Render/Stair/Hanna Chapter 6

advertisement

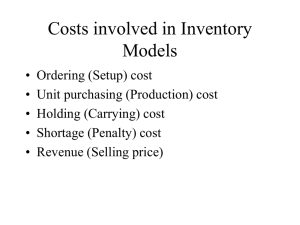

Chapter 6 Inventory Control Models To accompany Quantitative Analysis for Management, Tenth Edition, by Render, Stair, and Hanna Power Point slides created by Jeff Heyl © 2008 Prentice-Hall, Inc. © 2009 Prentice-Hall, Inc. Introduction Inventory is an expensive and important asset to many companies Lower inventory levels can reduce costs Low inventory levels may result in stockouts and dissatisfied customers Most companies try to balance high and low inventory levels with cost minimization as a goal Inventory is any stored resource used to satisfy a current or future need Common examples are raw materials, workin-process, and finished goods © 2009 Prentice-Hall, Inc. 6–2 Introduction Basic components of inventory planning Planning what inventory is to be stocked and how it is to be acquired (purchased or manufactured) This information is used in forecasting demand for the inventory and in controlling inventory levels Feedback provides a means to revise the plan and forecast based on experiences and observations © 2009 Prentice-Hall, Inc. 6–3 Introduction Inventory may account for 50% of the total invested capital of an organization and 70% of the cost of goods sold Energy Costs Capital Costs Labor Costs Inventory Costs © 2009 Prentice-Hall, Inc. 6–4 Introduction All organizations have some type of inventory control system Inventory planning helps determine what goods and/or services need to be produced Inventory planning helps determine whether the organization produces the goods or services or whether they are purchased from another organization Inventory planning also involves demand forecasting © 2009 Prentice-Hall, Inc. 6–5 The Inventory Process Suppliers Customers Inventory Storage Raw Materials Finished Goods Fabrication/ Work in Assembly Process Inventory Processing © 2009 Prentice-Hall, Inc. 6–6 Introduction Inventory planning and control Planning on What Inventory to Stock and How to Acquire It Forecasting Parts/Product Demand Controlling Inventory Levels Feedback Measurements to Revise Plans and Forecasts Figure 6.1 © 2009 Prentice-Hall, Inc. 6–7 Importance of Inventory Control Five uses of inventory The decoupling function Storing resources Irregular supply and demand Quantity discounts Avoiding stockouts and shortages The decoupling function Used as a buffer between stages in a manufacturing process Reduces delays and improves efficiency © 2009 Prentice-Hall, Inc. 6–8 Importance of Inventory Control Storing resources Seasonal products may be stored to satisfy off-season demand Materials can be stored as raw materials, work-in-process, or finished goods Labor can be stored as a component of partially completed subassemblies Irregular supply and demand Demand and supply may not be constant over time Inventory can be used to buffer the variability © 2009 Prentice-Hall, Inc. 6–9 Importance of Inventory Control Quantity discounts Lower prices may be available for larger orders Cost of item is reduced but storage and insurance costs increase, as well as the chances for more spoilage, damage and theft. Investing in inventory reduces the available funds for other projects Avoiding stockouts and shortages Stockouts may result in lost sales Dissatisfied customers may choose to buy from another supplier © 2009 Prentice-Hall, Inc. 6 – 10 Inventory Decisions There are only two fundamental decisions in controlling inventory How much to order When to order The major objective is to minimize total inventory costs Common inventory costs are Cost of the items (purchase or material cost) Cost of ordering Cost of carrying, or holding, inventory Cost of stockouts © 2009 Prentice-Hall, Inc. 6 – 11 Inventory Cost Factors ORDERING COST FACTORS CARRYING COST FACTORS Developing and sending purchase orders Cost of capital Processing and inspecting incoming inventory Taxes Bill paying Insurance Inventory inquiries Spoilage Utilities, phone bills, and so on, for the purchasing department Theft Salaries and wages for the purchasing department employees Obsolescence Supplies such as forms and paper for the purchasing department Salaries and wages for warehouse employees Utilities and building costs for the warehouse Supplies such as forms and paper for the warehouse Table 6.1 © 2009 Prentice-Hall, Inc. 6 – 12 Inventory Cost Factors Ordering costs are generally independent of order quantity Many involve personnel time The amount of work is the same no matter the size of the order Carrying costs generally varies with the amount of inventory, or the order size The labor, space, and other costs increase as the order size increases Of course, the actual cost of items purchased varies with the quantity purchased © 2009 Prentice-Hall, Inc. 6 – 13 Economic Order Quantity The economic order quantity (EOQ) model is one of the oldest and most commonly known inventory control techniques It dates from a 1915 publication by Ford W. Harris It is still used by a large number of organizations today It is easy to use but has a number of important assumptions © 2009 Prentice-Hall, Inc. 6 – 14 Economic Order Quantity Assumptions 1. Demand is known and constant 2. Lead time (the time between the placement and receipt of an order) is known and constant 3. Receipt of inventory is instantaneous Inventory from an order arrives in one batch, at one point in time 4. Purchase cost per unit is constant throughout the year; no quantity discounts 5. The only variable costs are the placing an order, ordering cost, and holding or storing inventory over time, holding or carrying cost, and these are constant throughout the year 6. Orders are placed so that stockouts or shortages are avoided completely © 2009 Prentice-Hall, Inc. 6 – 15 Inventory Usage Over Time Inventory usage has a sawtooth shape Inventory jumps from 0 to the maximum when the shipment arrives Because demand is constant over time, inventory drops at a uniform rate over time Inventory Level Order Quantity = Q = Maximum Inventory Level Minimum Inventory 0 Figure 6.2 Time © 2009 Prentice-Hall, Inc. 6 – 16 EOQ Inventory Costs The objective is to minimize total costs The relevant costs are the ordering and carrying/holding costs, all other costs are constant. Thus, by minimizing the sum of the ordering and carrying costs, we are also minimizing the total costs The annual ordering cost is the number of orders per year times the cost of placing each order As the inventory level changes daily, use the average inventory level to determine annual holding or carrying cost The annual carrying cost equals the average inventory times the inventory carrying cost per unit per year The maximum inventory is Q and the average inventory is Q/2. © 2009 Prentice-Hall, Inc. 6 – 17 Inventory Costs in the EOQ Situation Objective is generally to minimize total cost Relevant costs are ordering costs and carrying costs Average inventory level Q 2 INVENTORY LEVEL DAY BEGINNING ENDING AVERAGE April 1 (order received) 10 8 9 April 2 8 6 7 April 3 6 4 5 April 4 4 2 3 April 5 2 0 1 Maximum level April 1 = 10 units Total of daily averages = 9 + 7 + 5 + 3 + 1 = 25 Number of days = 5 Average inventory level = 25/5 = 5 units Table 6.2 © 2009 Prentice-Hall, Inc. 6 – 18 Inventory Costs in the EOQ Situation Develop an expression for the ordering cost. Develop and expression for the carrying cost. Set the ordering cost equal to the carrying cost. Solve this equation for the optimal order quantity, Q*. © 2009 Prentice-Hall, Inc. 6 – 19 Inventory Costs in the EOQ Situation Mathematical equations can be developed using Q EOQ D Co Ch = number of pieces to order = Q* = optimal number of pieces to order = annual demand in units for the inventory item = ordering cost of each order = holding or carrying cost per unit per year Annual ordering cost Number of Ordering orders placed cost per per year order Annual Demand Cost per order Number of units per order D Q Co © 2009 Prentice-Hall, Inc. 6 – 20 Inventory Costs in the EOQ Situation Mathematical equations can be developed using Q EOQ D Co Ch = number of pieces to order = Q* = optimal number of pieces to order = annual demand in units for the inventory item = ordering cost of each order = holding or carrying cost per unit per year Average Annual holding cost inventory Q 2 Carrying cost per unit per year Ch Total Inventory Cost = D Q Co Q Ch 2 © 2009 Prentice-Hall, Inc. 6 – 21 Inventory Costs in the EOQ Situation Optimal Order Quantity is when the Total Cost curve is at its lowest . This occurs when the Ordering Cost = Carrying Cost Cost Curve of Total Cost of Carrying and Ordering Minimum Total Cost Carrying Cost Curve Ordering Cost Curve Figure 6.3 Optimal Order Quantity Order Quantity © 2009 Prentice-Hall, Inc. 6 – 22 Finding the EOQ When the EOQ assumptions are met, total cost is minimized when Annual ordering cost = Annual holding cost D Q Co Q 2 Ch Solving for Q Q Ch 2 2 DC o 2 DC o Q o Q EOQ Q 2 Ch 2 DC Ch * © 2009 Prentice-Hall, Inc. 6 – 23 Economic Order Quantity (EOQ) Model Summary of equations Annual ordering cost D Q Annual holding cost EOQ Q * Q 2 Co Ch 2 DC o Ch © 2009 Prentice-Hall, Inc. 6 – 24 Sumco Pump Company Example Company sells pump housings to other companies Would like to reduce inventory costs by finding optimal order quantity Annual demand = 1,000 units Ordering cost = $10 per order Average carrying cost per unit per year = $0.50 Q * 2 DC Ch o 2 ( 1,000 )( 10 ) 0 . 50 40 ,000 200 units © 2009 Prentice-Hall, Inc. 6 – 25 Sumco Pump Company Example Total annual cost = Order cost + Holding cost TC D Q Co 1, 000 200 Q 2 Ch ( 10 ) 200 2 ( 0 .5 ) $ 50 $ 50 $ 100 © 2009 Prentice-Hall, Inc. 6 – 26 Sumco Pump Company Example Program 6.1A © 2009 Prentice-Hall, Inc. 6 – 27 Sumco Pump Company Example Program 6.1B © 2009 Prentice-Hall, Inc. 6 – 28 Purchase Cost of Inventory Items Total inventory cost can be written to include the cost of purchased items Given the EOQ assumptions, the annual purchase cost is constant at D C no matter the order policy C is the purchase cost per unit D is the annual demand in units It may be useful to know the average dollar level of inventory Average dollar level (CQ ) 2 © 2009 Prentice-Hall, Inc. 6 – 29 Purchase Cost of Inventory Items Inventory carrying cost is often expressed as an annual percentage of the unit cost or price of the inventory This requires a new variable I Annual inventory holding charge as a percentage of unit price or cost The cost of storing inventory for one year is then C h IC thus, Q * 2 DC o IC © 2009 Prentice-Hall, Inc. 6 – 30 Sensitivity Analysis with the EOQ Model The EOQ model assumes all values are know and fixed over time Generally, however, the values are estimated or may change Determining the effects of these changes is called sensitivity analysis Because of the square root in the formula, changes in the inputs result in relatively small changes in the order quantity EOQ 2 DC o Ch © 2009 Prentice-Hall, Inc. 6 – 31 Sensitivity Analysis with the EOQ Model In the Sumco example EOQ 2 ( 1,000 )( 10 ) 0 . 50 200 units If the ordering cost were increased four times from $10 to $40, the order quantity would only double EOQ 2 ( 1,000 )( 40 ) 0 . 50 400 units In general, the EOQ changes by the square root of a change to any of the inputs © 2009 Prentice-Hall, Inc. 6 – 32 Reorder Point: Determining When To Order Once the order quantity is determined, the next decision is when to order The time between placing an order and its receipt is called the lead time (L) or delivery time Inventory must be available during this period to met the demand When to order is generally expressed as a reorder point (ROP) – the inventory level at which an order should be placed ROP Demand per day Lead time for a new order in days dL © 2009 Prentice-Hall, Inc. 6 – 33 Determining the Reorder Point The slope of the graph is the daily inventory usage Expressed in units demanded per day, d If an order is placed when the inventory level reaches the ROP, the new inventory arrives at the same instant the inventory is reaching 0 © 2009 Prentice-Hall, Inc. 6 – 34 Procomp’s Computer Chip Example Demand for the computer chip is 8,000 per year Daily demand is 40 units Delivery takes three working days ROP d L 40 units per day 3 days 120 units An order is placed when the inventory reaches 120 units The order arrives 3 days later just as the inventory is depleted © 2009 Prentice-Hall, Inc. 6 – 35 Inventory Level (Units) The Reorder Point (ROP) Curve Q* Slope = Units/Day = d ROP (Units) Lead Time (Days) L © 2009 Prentice-Hall, Inc. 6 – 36 EOQ Without The Instantaneous Receipt Assumption When inventory accumulates over time, the instantaneous receipt assumption does not apply Daily demand rate must be taken into account The revised model is often called the production run model Inventory Level Part of Inventory Cycle During Which Production is Taking Place There is No Production During This Part of the Inventory Cycle Maximum Inventory t Time Figure 6.5 © 2009 Prentice-Hall, Inc. 6 – 37 EOQ Without The Instantaneous Receipt Assumption Instead of an ordering cost, there will be a setup cost – the cost of setting up the production facility to manufacture the desired product Includes the salaries and wages of employees who are responsible for setting up the equipment, engineering and design costs of making the setup, paperwork, supplies, utilities, etc. The optimal production quantity is derived by setting setup costs equal to holding or carrying costs and solving for the order quantity © 2009 Prentice-Hall, Inc. 6 – 38 Annual Carrying Cost for Production Run Model In production runs, setup cost replaces ordering cost The model uses the following variables Q number of pieces per order, or production run Cs setup cost Ch holding or carrying cost per unit per year p daily production rate d daily demand rate t length of production run in days © 2009 Prentice-Hall, Inc. 6 – 39 Annual Carrying Cost for Production Run Model Maximum inventory level (Total produced during the production run) – (Total used during the production run) (Daily production rate)(Number of days production) – (Daily demand)(Number of days production) (pt) – (dt) Total produced Q pt since we know t Q p Maximum Q Q d inventory pt dt p d Q 1 p p p level © 2009 Prentice-Hall, Inc. 6 – 40 Annual Carrying Cost for Production Run Model Since the average inventory is one-half the maximum Average inventory Q d 1 2 p and Q d Annual holding cost 1 C h 2 p © 2009 Prentice-Hall, Inc. 6 – 41 Annual Setup Cost for Production Run Model Setup cost replaces ordering cost when a product is produced over time (independent of the size of the order and the size of the production run) Annual setup cost D Q Cs and Annual ordering cost D Q Co © 2009 Prentice-Hall, Inc. 6 – 42 Determining the Optimal Production Quantity By setting setup costs equal to holding costs, we can solve for the optimal order quantity Annual holding cost Annual setup cost Q d D 1 C Cs h 2 p Q Solving for Q, we get Q * 2 DC s d Ch1 p © 2009 Prentice-Hall, Inc. 6 – 43 Production Run Model Summary of equations Q d 1 C h 2 p D Annual setup cost Cs Q Annual holding cost Optimal production quantity Q * 2 DC s d Ch1 p If the situation does not involve production but receipt of inventory over a period of time, use the same model but replace Cs with Co © 2009 Prentice-Hall, Inc. 6 – 44 Brown Manufacturing Example Brown Manufacturing produces commercial refrigeration units in batches Annual demand D 10,000 units Setup cost Cs $100 Carrying cost Ch $0.50 per unit per year Daily production rate p 80 units daily Daily demand rate d 60 units daily How many refrigeration units should Brown produce in each batch? How long should the production cycle last? © 2009 Prentice-Hall, Inc. 6 – 45 Brown Manufacturing Example 1. 2. Q * Q * 2 DC s Production d Ch1 p cycle Q p 2 10 , 000 100 4 , 000 80 50 days 60 0 .5 1 80 2 ,000 ,000 4 0 .5 1 16 ,000 ,000 4,000 units © 2009 Prentice-Hall, Inc. 6 – 46 Brown Manufacturing Example Program 6.2A © 2009 Prentice-Hall, Inc. 6 – 47 Brown Manufacturing Example Program 6.2B © 2009 Prentice-Hall, Inc. 6 – 48 Quantity Discount Models Quantity discounts are commonly available The basic EOQ model is adjusted by adding in the purchase or materials cost Total cost Material cost + Ordering cost + Holding cost Total cost DC D Q Co Q 2 Ch where D annual demand in units Cs ordering cost of each order C cost per unit Ch holding or carrying cost per unit per year © 2009 Prentice-Hall, Inc. 6 – 49 Quantity Discount Models Because unitare cost is now variable Quantity discounts commonly available Holding Ch IC The basic EOQ modelcost is adjusted by adding in the purchase materials cost I holdingorcost as a percentage of the unit cost (C) Total cost Material cost + Ordering cost + Holding cost Total cost DC D Q Co Q 2 Ch where D annual demand in units Cs ordering cost of each order C cost per unit Ch holding or carrying cost per unit per year © 2009 Prentice-Hall, Inc. 6 – 50 Quantity Discount Models A typical quantity discount schedule DISCOUNT NUMBER DISCOUNT QUANTITY DISCOUNT (%) DISCOUNT COST ($) 1 0 to 999 0 5.00 2 1,000 to 1,999 4 4.80 3 2,000 and over 5 4.75 Table 6.3 Buying at the lowest unit cost is not always the best choice © 2009 Prentice-Hall, Inc. 6 – 51 Quantity Discount Models Total cost curve for the quantity discount model Total Cost $ TC Curve for Discount 3 TC Curve for Discount 1 TC Curve for Discount 2 EOQ for Discount 2 0 Figure 6.6 1,000 2,000 Order Quantity © 2009 Prentice-Hall, Inc. 6 – 52 Brass Department Store Example Brass Department Store stocks toy race cars Their supplier has given them the quantity discount schedule shown in Table 6.3 Annual demand is 5,000 cars, ordering cost is $49, and holding cost is 20% of the cost of the car The first step is to compute EOQ values for each discount EOQ EOQ EOQ 1 ( 2 )( 5 , 000 )( 49 ) ( 2 )( 5 , 000 )( 49 ) 2 ( 2 )( 5 , 000 )( 49 ) 3 ( 0 . 2 )( 5 . 00 ) ( 0 . 2 )( 4 . 80 ) ( 0 . 2 )( 4 . 75 ) 700 cars per order 714 cars per order 718 cars per order © 2009 Prentice-Hall, Inc. 6 – 53 Brass Department Store Example The second step is adjust quantities below the allowable discount range The EOQ for discount 1 is allowable The EOQs for discounts 2 and 3 are outside the allowable range and have to be adjusted to the smallest quantity possible to purchase and receive the discount Q1 700 Q2 1,000 Q3 2,000 © 2009 Prentice-Hall, Inc. 6 – 54 Brass Department Store Example The third step is to compute the total cost for each quantity DISCOUNT NUMBER UNIT PRICE (C) ORDER QUANTITY (Q) ANNUAL MATERIAL COST ($) = DC ANNUAL ORDERING COST ($) = (D/Q)Co ANNUAL CARRYING COST ($) = (Q/2)Ch TOTAL ($) 1 $5.00 700 25,000 350.00 350.00 25,700.00 2 4.80 1,000 24,000 245.00 480.00 24,725.00 3 4.75 2,000 23,750 122.50 950.00 24,822.50 Table 6.4 The fourth step is to choose the alternative with the lowest total cost © 2009 Prentice-Hall, Inc. 6 – 55 Brass Department Store Example Program 6.3A © 2009 Prentice-Hall, Inc. 6 – 56 Brass Department Store Example Program 6.3B © 2009 Prentice-Hall, Inc. 6 – 57 Use of Safety Stock If demand or the lead time are uncertain, the exact ROP will not be known with certainty To prevent stockouts, it is necessary to carry extra inventory called safety stock Safety stock can prevent stockouts when demand is unusually high Safety stock can be implemented by adjusting the ROP © 2009 Prentice-Hall, Inc. 6 – 58 Use of Safety Stock The basic ROP equation is ROP d L d daily demand (or average daily demand) L order lead time or the number of working days it takes to deliver an order (or average lead time) A safety stock variable is added to the equation to accommodate uncertain demand during lead time ROP d L + SS where SS safety stock © 2009 Prentice-Hall, Inc. 6 – 59 Use of Safety Stock Inventory on Hand Time Figure 6.7(a) Stockout © 2009 Prentice-Hall, Inc. 6 – 60 Use of Safety Stock Inventory on Hand Safety Stock, SS Stockout is Avoided Time Figure 6.7(b) © 2009 Prentice-Hall, Inc. 6 – 61