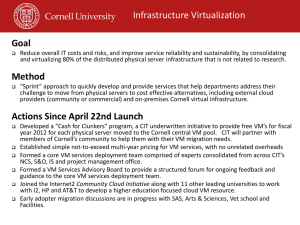

Survey Under Income Tax Act, 1961 Jurisdiction Of - Indore

advertisement

Overview of Search and Seizure and

Survey Provisions Under Income Tax Act

1961 with Relevant Provisions of Indian

Evidence Tax Act

Presented By

Ram Krishna Gupta

CCIT (CCA),Nagpur Mumbai

NATURE OF POWER UNDER SECTION

132

Punjab and Haryana High court in Janak Raj Sharma

v. Director of Inspection ( Investigation) ( 1995) 215

ITR 234 held ( page 237 of 215 ITR ) :

“Section 132 impinges upon the privacy of a citizen.

It even carries a social stigma. To a sensitive man, the

consequences can be serious. The Legislature has

consequently provided the in-built safeguards. These

have to be satisfied before any order for search, etc. can

be passed.”

SECTION 132: Legislative History

Section 37(2) was introduced by Finance Act, 1956 to

grant powers of search and seizure in the Income Tax

ACT 1922.

The same continued in the IT ACT 1961 under section

132. This provision as such continued till 1964.

Thereafter, it was replaced by a completely elaborate

provision as these provisions were stuck down by

Assam High Court being voilative of article 14 and

19 ( 1g) of the constitution. In this year section 133A

was also introduced giving power of survey.

SCOPE OF DISCUSSION

Search provisions-legal Action-validity of action-release of

explained assets

Presence of counsel -Quasi Judicial proceedings –meaning

thereof-Nature of Enquiries –

Confession –Advantages and Disadvantages

Confession -How to be made

Ingredients of Retraction

Post search Enquiry

Post search action necessarily to be taken

Assessment-how to determine income, etc

Controversies –Judicial Pronouncement

SEARCH AND SEIZURE-S.132

SEARCH - WHEN POSSIBLE

Object - to get direct and clinching evidence regarding

transactions, duplicate set of books, undisclosed,

concealed income, wealth and assets.

WHO CAN AUTHORIZE [U/s 132(1)

Authorisation of Search

DGIT / CCIT / DIT /CIT

May Authorize

ADIT/ ACIT

Dy. DIT / Dy. CIT

ITO

Addl. DIT / Addl. CIT

Jt. DIT / Jt. CIT

May Authorize

source of information

A: Information-outside the department: Professional

informers, business or professional rivals, disgruntled

employees, unhappy wife, estranged brothers or a

disgruntled son-in-law or a harassed daughter-in-law etc.,

within the department (CIB,AIR,ITS,AO etc.) and outside

the department (FIU, Police, NIA, Directorate of

Enforcement, custom and excise, Narcotics, sales tax etc)

B : Information of Hawala Transactions :

1. Bogus Purchases / Expenses

2. Bogus Cash Credits

3. Bogus Capital Gains

4. Foreign Bank Accounts

C Information gathered during search of third party or

associates

S.132-INFORMATION

Information’ within the meaning of section 132(1)

should be as accurate as possible having reference to

the precise assets of a person and not of general nature

and that should in all probabilities, lead the

authorities to have the unmistaken belief that money,

bullion, jewellery or other valuable articles or things

pointed out by the informer, would be found in

possession of the person named by the informer.

The reason to believe must be tangible in law and

it should have a rational nexus with the belief.

Conditions for valid search

Prabhubhai Vastabhai Patel Vs R.P. Meena 226 ITR

781 (Guj) has summarised conditions laid down by

various judgements

Authority must have information

Reason to believe & not suspect

It must be info & not rumour or gossip or hunch.

Information must exist prior to authorisation.

reason to believe must have reasonable bearing / connection

to information.

Existence of condition precedent is open to judicial scrutiny.

But sufficiency of information is not open to judicial scrutiny.

Search related Instruction

Instruction No. 7 of 2003 of 30th July 2003 –

(a) Searches should be carried out only in cases

where there is credible evidence to indicate

substantial unaccounted income/assets in relation

to the tax normally paid by the assessee OR

(b) where the expected concealment is more than

Rs. 1 crore.

SEARCH AND SEIZURE-S.132

VALIDITY OF SEARCH – WRIT JURISDICTION

At assessment stage: Chitra Devi Soni 313 ITR 174(Raj.)

in favour of assessee SLP dismissed.

Paras Rice Mills 313 ITR 182(P&H);Gaya Prasad Pathak

290 ITR 128 (MP) against the assessee

Illegal Search – Consequences

When a search is held as illegal by High Court :

All assets seized to be returned

Original copies of books of account or other documents to

be released.

No proceedings u/s. 153A or u/s. 153C .

No presumption u/s. 132(4A) / 292C

Costs may be awarded

However, department is not precluded from using the

document [Pooranmal Vs. Director of Inspection (1974 )

93 ITR 505 (SC)]

The material seized during an illegal search can be used

against the assesses. Dr. Pratap Singh v. Director of

Enforcement ( 1985) 155 ITR 166 (SC)

PRESENCE OF COUNSEL

QUASI JUDICIAL PROCEEDINGS-MEANING

A.Investigation and collection of incriminating

evidence and relevant facts and their verification,

examination (Police inspector role-administrative)

B.Issuing of show cause notice to the assessee after

charges are framed (ie prosecutor’s role - to file

charge sheet before the trial court- administrative )

C.Appreciation and evaluation of the evidences

collected by him and explanation and evidences

filed by the assessee (Judge’s Role)

Quasi Judicial Authority

The role of

the quasi

judicial

authority

Prosecutor’s

role

Police inspector’s

role

Judge’s role

PRESENCE OF COUNSEL

Nature of I-T proceeding

The Madras High Court, in the G. Giribabu & Anr. (2010)

326 ITR 575 Madras) case, decided that a person

summoned cannot insist that he should be permitted to

appear with his counsel during preliminary enquiry

proceedings.. The case arose under the FEMA provisions.

The petitioners' case before the high court was that

the right to be represented by an advocate flows as the

cross examination is justified as if before a court of law. The

FEMA/I-T authorities have no jurisdiction or power to deny

the presence of an advocate. The right of fair procedure is

part of the requirement of article 21 of the Constitution of

India.

PRESENCE OF COUNSEL

Nature of Enquiry

There is great latitude allowed to an income-tax authority

and the procedure in an adversary system of proceedings

cannot be applied to him even at the stage of collection

of information.

The court held that the functions that the AOs under the IT

Act and officers of the ED under FEMA perform are of an

inquisitive nature seeking and collecting informationnot that of deciding any issues.

Basically, these are information gathering exercises.

When the information gets collected through the machinery

of these provisions and it is to be put to use in passing

orders, the parties involved are to be given opportunity to

have their say in accordance with the principle of natural

justice and they get full opportunity for cross-examination

and, at that stage, the assessee/party proceeded against, can

be represented by his/her counsel-not at the enquiry stage.

STATEMENTS/CONFESSION

Statement on oath-Meaning thereof

Sec.8 of INDIAN OATHS ACT, 1969: Persons giving

evidence bound to state the truth: Every person giving

evidence on any subject before any Court or any person

authorized to administer oaths and affirmation shall be

bound to state the truth on the subject.

Name of Old act - The Indian Oaths Act, 1873

Binding nature of a statement

made on oath

an admission in statement recorded on oath is an

extremely important piece of evidence but it cannot be

said that it is conclusive : Pullangode Rubber

Products Co. Ltd. (91 ITR 18)(SC),Krishnan vs.

Kurushetra University (AIR 1976 SC 377) )(SC)

a statement recorded u/s.132(4) at midnight cannot be

considered a voluntary statement if it is subsequently

retracted by the assessee and necessary evidence is laid

contrary to such admission: Kailashben Manharlal

Chokshi (174 Taxmann 466)( Gujrat):

Importance of Disclosing/Substantiating the manner of

earning undisclosed income in

Assessment Proceedings-115BBE-introduced w.e.f 1st

Penalty Proceedings

Application for Settlement before the Settlement

commission

The meaning of “Substantiate” :

Refer: Hon’ble ITAT, Ahmedabad in Gujarat

Credit Corporation Ltd. v. ACIT [113 ITD 133 (Ahd)(SB)]

“…‘NOT ABLE TO SUBSTANTIATE’ DOES NOT MEAN

NOT ACCEPTED BY THE AUTHORITY

CONCERNED BUT NOT SHOWING A SUBSTANCE IN

THE CLAIM MADE BY THE ASSESSEE.

ASPECTS RELATING TO SURRENDER OF UNDISCLOSED

INCOME

Why to make surrender?

To avoid penalty

To mitigate rigors of search, To wrap up the search

proceedings

Conditions of surrender under section 132(4)

r.w.s 271AAB

State the manner how undisclosed income has been

derived

Substantiate the manner

Pay the taxes before the specified date.

Retraction of Surrender

To be made at the earliest

Department may view it adversely

Ultimately nature of evidences will decide

Challenging valuation, not retraction

Challenging calculation, not retraction

Conditional surrender- fulfilling conditions

Consequences of retraction.

In case of retraction burden of proof on assessee : Krishan

Lal Shiv Chand Rai v. CIT (1973) 88 ITR 293 (P&H).

Surrender- consideration

Cover incriminating material found

Creation of capital

Generation of income v. Application in assets

Set-off of losses

Assets acquired prior to seven financial years

Current year income not recorded, advance tax not paid

Conditional surrender

Principle of Peak Balance

No surrender for third party

SURRENDER OF UNDISCLOSED INCOME: How to be

made during the course of search

A paragraph mentioning that the surrender letter

submitted by the assessee is in the nature of statement

of the assessee u/s.132(4).

To mention that the declaration is subject to no penal

consequences. However,it has to be decided on merit:

To mention broad manner of earning undisclosed

income and to substantiate it to the extent possible.

Surrender letter to be signed by of the person/entity

making the surrender. In case a person makes

declaration on behalf of other person, he should be

authorized to do so.

SURRENDER OF UNDISCLOSED INCOME:

Surrender of undisclosed income to be made in the hands of the

person/entities against whom search warrant has been issued.

To ensure that surrender letter is given prior to the date of

conclusion of search with respect to the concerned

person/entity.

In case declaration is made amending or improving upon any

earlier declaration, this fact should be clearly mentioned.

In case there is seizure of cash, assessee should state and

request to treat the amount of cash seized as payment of

advance tax in the hands of concerned person/entity.

A line mentioning that surrender of undisclosed income is being

made to buy peace and to settle the dispute.

Retraction-Valid

Affidavits

of independent witness to the search

proceedings be submitted corroborating the claim of the

deponent.

The Gauhati

High court

in_Green_ViewRestaurant. vs. Asstt. CIT (2003) 185 CTR (Gau) 651

dismissed the contention advanced by the assessee as to

recording of statements by using force and coercion when

the statements were recorded in the presence of two

witnesses and the retraction was after lapse of time.

Retraction-Duty of the officer

After retraction, statements must be recorded on oath.

At the time of re-recording of such statements, the

deponent must corroborate and confirm what he has

stated in the letter of retraction

Application of seized assets (Sec 132B)

The assets seized shall be dealt with in the following manner

i) Seized assets may be applied towards existing and future liability (sec

132B(1)(i)

ii) Release of seized asset after meeting existing liabilities in certain cases

132B(1)(ii),

iv) Assets other than money may also be applied to discharge liabilities (sec

132B (1)(iii)

Return of excess assets seized (section 132B(3)

the interest shall be payable from the expiry of the period of 120 days from

the execution of the last of the authorizations for search till the date of

completion of assessment under section 153A or block assessment.

Section 132B

Seized Cash can be adjusted against any existing income

tax and wealth tax liability

It is also be adjusted against tax liability determined on

completion of assessment u/s 153A

Where an application to the AO is made for release of asset

within 30 days from the end of the month in which asset

was seized and if nature and source of such asset is

explained to the satisfaction of the AO. The AO after

adjusting existing liability has to release asset after

taking prior approval of CIT or CCIT.

After the amendment made by the Finance Act, 2013 w.e.f.

01.06.2013, seized cash cannot be adjusted against liability

for payment of advance tax. Refer Expl.2

Instruction No. 11 of 2006, of 1st Dec., 2006 regarding

release of seized cash deposited in PD Account

POST SEARCH LETTERS

request to appropriate cash seized toward advance tax. Now not

possible from 1st June 2013

Application u/s.132B for release of disclosed assets if any seized

along with all the relevant evidences.(Refer 1st and 2nd proviso to

132B(1)(i)

Letter requesting to give photocopies of all the documents, papers

or books of account seized. Delay in supplying copies of seized

material – Levy of interest not justified.[Refer Board order issued

u/s119(2)(a)] reported in 219 ITR 169 (ST)

Letter for release by person/entity not covered in the search, in

case any books of account or assets belonging to them have been

seized.

Letter with complete evidences regarding disclosure of jewellery or

assets in case restraint order u/s.132(3) has been passed but assets

have not yet been seized.

Letter for release of jewellery against deposit of equivalent amount

of cash /furnishing of bank guarantee.

Presumption as to ownership. S. 292 C

[Inserted by Finance Act, 2008, w.r.e.f. 1/06/2002].

Presumption regarding

Belongingness of book of account, other documents,

money, bullion, jewellery, other valuable article or thing

Truthfulness of the contents

regarding signature and handwriting and stamping and

execution or attestation.

NOTE:

This concept is in line with the principle given

under Indian Evidence Act. Section 110 of Indian Evidence

Act. 1872 reads as under :“ when the question is whether any

person is owner of anything of which he is shown to be in

possession, the burden of proving that he is not the owner is

on the person who affirms that he is not the owner”.

HANDLING OF ASSESSMENT IN SEARCH CASES

Systematically and chronically arrange all the seized

documents entities wise and Assessment year wise . For that,

get the transactions entered in excel sheet preferably in the

following columns. Name of Entity, Date, amount ,narration

of expenditure, narration of income, narration of investment

and premise wise,

Benefit of telescoping /peak credits

Where any undisclosed income is offered in the return filed

u/s 153A then the expenditure incurred to earn that income

may also be claimed.

Below the computation of income put the suitable and

appropriate notes-provide flexibility , no allegation of non

disclosure etc

RELEVANT ISSUES UNDER SECTION 153A / 153C (made after

31/5/03)

Assessment for the preceding seventh year prior to the

year of search can be reopened under section

148.Ramballabh Gupta v. Asstt. CIT(2007) 288 ITR 347

(MP).

Fresh assessments to be framed for all the preceding six

years whether assessment proceedings are abated or not.

Notice under section 143(2) within time limit as

prescribed is mandatory in case of proceedings under

section 153A :Asstt. CIT v. Hotel Blue Moon (2010) 321 ITR

362 (SC).

RELEVANT ISSUES UNDER SECTION 153A / 153C

Recording of satisfaction before invoking provision of section

153C :Manish Maheshwari v. Asstt. CIT (2007) 280 ITR 341

(SC).

Jurisdiction under section 153C can be assumed when seized

material belong or belongs to other person :Vijaybhai N.

Chandrani v. Asstt. CIT (2010) 38 DTR (Guj.) 225.

Reference to departmental valuation officers in search cases.

Reference for special audit under section 142(2A).

Reliance on statement recorded by authorized officer during

search.

No addition for investment in jewellery upto specified limit

not required to be seized.

Assessment in the case of retraction surrender of

undisclosed income.

ASSESSMENT U/S.153A IN THE CASE OF CONCLUDED

ASSESSMENTS

ASSESSMENT U/S.153A HAS TO BE MADE ON THE BASIS OF

INCRIMINATING MATERIAL ONLY IN THE CASE OF

CONCLUDED ASSESSMENTS

All Cargo Global Logistics Ltd. vs. DIT, 2012-TIOL-391-ITAT-MumSB, i.e., on the basis of undisclosed income/property/books of

accounts/ documents found during 132/132A operation.

A.C.I.T. vs. Pratibha Industries Ltd., [2012] 28 taxmann.com 246

(Mum.)

Jai Steel (India) vs. Assisstant Commissioner Of Income Tax

(dt.24.05.2013)(Raj.) held

(a) the assessments or reassessments, which stand abated in terms

of II proviso to Section 153A of the Act, the AO acts under his

original jurisdiction, for which, assessments have to be made; (b)

regarding other cases, the addition to the income that has already

been assessed, the assessment will be made on the basis of

incriminating material and (c) in absence of any incriminating

material, the completed assessment can be reiterated and the

abated assessment or reassessment can be made.

Penalty Provisions

For earlier years U/s 271(1)(c)

For specified years U/s 271AAA Introduction of Section

271AAB by Finance Act, 2012 w.e.f.1st july 2012

Penalty for undisclosed income even for specified

previous year in staggered manner:Declared during search in statement under section

132(4) – 10%

Declared in the return of income filed under section 153A

– 20%

Not Declared, addition made during assessment – 30%90%

Voluntary disclosure- consequences

The Supreme Court in the case MAK Data (P.) Ltd. V. CIT (2013) 38

Taxman.com 448 (SC) held as under:

The Assessing Officer shall not be carried away by the plea of the assessee like

‘voluntary disclosure’, ‘buy peace’, ‘avoid litigation’, ‘amicable settlement’, etc.,

to explain its conduct;

Assessee had only stated that he had surrendered the additional sum with a

view to avoid litigation, buy peace and to channelize the energy and resources

towards productive work and to make amicable settlement with the income-tax

department. Statute does not recognize those types of defences under the

Explanation 1 to section 271(1)(c);

It is trite law that the voluntary disclosure does not free the assessee from the

mischief of penal proceedings under section 271(1)(c). The law does not provide

that when an assessee makes a voluntary disclosure of his concealed income, he

has to be absolved from penalty;

The surrender of income in this case was not voluntary in the sense that the

offer of surrender was made in view of detection made by the Assessing Officer

in the search conducted in the sister concern of the assessee.

Survey Under Income Tax Act,

1961

Jurisdiction Of Income tax authority for conducting

survey s. 133A (1)

Territorial Jurisdiction

Assessee specific Jurisdiction

Authorized Jurisdiction

The place of the business or profession shall include

any other place where the books of accounts or other

documents or any part of the cash or stock or other

valuable article is kept.(Business related material)

Expln.to Sec.133A defines an Income Tax Authority :

Director /Commissioner to Inspector level however If

authorized by Joint/Addl. Director/ commissioner then

Deputy / Assistant Director / Commissioner ITOs ,Tax

Recovery Officer,Inspector of Income Tax (For

certain Specific purpose)

Jurisdiction:

Residential premises can also be covered if the

assessee states that business/professional

work/document/assets is there

Survey is possible even to enquire about tax deducted at

source : Reckitt and Colman of India Ltd. vs. ACIT [2001] 251

ITR 306 (Cal)..

Business or residential premises of third parties,

including a Chartered Accountant, a pleader, or Income Tax

Practitioner, of whom the assessee may be a client, are

not places which could be entered into for the

purpose of section 133A. (Circular no. 7- D dt

3/5/1967),however if it is found that assessee’s books of

accounts/documents are there than for that limited purpose

it can also be covered.

Note : Survey team has no power to break open any locked

premises as power to break open any lock is not conferred u/s

133A as against specific provisions contained u/s 132.

Evidentiary Value of Statement Recorded

u/s 133A

Statement u/s 133A is not recorded on oath and,

therefore, in the absence of any corroborative

evidence, has no evidentiary value.Refer: CIT v.S.

Khader Khan & Sons 352 ITR 480(SC),Paul Mathews

and Sons 263 ITR ITR 101 (Ker)

However addition can be made on the basis of

assessee’s statement in survey, if it is supported by

relevant material.Refer: CIT v. P. Balasubramaniam 215

Taxman 288 {2013} Madras- High Court and Mumbai

ITAT Income Tax Officer v. Devji Premji

Brief Comparison between Search u/s 132 and Survey u/s 133A

Seizure of Books of account as well as money, Impounding of only Books of account and

jewellery, bullion and other valuable article

other documents

Retention-Not exceeding

Section139(9A)*

60Days

[As

per Retention-Not exceeding10Days [As per

section133A(3)(ia)]**

Statement recorded on oath and used as evidence Statement not recorded on oath and hence,

in subsequent proceedings

In the absence of incriminating material, no

evidentiary value

Retraction-Possible

Retraction–Easier-As no evidentiary value

Pending Assessments-Abate

Not applicable

Statement u/s131(1A)-Can be recorded

Statement u/s131(1A)-Can be recorded

*Books of accounts or documents shall not be **It can be extended with prior approval of

retained by the A.O. for a period exceeding thirty CCIT or DGIT as the case may be.

days from the date of the order of asst. u/s153A

Nature of ‘Escaped Income, Concealed Income and‘Undisclosed Income’

Escaped Income

Concealed Income

Undisclosed Income

Section147

Section271

271AAA/271AAB

(i) under assessment of income The word ‘conceal’ means to

(ii) income assessed at too Low a hide, to keep secret. The phrase

rate

‘conceal the Particulars of his

income’ would include false

(iii)Excessive relief granted

deduction or exemptions claimed

(iv) excessive loss or depreciation

by the Assessee in his return.

allowance or Any other allowance

CIT vs. Manjunatha Cotton

and Ginning Factory (Kart.

HC)2013

Any income of the specified

previous year represented, either

wholly or partly, by any money,

bullion, Jewellery or other valuable

article or thing or any entry in the

books of account or other documents

or transactions found in the course

of a search under section 132, which

has—

Section147

271AAA/271AAB

Section 271

(A) Not been recorded on or before

the Date of search in the books of

account or other

documents

maintained in the normal course

relating to such previous year; or

(B) otherwise not been disclosed to

the

Chief

Commissioner

or

Commissioner before the date of

search;

APPLICATION TO SETTLEMENT COMMISSION

Pre-requisite for Filing Application –

1. An application before the Settlement Commission can be made only

if the additional income disclosed exceeds Rs 10 lakhs in normal case

and in search case if disclosure exceeds 50 lakhs.

2. Application can be made only at the stage of the pendency of the

original assessment proceedings before the assessing officer (AO).

3. No application can be made when proceedings are initiated for

assessment or reassessment under Section 148 of the Income-Tax Act,

1961

4. Proceedings for making fresh assessment when original assessment

was set aside either by the Commissioner or by the Tribunal will also be

outside the purview of the application for settlement.

5. An application can be made by an assessee for settlement before the

Commission only once in a lifetime.

Advantage: Order is conclusive and final. Waiver of penalty and

prosecution under Income Tax Act can be given

WRIT Related Matters:

ILLEGAL SEARCH-release of Jewellery and ornaments

seized: In Director General of Income Tax and Anr. vs

Diamondstar Exports Ltd and Ors. [2006] 293 ITR 438

:Hon’ble SC has held that Jewellery and ornaments seized

during an illegal search were to be returned to the owners

as soon as possible, along with the interest at the rate of 8

per cent on the value of the seized items.

VIOLATION OF HUMAN RIGHTS : Chief

Commissioner of Income-tax (CCA) v. State of Bihar

Through The Chief Secretary, [2012] 18 taxmann.com

70 (Pat.):Due regard to human dignity and value cannot be

ignored.:

WRIT Related Matters:

SUPPLY OF REASONS WITHOUT SOURCE OF INFORMATION: M/s M D

Overseas Ltd. v DGIT & Others, [2011] 198 TAXMAN 136(All.):Whether when

assessee makes a prima facie case against validity of search, Revenue is obliged

to share information relating to 'reasons to believe' for authorizing search

except the source of information. Held Yes

GENERAL REASONS LIKE HIGH GROWTH AND HIGH PROFIT

MARGINS CAN NOT BE TH E BASE FOR SEARCH :Space wood

Furnishers Pvt. Ltd. Director General of Income Tax (Investigations)

[2012] 340 ITR 0393 (Bom)

NOTICE ISSUED U/S 131(1A) SUBSEQUENT TO SEARCH WOULD NOT

INVALIDATE SEARCH : Dr. Roop v. Commissioner of Income-tax, Meerut

[2012] 20 taxmann.com 205 (All.) see also Neesa Leisure Ltd. V Union of India

through Secretary. [2011] 338 ITR 0460 (Guj). Contrary view: Allahabad High

Court in the case of Dr. Mrs. Anita Sahai v. DIT [2004] 266 ITR 597

Other Important cases

THE ISSUANCE OF PROHIBITORY ORDERS U/S

132(3) IN RESPECT OF ACCOUNTS DULY PASSED

THROUGH REGULAR BOOKS OF ACCOUNTS

ARE NOT VALID :MAA VAISHNAVI SPONGE LTD. V.

DGIT (INVESTIGATION) [2011] 339 ITR 0413 (ORI).

DUMPING OF DOCUMENTS AND ARTICLES IN

PARTICULAR PLACE AND SEAL IT, NOT RIGHTS :

Dr. C. Balakrishnan Nair v CIT 237 ITR 70 (Kerala)

AUTHORISATION OF SEARCH MERELY ON AN

INTIMATION FROM CBI WAS INVALID,:Ajit Jain

Vs Union of India 242 ITR 302(Delhi)

Other Important cases

NO SEIZURE OF THIRD PARTY IF THERE IS

EXPLANATION AS TO THE OWNERSHIP OF SUCH

ASSETS: Alleppey Financial Services V ADIT 236 ITR

562(Kerala)

PROHIBITORY ORDER ON BANK AND CASH

WITHDRAWN AND SEIZED: KCC Software Ltd, 298/1

(SC) – cash in bank account is not same as cash on hand.

SEIZURE OF PAWNED ARTICLES: Alleppey Financial

Enterprises vs ADIT (Inv. ) & Anr. ,(1999) 236 ITR 562

(Ker.) :Gold ornaments pledged by the customer with the

assessee as security for loan amount sanctioned by him

cannot be seized u.s 132, respondent directed to return the

gold ornaments together with the pledged forms

Other Important cases

NO SEIZURE OF LAPTOP OR OTHER RECORDS

OF CA EXCEPT TO THE EXTENT RELATED TO

CLIENT SEARCHED – S R Batliboi & co, 186 Taxman

350 (SC)

Post Search enquiry: issuance of summon:

Can be issued. Arti Gases v. DIT (Inv.) [2001] 248 ITR

55 (Guj.)

Can not be issued: Arjun Singh & Another v.

Assistant Director of Incometax (Investigation) 246

ITR page 363(MP) ; Dr. Balkrishnan Nair v. CIT

reported in 154 CTR page 543(Kerela )

Other Important cases

Presumption: Surendra M. Khandhar vs ACIT &

Ors. (2009) 224 CTR (Bom.) 409 :Assessee having

failed to rebut the presumption u/s 292C , addition u/s

69 on the basis of documents seized from the

possession of the assessee was rightly made by AO &

sustained by the tribunal.

No presumption u/s 132(4A) available in the

assessment ,S. 132 a separate code by itself –– Metrani’s

case, 287 ITR 209 (SC)-

Technical rules of Evidence Act inapplicable

The perception that the provisions of the Evidence Act is

inapplicable to taxation proceedings is incorrect. The

Bombay High Court in the case J.S.Parker vs. V.B.Palekar 94

ITR 616held that what was meant by saying that the

Evidence Act did not apply to the proceedings under the

Act was that the rigours of the rules of evidence contained

in the Evidence Act was not applicable but that did not

mean that when the taxing authorities were desirous of

invoking the principles of the Act in proceedings before

them, they were prevented from doing so. Evidence Act

embodies principle of common law jurisprudence which

could be attracted to a set of circumstances that satisfy its

conditions

Evidence

Section 3 of the Indian Evidence Act reads as follows:

Evidence-Evidence means and includes (1) All statements which the Court permits or requires to

be made before it by witnesses, in relation to

matters of fact under inquiry, such statements are

called oral evidence;

(2) All documents including electronic records produced

for the inspection of the Court, such documents are

called documentary evidence. Thus, evidence can

be both oral and documentary and electronic

records can be produced as evidence."

Evidence – Oral & Documentary

All statements which are recorded by or before an

authority are called oral evidence.

All documents including books of account, bills,

vouchers, receipts, supporting record, bank

statements, registers, etc. are documentary evidence.

Documentary Evidence

•A document means;

•any matter expressed (written)

•on any substance

•in letters; figures or marks.

•Documentary evidences are;

• either primary (original) evidences or

• secondary (copies) evidences.

Forms of Evidence

Following are relevant but not sufficient evidence:

Books of Accounts

Public records

Published maps or charts

Official gazette

Statement of law

Certain judgments of Courts

Expert Opinions

Opinion on handwriting

Customs and usage

Character and past history

Burden of Proof and Onus of Proof

•Duty of proving a fact

•Used interchangeably

•Carries definite meaning

•Burden is fixed

•Onus is ambulatory

•Extent of onus can shift & re-shift

•Degree of proof required

Golden Rules of Evidence & Natural Justice

•First ; what is apparent is believed to be true.

•Second ; what is believed to be true can be proved with

evidence to be false.

•Third ; the person seeking to counter the apparent truth has to

lead evidences.

•Fourth ; law can shift the burden of proof on the assessee to

prove that apparent is real.

•Fifth ; evidence gathered behind the back of the assessee

cannot be used unless an opportunity of rebutting same is

given

•Sixth ; the rules of Natural Justice shall apply in admission of

the evidence ; an opportunity of hearing and cross

examination : a must.

•Seventh; evidences not produced can be produced before the

appellate authorities on a written application.

•Eighth ; statement made on oath is binding but not conclusive

Evidence Act-Principle

Statements made in ordinary course of business:

S. 32(2): When the statement is made by such a person(i.e. a person

who is dead or can not be found ,etc.) in the ordinary course of

business ,and in particular when it consists of any

(a) An entry or memorandum made by him in books kept in (i)the

ordinary course of business ,or (ii) the discharge of

professional duty: or

(b) An acknowledgement (written or signed by him)of the receipt of

money, goods, securities or properties of any kind .or

(c) Documents used in commerce, written or signed by him. or

(d) The date of a letter or other document usually dated ,written or

signed by him,

are relevant.

Evidence Act-Principle

Regular enteries in accounts book

S. 34:

Enteries in books of accounts ,including

those maintained in an electronic form ,regularly

kept in the course in business ,are relevant,

whenever they refer to a matter into which the

court has to inquire but such statements are not

alone sufficient evidence to charge any person with

liability.

Burden of Proof-General

Chapter VII of Part III of Indian Evidence Act deals

with Burden of Proof. Relevant section are 101 to114.

Section101:When a person is bound to prove the

existence of any fact, it is said that burden of proof lies

on that person.

Section 106: The burden of proving any fact, which is

especially within the knowledge of any person is upon

him.

Burden of Proof-General

Section 110: When the question is whether any

person is owner of any-thing of which he is shown

to be in possession, Sec. 110 of the Evidence Act is

material in this respect. The onus of proving that

he is not the owner is on the person who affirms

that he is not the owner. In other words, it follows

from the well-settled principle of law that

normally, unless the contrary is established, title

always follows possession. Chuharmal vs CIT 172

ITR 250 ( S C)

Section 114

The Court may presume the existence of any fact

which it thinks likely to have happened, regard being

had to the common course of natural events, human

conduct and public and private business, in their

relation to the facts of the particular case.

(e) that judicial and official acts have been regularly

performed;

61

Evidence Act-Principle

Estoppel

S115: When a person has by his declaration ,act, or

omission intentionally caused or permitted

another person to believe a thing to be true and to

act upon such belief neither he ,nor his

representative can be allowed to deny the truth of

that thing in a suit or proceeding between himself

and such person or his representative.

Burden of Proof- Case Laws

Source of Receipt - Burden on Assessee

Kalakhan Mohd. Hanif V. CIT 50 ITR 1(SC)

Receipt is taxable - Burden on Revenue

Janki Ram Bhado Ram V. CIT 57 ITR 21 (SC)

CIT Vs Sumiti Dayal 214 ITR 801 (Hon’ble Supreme

Court)

Deduction/Exemption – Burden on Assessee

UnexplainedInvestment/expenditure

69, 69A, 69B and 69C.

Initial onus on assessee to prove source

(98 ITR 280 (All.)

Burden to prove that apparent is not real

Burden to prove that apparent is not real will depend on

the facts of the case.

1.

2.

3.

Burden is on the assessee where the Department

alleges that apparent is not real. Sumati Dayal vs.

CIT (1995) 214 ITR 801 (SC), The test of human

probabilities influenced.

Burden is on the party who claims it to be so that the

apparent is not the real. Daulat Ram Rawatmull's

case_(1973) 87 ITR 349 (SC),.

The Supreme Court, once again, laid burden on the

Department in the subsequent case of Kishinchand

Chellaram vs. CIT (1980) 19 CTR (SC) 360 : (1980)

125 ITR 713 (SC)

Books of Account

Books of account

The books or books of account as defined in section 2(12A)

of the Act includes ledgers, day books, cash books, account

books and other books, whether kept in written form or as

printouts of data stored in a floppy, disc, tape or any other

form of electromagnetic data storage device known in

common parlance. It is wider and includes books of

account.

'Book' ordinarily means a collection of sheets of paper or

other material, blank, written or printed, fastened or

bound together so as to form a material whole.

Books of Account-Loose papers

Loose sheets or scraps of paper cannot be termed

as 'book' for they can be easily detached and

replaced.

The Supreme Court in Central Bureau of

Investigation vs. V.c. Shukla AIR 1998 SC 1406

approved of the decision in Mukund Ram vs. Daya

Ram AIR 1914 Nagpur 44 where the Court observed

:

"In its ordinary sense it signifies a collection of

sheets of paper bound together in a manner which

cannot be disturbed or altered except by tearing

apart

There are two kinds of people, those who

do the work and those who take the credit

, try to be in the first group, there is less

competition.

68

If you are interested in balancing work and

pleasure, stop trying to balance them,

instead make your work more pleasurable.

Donald Trump

My Email:rk7154@yahoo.com