Veco Invest Asia Presentation

advertisement

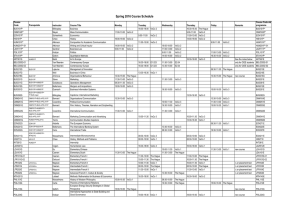

VECO INVEST Swiss Asset Management Switzerland Hong Kong 1 VECO INVEST – Company Profile • VECO INVEST is an independent Swiss asset management firm founded in 1988 and is a member of VECO Group SA (est. 1973). We provide asset management and investment services. • We are prudent in our investment process and choice of investment instruments but innovative in our investment philosophy and portfolio construction. • As a family owned private company, we are in a position to offer long term commitment and dedication to our clients. Our Group is one of the most respected group in Lugano, Switzerland. • Our investment professionals have extensive experience in portfolio management. Our firm pursue a philosophy of independence and discretion. As we do not belong to any banking group, this enables us to provide objective advice and flexible investment strategies. • Our clients include high net worth individuals, family offices, trust and foundations. We can also provide consulting services to family offices on their asset allocation and long term investment strategies. • Long and well established working relationships with over 20 banking institutions worldwide. We are the first External Asset Manager (EAM) from Lugano to establish a full operation in Hong Kong/China. • Our Group is regulated by FINMA* of Switzerland. VECO INVEST (Asia) Limited has been granted Type 9 licence (dealing in asset management) by the Hong Kong Securities & Futures Commissioner. * Swiss Financial Market Supervisory Authority 2 VECO GROUP Corporate services International tax planning Asset protection Trust services Veco Trust Veco Invest Asset & Investment Management Veco Multi-Family 360 degrees family wealth management Office Veco Trade Through our global presence with 10 offices worldwide, we will meet all your needs with a personalised approach in international tax planning, asset protection, asset management and succession planning. International Trade 3 Our Personalised “360 Degrees” Services International Tax Planning Succession Planning Asset Protection Investment (Asset Management) Highly personalised and tailored 360 degrees solutions 4 VECO GROUP: branches and subsidiaries Over 100 professional staff worldwide in 10 offices. Asia • Hong Kong * Latin America • São Paulo • Panama Europe Middle East • Amsterdam • Dubai • Luxembourg * VECO INVEST offices • Malta • London • Lugano * (head office) • Zurich 5 Global Presence – Global Solution TRUST SERVICES PORTFOLIO INVESTMENT FAMILY OFFICE INTERNATIONAL TRADE Trust Tax planning Asset protection Asset Management Multi-Family office Int’l Trade Lugano Zurich Luxembourg Amsterdam London Malta Dubai Main offices Sao Paulo Panama Hong Kong 6 Our Mission To offer you a wide range of personalised services and tailored solutions to meet all your needs – to preserve Assets in bad times and… to grow your Assets in good times. 7 Customised Approach for Different Risk Profiles We provide customised portfolios based on client’s individual risk profile Return HIGH Execution Only MED Mandates with Constraints Discretionary Mandate LOW Risk Discretion 0% 100% Flexible mandate 8 Our Disciplined Investment Process Annually Strategic Asset Allocation Quarterly Global context and Investment strategy Fund Selection Monthly Tactical Asset Allocation Market Timing / Rebalancing / Risk Management Weekly Choice of investment products Macro context and expected return Investment models 9 Innovative Investment but traditional analysis Transparency, liquidity, quality, costs and risk levels are key considerations when selecting investment vehicles to achieve the best risk/return profiles. ASSET CLASS Equities Commodities Liquid assets Bonds Currencies Bond funds Long-only funds Long-only funds Structured Products Individual issuers Structured Products Structured Products Alternative Assets Hedge funds Non-directional funds Absolute return funds Income enhancing products 10 Open Architecture Through our Open Architecture platform, once the investment idea has been established, we select the best vehicle on the basis of a best-in-class approach with a truly independent and objective view. Fund houses: 11 Our Simple and Transparent Fee Structure Manage the Wealth Managers Manage Consolidated Assets Custodian Banks Account Opening Asset Management Mandate Power of Attorney Reporting Client 12 VECO helps you to prepare for tomorrow 13 Our offices Hong Kong, China Lugano, Switzerland VECO INVEST (Asia) 3204-05 Alexandra House 7-15 Des Voeux Road Central Hong Kong Email. info@vecoinvest.hk VECO INVEST SA Via L. Lavizzari 4 CH – 6900 Lugano Switzerland Tel. +852 31082700 Fax. +852 21521623 Tel. +41 91 911 71 11 Fax.+41 91 923 94 19 14