MJK_ch5

advertisement

Autoregressive Integrated

Moving Average (ARIMA)

models

1

- Forecasting techniques based on exponential smoothing

-General assumption for the above models: times series

data are represented as the sum of two distinct components

(deterministc & random)

- Random noise: generated through independent shocks to

the process

-In practice: successive observations show serial

dependence

2

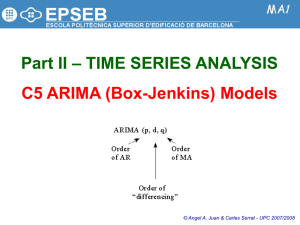

ARIMA Models

- ARIMA models are also known as the Box-Jenkins methodology

- very popular : suitable for almost all time series & many times generate more

accurate forecasts than other methods.

- limitations:

If there is not enough data, they may not be better at forecasting than the

decomposition or exponential smoothing techniques.

Recommended number of observations at least 30-50

- Weak stationarity is required

- Equal space between intervals

3

4

5

Linear Models for Time series

6

Linear Filter

¥

yt = L ( xt ) ) = å yi xt-i , t = ...., -1, 0,1,....

i=-¥

- It is a process that converts the input xt, into output yt

- The conversion involves past, current and future values of the input in

the form of a summation with different weights

- Time invariant do not depend on time

- Physically realizable: the output is a linear function of the current and

past values of the input

- Stable if

i

i

i

In linear filters: stationarity of the input time series is also

reflected in the output

7

Stationarity

8

A time series that fulfill these conditions tends to return to its mean and

fluctuate around this mean with constant variance.

Note: Strict stationarity requires, in addition to the conditions of weak

stationarity, that the time series has to fulfill further conditions about its

distribution including skewness, kurtosis etc.

Determine stationarity

-Take snaphots of the process at different time points & observe its

behavior: if similar over time then stationary time series

-A strong & slowly dying ACF suggests deviations from stationarity

9

10

11

Infinite Moving Average

Input xt stationary

Output yt

Stationary, with

+¥

yt = å yi xt-i

i=-¥

+¥

E(yt ) = m y = å yi m x

i=-¥

¥

&

¥

Cov ( yt, yt+k ) = g y ( k ) = å å yiy jg x (i - j + k )

i=-¥ j=-¥

THEN,

the linear process with white noise time series εt

+¥

yt = m + åyiet-i

i=0

Is stationary

εt independent random shocks, with E(εt)=0 & g e ( h) =

{

s 2 , if h=0

0, if h¹0

12

autocovariance function

¥

¥

g y ( k ) = ååyiy jg e (i - j + k )

i=0 j=0

=s

¥

2

åy y

i

i+k

i=0

Linear Process

+¥

yt = m + åyiet-i

i=0

yt 0 t 1 t 1 2 t 2

( i B i ) t

i 0

B t

Infinite moving

average

13

The infinite moving average serves as a general class of models for any

stationary time series

THEOREM (World 1938):

Any no deterministic weakly stationary time series yt can be

represented as

+¥

yt = m + åyiet-i

i=0

¥

where

åy

2

i

<¥

i=0

INTERPRETATION

A stationary time series can be seen as the weighted sum of the present

and past disturbances

14

Infinite moving average:

- Impractical to estimate the infinitely weights

- Useless in practice except for special cases:

i. Finite order moving average (MA) models : weights set to 0,

except for a finite number of weights

ii. Finite order autoregressive (AR) models: weights are

generated using only a finite number of parameters

iii. A mixture of finite order autoregressive & moving average

models (ARMA)

15

Finite Order Moving Average (MA) process

Moving average process of order q(MA(q))

y0 =1, q weights not set to 0

yt t 1 t 1 q t q

t white noise

MA(q) : always stationary regardless of the values of the weights

yt (1 1 B q B q ) t

q

1 i B i i

i 1

B t

q

Q ( B) =1- åqi Bi

i=1

16

εt white noise

Expected value of MA(q)

Variance of MA(q)

E yt E t 1 t 1 q t q

Var yt y 0 Var t 1 t 1 q t q

2 1 12 q2

Autocovariance of MA(q)

y k E t 1 t 1 q t q t k 1 t k 1 q t k q

, k 1, 2,.,q

Autocorelation of MA(q)

2

0, k q

k

1 k 1

k q q

y k

y k

0, k q

y 0

k

1 k 1 k q q

/ 1

2

2

1 q

,

k 1, 2 ,.,q

17

ACF function:

Helps identifying the MA model & its appropriate order as its cuts off after lag k

Real applications:

r(k) not always zero after lag q; becomes very small in absolute value after lag q

18

First Order Moving Average Process MA(1)

q=1

Autocovariance of MA(q)

yt = m + et - q1et-1

et white noise

g y (0) = s 2 (1+ q12 )

g y (1) = -q1s 2

g y (k) = 0, k > 1

Autocorelation of MA(q)

y 1

1

1 12

y (k ) 0, k 1

y 1

1

1

1 12 2

19

- Mean & variance : stable

- Short runs where

successive observations

tend to follow each other

- Positive autocorrelation

- Observations oscillate

successively

- negative autocorrelation

20

Second Order Moving Average MA(2) process

yt t 1 t 1 2 t 2

1 1 B 2 B 2 t

Autocovariance of MA(q)

g y (0) = s 2 (1+ q12 + q 22 )

g y (1) = s 2 (-q1 + q1q 2 )

g y (2) = s 2 (-q 2 )

g y (k) = 0, k > 2

Autocorelation of MA(q)

r y (1) =

-q1 + q1q 2

1+ q12 + q 22

-q 2

1+ q12 + q 22

r y (k) = 0, k > 2

r y ( 2) =

21

The sample ACF cuts off after lag 2

22

Finite Order Autoregressive Process

- World’s theorem: infinite number of weights, not helpful in

modeling & forecasting

- Finite order MA process: estimate a finite number of weights,

set the other equal to zero

Oldest disturbance obsolete for the next observation; only finite

number of disturbances contribute to the current value of time

series

- Take into account all the disturbances of the past :

use autoregressive models; estimate infinitely many weights that

follow a distinct pattern with a small number of parameters

23

First Order Autoregressive Process, AR(1)

+¥

yt = m + åyie t-i

i=0

æ¥

ö

i

= m + çåyi B et ÷

è i=0

ø

q

Y ( B) =1- åyi Bi

i=1

= m + Y ( B) et

Assume : the contributions of the disturbances that are way in the past are small

compared to the more recent disturbances that the process has experienced

Reflect the diminishing magnitudes of contributions of the disturbances of the

past,through set of infinitely many weights in descending magnitudes , such as

yi = f i , f < 1

Exponential decay pattern

The weights in the disturbances starting from the current disturbance and

going back in the past:

1,, 2 , 3 ,

24

yt t t 1 2 t 2

i t i

i 0

yt 1 t 1 t 2 2 t 3

THEN

yt t t 1 2 t 2

yt 1 t

yt 1 t

where

First order

autoregressive process

AR(1)

d = (1- f ) m

WHY AUTOREGRESSIVE ?

AR(1) stationary if

f <1

¥

Þ å yi < ¥

i=0

25

Mean AR(1)

E ( yt ) = m =

Autocovariance function

AR(1)

d

1- f

k 2 k

Autocorrelation function AR(1)

1

, k 0,1,2

2

1

k

k k

, k 0,1,2

0

The ACF for a stationary AR(1) process has an exponential decay form

26

Observe:

- The observations exhibit up/down movements

27

Second Order Autoregressive Process, AR(2)

y t 1 yt 1 2 yt 2 t ,

1

This model can be represented in the infinite MA form & provide the

conditions of stationarity for yt in terms of φ1 & φ2

WHY?

1. Infinite MA

yt 1 yt 1 2 yt 2 t

yt 1 Byt 2 B 2 yt t

(1 1 B 2 B 2 ) yt t

B yt t

Apply

B

1

28

yt B B t

1

1

B t

i t i

i 0

i B i t

i 0

where

B 1

&

B i B i B

1

i 0

29

Calculate the weights i

BB 1

B i Bi B

1

i 0

1 B B

2

1

2

0

1 B 2 B 2 1

0 1 1 0 B 2 1 1 2 0 B 2 j 1 j 1 2 j 2 B j 1

We need

0 1

1 1 0 0

j 1 j 1 2 j 2 0, for all j 2,3,

30

Solutions

The satisfy the second-order linear difference equation

The solution : in terms of the 2 roots m1 and m2 from

j

m 2 1m 2 0

m1 , m2

AR(2) stationary:

1 12 42

2

if m1 , m2 1,

i 0

i

Condition of stationarity for complex conjugates a+ib:

2 b2 1

AR(2) infinite MA representation: m1 , m2 1

31

Mean

E yt 1E yt 1 2 E yt 2

1 2

1 1 2

For 1 1 2 , m 1 : nonstationarity

Autocovariance

function

k cov yt , yt k

cov 1 yt 1 2 yt 2 t , yt k

1 cov yt 1 , yt k 2 cov yt 2 , yt k cov t , yt k

1 k 1 2 k 2

For k=0:

For k>0:

2 , if k 0

0 , if k 0

0 1 1 2 2 2

k 1 k 1 2 k 2, k 1,2 Yule-Walker equations

32

Autocorrelation

function

k 1 k 1 2 k 2, k 1,2,

Solutions

A. Solve the Yule-Walker equations recursively

1 1 0 2 1

1 1

1 2

2 1 1 2

3 1 2 2 1

B. General solution

Obtain it through the roots m1 & m2 associated with the polynomial

m2 1m 2 0

33

Case I: m1, m2 distinct real roots

k c1m1k c2m2k , k 0,1,2,

c1, c2 constants: can be obtained from ρ (0) ,ρ(1)

stationarity: m1 , m2 1

ACF form: mixture of 2 exponentially decay terms

e.g. AR(2) model

It can be seen as an adjusted AR(1) model for which a single exponential decay

expression as in the AR(1) is not enough to describe the pattern in the ACF and

thus, an additional decay expression is added by introducing the second lag

term yt-2

34

Case II: m1, m2 complex conjugates in the form

a ib

k Rk c1 cosk c2 sink , k 0,1,2,

R mi a 2 b 2

cos( ) a / R

sin( ) b / R

a ib Rcos( ) i sin

c1, c2: particular constants

ACF form: damp sinusoid; damping factor R;

2 /

frequency ; period

35

Case III: one real root m0; m1= m2=m0

k c1 c2k m0k , k 0,1,2,

ACF form: exponential decay pattern

36

AR(2) process :yt=4+0.4yt-1+0.5yt-2+et

Roots of the polynomial: real

ACF form: mixture of 2 exponential decay terms

37

AR(2) process: yt=4+0.8yt-1-0.5yt-2+et

Roots of the polynomial: complex conjugates

ACF form: damped sinusoid behavior

38

General Autoregressive Process, AR(p)

Consider a pth order AR model

yt 1 yt 1 2 yt 2 p yt p t , t white noise

or

B yt t ,

where B 1 1 B 2 B 2 p B p

39

AR(P) stationary

If the roots of the polynomial

m p 1m p1 2m p2 p 0

are less than 1 in absolute value

AR(P) absolute summable infinite MA representation

Under the previous condition

yt B t i t i

i 0

B B & i

1

i 0

40

Weights of the random shocks

B B 1

as

j 0, j 0

0 1

j 1 j 1 2 j 2 p j p 0, forall j 1,2,

41

For stationary AR(p)

E yt

1 1 2 p

k Cov yt , yt k

Cov 1 yt 1 2 yt 2 p yt p t , yt k

p

i k i

i 1

2 , if k 0

0 , if k 0

p

0 i i 2

i 1

p

0 1 i i 2

i 1

42

ACF

p

k i k i , k 1,2, pth order linear difference equations

i 1

AR(p) :

-satisfies the Yule-Walker equations

-ACF can be found from the p roots of the associated polynomial

e.g. distinct & real roots :

k c1m1k c2 m2 k c p mp k

- In general the roots will not be real

ACF : mixture of exponential decay and damped sinusoid

43

ACF

- MA(q) process: useful tool for identifying order of process

cuts off after lag k

- AR(p) process: mixture of exponential decay & damped sinusoid

expressions

Fails to provide information about the order of AR

44

Partial Autocorrelation Function

Consider :

- three random variables X, Y, Z &

- Simple regression of X on Z & Y on Z

Cov(Z, X)

Var(Z)

Cov(Z,Y )

Y = a 2 + b2 Z, where b2 =

Var(Z)

X = a1 + b1Z, where b1 =

The errors are obtained from

X * = X - X = X - (a1 + b1Z )

Y * = Y -Y = Y - (a 2 + b2 Z )

45

Partial correlation between X & Y after adjusting for Z:

The correlation between X* & Y*

(

corr ( X *,Y * ) = corr X - X,Y -Y

)

Partial correlation can be seen as the correlation between two variables

after being adjusted for a common factor that affects them

46

Partial autocorrelation function (PACF) between yt & yt-k

The autocorrelation between yt & yt-k after adjusting for yt-1, yt-2, …yt-k

AR(p) process: PACF between yt & yt-k for k>p should equal zero

Consider

- a stationary time series yt; not necessarily an AR process

- For any fixed value k , the Yule-Walker equations for the ACF of

an AR(p) process

k

r ( j ) = åfik r ( j - i ), j = 1, 2,..., k

i=1

r (1) = f1k + f2k r (1) +… + fkk r ( k -1)

r ( 2) = f1k + f2k r (1) +… + fkk r ( k - 2)

r ( k ) = f1k + f2k r (1) +… + fkk

47

Matrix notation

1

1

2

k 1

Solutions

1

1

1

k 2

2

3

1

k 1

k 2

k 3

k 3

1

Pkk k

k Pk 1k

For any given k, k =1,2,… the last coefficient kk is called the partial autocorrelation

coefficient of the process at lag k

AR(p) process:

kk 0, k p

Identify the order of an AR process by using the PACF

48

MA(1)

yt 40 t 0.8 t 1

MA(2)

yt 40 t 0.7 t 1 0.28 t 2

Decay pattern

Decay pattern

AR(1)

yt 8 0.8 yt 1 t

AR(1)

yt 8 0.8 yt 1 t

Cuts off after

1st lag

AR(2)

AR(2)

yt 8 0.8 yt 1 0.5 yt 2 t

Cuts off after

2nd lag

49

Invertibility of MA models

Invertible moving average process:

The MA(q) process

k Pk 1k

is invertible if it has an absolute summable infinite AR representation

It can be shown:

The infinite AR representation for MA(q)

i 1

i 1

yt i yt i t , i

50

Obtain i

1 B B

1

2

2

q Bq 1 1B 2 B2 1

We need

1 1 0

2 1 1 2 0

j 1 j 1 q j q 0

0 1 & j 0, j 0

Condition of invertibility

The roots of the associated polynomial be less than 1 in absolute value

mq 1mq1 2mq2 q 0

An invertible MA(q) process can then

be written as an infinite AR process

51

PACF possibly never cuts off

PACF of a MA(q) process is a mixture of exponential decay

& damp sinusoid expressions

In model identification, use both sample ACF & sample PACF

52

Mixed Autoregressive –Moving Average (ARMA) Process

ARMA (p,q) model

yt 1 yt 1 2 yt 2 p yt p t 1 t 1 2 t 2 q t q

p

q

i 1

i 1

i yt i t i t i

Byt B t , t white noise

Adjust the exponential decay pattern by adding a few terms

53

Stationarity of ARMA (p,q) process

Related to the AR component

ARMA(p,q) stationary if the roots of the polynomial less than one in absolute value

m p 1m p1 2m p2 p 0

ARMA(p,q) has an infinite MA representation

yt i t i B t , B B B

1

i 0

54

Invertibility of ARMA(p,q) process

Invertibility of ARMA process related to the MA component

Check through the roots of the polynomial

mq 1mq1 2mq2 q 0

If the roots less than 1 in absolute value then ARMA(p,q) is invertible & has

an infinite representation

B yt t

B 1 & B B 1 B

Coefficients:

i 1 i1 2 i2 q iq 0,,iip1,, p

i

55

ARMA(1,1)

Sample ACF & PACF: exponential

decay behavior

56

57

58

59

Non Stationary Process

Not constant level, exhibit homogeneous behavior over time

yt is homogeneous, non stationary if

-It is not stationary

-Its first difference, wt=yt-yt-1=(1-B)yt or higher order differences wt=(1-B)dyt produce a

stationary time series

Yt autoregressive intergrated moving average of order p, d,q –ARIMA(p,d,q)

If the d difference , wt=(1-B)dyt produces a stationary ARMA(p,q) process

ARIMA(p,d,q)

B1 B yt B t

d

60

The random walk process ARIMA(0,1,0)

Simplest non-stationary model

1 Byt t

First differencing eliminates serial dependence & yields a white noise

process

61

yt=20+yt-1+et

Evidence of non-stationary process

-Sample ACF : dies out slowly

-Sample PACF: significant at the first lag

-Sample PACF value at lag 1 close to 1

First difference

-Time series plot of wt: stationary

-Sample ACF& PACF: do not show any

significant value

-Use ARIMA(0,1,0)

62

The random walk process ARIMA(0,1,1)

1 Byt 1 B t

Infinite AR representation, derived from:

i i 1 10,,ii10 , i 1

yt i yt i t

i 1

1 yt 1 yt 2 t

ARIMA(0,1,1)= (IMA(1,1)): expressed as an exponential weighted moving average

(EWMA) of all past values

63

ARIMA(0,1,1)

-The mean of the process is moving upwards in time

-Sample ACF: dies relatively slow

-Sample PACF: 2 significant values at lags 1& 2

Possible model :AR(2)

Check the roots

-First difference looks stationary

-Sample ACF & PACF: an MA(1)

model would be appropriate for

the first difference , its ACF cuts off

after the first lag & PACF decay

pattern

64

yt 2 0.95yt 1 t

65

66