ECONOMIC MANAGEMENT MODELING IN THE ECO REGION

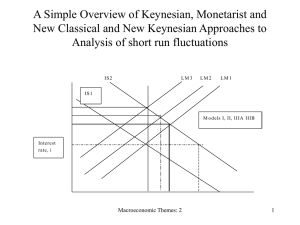

advertisement

Research Proposal PIDE and Iran Prudent economic management is essential for putting the economies on the path of sustainable economic growth. Over the years, the economies of the ECO region have sought to improve macroeconomic policies as reflected in trade liberalization efforts, more flexible exchange rate regimes, and lower fiscal deficits, which have combined to reduce uncertainty and improve the overall investment environment. The ECO countries are also pursuing privatization and structural reforms ECO’s commonalities indicate a big potential for cooperation in these resource-rich economies In this era of globalization, economic opportunities arising from the global market can be better harnessed through efficient economic management Economic management leads to development in region which is essential for standard of living. Efficient economic management strategy must based on local conditions and circumstances and priorities should be set with longer-term perspective. ECO countries must continue with their agenda of reforms and institutional innovation in banking, capital markets, tax system, and corporate sectors Macroeconomic stability and economic growth could help reduce poverty in conjunction with investment in social sectors Structural reforms are needed to strengthen policies and to remove microeconomic distortions Improved governance affects the quality of growth by allowing realization of higher returns on investment and is also conducive to poverty reduction To deal with domestic macroeconomic imbalances, the member states need strong commitment to sound fiscal and monetary policies. Prudent macroeconomic management of the economies based on a rigorous and internally consistent macroeconomic model may help the process of macro policy formulation in the ECO member countries. The foremost goal remains improvement in the quality of life of people through stable and sustained economic growth, which in turn depends on sound macroeconomic policies. To develop a macro-econometric model for the ECO member countries that can provide rigorous analytical platform for assessing the impact of macroeconomic policies in the economy Economic management is an important component of a nation’s strategies for economic development and subsequently a better standard of living In this era of globalization, economic opportunities arising from the global market can better be harnessed through efficient economic management Economic management modeling provides tools and procedures through which this objective could be realized. Develop a dynamic macroeconomic model to study the role of macroeconomic policies and identify the dynamic adjustment process in the key economic variables. Specifically study would focus on macroeconometric models because they depict the structure as well as temporal behavior of the macro-economy and provide implications of a exogenous and policy shocks. proposed models would be based on an open economy framework and would take into account the features of the ECO economies. key components (i) production, (ii) aggregate demand and expenditures, (iii) fiscal block, (iv) foreign trade block, and (v) monetary and price. Yt a f (Lat , CDta , Wt ) Where Yt a = Agriculture value added Lat = Labour engaged in agriculture CDta = Credit disbursed to agriculture Wt = Water availability. (1) Yt m f (Ktm , Lmt ) (2) Where Yt m = Manufacturing value added. m t m t K = Capital stock employed in manufacturing L = Labor employed in manufacturing Yt At ( X t M t ) (6) Where A is domestic absorption refers to consumption ( C ), investment ( I ) and government expenditures ( G ) respectively. Whereas, X and M denotes exports and imports of goods and services respectively. The national income now is defined as: Yt Ct It Gt ( X t M t ) This relationship always holds as an identity (7) Pt c f (Yt d , rt d , RMt ) (8) Where P c is real private consumption, Y d is real disposable income, r d is real interest rate and RM is the real money balances ( M 2 definition). Following Haque et al. (1990) we define real disposable income ( Y d ) as: Yt d (GDPt DTXRt INDTXRt WREMt CRPt ) / CPIt (9) Where DTXR denote direct tax revenues and INDTXR is indirect tax revenues. WREM , CRP and CPI are worker’s remittances, credit to private sector and consumer price index respectively. Worker’s remittances are included to capture the effect of remittance on private consumption. Time series data for the macroeconomic aggregates Cointegration approach (Engle-Granger two-step procedure) to estimate the model. mean absolute percentage error (MAPE) and Theil’s inequality coefficient (U ) a range of simulations of macroeconomic policy model to assess issues such as the domestic and international consequences of policies workable set of macro-econometric models that can help the process of macroeconomic management in the ECO member countries.