 dec19 A B C D E F AutoLoans 15% G 0% giu-12dec12 jun13 dec13 jun14 dec14 jun15 dec15 jun16 dec16 jun17 dec17 jun18 dec18 jun19 dec19 A B C D E F Strictly confidential 29/05/2013 AGENDA Background Life time default estimation - Analytical framework Main Results Expected cash flow estimation - Analytical framework Discount rates Early repayment rate Portfolio pricing Benchmark analysis Conclusions | 10 | Strictly confidential 29/05/2013 EXPECTED CASH FLOWS ESTIMATION-ANALITICAL FRAMEWORK To estimate the expected cash flows is necessary to build the amortization schedule of the loans from the evaluation date until the date of expiration, based on the amount of the installment, the residual debt and the annual rate (APR) provided by the bank on individual basis. Once it were obtained the values of the residual capital and of the interest at any time t, it has been developed a binomial tree where at each subsequent time t (t = 1,2... until expiration), the probability of being current or default status is derived from the Markov process. In case of default at the time t, the cash flows are represented by the installment collected up to t-1, with the addition of the recovered residual debt plus the installment gained in the period, all multiplied by the recovery rate: Revenuest = Installments + the amount of the installments already paid from 0 to s =t-1 (1-LGD) * (Installmentt +Residual Debtt ) current installment+the recovered residual debt at the default event. In case of not default at the time t, revenues are represented by the sum of installments paid up to s = t-1, with in addition the installment of the period t: Revenuest = Installments + Installmentt Expected cash flows is determined by the sum of the discounted expected revenues from the evaluation date until the date of expiration | 11 | Strictly confidential 29/05/2013 DISCOUNT RATES AND EARLY REPAYMENT RATE Early repayment rates Discounts rates Revenues resulting from the application of the algorithm are then discounted at each time t, In order to give an expected value of the portfolio that takes into account the cost of funding of the bank. For the evaluation of the expected cash flows, it was necessary to define the early repayment rate of a credit line,. The repayment rate was measured, on annual basis, in the year 2012. The ratio is measured as the number of contracts that expire in advance during 2012, with respect to the number of contracts alive at the beginning of that year. The early repayment rates are introduced into the cash flows analysis: grater is the repayment rate lower will be the expected cash flows. Here we can see the early repayment rates chose for the Personal Loans portfolio. Liquidity curve = risk free rate + liquidity spread Greater is the cost of funding lower will be the expected value of the portfolio Upper Bound Lower Bound | 12 | Personal Loans Early repayment rate grouped by Perform tranches: Rate f or PP tranche A 0.62% Rate f or PP tranche B 1.65% Rate f or PP tranche C 4.42% Rate f or PP tranche D 10.66% Rate f or PP tranche E 14.49% Rate f or PP tranche F 11.27% Rate f or PP tranche G 9.97% Strictly confidential 29/05/2013 PORTFOLIO PRICING Portfolio pricing is determined by the ratio of the expected cash flows to the total balance. As for bonds, portfolio priced over 100 are more profitable meanwhile portfolio priced under 100 are less profitable for the originators. The tranching of the portfolios is defined on the basis of the CRIF Credit Bureau Score. The price is mainly determined by the risk profile and the structure of the amortization plan Pricing = Expected C.F./Total Balance >100 OK =100 <100 | 13 | KO Perform Pricing A 98,2% B 103,1% C 105,8% D 108,5% E 108,9% F 109,6% G 106,3% Total 108,0% Strictly confidential 29/05/2013 AGENDA Background Life time default estimation - Analytical framework Main Results Expected cash flow estimation - Analytical framework Discount rates Early repayment rate Portfolio pricing Benchmark analysis Conclusions | 14 | Strictly confidential 29/05/2013 BENCHMARKING ANALYSIS Comparison of Default Rate To compare and validate the results obtained on specific “customer” portfolios, CDS has developed a benchmarking analysis extracting two random samples, from Italian Credit Bureau, that has similar features to those of “customer” . The main purpose of the benchmarking analysis was to compare the risk detected in the Credit Bureau samples, to verify if the behavior and the structure of the “customer” portfolios are aligned or not with what is observed in the total market. As can be seen from the graphs, the risk curves by Credit Bureau Score bands that are obtained from the samples of the system show comparable trends to those defined on the portfolios of the customer | 15 | Strictly confidential 29/05/2013 BENCHMARKING ANALYSIS Customer and Credit Bureaus LTD curves comparison Credit Bureau sample Customer sample Personal loan 30% 20% 10% 0% giu- dec12 jun13 dec13 jun14 dec14 jun15 dec15 jun16 dec16 jun17 dec17 jun18 dec18 jun19 dec19 12 Auto & consumer loans A B C D E F G 20% 10% 0% giu-12 dec12 jun13 dec13 jun14 dec14 jun15 dec15 jun16 dec16 jun17 dec17 jun18 dec18 jun19 dec19 A | 16 | B C D E F Strictly confidential 29/05/2013 AGENDA Background Life time default estimation - Analytical framework Main Results Expected cash flow estimation - Analytical framework Discount rates Early repayment rate Portfolio pricing Benchmark analysis Conclusions | 17 | Strictly confidential 29/05/2013 CONCLUSIONS Internal securitization CRIF can support banks in a preliminary assessment phase in order to identify the best strategy for securitization. Provision estimation CRIF can help banks define the amount of provisions based on the expected lifetime risk or limited to fixed periods (e.g. 36 months), as required by the new IAS Regulation. CRIF can support banks in an evaluation phase of the portfolio or specific segments to handle the negotiations with potential buyers. CRIF, on the basis of the expected cash flows estimation, can support Banks in reviewing the credit portfolio governance and management, and get preliminary estimates of pricing and profitability of the portfolio. CRIF, where the Credit Bureau information is available, is able to compare the expected risk (life time or multi-period) of the Bank with those of the system, providing evidence of benchmarking useful in all areas listed above but, more generally, to assess whether the value of its portfolio is determined by a systemic context or from a specific credit management approach. Asset Disposal Due diligence Benchmarking | 18 | 18 Strictly confidential 29/05/2013 Crif Decision Solutions Via M. Fantin 1-3 40131 Bologna Tel.: + 39 051 4176111 Fax.: + 39 051 4176010 www.crif.com Riservato e confidenziale Business Consulting – R&I Innovation