The Potential for the Siting of an Ethane Cracker in the State

advertisement

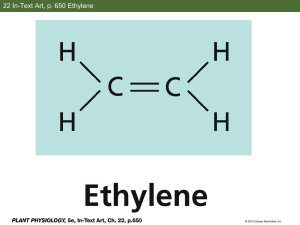

The Potential for the Siting of an Ethane Cracker in the State John Houston Senior Vice President, Bayer Corporation North America – Business Structure Breakdown of Total Sales by Subgroup 2010 25 % 56 % MaterialScience HealthCare EUR 8.2 billion 19 % CropScience • Employees in United States: ~15,100 • Employees in West Virginia: ~1,000 • Employees in Pittsburgh: ~2,700 Pittsburgh/West Virginia = 24.5% of all U.S. Employees As of December 31, 2010 Page 2 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 bo·nan·za [buh-nan-zuh] –noun 1: rich mass of ore, as found in mining. 2: a source of great and sudden wealth or luck; a spectacular windfall –noun 1: an exceptionally large and rich mineral deposit (as of an ore, precious metal, or petroleum) 2: a something that is very valuable, profitable, or rewarding : a very large amount : extravaganza Ethylene Demand Driven By What We Consume Polystyrene/ ABS PVC Ethylene LDPE Polyethylene PET/Ethylene Glycol LLDPE HDPE Source: Chemical Market Associates, Inc. Page 4 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 U.S. Ethane Supply/Cracker Capacity Source: Bentek Page 5 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 U.S. PE Converters 2010 71 to 105 companies 41 to 70 companies 21 to 40 companies 11 to 20 companies 6 to 10 companies 1 to 5 companies Source: CMAI Page 6 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 Statistics According to the WVONGA-commissioned study by WVU, Marcellus shale development by 2015 could mean 6,600 and 19,600 additional jobs for the Mountain State $890 million in employee payrolls (in 2015) 20% growth rate each year According to the American Chemistry Council, a 25% increase in ethane supply could mean 17,000 new knowledge intensive, high paying chemical industry jobs 395,000 jobs outside the chemical industry More than $4 billion in federal, state and local tax revenue annually over 10 years Nearly $33 billion increase in American chemical production About $16 billion in chemical industry capital investment to build new capacity More than $132 billion in U.S. economic output Page 7 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 Bayer’s Potential Scenario Photo: Ras Laffan Olefin Cracker in Qatar Page 8 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 Why West Virginia? Why Bayer? Well positioned for both feedstocks and consumers Direct access to major highways, waterways, railroads, pipeline Available Land Ethylene producers likely to build where they have an anchor Long term security of feedstock supply is a key Project needs a champion Page 9 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 Liquids from Wet Shale Gas Seeking a Home Steam Crackers Source: EIA Page 10 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 Tug of War Page 11 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 Questions Ethylene – The Ethane / Ethylene Family Tree Ethane (C2H6) Acetic Acid (CH3COOH) Annual Global Production: 6.5M tons Polymerization Vinyl Acetate Monomer (VAM) Acetic Anhydride 40-45% of Global Acetic Acid 25-30% of Global Acetic Acid Wood glue, Paints, Adhesives Synthetic fibers & fabrics Synthetic textile, photographic film Ester of Acetic Acid Food Additive (E260) Polyethylene ~50% of Global Ethylene World’s most widely used plastic Halogenation & Polyvinyl Acetate Cellulose Acetate Unsaturated Hydrocarbon Ethylene (C2H4) World’s Highest Vol. Organic Compound Annual Global Production: 113M tons Polymerization Polyethylene terephthalate 31.1M Tons in 2000 Polymerization O R Polyvinyl Chloride (PVC) Annual Global Production: 30+M tons Clothing, upholstery, hoses, tubing, flooring Inks, paints, coatings Acidity regulator, condiment (vinegar) Vinyl Chloride (CH2=CHCl) Alkyl Alkanolamines Absorbents, Coatings, Detergents Flocculants, Metalworking, Textiles Ethanolamines Adhesives, Agro, Cleaners, Pharma, Printing, Surfactants Ethylene Oxide (C2H4O) Annual Global Production: 20M tons Soft drink bottles Ethyleneamines Corrosion Inhibitors, Coatings, Detergents Fungicides, Lubes, Surfactants Glycol Ethers Polar Protic Solvent Acetaldehyde (CH3CHO) Annual Global Production: 1M tons Brake Fluids, Detergents, Paints/Inks, Pharma, Plasticizers, Solvents Glycol Ester Acetates Adhesives, Coatings, Heat Transfer, Inks, Paints, Polyester, HI&I Oligomerization Alpha Olefins Precursors, Detergents, Plasticizers, Lubricants, Additives Ethylene Glycol Antifreeze/Deicing, Dye/printing, Hydraulics, Latex, PET Polyurethanes Rigid & Flexible Polyols, Coatings, Adhesives, Sealants, Elastomers Alkylation Page 13 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 Ethylbenzene Solvents Precursor to styrene (packaging and rubber) Adhesives, Agro, Dry Cleaning, HI&I, Inks Paints, Coatings, Rubber & Polymer Mfg. Heavy Feeds & Polyethylene Dominate Global Ethylene Market 120 Million Tons Ethylene 2010 Ethylene 2010 Ethylene Ethane Other Propane & Butane Supply 33% 2% EDC/VCM/PVC Styrene 7% 12% Naphtha/Gas Oil 53% Page 14 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 11% Demand Ethylene Oxide/Glycol 13% Other 8% Polyethylene 61% An Ethane Primer Only two uses for ethane Keep it in the NG stream or separate it out for chemicals production Natural gas price sets the floor value Yields only ethylene, hydrogen, and fuel gas when cracked Ethane cracker capital costs are low Every 10 cent move in ethane price changes cash costs by 4 cents A cracker consumes roughly 1.29MT of ethane for 1MT of ethylene A 1 MM MT/year cracker consumes ~ 63K BPD Page 15 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 Olefins Flow Diagram Energy Feedstocks Petrochemicals Crude Oil Refinery Gas Separation Unit Ethylene Propylene Methane/Hydrogen Naphtha Gas Oil Ethane Propane Butanes Field Condensates Ethylene Unit Page 16 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011 Butadiene Mixed Butylenes Pygas Benzene Toluene/Xylene Heavy Aromatics C5/C6 Non Aromatics Fuel Oil Natural Gas Crude C4 U.S. Ethylene Expansion “Talk” In The Press ~ 4.0 Million Tons By 2017 Company 2012 Announced (-000- MT) Westlake, Lake Charles Ineos, Chocolate Bayou Chevron Phillips Dow Equistar 2013 110 115 2014 2015** 2016+ 110 1200* 384 230 Unconfirmed (-000- MT) Williams Formosa 1400* 100 450 Total 839 100 110 1650 1400 Cumulative Total 839 939 1049 2699 4099 * Dow and ChevronPhillips capacity additions shown are CMAI estimates ** 1 MM metric tons Braskem/Idesa JV in Mexico expected to start-up in 2015/16 Page 17 • The Potential for the Siting of an Ethane Cracker in the State • June 21, 2011