Impartiality and the Principal and Income Problem

advertisement

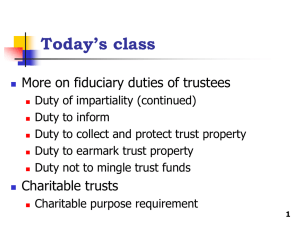

Today’s class We conclude our discussion of the trustee’s fiduciary duties by considering Duty of impartiality Duty to inform With brief review of Duty to collect and protect trust property Duty to earmark trust property Duty not to mingle trust funds 1 Duty of impartiality If a trust has two or more beneficiaries, the trustee shall act impartially in investing, managing, and distributing the trust property, giving due regard to the beneficiaries’ respective interests. Uniform Trust Code § 803 Thus, impartiality does not require equivalent treatment, only fair treatment 2 Howard v. Howard Howard v. Howard 156 P.3d 89 (Or. App. 2007), p. 726 First wife Leo Marcene (Co-Tr) Coy (Co-Tr) Trust income to Marcene for life, remainder to Leo’s children When investing the trust principal, should the trustee favor production of income or growth of principal? 3 The trustees’ duty according to Coy Coy and Marcene should take into account the other resources of Marcene in deciding how much income the trust should generate. If they did not consider her other resources, she would be able to save income from the trust for her own children, and that would have frustrated Leo’s intent that the remainder pass to his children. Leo and Marcene divided their assets in a way such that 60 percent would go to Leo’s three children and 40 percent to Marcene’s two children. That way, each child would receive an equal share. 4 Trustees not required to take into account other resources of Marcene A provision in the trust instrument stated that “my spouse’s support, comfort, companionship, enjoyment and desires shall be preferred over the rights of the remaindermen.” There was no provision in the trust directing the trustees to take into account the needs of, or other financial resources available to, Marcene (and recall that the trust would pay her all of the income rather than income as needed). There were provisions in the trust instrument instructing the trustees to take into account the needs and other resources of other beneficiaries. 5 Drafting lesson from Howard If Leo really did want to ensure equality between his line of descent and Marcene’s line, he should have included language in the trust agreement instructing the trustee to take into account the other resources of Marcene in allocating investments between generation of income and growth of principal (note 1, page 729) 6 Impecunious surviving spouse, note 2, page 729 Will the more contemporary modification statutes make courts more receptive to petitions on behalf of surviving spouses? “The court may modify the administrative or dispositive terms of a trust if, because of circumstances not anticipated by the settlor, modification or termination will further the purposes of the trust. To the extent practicable, the modification must be made in accordance with the settlor's probable intention.” Ind. Code 30-4-3-24.4(a) 7 Uniform Principal and Income Act: Reallocation between income and principal Trust 1: $100,000 in bonds with a 4 percent interest rate. Each year, $4,000 in income is generated, and principal remains at $100,000. Trust 2: $100,000 in stock with an 8 percent appreciation but no dividends. Each year, the principal grows by $8,000 or more, but no income. If the trustee splits the increase in trust value between income and principal, both income and principal beneficiaries are better off. (Income starts at $4,000, then $4,160, etc.) Ind. Code § 30-2-14 8 Uniform Principal and Income Act and the unitrust provisions The UPIA allows trustees to focus on total return without worrying whether the return takes the form of income or principal, but trustees still have to decide how much of the income to allocate to “income” and how much to “principal.” The unitrust provisions allow for a specified percentage of the trust’s assets to be treated as “income”—it can be a fixed percentage (4%), it can be tied to inflation, or it can be based on prevailing interest rates When the settlor chooses the unitrust, the settlor determines the percentage When trustees convert a trust to a unitrust, as in Heller, the statute sets the percentage (usually 3-5 percent) (3-5 percent in Indiana, 9 with a presumption in favor of 4 percent, § 30-2-15-15). In re Matter of Heller In re Matter of Heller 849 N.E.2d 262 (N.Y. 2007), p. 731 First Wife Jacob Remainder Alan Herbert Suzanne Bertha First Husband Income Faith Sandra 10 Unitrust conversion and interested trustees In Heller, the trustees who elected the unitrust conversion also were remainder beneficiaries who would benefit from the reduced allocation of estate returns as “income” (from $190,000 to $70,000) The court rejected a no-further-inquiry standard for this structural conflict and instead required close scrutiny to ensure good faith and fairness by trustees NY did not prohibit unitrust conversions by conflicted trustees even though it did prohibit UPIA adjustments that would favor a trustee The trustees were meeting their fiduciary obligations to the other remainder beneficiaries In Indiana, trustees who are beneficiaries need court approval for a unitrust conversion (Ind. Code § 30-2-15-11)11 Subrules relating to trust property, pp. 736-738 Duty to Collect and Protect Trust Property Duty to Earmark Trust Property Trustee must collect and protect property without unnecessary delay (i.e., as promptly as circumstances permit). Trustee must designate property as trust property rather than the trustee’s own. Duty Not to Mingle Trust Funds Trustees must not commingle trust funds with their own, even if the trustees do not use the trust funds for their own purposes. 12 UTC §813: Duty to inform and report, p. 738 (a) A trustee shall keep the qualified beneficiaries of the trust reasonably informed about the administration of the trust and of the material facts necessary for them to protect their interests. … (b) A trustee: (1) upon request of a beneficiary, shall promptly furnish…a copy of the trust instrument;… (3) … shall notify the qualified beneficiaries of the trust’s existence … . (c) A trustee shall send to the distributees…, and to other qualified or nonqualified beneficiaries who request it, at least annually … a report of the trust … . (d) A beneficiary may waive the right to a … report or other information … required to be furnished under this section. … 13 UTC definitions “Beneficiary” means a person that (A) has a present or future beneficial interest in a trust, vested or contingent; or (B) in a capacity other than that of trustee, holds a power of appointment over trust property “Qualified beneficiary” means a beneficiary who, on the date the beneficiary’s qualification is determined: (A) is a distributee or permissible distributee of trust income or principal; (B) would be a distributee or permissible distributee of trust income or principal if the interests of the distributees described in subparagraph (A) terminated on that date without causing the trust to terminate; or (C) would be a distributee or permissible distributee of trust income or principal if the trust terminated on that date. 14 Fletcher v. Fletcher Fletcher v. Fletcher 480 S.E.2d 488 (Va. 1997), p. 739 Elinor placed all of her assets into a revocable, inter vivos trust and then amended it to provide for a number of separate trusts upon her death, including three for James, Andrew and Emily $50,000 to provide “adequate medical insurance and medical care.” $50,000 in such amounts as trustees deem advisable. Elinor J. North Henry James Andrew Emily $50,000 in such amounts as trustees deem advisable. 15 Fletcher As a beneficiary of Elinor’s trusts, was son, James, entitled to information only about his individual trust or about all of the trusts? That is, should the court treat the arrangement as a single trust or as many separate trusts? According to the court, James should be treated as a beneficiary of a single trust—there was a single trust agreement with multiple trust provisions rather than multiple trust agreements for the different trusts 16 Fletcher But James didn’t really need to see the entire trust agreement to monitor his own trust The court probably was sympathetic to James because he was Elinor’s son Even if James’ kinship motivated the court, the UTC codified the Fletcher holding with respect to all beneficiaries of a single trust agreement (§ (b)(1)) Drafting lesson Elinor could have limited disclosure to James of the terms of his individual trust in the trust agreement, or she could have had multiple trust agreements 17