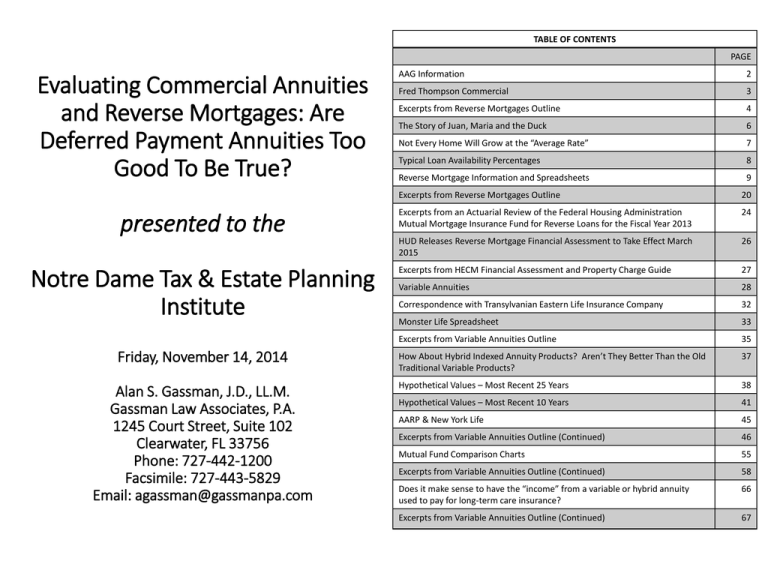

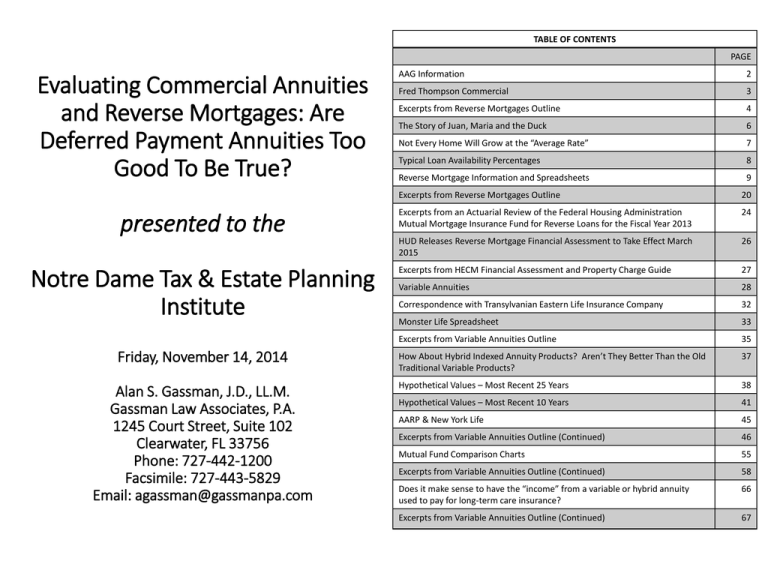

TABLE OF CONTENTS

PAGE

Evaluating Commercial Annuities

and Reverse Mortgages: Are

Deferred Payment Annuities Too

Good To Be True?

presented to the

Notre Dame Tax & Estate Planning

Institute

Friday, November 14, 2014

Alan S. Gassman, J.D., LL.M.

Gassman Law Associates, P.A.

1245 Court Street, Suite 102

Clearwater, FL 33756

Phone: 727-442-1200

Facsimile: 727-443-5829

Email: agassman@gassmanpa.com

AAG Information

2

Fred Thompson Commercial

3

Excerpts from Reverse Mortgages Outline

4

The Story of Juan, Maria and the Duck

6

Not Every Home Will Grow at the “Average Rate”

7

Typical Loan Availability Percentages

8

Reverse Mortgage Information and Spreadsheets

9

Excerpts from Reverse Mortgages Outline

20

Excerpts from an Actuarial Review of the Federal Housing Administration

Mutual Mortgage Insurance Fund for Reverse Loans for the Fiscal Year 2013

24

HUD Releases Reverse Mortgage Financial Assessment to Take Effect March

2015

26

Excerpts from HECM Financial Assessment and Property Charge Guide

27

Variable Annuities

28

Correspondence with Transylvanian Eastern Life Insurance Company

32

Monster Life Spreadsheet

33

Excerpts from Variable Annuities Outline

35

How About Hybrid Indexed Annuity Products? Aren’t They Better Than the Old

Traditional Variable Products?

37

Hypothetical Values – Most Recent 25 Years

38

Hypothetical Values – Most Recent 10 Years

41

AARP & New York Life

45

Excerpts from Variable Annuities Outline (Continued)

46

Mutual Fund Comparison Charts

55

Excerpts from Variable Annuities Outline (Continued)

58

Does it make sense to have the “income” from a variable or hybrid annuity

used to pay for long-term care insurance?

66

Excerpts from Variable Annuities Outline (Continued)

67

2

Fred Thompson Commercial as Analyzed by Congressman Mark Takano and

Reported to Congress (See page 17-31 of our 2014 Notre Dame Tax & Estate

Planning Institute outline):

Here is the exact small print found, but not readable, on the Fred Thompson television

commercial:

Congressman Mark Takano’s April 24, 2014 report featured later in this outline has

the following to say about Mr. Thompson’s commercial:

Reverse mortgage lenders use trusted celebrity spokespeople to encourage seniors

to take out these types of loans. Take these examples from actors and even a

former U.S. Senator:

Reverse mortgages are first and second mortgage loans.

A reverse mortgage increases the principal mortgage loan amount and decreases

home equity (it is a negative amortization loan).

Borrowers are responsible for paying taxes and insurance, which is substantial.

We do not establish an escrow account for disbursement of these payments.

We arrange loans with third-party providers but do not make mortgage loans in New

York.

Fred Thompson is a paid AAG spokesperson.

AAG also works with other lenders and financial institutions that offer reverse

mortgages.

With your consent, AAG may forward your contact information to other lenders and

financial institutions that offer reverse mortgages for your consideration of reverse

mortgage programs that they offer.

These materials are not from HUD or FHA and were not approved by HUD or a

government agency.

A GREAT MANY PEOPLE WOULD RATHER FACE DESTITUTION IN A FEW YEARS THAN

CHANGE NOW, ESPECIALLY IF TOLD BY A PROFESSIONAL THAT THEY CAN HAVE THEIR CAKE

AND EAT IT TOO, WITHOUT REGARD TO WHETHER THEY ACTUALLY CAN OR NOT

Fred Thompson for American Advisors Group (AAG): “A government

insured reverse mortgage allows seniors to stay in their own home and to turn

their equity into tax-free cash.”

What Senator Thompson fails to mention is that reverse mortgages can cause

loss of eligibility for Medicaid or Supplemental Security Income (SSI).

The ad includes disclaimers in small, almost illegible font that only the

keenest eyes can spot. He doesn’t mention that homeowners must continue to

pay insurance, taxes, maintain the property, and comply with loan terms.

Testimonials from customers in the same ad claim “It doesn’t cost anything.

You won’t lose anything, and at the end of the day you might be pleasantly

surprised.” These downplay the risks that seniors face when taking out reverse

mortgages.

Research has found that consumers often focus on short-term costs and underestimate longterm costs. This bias, coupled with the sheer complexity of the product’s pricing, may result

in an inaccurate perception of how much it costs to take out a reverse mortgage. To the

extent that consumers underestimate the costs of a reverse mortgage, they are at risk of

choosing to pursue a reverse mortgage when another option might be a better financial

choice. Borrowers who underestimate the effects of compounded interest may also be more

likely to choose a reverse mortgage product option that is poorly suited to their situation.

The most common misperception counselors reported was the presumption that a reverse

mortgage is a government entitlement program similar to Medicare. Counselors often find

themselves explaining to clients that a reverse mortgage is in fact a loan. This confusion

echoes concerns expressed in the 2009 GAO report about advertising suggesting that a

reverse mortgage is a government benefit. Counselors recommend that misleading

marketing should remain a focus for regulators.

3

EXCERPTS FROM OUTLINE

INTRODUCTION

Definition: A mortgage is a loan agreement secured

with real estate as its collateral.

Under most

mortgages, the borrower makes monthly payments

until the loan is repaid. In a reverse mortgage, however,

payment is only due if and when one of the following

events occur:

(a)

(b)

(c)

(d)

the home is sold,

the borrower no longer lives in the home for a

period of more than 12 months (this includes if

the borrower has to move into a long-term care

facility such as a nursing home or an assisted

living facility),

the borrower dies, or

the borrower does not keep up with the real

estate taxes, insurance and maintenance of the

home.

When a husband and wife are joint borrowers, then (b)

or (c) may not apply until neither of them is residing in

the home.

HOW REVERSE MORTGAGES WORK

Terms: When a loan is FHA insured, both the lender

and the borrower are protected from either party owing

any amount on the mortgage in excess of the net

proceeds from the sale of the home. This is because

HUD guarantees that a borrower who remains in

compliance with the terms of the reverse mortgage

loan will never have a responsibility above and beyond

the actual market value of the home at the time of sale.

HUD will therefore pay the lender the difference of any

amount owed on the mortgage which exceeds the net

proceeds from the sale of the home.

In order to qualify a loan as FHA insured under these

terms, lenders and borrowers must follow the HUD

guidelines, and borrowers are required to pay an annual

mortgage insurance premium equal to 1.25% of the

outstanding loan balance. This is in addition to the

interest and other loan charges that are incurred.

Types of Reverse Mortgage Loans: There are three

main types of Home Equity Conversion Mortgage loan

options.

(a) Line of Credit- This is an immediate loan where the

borrower receives up to a maximum percentage of

the value of the home. HUD regulations provide

that only a portion of this loan amount can be taken

over the first year, so the borrower will typically

receive one lump sum amount when the loan is

established, and then the remaining borrowed

funds are provided one year thereafter. The Line of

Credit was designed for elderly people who want to

borrow money to cover major expenses, such as

home improvements or medical bills. However, in

practice these funds are commonly used for other

things, leaving borrowers vulnerable to the possible

loss of their home when they cannot keep up with

insurance, taxes, and maintenance.

The life expectancy of the surviving spouse of such a

married couple (assuming both spouses are 79) is

eight (8) years, so the total amount borrowed would

be expected to be $102,550.71.

(c) Fixed Term Loan- The fixed term loan is similar to

the tenure loan, but it provides for annual or

monthly loan amounts that are preset as to the

amount received and the duration. For example, a

homeowner may borrow $1,000 a month for one

hundred and twenty (120) consecutive months,

notwithstanding whether the home goes down in

value, or whether the lender would prefer not to

make further advances or becomes insolvent.

For example, suppose a loan is made against a

house valued at $190,000 by a 79 year old borrower

in September of 2014. $20,000, plus loan costs

(which might be an additional $9,235.50) can be

borrowed at the time of the loan closing, and

$64,637.50 can be borrowed the year after. Further

borrowing is limited to a certain portion of future

growth in value of the property, if it goes up in

value.

(b) Tenure Loan- The tenure loan is set up in a life

payment format, whereby the borrower can receive

a small lump sum initially, and then continues to

receive a fixed monthly amount for the rest of his or

her lifetime. This income stream loan was intended

to help borrowers cover their everyday expenses.

The loan amounts are to be advanced each month

notwithstanding what the value of the house will

be, again as long as the borrower maintains the

taxes, insurance and maintenance thereof.

For a married 79 year old fully owning his or her

home, a typical tenure loan would provide $20,000

cash at closing, and then $667.25 a month (about

$8,000 a year) until the death of both the borrower

and his or her spouse.

4

EXCERPTS FROM OUTLINE

Mortgage Rates: Reverse mortgage borrowers have

multiple choices with respect to the interest rates of

their loans: whether the interest rate will be fixed, and

if capped, what the possible terms of increasing rates

will be:

(a) Fixed Interest Rate- The fixed interest option locks

the rate in for the duration of the loan, whether

that be term or lifetime. Fixed interest loans

typically

have

somewhat

higher

rates

(approximately 5% in September of 2014), but they

offer a rate stability. The interest charged is above

and beyond the 1.25% per year payment that the

borrower must make for the FHA/HUD insurance

described above.

(b) Floating Interest Rate- The floating interest rate is

subject to change with the market throughout the

duration of the loan. A floating interest rate is

typically lower to begin with, but can increase

considerably. A September 2014 loan might begin

at a 2% interest rate but be able to float up to a 12%

rate. Typically these loans have a provision in place

whereby the increase in rate must be incremental,

such as a 2% increase every year.

An example for the married couple described above

would be the following choices for a loan taken in

September of 2014:

1. 4.990% fixed (plus the 1.25% per year cost)

with $6,767.50 in closing costs.

2. 2.935% floating (plus the 1.25% per year

cost), but guaranteed to not go up by more

than 2.00% annually and capped at 7.935%,

with closing costs of $9,234.50.

4.

3.656% floating (plus the 1.25% per year

cost), but guaranteed not to go up by more than 2.00%

annually and capped at 13.656%, with closing costs of

$4,484.50.

Loan Costs: Loan costs above and beyond the interest

for a reverse mortgage are typically 2-3% of the total

credit offered. This is not particularly high compared to

other loan products. Loan costs may be advanced by

the lender, or the borrower may be directly responsible

for them. It is important to consider this factor when

looking at the terms of a reverse mortgage. For some

reason, the normal rules under the Truth in Lending Act,

which apply when people buy cars or take out other

kinds of loans, do not have jurisdiction in the reverse

mortgage world. Instead, there is a separate disclosure

known as the Total Annual Loan Cost or TALC.

Default: If the borrower defaults on the loan by not

remaining current with his or her payment of real estate

taxes, homeowner’s insurance, or maintenance on the

home, then the lender can call the loan into default and

demand full repayment. At that point, to avoid

foreclosure the borrower must complete one of the

following precautionary actions:

(a) correct the default,

Usage: There were over 770,000 reverse mortgages

issued through September of 2012, and 595,000 of

these loans remained outstanding as of May of 2013.

Banks and financial institutions make a significant

amount of money under this program by:

(a) collecting loan origination fees, which commonly

range anywhere between $2,500 and $6,000,

and/or

(b) selling the loans to investment syndicates and other

organizations, who reportedly pay a premium of

10% to 12% of the total amount to be loaned for

the right to be the lender.

Many people believe that the high rate of return many

lenders receive on the sale of reverse mortgages is

evidence that the U.S. Government’s program benefits

lenders more than it benefits borrowers. Lenders are

not able to charge borrowers more than certain

amounts upon origination, but are able to charge

interest rates that exceed what an unsubsidized

marketplace might provide. The end result may be seen

as a government subsidy made primarily to lenders,

which in many cases causes harm to borrowers who are

supposed to be the beneficiaries of this program. The

harm done to borrowers is further discussed below.

(b) pay off the debt, default rate interest, legal

expenses, and lender costs;

(c) sell the property and apply the net proceeds to the

loan balance, or

(d) deed the property to the lender.

3. 3.560% floating (plus the 1.25% per year

cost), but guaranteed not to go up by more

2.00% annually and capped at 8.560%, with

closing costs of $5,934.50.

5

THE STORY OF JUAN, MARIA AND THE DUCK

The tremendous cost of this borrowing is best explained

by illustration:

1-Month- 3.49%

3-Month- 3.60%

Juan and Maria are both age 79, have a home worth

$190,000 and would like to receive a $20,000 loan now

for home improvement purposes, and then as much as

possible each year for the rest of their lives to help

assure that they never run out of money and can

supplement their other income.

Juan and Maria see commercials featuring trustworthy

celebrity figures Fred Thompson and Henry Winkler

promoting an industry that is willing to loan them

$20,000 in year one, which will also cover $9,234.50 in

loan costs (yes $9,234.50 in loan costs!), giving them a

net of $10,765.50, and then $8,007.00 per year as a

maximum loan until they are both deceased.

Even if their home goes down in value and the economy

crashes, as long as Juan and Maria keep up the taxes,

insurance, and maintenance of the home, they will

continue to borrow the $8,007 a year, and the loan will

not need to be repaid until the earliest of the following

events: (1) the sale of the home, which must occur no

later than 6 months after the death of the survivor of

them; (2) a refinancing of the home; (3) a default in

paying real estate taxes, maintaining insurances, or

maintaining the home itself; or (4) they no longer live in

the home for a period of more than 12 months, which

constitutes a permanent move.

Besides the loan costs, Juan and Maria will have to pay

4.99% in interest plus a 1.25% Mortgage Insurance

Premium, for a total of 6.24% interest per year on the

balance owed, assuming they select a fixed rate

obligation. Alternatively, the interest rate can float

based on the LIBOR rate, starting as low as 2.953% in

the first year, but has the capability of increasing by up

to 2% incrementally per year thereafter, and reaching as

high as 13.656%. Below is a chart showing the history

of the LIBOR Rate. The rate is currently near an all-time

low, meaning it will likely go up in the future, increasing

the annual cost of the reverse mortgage. The average

LIBOR rates from 1990 to September 2014 are:

6-Month- 3.72%

12-Month- 3.94%

For example in year one, when you take into

consideration that $9,234.50 worth of interest is prepaid,

the total amount financed is only $20,000, resulting in a

much higher interest rate than one might expect; a

whopping 46.17%.

No wonder Fred Thompson and Henry Winkler are

smiling!

The following chart shows the annual advances, the

total amount owed, and the average cost of the

borrowing rate (interest plus closing costs divided by

the cumulative amount loaned).

Are we going

to float this

loan or not?

Suppose Juan has to go into a nursing home after

7 years, and Maria cannot afford the real estate taxes,

insurance, and upkeep on the home. She may also not

be able to live alone, or may be forced to take on a

renter, and unable to move to a home near where one or

more of her children live, who would be able to provide

her with significant assistance.

If the home is sold in year 7 and the loan is repaid at that

time, the average interest rate paid under the

arrangement will be 5.50% per year. Additionally, there

may be costs incurred that would not have been

necessary if Juan and Maria had been able to move to

another residence, rent, or qualify for benefits such as

SSI that might not have been possible because of the

loan arrangement.

6

REVERSE MORTGAGES

NOT EVERY HOME WILL GROW AT THE "AVERAGE RATE"

By Frank Catlett and Alan Gassman

A great many senior Americans borrow money on "Reverse Mortgages" based in part on

being told that their homes will go up in value with "national or regional averages", which is often

not the case.

For many of these homeowners, the better decision would be to downsize and not try to

hold onto more house than they can afford. The decision to stay in a house that is too large causes

the loss of investment resources in return, and increased expenses. One national study has

indicated that the cost of maintaining a home is based upon a 3.53% of its value. Having a

$200,000 home, when only a $100,000 home is needed, may therefore cost the senior citizen not

only the investment return on $100,000, but also an additional 3.53% or more per year in

expenses for utilities, taxes, insurance, and maintenance.

The reverse mortgage industry has encouraged many seniors to stay in their “too large”

homes, based in part upon showing them projections that will indicate a likelihood of a 4% per

year increase in value.

In fact, a 2013 actuarial report prepared for the U.S. Federal Housing Administration (FHA)

has indicated that a “worst case scenario” bottom 25 percentile Monte Carlo simulation has

predicted that home prices could go down by more than 20% between 2014 and 2018, and might

not recover to 2018 levels until 2024.

While the "average home" in a given area can be expected to increase in value on average

over a term of years, the retiree's home will typically be expected to go up in value at a slower

rate, if it does go up in value, for the following reasons:

3.

Senior citizens typically do not restore or renovate their homes, especially if they

are of the average household that has the need to borrow on a reverse mortgage. A high

percentage of the "average" homes in any given area have new kitchens, bathrooms, and other

primary aspects installed or refurbished every 20 to 25 years. A senior citizen's home will have a

much lower restoration rate on average, which would bring the average growth rate in the above

example well below the 2.2433% described above.

4.

Oftentimes neighborhoods or surrounding areas start to turn for the worse, and

mobile homeowners will move to more secure economic areas and neighborhoods where values

normally increase at or above the average. Reverse mortgage borrowers are not able to do this,

and are thus unable to move when value issues are likely to arise, and thus have a less than average

chance of being situated in a proper neighborhood for appreciation to be expected.

Based upon the above, we believe that it is a significant fallacy, and actually a deceptive

trade practice, for the reverse mortgage industry to tell homeowners that their homes can be

expected to go up in value based upon statistical averages now being used.

Further, 4% as a normal projection rate seems ludicrous when the average home rate value

increase in the last 20 years in the United States has been only 3.4%, before taking into account the

issues described above.

Frank A. Catlett is a State-Certified General Real Estate Appraiser (FL), General Real Estate

Appraiser (NC), and Certified General Real Property Appraiser(GA) with over 37 years experience.

Mr. Catlett is President of Trigg, Catlett, & Associates, located in Tampa Florida, which provides

appraisal and brokerage services to not only the Tampa Bay, but most parts of Florida as well as

North Carolina.

1.

The home gets older every year. The age of a home is a factor in valuation and

appreciation. If the average home in a given area is 28 years old now, and the average house will

be 26 years old in 20 years, then a 48-year-old home in twenty years from now will be worth less

than a 26-year-old home will be, and will not be expected to have kept up with the "average

growth rate.”

2.

The above is corroborated by the fact that homes have a typical estimated life

expectancy of 60 years, and thus depreciate in value to some extent. An appropriate rate of

depreciation might be 1.667% of the value of the home itself each year, separate and apart from

the land, because typically a 60 year life expectancy will apply (1 / 60 = 1.667%). On the other

hand, should this be 3.333% a year (2 x 1.6667%) if the home is 30 years old to begin with?

If a typical house is worth 77.5% of the combined value of the house and land

together, and the 77.5% house portion is going up by 3.5% statistically, not counting age, but then

depreciating at 1.677% a year, then 22.5% of the total value (the land portion) is going up by 3.5%

annually, and 22.5% of the value (the home portion) is going up by the excess of 3.5% over 1.66%,

which is 1.89% per year.

Therefore, the average growth rate for a house might only be 2.2433% ((22.5% x

3.5%) + (77.5% x 1.89%)), on average.

7

TYPICAL LOAN AVAILABILITY PERCENTAGES

Age

Total Loan

Available

Loan Divided

by Value

Available at

Closing

Available After 1st

Year

Estimated

Closing Costs

Lowest Initial

Interest Rate

Annual MI

Expected Rate/10 yr

Average

$200,000

62

$97,976.50

48.99%

$56,056.50

$41,920.00

$6,823.50

2.406

$99,201.21

4.07

$200,000

67

$104,356.50

52.18%

$59,876.50

$44,480

$6,823.50

2.406

$105,660.96

4.07

$200,000

72

$111,376.50

55.69%

$64,096.50

$47,280.00

$6,823.50

2.406

$112,768.71

4.07

$200,000

77

$119,376.50

59.69%

$68,896.50

$50,480.00

$6,823.50

2.406

$120,868.71

4.07

$200,000

82

$127,976.50

63.99%

$74,056.50

$53,920.00

$6,823.50

2.406

$129,576.21

4.07

$200,000

87

$136,976.50

68.49%

$79,456.00

$57,520.00

$6,823.50

2.406

$138,688.71

4.07

Estimated

Home Value

8

REVERSE MORTGAGES

9

REVERSE MORTGAGES

10

REVERSE MORTGAGES

11

REVERSE MORTGAGE SPREADSHEETS

Spreadsheet One – - Lifetime payments of $8,007 annually, assuming a 4.00% Home Appreciation

Home Value Assumed Home Appreciation Cash Advance Monthly Payments Interest Rate -

$190,000

4.00% per year

$20,000

Tenure payments of $667.25 ($8,007 annually)

2.935% increasing to 5.00% in Year 6

This will provide the potential borrowers with monthly payments of $667.25 ($8,007

annually) for the remainder of their joint lifetimes. Under this scenario, the borrowers will pay total

costs of $9,234.50 in Year 1, $7,656.70 in Year 10, and 20,712.95 in Year 20. This represents a Total

Annual Loan Cost of 46.17%, 8.32%, and 12.03% respectively. At the end of the illustration the

homeowners will have $25,671.33 of net equity in the home; just 6.17% of the total home value.

Spreadsheet Two - Lifetime payments of $8,007 annually, assuming a 2.00% Home Appreciation

Home Value Assumed Home Appreciation Cash Advance Monthly Payments Interest Rate -

$190,000

2.00% per year

$20,000

Tenure payments of $667.25 ($8,007 annually)

2.935% increasing to 5.00% in Year 6

This will provide the potential borrowers with monthly payments of $667.25 ($8,007

annually) for the remainder of their joint lifetimes. Under this scenario, the borrowers will pay total

costs of $9,234.50 in Year 1, $7,656.70 in Year 10, and 20,712.95 in Year 20. This represents a Total

Annual Loan Cost of 46.17%, 8.32%, and 12.03% respectively. At the end of the illustration the

homeowners will have negative equity in the home of ($108,312.06).

Spreadsheet Three - Max Payments withdrawn in first two years, assuming a 4.00% Home

Appreciation

Home Value Assumed Home Appreciation Cash Advance Max Payments Interest Rate -

$190,000

4.00% per year

$20,000

Year one - $64,637

Year two - $49,248

2.935% increasing to 5.00% in Year 6

This would provide the borrower with $20,000 in Year 1, $64,637 in Year 2, and $49,248 in

Year 3. This represents a Total Annual Loan Cost of 46.17% of what has been borrowed in the first

year, 6.12% of what has been borrowed in the second year, and 4.70% of what has been borrowed

in the third year. However interest will continue to be charged on the outstanding loan balance

increasing the Total Annual Loan Cost to 9.58% in Year 10, and 17.56% in Year 20. At the end of the

illustration, the homeowners will have negative net equity in the home of ($8,388.41).

Spreadsheet Four – Max payments withdrawn in first two years, assuming a 2.00% Home

Appreciation

Home Value Assumed Home Appreciation Cash Advance Max Payments Interest Rate -

$190,000

2.00% per year

$20,000

Year one - $64,637

Year two - $49,248

2.935% increasing to 5.00% in Year 6

This would provide the borrower with $20,000 in Year 1, $64,637 in Year 2, and $49,248 in

Year 3. This represents a Total Annual Loan Cost of 46.17% of what has been borrowed in the first

year, 6.12% of what has been borrowed in the second year, and 4.70% of what has been borrowed

in the third year. However interest will continue to be charged on the outstanding loan balance

increasing the Total Annual Loan Cost to 9.58% in Year 10, and 17.56% in Year 20. At the end of the

illustration, the homeowners will have negative net equity in the home of ($142,371.81).

Spreadsheet Five - 100 monthly payments of $1,200, assuming a 4.00% Home Appreciation

Home Value Assumed Home Appreciation Cash Advance Monthly Payments Interest Rate -

$190,000

4.00% per year

$20,000

$1,200 for 100 months ($14,364 annually)

2.935% increasing to 5.00% in Year 6

The borrowers will receive annual payments of $14,394, but will pay total costs of

$9,235 in Year 1, $11,702 in Year 10, and $21,974 in Year 20. This represents a Total Annual Loan

Cost of 46.17%, 8.36%, and 15.70% respectively. It is important to realize that even if the borrowers

are no longer receiving payments from a fixed term loan, interest will continue to be charged on the

loan balance until the borrower leaves the home. The cumulative effect of paying interest on

interest will drive up the Total Annual Loan Cost as shown in column N. At the end of the provided

illustration, the homeowners will remaining net equity of $19,403; just 4.66% of the Home Value.

Spreadsheet Six - 100 monthly payments of $1,200, assuming a 2.00% Home Appreciation

Home Value Assumed Home Appreciation Cash Advance Monthly Payments Interest Rate -

$190,000

2.00% per year

$20,000

$1,200 for 100 months ($14,364 annually)

2.935% increasing to 5.00% in Year 6

The borrowers will receive annual payments of $14,394, but will pay total costs of $9,235 in

Year 1, $11,702 in Year 10, and $21,974 in Year 20. This represents a Total Annual Loan Cost of

46.17%, 8.36%, and 15.70% respectively. It is important to realize that even if the borrowers are no

longer receiving payments from a fixed term loan, interest will continue to be charged on the loan

balance until the borrower leaves the home. The cumulative effect of paying interest on interest

will drive up the Total Annual Loan Cost as shown in column N. At the end of the provided

illustration, the homeowners will have negative net equity of ($114,580).

12

Spreadsheet #1

(Plus 1.25% a year)

Justice For All

$1,200/ month for 100 month term

2nd Year

Justice For All

$1,200/ month for 100 month term

12th Year

Justice For All

$1,200/ month for 100 month term

22nd Year

Net Equity,

$159,134.52

, 81%

Total

Amount

Received ,

$108,077 ,

37%

Total Cost,

$210,502 , 51%

Total Costs,

$64,419 ,

22%

Total Costs,

$10,458 , 5%

Total Amount Received ,

$28,007 , 14%

Total Amount

Received ,

$180,140 , 43%

Net Equity,

$25,671.33 ,

6%

Net Equity,

$119,999.90

, 41%

13

Spreadsheet #2

(Plus 1.25% a year)

Justice For All

$1,200/ month for 100 month term

2nd Year

Justice For All

$1,200/ month for 100 month term

12th Year

Justice For All

$1,200/ month for 100 month term

22nd Year

Net Equity,

$155,334.52

, 80%

Total Costs,

$64,419 ,

27%

Total Cost,

$210,502 , 42%

Total

Amount

Received ,

$108,077 ,

46%

Total Costs,

$10,458 , 5%

Total

Amount

Received ,

$28,007 ,

15%

Total Amount

Received ,

$180,140 , 36%

Net Equity,

$63,744.75 ,

27%

Negative Equity

$(108,312.06),

-22%

14

Spreadsheet #3

(Plus 1.25% a year)

Justice For All

$1,200/ month for 100 month term

2nd Year

Total Costs,

$10,458 , 5%

Justice For All

$1,200/ month for 100 month term

12th Year

Justice For All

$1,200/ month for 100 month term

22nd Year

Net Equity,

$102,504.02 ,

52%

Total Cost,

$290,816 ,

67%

Total Amount

Received ,

$133,886 , 46%

Negative

Equity,

$(8,388.41), 2%

Total Costs,

$112,221 , 38%

Total

Amount

Received ,

$84,638 ,

43%

Net Equity,

$46,389.44 ,

16%

Total Amount

Received ,

$133,886 ,

31%

15

Spreadsheet #4

(Plus 1.25% a year)

Justice For All

$1,200/ month for 100 month term

Total Costs,

2nd Year

Justice For All

$1,200/ month for 100 month term

12th Year

Justice For All

$1,200/ month for 100 month term

22nd Year

$10,458 , 5%

Net Equity,

$98,704.02 ,

51%

Total Amount

Received ,

$133,886 ,

52%

Total Amount

Received ,

$84,638 , 44%

Total Cost,

$290,816 ,

51%

Total Costs,

$112,221 ,

44%

Total Amount

Received ,

$133,886 ,

24%

Negative Equity,

$(9,865.71), -4%

Negative

Equity,

$(142,371.81),

-25%

16

Spreadsheet #5

(Plus 1.25% a year)

Justice For All

$1,200/ month for 100 month term

12th Year

Justice For All

$1,200/ month for 100 month term

2nd Year

Justice For All

$1,200/ month for 100 month term

22nd Year

Net Equity,

$152,394 , 77%

Total Amount

Received ,

$139,950 ,

48%

Total Cost,

$256,960 ,

62%

Total Cost,

$90,052 , 31%

Total Cost,

$10,812 , 6%

Total Amount

Received ,

$34,394 , 17%

Net Equity,

$62,494 , 21%

Total Amount

Received ,

$139,950 ,

33%

Net Equity,

$19,403 , 5%

17

Spreadsheet #6

(Plus 1.25% a year)

Justice For All

$1,200/ month for 100 month term

2nd Year

Justice For All

$1,200/ month for 100 month term

12th Year

Justice For All

$1,200/ month for 100 month term

22nd Year

Net Equity,

$148,594 , 77%

Total Cost,

$256,960 , 50%

Total Amount

Received ,

$139,950 , 59%

Total Cost,

$90,052 , 38%

Total Cost,

$10,812 , 5%

Total Amount

Received ,

$139,950 , 27%

Total Amount

Received ,

$34,394 , 18%

Net Equity,

$6,239 , 3%

Negative

Equity,

$(114,580), 21%

18

19

EXCERPTS FROM OUTLINE

Alternatives to Reverse Mortgages:

i.

Do not borrow - Live within the homeowner’s

means.

ii. Sell the house - Invest some of the sale proceeds,

and use the other proceeds to purchase a less

expensive, easier to maintain condominium or

other home, which may be in a retirement

community that will provide social and other

community attributes.

iii. Borrow privately from family members whose CDs

and/or bonds or bond funds pay far less than what

the borrower will have to pay in interest and costs if

the borrower goes with a traditional reverse

mortgage.

iv. Sell the home and set aside the money to pay rent

- Renting can be a good choice for many senior

citizens, particularly if they eventually need

assisted living facilities or nursing home care.

2. Demographics. Governmentally guaranteed reverse

mortgages are only available for people over the age of

62. Often, the elderly end up making decisions that are

not to their benefit for a number of reasons, including:

(a) They are drawn to the sales pitch and the good

nature of the salesperson;

(b) They do not adequately research the product,

including their responsibilities in the agreement;

(c) They may be in an impaired mental state or fall

under the influence of a “well-meaning” friend or

family member;

(d) They are attracted to the selling points of the

product such as the low interest rate set forth at the

start of a loan with a floating rate, and do not

realize how quickly the rate can increase.

3. Poor Planning.

4. Unexpected Costs.

Reverse Mortgage Concerns: The terms and conditions

of reverse mortgages, combined with the demographics

and decision-making of the target clientele, make these

vehicles dangerous and far too good to be true for

many, if not most, borrowers.

1. Encouraging Unwise Financial Behavior. The 9%

default rate gives a clear indication that a great

many reverse mortgage borrowers should have

downsized, postponed spending their home equity,

or reduced their living expenses in order to actually

be able to have a safe and appropriate home for

retirement. A good many borrowers would have

been better served by using one or more of the

following strategies:

5. Early Sale of the Home. Reverse mortgages were

initially intended to provide the elderly with a way to

live out their lives in their own homes, and to deal with

increased costs while living on a fixed income.

However, two important factors have come into play

that have changed the purpose of reverse mortgages

for many borrowers:

(a) Borrowers are applying for reverse mortgages at

much younger ages, and are living longer lives than

ever before. This means their loan payments are

much larger because they hold the loans for a

greater number of years (in the case of immediate

and tenure loans). It also means they have

increased interest and loan costs. In the event of

default, the amount they owe is much greater.

(b) Because borrowers are starting younger and living

longer, they are often selling their homes rather

than living in them until they die. When the house

is sold the loan becomes due. As a result, many

borrowers who sell find themselves unprepared to

cover the cost of the reverse mortgage, and may

find themselves in default or foreclosure.

6. Medicaid Eligibility and Post-Medicaid Nursing Home

Benefits Complications. None of the commercials or

loan literature discuss the issues that can arise when a

person who would have otherwise owned their home

free and clear or subject to a conventional mortgage

must go on Medicaid to pay for nursing home care.

These individuals may have to sell off a majority of their

assets in an effort to qualify for Medicaid long-term

care. The rules for this vary in each state, but for many

families a home can be maintained free and clear of

mortgage, and can pass to family members without

exposure to Medicaid claims, notwithstanding whether

all taxes, insurance, and maintenance expenses have

been maintained.

7. Loss of SSI Benefits. An unexpected and negative

outcome for some borrowers is that they end up being

disqualified from specific Social Security benefits. The

television commercials specifically note that Social

Security benefits will not be impacted by a reverse

mortgage.

However, some individuals receive

Supplemental Security Income (SSI), and may become

disqualified because loan proceeds will be considered

an asset that can cause a borrower to not meet the

“limited resources” test described below.

20

EXCERPTS FROM OUTLINE

8. Loss of Home Upon Default.

While Senator

Thompson and “The Fonz” indicate that the borrower

cannot lose their home, the nagging statistic that over

9% of reverse mortgages are in default indicates the

facts are to the contrary. Lenders are not required to

perform due diligence to ascertain whether a borrower

will have the financial wherewithal to maintain the

home, particularly if the borrower becomes feeble and

needs help living. The counselor in charge of certifying

that the borrower has received guidance may not be

qualified to help determine whether such financial

wherewithal is likely to exist. There is no insurance

rider or program offering assistance in situations where

a reverse mortgage borrower becomes unable to pay

taxes, insurance, and maintenance costs through no

fault of his or her own.

10. Mutual Mortgage Insurance Fund. The U.S.

Department of Housing and Urban Development (HUD)

contracted with Integrated Financial Engineering, Inc. to

issue a December 11, 2013 Actuarial Review of the FHA

Mutual Mortgage Insurance Fund HECM Loans for Fiscal

Year 2013.

Actuary and Chairman and CEO of

Integrated Financial Engineering, Inc., Tyler T. Yang,

Ph.D., stated that insurance-in-force, which is defined as

the obligation on outstanding mortgages, was $87.67

billion, ($6.54 divided by $87.67 is 7.46%) and that the

economic value of the HECM Fund as of the end of

fiscal year 2013 was $6.54 billion. The report further

projected that at the end of the fiscal year 2020, the

Fund’s economic value will be $15.38 billion, and

insurance in force will be $161.48 billion ($15.38

divided by $161.48 is 9.52%)!

9. Probate and Debt Obligation Complicates Estate

Administration. While the reverse mortgage debt

exceeding the value of the home may not cause an

obligation by the estate to the lender, the home will still

be a probate asset, and the liability will still have to be

reported to the court. In many cases abbreviated

probate administration Statutes that apply when there

is no real estate will require full and complicated

probate administrations and possible joinder of the

estate and children in foreclosure proceedings which

will be much more complicated and in some cases

emotionally stressing for survivors than would be the

case if the home had simply been sold during the

lifetime of the retiree decedent.

21

EXCERPTS FROM OUTLINE

Who Really Benefits:

1. Lenders and Speculators.

2. Reverse Mortgage Counselors.

In a written testimony to the U.S. House Committee

financial services subcommittee on insurance housing

and community opportunity on May 9, 2012, AARP

Public Policy Institute’s Senior Strategic Policy Advisor,

Lori A. Trawinski, Ph.D., CFP stated:

HECM counselors tell us that they often require two or

more hours to cover all topics required by the HECM

counseling protocol. In contrast, other counselors, and

specifically many who conduct counseling via

telephone, manage to conduct a session in less than

one hour. We believe that this discrepancy may

highlight a potential problem with the consistency and

quality of counseling, and we urge HUD to investigate

this difference.

According to the various salespeople we interviewed,

borrowers do not receive a copy of the Truth in Lending

Act disclosure until they complete an application and

pay the applicable application fee.

This section discusses what exactly must be reflected in

the projected total costs of the loan, which are as

follows:

Costs to consumer. All costs and charges to the

consumer, including the costs of any annuity or any

other financial products that the consumer might

purchase with the proceeds from the reverse mortgage

loan.

Payments to consumer. All advances to and for the

benefit of the consumer, including annuity payments

that the consumer will receive from an annuity that the

consumer purchases as part of the reverse mortgage

transaction.

The 2012 Report to Congress from the Consumer

Financial Protection Bureau (described in greater detail

below) references a 2009 report released by the U.S.

Government Accountability Office (“GAO”). The report

from the Government Accountability Office has

expressed concerns regarding counselors and their

deviation from HUD Protocol.

Additional creditor compensation. Any shared

appreciation or equity in the dwelling that the creditor

is entitled by contract to receive.

The 2009 GAO report raised concerns over counselor

compliance with the HUD Protocol. GAO staff posed as

prospective HECM borrowers for 15 counseling sessions

at 11 separate agencies. The evaluation found that

none of the counselors consistently complied with

HECM counseling requirements. [emphasis added]

(5) Assumed annual appreciation rates. Each of the

following assumed annual appreciation rates for the

dwelling:

2. Truth In Lending Act. The Truth in Lending Act, also

known as Regulation Z, was created to promote the

informed use of consumer credit by requiring

disclosures about the terms and cost.

Limitations on consumer liability. Any limitation on the

consumer's liability (such as nonrecourse limits and

equity conservation agreements).

(i)

(ii)

(iii)

0 percent.

4 percent.

8 percent. (8 PERCENT, ARE THEY KIDDING?

HOMES WENT DOWN BY OVER 30% IN 2008!!)

3. AARP Involvement. For years the AARP was rather

quiet on the issue of reverse mortgages, until it issued a

general report about the risks and benefits of these

loans in 2008. AARP’s Public Policy Institute is officially

in favor of having reverse mortgages available for senior

citizens, but it is notable that AARP does not specifically

endorse any third mortgage product, and maintains

literature pointing out the many risks that are not

pointed out in advertising and otherwise. This is

somewhat surprising to the authors, because AARP is in

support of the reverse mortgages and the continuation

of these loans. This is surprising to the authors, because

AARP specifically endorses a number of investments,

insurances, and services for its members, for which it is

very handsomely compensated. According to AARP IRS

Form 990, in 2012 the AARP received $723,333,181 of

endorsement income; yes that is seven hundred

twenty-three million dollars - giving AARP the incentive

to influence the behavior of its members, who are not

explicitly informed that it derives profits from their

purchases of endorsed products. Maybe the author can

talk about that next year!

New Legislation: On April 25, 2014, HUD issued new

regulations in Mortgagee Letter 2014-07, which

protects surviving spouses who would like to stay in the

home of the borrower spouse. The new regulations

require that lenders treat the spouse of a borrower as a

co-borrower for purposes of determining actuary

discussions, maximum loan amounts, and with respect

to underwriting. As a result, the surviving spouse of a

borrower who takes out a reverse mortgage after

September 4, 2014 will be able to stay in the home for

his or her remaining lifetime after the death of the

borrower, as long as the surviving spouse or someone

else keeps up the taxes, insurances, and maintenance of

the home.

(6) Assumed loan period.

22

EXCERPTS FROM OUTLINE

While this change is necessary to protect many

surviving spouses, one consequence is that annual

lending limits will now be reduced as if both spouses

were borrowers on an “only the survivor pays” basis.

This will reduce the amounts that can be borrowed

under a number of scenarios. Another consequence is

that some borrowers will get divorced so that they can

receive higher lifetime payments under tenure

mortgages, and as a result of this, the spouse that they

divorce but continue to cohabitate with will be moved

out of the house when the borrower dies. This new

legislation will not protect individuals who marry a

reverse mortgage borrower after the loan has been

taken.

What happens if the couple decides to get divorced, but

neither of them have the financial wherewithal to pay

off the loan, and they need to live in separate, smaller

houses? Once divorced, will the non-borrowing spouse

lose protection under the law?

The new regulations follow the filing of a Federal Court

District of Columbia Class Action Suit in February of

2014 that was prepared by legal counsel for the AARP

Foundation Litigation and a public interest law firm

claiming that the previously effective regulations

required the same protection for a non-borrowing

spouse, notwithstanding that the lenders have not been

interpreting the regulation that way.

Congressman Mark Takano’s April 24, 2014 Report: On

April 24, 2014, California Representative Mark Takano

released a report titled “Reverse Mortgages: Senior

Housing Bubble Held Together by Glue and Tax Dollars”.

The Congressman stressed extreme concern and

provided specific recommendations regarding the flaws

in the reverse mortgage industry, and sent a letter to

the Federal Housing Administration recommending

reforms stating that, “It’s time for the federal

government to reconsider its involvement with reverse

mortgages and make crucial changes to the program to

protect seniors and taxpayers.” The very well-written

report presented several key findings, which include:

• 1 out of every 10 reverse mortgages are in default

and could face foreclosure;

• Reverse mortgages are indeed expensive, adding a

significant amount to a lump sum option as a result

of interest and ongoing fees;

Misleading advertising presented by “trusted

celebrities” suggest that a reverse mortgage is a

government benefit (i.e. SSI, Medicaid, Medicare, etc.)

and not a loan, therefore, the risks associated with

reverse mortgages are not emphasized.

Representative Takano’s recommended solutions to

FHA are to:

NEW LEGISLATION

On April 25, 2014 HUD issued new regulations in

Mortgagee Letter 2014-07, which protects surviving

spouses who would like to stay in the home of the

borrower spouse. The new regulations require that

lenders treat the spouse of a borrower as a co-borrower

for purposes of determining actuary discussions,

maximum loan amounts, and with respect to

underwriting. As a result, the surviving spouse of a

borrower who takes out a reverse mortgage after

August 4, 2014 will be able to stay in the home for his

or her remaining lifetime after the death of the

borrower, as long as the surviving spouse or someone

else keeps up the taxes, insurances, and maintenance of

the home.

(1) Improve Counseling and Consumer Protections;

(2) Require Brokers and Originators to act in the best

interest of seniors;

(3) Introduce protections to limit defaults and hold

lenders accountable; and

(4) Strengthen protections for spouses and family

members.

We believe that the Congressman is spot on with his

analysis of the reverse mortgage industry, the flaws and

manipulations associated therewith, and his

recommended solutions can lead to a protection of our

seniors rather than the current detriment reverse

mortgages are causing. The Congressman’s “Reverse

Mortgages: Senior Housing Bubble Held Together by

Glue and Tax Dollars” is reproduced in the Appendix

beginning at page 17-55.

While this change is necessary to protect many

surviving spouses, one consequence is that annual

lending limits will now be reduced as if both spouses

were borrowers on a “only the survivor pays” basis.

This will reduce the amounts that can be borrowed

under a number of scenarios. Another consequence is

that some borrowers will get divorced so that they can

receive higher lifetime payments under tenure

mortgages, and as a result of this, the spouse that they

divorce but continue to cohabitate with will be moved

out of the house when the borrower dies. This new

legislation will not protect individuals who marry a

reverse mortgage borrower after the loan has been

taken.

23

THE FOLLOWING ARE EXCERPTS FROM AN ACTUARIAL REVIEW OF THE FEDERAL

HOUSING ADMINISTRATION MUTUAL MORTGAGE INSURANCE FUND FOR

REVERSE LOANS FOR THE FISCAL YEAR 2013

House Price Growth Rate

Exhibit I-3a presents a brief summary of the July 2013

Moody’s baseline national house price growth rate

forecast as compared to the one used in the 2012

Review.

According to this year’s forecast, the

annualized national house price growth rate during the

remainder of FY 2013 is 5.31 percent. National house

prices are projected to grow at 5.00 percent per annum

basis through the first quarter of FY 2017, representing

a minor recession. After that, the house price growth

rate gradually rises to a long-run average annual rate of

around 3.50 percent thereafter.

The house price projections for individual states generally differ from the overall

national level. The HECM portfolio active at the end of FY2013 is concentrated

in California, Florida, New York and Texas. A near-term strong recovery is

forecasted for California, while a mild increase is forecasted for Texas and

Florida. Except for Florida, the long-term trends of house price growth for these

states remain similar to those in last year’s Moody’s forecast. The differences

compared to last year’s Review are show below in Exhibit I-3b for these large

states and nationally.

Exhibit I-3b. Comparison of House Price Forecasts in Four States

House Price Growth Forecast

State

Percent of FY2013

Endorsements

Short Term Trend

Long Term Trend

Forecast in

FY2013

Review

Forecast in

FY2012 Review

Forecast in

FY2013 Review

Forecast in

FY2012 Review

California

13.50%

10.40%

0.46%

3.30%

3.40%

Texas

8.80%

3.82%

2.86%

2.60%

2.70%

Florida

6.40%

3.87%

2.53%

3.30%

4.00%

New York

6.50%

1.47%

3.48%

3.10%

3.00%

5.44%

2.93%

3.50%

3.40%

National

Average

The strong recovery in house price growth affects the HECM portfolio in two

ways. First, we observe strong short-term recovery in states that suffered the

most in the recent recession, such as California. A recovering housing market

leads to more refinancing and less claim payment. The positive house price

growth rates in 2013 and the mild long-term house price growth projection

increase the recovery revenue of HECM loans. Consequently, HECM insurance

losses would be lowered.

24

THE FOLLOWING ARE EXCERPTS FROM AN ACTUARIAL REVIEW OF THE FEDERAL

HOUSING ADMINISTRATION MUTUAL MORTGAGE INSURANCE FUND FOR

REVERSE LOANS FOR THE FISCAL YEAR 2013

2. Interest Rates

According to Federal Reserve Board statistics, the one-year U.S. Treasury rate

declined steadily over the past several years. In response to the Federal

Reserve’s second round of quantitative easing (QE2) in November 2010, and

“Operation Twist” starting in September 2011, the 10-year Treasury rate

continued to drop since 2010 and reach its lowest point since the 1950s in the

second quarter of 2012, as shown in Exhibit I-4a. Similarly, the one-year London

Interbank Offered Rate (LIBOR) reached an historical low in the second quarter

of CY 2013 of 0.70 percent.

Exhibit I-4b shows the forecasts of the 10-year Treasury rate during the past

years. The realized 10-year Treasury rates during the last year turned out to be

much lower than what was forecasted by Moody’s in July 2012. Also, the

forecast of long-term stable rates was also adjusted downward this year.

Exhibit I-4a. Comparison of Interest Rates

Rate Type

Interest Rate

July 2011

July 2012

July 2013

1yr CMT

0.26%

0.24%

0.26%

10yr CMT

3.18%

2.01%

2.24%

1yr LIBOR

0.79%

1.05%

0.70%

25

HUD Releases Reverse Mortgage Financial Assessment to Take Effect March 2015

Posted By Elizabeth Ecker On November 10, 2014 @ 1:39

pm In News,Reverse Mortgage | No Comments

The Department of Housing and Urban Development has

issued a financial assessment for reverse mortgage

borrowers that will take effect for all case numbers issued

on or after March 2, 2015.

The financial assessment [1] is detailed by HUD through

Mortgagee Letter 2014-22 [2] published Monday. For

borrowers who do not demonstrate their willingness to

meet their loan obligations, a fully-funded life expectancy

set-aside will be required.

“The mortgagee must evaluate the mortgagor’s willingness

and capacity to timely meet his or her financial obligations

and to comply with the mortgage requirements,” HUD

writes in defining the purpose of the financial assessment.

“In conducting this financial assessment, mortgagees

must take into consideration that some mortgagors seek a

HECM due to financial difficulties, which may be reflected

in the mortgagor’s credit report and/or property charge

payment history. The mortgagee must also consider to

what extent the proceeds of the HECM could provide a

solution to any such financial difficulties.”

According to HUD, the lender must evaluate the

borrower’s “willingness and capacity to timely meet his or

her financial obligations and to comply with the

mortgage requirements.

“Where

the

mortgagor

has

not

demonstrated

the willingness to meet his or her financial obligations as

stated above and no extenuating circumstances can

be documented, the mortgagee must require a fully

funded Life Expectancy Set-Aside.”

The assessment refers to previous mortgagee letters that

drafted the financial assessment but takes the place of

those mortgagee letters with some changes.

The changes are likely to present tailwinds, rather than

headwinds, one executive told attendees of the National

Reverse Mortgage Lenders Association national conference

in Miami on Monday.

Written by Elizabeth Ecker

[4]

The mortgagee letter also specifies documents [3] that

must be collected and submitted for all borrowers. The

documentation has been updated to include “Financial

Assessment Documentation” that includes, but is not

limited to, credit history documentation, income

verification, asset verification, property charge verification,

residual income analysis, documentation of extenuating

circumstances or compensating factors, and calculations

for life expectancy set asides and residual income shortfall

set asides.

26

27

VARIABLE ANNUITIES ARE SO CUTE AND CUDDLY THAT THERE IS EVEN A CARTOON ABOUT THEM:

Question:

The description that the narrator reads in this video is as follows:

Learn More About...Variable Annuities

Withdrawals will reduce the policy values of the annuity. The withdrawal

base is not a cash value, surrender value or death benefit and is not

available for withdrawal.

What is my withdrawal base?

a.

The amount of money I can withdraw from the contract if I need my

principal back and the funds within the contract collapse.

b.

The amount in a. above, minus up to a 10% surrender charge?

c.

Only the amounts in the investment portion of the contract, minus

surrender charges, plus a small percentage of the “withdrawal base”?

d.

None of the above.

“I am not so much concerned with the return on capital

as I am with the return on capital.”

“How are variable annuities addressing today’s challenges? With an option feature

called a living benefit rider.

Widely attributed to Will Rogers, however, he was not

the person who said this.

Living benefits within variable annuities offer you the added comfort of knowing that

even if your account value declines, the variable component of your contract that can

rise or fall with your investment options, and your withdrawal base, the amount used to

determine your retirement income, will not decline. More importantly, most living

benefits provide features that allow your withdrawal base and your retirement income

the opportunity to grow not only when your investment options perform well but also

when they under perform.” 3:50-4:25

The link to the video is as follows:

http://www.youtube.com/watch?feature=player_detailpage&v=zjNHO7UPWRs#t=262sl

ow

28

29

30

1.9% + 1.25% = 3.15%

31

LETTER FROM TRANSYLVANIAN EASTERN LIFE

INSURANCE COMPANY

It seems to us that one of your people could at

least look at the columns on expenses and confirm

that we have these right.

October 9, 2014

Alan S. Gassman

1245 Court Street

Suite 102

Clearwater, FL 33756

RE: Annuity Number(s) _______________

Dear Alan S. Gassman:

We have received a request for information regarding

this annuity for Dr. ___________________.

Our company acknowledges receipt of your letter

dated

September

12,

2014.

______________________ requests that you not

identify our company as the issuer of the contract.

We also respectfully decline your request to address

the accuracy of the charts and the spreadsheets

which you have prepared for your presentation as we

currently do not have the actuarial resources

available to verify your calculations.

If you have any questions, please call us at

_____________ Monday through Friday between

7:30 a.m. and 6:00 p.m. Central time.

In addition, our client bought this policy in large

part because of the “guaranteed income” feature.

Our numbers show that the rate of return under

this feature is much lower than was expected. Can

you please confirm that we have this right?

In the life insurance world carriers are always

willing to provide in force ledgers which show the

information we are requesting. Your literature and

policy indicate that questions will be answered, so

we would appreciate this courtesy being extended

for our client.

Your people on the phone are very friendly, and

may be qualified, but instructing them to not

answer our questions seems to be at odds with

what your company stands for. Also, it took

several weeks to be able to talk to them and to

provide them with the information.

I look forward to hearing from you with respect to

this.

Best

personal

Alan S. Gassman

GASSMAN LAW ASSOCIATES, P.A.

ATTORNEYS AT LAW

October 24, 2014

RE: Our Request for Help Understanding a Client’s

Variable Annuity Policy and the Attached Letter

Rejecting That Request dated October 9, 2014

Dear Sir/Madam:

I would appreciate it if you could ask your customer

service department to reconsider the attached letter,

which responds to a request that we made to help us

understand a client’s variable life policy.

We spent over 50 lawyer and CPA hours attempting

to understand the policy, and we would appreciate it

if you could let us know if we got this right before we

present our findings to the Notre Dame Tax Institute

next month.

It seems to us that one of your people could at

least look at the columns on expenses and confirm

that we have these right.

In addition, our client bought this policy in large

part because of the “guaranteed income” feature.

Our numbers show that the rate of return under

this feature is much lower than was expected. Can

you please confirm that we have this right?

In the life insurance world carriers are always

willing to provide in force ledgers which show the

information we are requesting. Your literature and

policy indicate that questions will be answered, so

we would appreciate this courtesy being extended

for our client.

Your people on the phone are very friendly, and

may be qualified, but instructing them to not

answer our questions seems to be at odds with

what your company stands for. Also, it took

several weeks to be able to talk to them and to

provide them with the information.

regards,

Sincerely,

Administrative Services

Customer Correspondence Team

Our Lead Actuarial Technician has thoroughly

reviewed one of the scenarios you provided (Life

only with Market = 4%). These are his comments

in order of significance.

Dear Mr. Gassman,

We've received the letter you sent to

____________ and myself last week requesting

information to help understand a variable annuity

policy that you are using in the paper you are

presenting at the Notre Dame Tax Institute in

November. I do apologize for our response on

October 9. We generally do not provide policy

detail to anyone other than policy owner or the

advisor assigned.

After further review, we

understand the academic nature of your request

and have reviewed one of the scenario's you

provided. We do ask that you leave out any

reference to WRL, Transamerica or any

Transamerica affiliate in your paper and the

presentation.

Due to the timing of your event, we're responding

by email to provide feedback on your request.

I look forward to hearing from you with respect to

this.

Best personal regards,

Alan S. Gassman

Dear Mr. Gassman,

We've received the letter you sent to

____________ and myself last week requesting

information to help understand a variable annuity

policy that you are using in the paper you are

presenting at the Notre Dame Tax Institute in

November. I do apologize for our response on

October 9. We generally do not provide policy

detail to anyone other than policy owner or the

advisor assigned.

After further review, we

understand the academic nature of your request

and have reviewed one of the scenario's you

provided.

We do ask that you leave out any

reference to WRL, Transamerica or any

Transamerica affiliate in your paper and the

presentation.

Due to the timing of your event, we're responding

by email to provide feedback on your request.

Our Lead Actuarial Technician has thoroughly

reviewed one of the scenarios you provided (Life

only with Market = 4%). These are his comments

in order of significance.

• We are unable match up to the ROR's in

columns 21-23. It is important to note that the

6% growth on the GMIB (phantom) value

applies during the accumulation phase

only. Once annuitized, the ROR for the GMIB

would be determined by how long the

annuitant (or for joint life, the joint annuitants)

lives.

• The calculations show the annuity has $0 value

after annuitization. While the annuity has no

cash value, there is value to the series of future

lifetime payments. Depending on how this

information will be utilized, you may consider

using a present value of future annuity

payments after annuitization.

• The GMIB fee for this policy is 0.35%. The

scenarios show it as 1.10%.

• The admin fee is waived on this policy, since

both the Policy Value and premiums exceed the

$50,000 waiver threshold. The scenarios are

still applying the $30 fee annually.

• The parenthetical within the "Total Expenses"

column needs to be revised. The revised value

should be 2.55% once the revisions from the

prior 2 bullet points are accounted for.

• The separate account charge and subaccount

fee percentages are being based on the

beginning of year values. A more accurate

estimate is to calculate based on a midpoint

(average) value to reflect the fact that these

fees are assessed daily on the then-current

values.

Thank you and please contact me if you need

clarification on any of the feedback listed here.

_______________

Senior Vice President of Operations

Transylvanian Investments & Retirement

32

Monster Life

33

Monster Life

34

EXCERPTS FROM VARIABLE ANNUITIES OUTLINE

An Example of the Financial Cost of Annuitization

A 59 year old client, who invested $100,000

in a variable annuity with a “guaranteed value feature”,

wanted to convert his $159,700 “guaranteed value” into an

annuitized contract, because that is the only way under the

contract to make use of the guaranteed value. The carrier

indicated that this would entitle him to a $9,078.24 per year

payment for life or 10 years, whichever is longer.

His standard table life expectancy was 22.3

years, so he was expected to live until age 81. In reality his

health is problematic, and he expects to die before age 81.

Assuming that he would reach age 81, the rate of return on

this investment would be 2.36%, based on the following

chart:

Age

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

Last Year

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

Investment

$159,700.00

Annual Payment

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

$9,078.24

Cumulative Payments

$9,078.24

$18,156.48

$27,234.72

$36,312.96

$45,391.20

$54,469.44

$63,547.68

$72,625.92

$81,704.16

$90,782.40

$99,860.64

$108,938.88

$118,017.12

$127,095.36

$136,173.60

$145,251.84

$154,330.08

$163,408.32

$172,486.56

$181,564.80

$190,643.04

$199,721.28

$208,799.52

$217,877.76

$226,956.00

$236,034.24

$245,112.48

$254,190.72

$263,268.96

$272,347.20

$281,425.44

$290,503.68

$299,581.92

$308,660.16

$317,738.40

$326,816.64

$335,894.88

$344,973.12

$354,051.36

$363,129.60

Rate of Return

-94.31%

-73.15%

54.45%

-40.89%

-31.20%

-24.14%

-18.86%

-14.81%

-11.65%

-9.14%

-7.11%

-5.44%

-4.06%

-2.91%

-1.93%

-1.09%

-0.38%

0.24%

0.78%

1.25%

1.67%

2.04%

2.36%

2.65%

2.91%

3.14%

3.35%

3.54%

3.71%

3.86%

4.00%

4.13%

4.24%

4.35%

4.44%

4.53%

4.61%

4.69%

4.76%

4.82%

35

HOW ABOUT HYBRID INDEXED ANNUITY PRODUCTS? AREN’T THEY BETTER THAN THE OLD TRADITIONAL VARIABLE PRODUCTS?

Under an equity indexed annuity, the policy holder can

select a well-recognized financial market index, like the

S&P 500, Russell 2000, or the Wilshire 5000, and the

contract will provide a rate of return each year based

upon calculations that are derived from the index, but

use “caps” and other calculation methods that yield a

significantly lower return than the actual index, while

also providing a floor each year to prevent losses below

zero. They do this by using complex concepts such as

point to point measurements, the spreads, and ceiling

provisions as described below.

Typically the contract provides that if the index is

negative for a given period of time, then the value of

the contract will not go down, but if the index is

positive then the value of the contract will go up ONLY

by some portion thereof.

For example the company may say “We will put your

money, or the equivalent thereof, into an S&P 500

Index, or a NASDAQ Index, or a Morgan Stanley Index,

and we promise you that if during a contract year the

index goes down we will keep you at zero and you will

never lose your principal.” That seems straightforward

and easy to understand.

However, this is not the whole picture. In exchange, the

company wants “the spread,” which means, for

example, that they might keep the first 3.5% of annual

growth, and the contract holder gets everything above

this percentage. Alternately, they may request a ceiling

provision, referred to as a cap, whereby during any

calendar month where the index goes up more than a

set percentage, then the company keeps the excess, or

a percentage of the excess. The percentage of the

excess is referred to as a participation rate. An example

would be that the carrier keeps 80% of everything over

3% in gains per month and keeps 100% of the first 3%.

One problem is that it is difficult for a layman, or even

an expert, to understand how this mechanism works,

and to appreciate how much money may be left on the

table for the carrier based upon how index markets

typically move.

36

HOW ABOUT HYBRID INDEXED ANNUITY PRODUCTS? AREN’T THEY BETTER THAN THE OLD TRADITIONAL VARIABLE PRODUCTS?

THE FOLLOWING ARE EXCERPTED QUOTES FROM AN ARTICLE BY PROFESSOR ANDREW B. CARVER OF THE COLLEGE OF NEW JERSEY SCHOOL OF

BUSINESS THAT WAS PUBLISHED IN THE JANUARY 2013 EDITION OF THE DECISION SCIENCES

JOURNAL OF INNOVATIVE EDUCATION

TEACHING BRIEF

The Equity Indexed Annuity: A Monte

Carlo Forensic Investigation into

a Controversial Financial Product

ABSTRACT

Equity Indexed Annuities (EIAs) are controversial

financial products because the payoffs to investors are

based on formulas that are supposedly too complex for

average investors to understand. This brief describes

how Monte Carlo simulation can provide insight into

the true risk and return of an EIA. This approach can be

used as a project assignment or an in-class assignment

to demonstrate the ability of Monte Carlo simulation to

solve problems involving uncertainty and nonlinear

payoffs.

A DECEPTIVE FINANCIAL PRODUCT?

An EIA is a financial product offered by insurance

companies that supposes to offer both the upside

potential of the stock market and at the same time is

guaranteed to not lose money. It sounds good, but is it

too good to be real? The lure of potential high returns

with no possible losses has made the EIA popular but

controversial. Critics of EIAs charge that the design of

the contract is too complex for most investors to

understand. According to Business Week (2007),

“Attorneys general in at least two states have filed suits

against insurers, charging inappropriate sales tactics.”

Security industry watchdogs have also voiced concerns