International Monetary Policy Co

advertisement

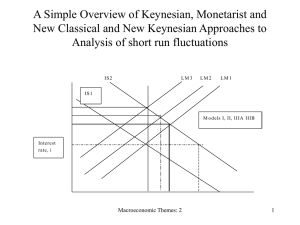

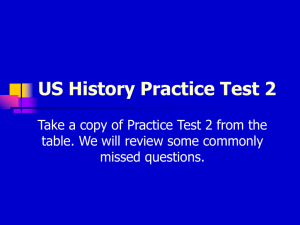

Importance of International Policy Coordination The global economy consists of many interdependent individual and regional economies. Expansionary or contractionary monetary and fiscal policies in one country most often affects economic events significantly in another economies. Economic events in the UK are influenced by policy choices of the France and Germany and other European economies and the US. To some extent also by policies in Asia, Middle East, Africa and Latin America. Stability and prosperity as well as economic shocks and crises in one country have wide-ranging global impacts. It is important to consider both domestic as well as international aspects of opportunities and constraints while setting an economic policy. Macroeconomic Themes: 14 1 Some Models to Analyse International Macroeconomic Policy (1) Mundell-Fleming two country global economy model (2) Policy co-ordination analysis using Pareto-Contract diagram (3) Canzoneri M. B. and J A Gray (1985) (4) More recent micro-founded computable general equilibrium model of interenational monetary policy coordination. Macroeconomic Themes: 14 2 Analysing Interdependent Economic Policy Using Mundell-Fleming-Dornbusch Diagram Impact in country 2 Expansionary fiscal policy in country 1 c i1=i1* e d i2=i2* BOP a LM2’ LM2 LM1 LM2 IS2 IS2’ IS1’ O y0 IS1 y1 y2 o y20 y22 y21 Here start with a global equilibrium in which the interest rates are same across two Macroeconomic Themes: 14 3 Simple Open Economy and Exchange Rate Model in Mundell-Fleming World Small Open Economy Mundell-FlemingDornbusch type model: Fundamentals of Long Run Exchange Rate Purchasing power parity: Money demand: m d pt y rt t 2 pt p * et PPP: (3.2) * e e r r UIP: t t t t 1 Eee e Expectation: t 1 t 1 M * K *Y * p* (3.3) (3.4) E p P* *Y * M K E KY M * e m m* k * k y* y Sterilisation policy: m s m et e t M KY p Money demand: (3.1) p EP * (3.5) Macroeconomic Themes: 14 4 Non-Co-operative Nash and Co-operative Solutions of Policy Games in an Interdependent Word Economic Policy Games in Interdependent Economies X I2 Policy instrument Of Country 1 I2’ I1’ O2 I1 B A C O1 O Policy instrument of country 2 Macroeconomic Themes: 14 5 International Monetary Policy Co-ordination Game : Canzoneri M. B. and J A Gray (1985) There are two countries home and foreign. Their policy objective (utility) function includes deviation of output from the trend x and the inflation 2 2 2 * * * u x ; u x 2 g ; * * g * 0 0 2 (2) 2 u x g and 0 2 2 * * * * u x g 0 (1) (3) x g g * q ; 1 2 3 x* *g * *g *q* 1 2 3 (4) Macroeconomic Themes: 14 6 Parametric Specifications for Beggar-ThyNeighbour, Locomotive or Prosper-Thy-Neighbour Policies Spill over effects of the policy of one country into another depends upon a set of policy response parameters,1 , 2 ,3 ,1* , 2* and * . 2 There are three potential cases of policy spillover: * 1. Symmetric negative (beggar thy neighbour) i i 0 , 0 2 3 * 2. Symmetric positive (locomotive effect) i i 0 , 0 2 3 3. Asymmetric (prosper thy neighbour) 1 0 , 0 , * 0 , * 0 . 2 2 3 0, 1 0, 1 3 Four channels of transmission mechanism for policy spill over (a) interest rate (b) aggregate demand output (c) wage indexation and terms of trade (d) oil prices Macroeconomic Themes: 14 7 Coopeative and Non-co-operative Solutions of International Monetary Policy Game in Canzoneri M. B. and J A Gray (1985) Nash, Stackleberg and Fixed Rule equilibria in international policy coordination game dg N F N S dg* N N* Macroeconomic Themes: 14 8 Nash Optimal Monetary Policy for Home and Abroad Adaptive regime of the world economy 2 u g g * q 2 ; 2 3 1 2 2 u* *g * *g *q* * g * 2 3 1 0 (5) Choice of optimal policy u 2 g g * q g 0 1 2 3 1 0 g g * q 1 2 1 3 g (6) 2 1 u* 2 *g * *g *q* * g * 0 1 0 2 3 g *g *q* 2 3 g * (7) 2 * Macroeconomic Themes: 14 1 9 Money Supply Growth Rate under the Nash equilibrium g g * q 1 3 0 g 2 * 1 1 2 Macroeconomic Themes: 14 (8) 10 Monetary Policy Choice of Home Country Under Stackleberg Equilibrium x g g * q 1 2 3 *g *q* 3 q x g 2 1 2 3 2 * 1 x 2 2 * g *g *q* q * 1 1 3 3 1 2 2 * 1 2 2 u x g 0 u 2 2 * * * * * g g q q 1 1 3 3 1 2 2 * 1 2 Macroeconomic Themes: 14 g 0 2 (9) 11 Monetary Policy Choice of Home Country Under Stackleberg Equilibrium *2 * 2 *2 * * * * 2 1 1g 2 g 3 q 3q 1 1 1 3q 1 u 0 g 0 2 2 * * g 1 1 q 2 2 2 1 1 2 1 2 0 g 1 3 2 2 2 2 1 1 1 (11) 2 g * 13q 12 12 1 2 12 22 1 22 1 2 12 12 12 22 0 (12) Macroeconomic Themes: 14 12 Coordination Under the Fixed Exchange Rate Regime Under the fixed exchange rate rule monetary policy is the same at home and abroadg g * . Substituting this condition the output function in (4) x g g * q x g q . 1 2 3 2 3 1 Substitute this in the utility function and maximise wrt g 2 2 u g q g 2 3 0 1 u g q 2 g 0 3 0 g 1 2 q g 1 2 3 (13) 2 2 1 Macroeconomic Themes: 14 13 Contribution of Canzonery and Gray Model in International Policy Analysis The major contribution of Canzonery and Gray (1985) model lies in showing how monetary policy in one country can have a detrimental, or favourable or neutral effects in another economies depending how the policy games is played. Money growth rate is smaller in the fixed rate than the stackleberg equilibrium which is small than the Nash equilibrium. The welfare gains from the cooperation in the monetary policy can be obtained by taking the differences of utilities under these two different regimes. Macroeconomic Themes: 14 14 Micro-Founded Models of International Policy Co-ordination Corsetti and Pesenti (2001) Model to asset welfare impacts of macroeconomic inter-dependence utility function has three arguments; composite good made of domestic and foreign goods, real money balances and leisure. Output in each country is produced using domestic labour. Goods market is monopolistic and there are imperfections in the labour market so that wage rate is not completely flexible. Agents are free to hold domestic money or international bonds of combination to two. Terms of trade effect and impacts of monopolistic structures are considered with an expansionary monetary policy. A competitive equilibrium is a set of prices and quantities that maximise utility for households in both domestic and foreign countries. Macroeconomic Themes: 14 15 Major Conclusions of Micro-Founded Models of International Policy Co-ordination Using closed form solutions Corsetti and Pesenti (2001) conclude that the terms of trade effects may welfare dominate aggregate demand externalities. These models correct lack of micro-foundation in the traditional Mundell-Fleming-Dornbusch models for analysis of economic policy of open and interdependent economies including issues such as “beggar thyself” or beggar-thy-neighbour or prosper-thyneighbour effects. In a follow up study Benigno (2002) uses this new framework to establish new results. He proves that Nash equilibrium is not the Pareto efficient allocation and the co-operative solution is not credible. He shows rationale for delegating monetary policy to a central institution. Macroeconomic Themes: 14 16 An Important Question How can we use above models to analyse five economic tests for the UK to join the European Monetary Union. These five tests include (a) cyclical convergence (b) flexibility in economic policy (c) impacts on investment (d) Impacts on financial services and (e) impacts on employment and growth . Refer to HM-Treasury’s Report on UK Membership of EMU available at www.hm-treasury.gov.uk. Macroeconomic Themes: 14 17 References http://www.stern.nyu.edu/globalmacro/ Altig D E, C.T. Carlstrom and K.L. Lansing (1995) Computable General Equilibrium Models and Monetary Policy Advice, Journal of Money Credit and Banking, vol. 27, no. 4, Nov., pp. 1472-1493. Argy V. and J.Salop (1983) Price and Output Effects of Monetary and Fiscal Expansion in Two-Country World Under Flexible Exchange Rates”, Oxford Economic Papers, June. Benigno, Pierpaolo (2002) A Simple Approach to International Monetary Policy Coordination; Journal of International Economics, June 2002, v. 57, iss. 1, pp. 177-96 Blanchard O.J.and Kiyotaki (1987) Monopolistic competition and the effects of aggregate demand, American Economic Review, 77: September, pp 647-66. Canzoneri M. B. and J A Gray (1985) “Monetary Policy Games and the Consequences of NonCooperative Behaviour”, International Economic Review, 26:3:1985, pp. 547-567. Corsetti, Giancarlo; Pesenti, Paolo; (2001) Welfare and Macroeconomic Interdependence; Quarterly Journal of Economics, May 2001, v. 116, iss. 2, pp. 421-45 K. A.Chrystal and Simon Price (1994) Controversies in Macroeconomics, Harvester Wheatsheaf, chapter 9. De Grauwe Paul (1997) The Economics of Monetary Union, 3rd edition, Oxford. Dornbusch Rudiger (1976) Expectations and Exchange Rate, Journal of Political Economy, vol. 84, no.6, pp. 1161-1176. Fleming J. Marcus (1962) Domestic financial policies under fixed and under floating exchange rates, IMF staff paper 9, November , 369-379. Hamada K (1976) Strategic Analysis of Monetary Interdependence, Journal of Political Economy, 84 August. Lockwood B., M. Miller and L Zhang (1998) Designing Monetary Policy when Unemployment Persists, Economica (1998) 65 327-45. Miller, Marcus; Salmon, Mark When Does Coordination Pay? Journal of Economic Dynamics and Control, July-Oct. 1990, v. 14, iss. 3-4, pp. 553-69 Mundell R. A (1962) Capital mobility and stabilisation policy under fixed and flexible exchange rates, Canadian Journal of Economic and Political Science, 29, 475-85. Williamson J. and M. Miller (1987) Targets and indicators: a blue print for international coordination of economic policies, Institute of International Economics, Washington. Macroeconomic Themes: 14 18