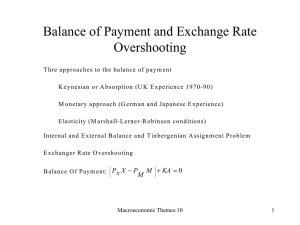

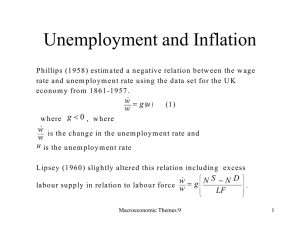

Talk: Keynesian Models

advertisement

A Simple Overview of Keynesian, Monetarist and New Classical and New Keynesian Approaches to Analysis of short run fluctuations IS 2 LM 3 LM 2 LM 1 IS 1 M o d els I, II, IIIA IIIB Interest rate, i Macroeconomic Themes: 2 1 Summary of Four Macro Models in the above Figure G overnm ent expenditure rises IS 1 shifts to IS 2. Im pact on output according to four different m acroeconom ic m odels. M odel I is sim ple K ey nesian m odel for the real sector. G ood m arket equilibrium is given by the dow nw ard sloping IS curve because low er interest rate stim ulates the aggregate dem and. M odel II includes m oney m arket. It is given by upw ard sloping L M function w hich show s m oney m arket equilibrium w ith the rising level of dem and for m oney as incom e rises. T his includes interest rate feedback. M odels I and II are K ey nesian and new K ey nesian m odels. M odel IIIA includes a price feedback. W hen A D rises price also rises. It reduces real balances and there is less dem and for output. T his is the m onetarist proposition in the short run. M odel IIIB m onetarist proposition in the long run and N ew C lassical m odel w ith rational expectation. Macroeconomic Themes: 2 2 IS-LM and Aggregate Demand and Aggregate Supply Analysis IS 2 LM 3 LM 2 LM 1 IS 1 M o d els I, II, IIIA IIIB Interest rate, i Y0 y1 y2 y3 LAS SAS P rice level Macroeconomic Themes: 2 Y0 y1 y2 3 Specification of the IS-LM Model C onsum ption: D isposable incom e: Investm ent: C a bY d Y d Y T (1) (2) (3) I r I q r 0 D em and for real balances: M kY r (4) P N ational incom e identity: Y C I G (5) Macroeconomic Themes: 2 4 Equilibrium in Model I: Keynesian Multiplier P ut equation (2) into (1), then use the resulting equation for C and the investm ent (3) into (5) and solve for Y (M odel I). a bT I qr G 0 Y (6) 1 b T his is goods m arket equilibrium or the IS curve according to H icks (1933). It is a dow nw ard sloping line: Y q 0 ; and r 1 b 1 b Y a bT I G 0 r q In term s of saving investm ent identity : Y C G I r ; w hen incom e rises saving is greater than investm ent, the interest rate should fall to accom m odate an increase in investm ent. Macroeconomic Themes: 2 5 Crowding out of Investment: Equilibrium with Interest Rate Feedback T he m oney m arket equilibrium , L M curve, is provided by equation (5) and exogenously fixed real m oney supply M kY r P or r 1 kY M P (7) r k L M is an upw ard sloping line y 0 Macroeconomic Themes: 2 6 Equilibrium with Price Feedback: Model III: Aggregate Demand 1 a bT I q kY M 0 P Y 1 b G , S olve for Y as a bT I q M G 0 P Y 1 b q k (8) Macroeconomic Themes: 2 7 Response of Output to the Fiscal and Monetary Policy Y b 0; q T 1 b k Y q 0 and M 1 b q k Y 1 0 q G 1 b k Macroeconomic Themes: 2 8 Parametric Specifications for Model I, II and III a 150 b 0 .8 T 50 G 60 I0 50 q 10 M 150 P 1 k 0 .8 n 3000 r-fo r m o d e l1 P ric e change 0 .0 5 Macroeconomic Themes: 2 2 9 Macroeconomic equilibrium without and with interest and price feedback Y G-Multipler Consumption Tax G-Spending Investment Saving Interest rate Price level Model 1 1097.5 5 988 50 60 49.5 59.5 0.05 1 Model 2 1087.993 4.934211 980.3947 50 60 47.59868 57.59868 0.240132 1 Macroeconomic Themes: 2 Model 3 Model 4 1086.349 1085 4.934211 4.934211 979.0789 978 50 50 60 60 47.26974 47.2654 57.26974 57 0.273026 0.27346 3 3.25 10 Simple Model of Aggregate supply Y L L abo u r d em an d co n sisten t w ith m ax im isatio n o f p ro fit: 1 L 1 W 1 P S in ce lab ou r d em and is eq u al to th e labou r su p ply in eq u ilib riu m A gg reg ate su pp ly : Y 1 W 1 ; Y 0 P P th e ag g reg ate su pp ly is u p w ard slop in g . Macroeconomic Themes: 2 11 Parametric Specification for the Labour Market a b c d phi Note 5487.50 0.50 3841.25 0.50 0.75 5439.97 0.50 3841.25 0.50 0.75 a=y*5 5431.74 0.50 3841.25 0.50 0.75 5425.00 0.50 3841.25 0.50 0.75 b=y*3.5 Macroeconomic Themes: 2 12 A Numerical Illustration of the Determination of Employment and the real wage rates in above models a b c d phi Output Employment Real wage Price level Nominal wage Labour Market 5487.50 0.50 0.00 0.50 5487.50 5439.97 5431.74 5425.00 0.50 0.50 0.50 0.50 3841.25 3841.25 3841.25 3841.25 0.50 0.50 0.50 0.50 0.75 0.75 0.75 0.75 Model 1 Model 2 Model 3 Model 4 1097.50 1087.99 1086.35 1085.00 11320.68 11190.13 11167.58 11149.10 1646.25 1598.72 1590.49 1583.75 1.00 1.00 1.00 1.00 1646.25 1598.72 1590.49 1583.75 Macroeconomic Themes: 2 13 Can you suggest other forms of Supply Curves? R eferen ces: 1. 2. 3. H icks, J. R .(1937): M r. K eynes and the "C lassics"; A S uggested Interpretation, E con 1937. M ankiw N .G . (1989) R eal B usiness cycle: A N ew K eynesian P erspective, Journal of E con P erspectives, vol. 3, no. 3 pp. 79-90. L ucas, R obert Jr. and Sargent, A fter K eynesian M acroeconom ics, Spring 1979, Federal R eserve B ank of M o nneapolis Q uarterly R eview . Macroeconomic Themes: 2 14