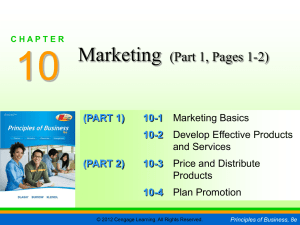

California Mortgage Loan Brokering & Lending - PowerPoint

advertisement

Chapter 9: Processing: Escrow Settlement, Title and Appraisal By Dr. D. Grogan M.C. “Buzz” Chambers ©2011 Cengage Learning PREVIEW 1. 2. 3. 4. 5. The mortgage loan broker does not close the loan. The process is handled by an escrow agent and the title company. The escrow agent: • makes sure all documents are prepared and properly signed. • calculates the various charges to be assessed against each party. • deposits all the necessary funds. • gives each party an itemized list of the costs, charges and fees associated with the transaction. The title company: • handles the existing loan payoff, if any. • receives the new loan proceeds. • records the necessary documents with the recorder’s office. An appraisal is normally required for most loans. After all these items have been completed, the loan is then in a position to fund and close. ©2011 Cengage Learning Student Learning Outcomes 1. 2. 3. 4. 5. Outline the what, why, who, and how of the escrow process. Discuss escrow instructions, expenses handled by escrow and the impound account. Describe title insurance, a preliminary title report, and a binder. Differentiate between a title company and a title insurance policies. Review the appraisal report. ©2011 Cengage Learning What is escrow? An independent stakeholder. A neutral depository for things of value to be handled according to the terms and conditions of the mutually agreed upon escrow instructions given to the escrow holder, agent or officer. Money and instruments include the down payment, deposits, deeds, and documents. ©2011 Cengage Learning Escrow = Confidentiality Parties in an escrow must have: an interest Lien Claim Estate into or on the property Outside parties are not privileged to any information on the property held “in escrow” ©2011 Cengage Learning A binding Escrow All parties must execute written escrow instructions. All parties must deliver written escrow instructions to the escrow holder. Represent a written statement of instructions to the escrow agent: The lender is not required to sign instructions (refinance) Failing to sign and return the instructions may be deemed “breach of contract” on a separate contract (usually the offer to purchase form). ©2011 Cengage Learning Southern California Escrow 1. 2. 3. Title Insurance company, escrow division, under the insurance commissioner. Broker-owned escrow, division of sales office, under the California Department of Real Estate (DRE) commissioner. Independent escrow services, under the California Department of Corporation (DOC) commissioner. ©2011 Cengage Learning Northern California Escrow Title insurance company Broker-owned escrow services (very few) Regulation falls under the California Insurance Commissioner Handle the escrow and write the title insurance policy ©2011 Cengage Learning Escrow Opening of Escrow Instructions come by phone, fax, email Certified escrow instructions Verification of funds deposited Affidavit of occupancy Vesting to be held by borrower(s) Competent parties Lawful object of the subject matter ©2011 Cengage Learning Why is an Escrow needed? Assurance of an exchange of a deed for money Clear and marketable title Clearance of tax liens Clearance from government agencies A neutral third party to determine execution in good faith of escrow instructions--orders ©2011 Cengage Learning Escrow During escrow period Property profile/Preliminary title report The escrow “take sheet” Existing liens and the assessor’s parcel number (APN) (AIN) Amendments to escrow Lender instructions: No or Only approved junior liens Supporting documents: Reconveyance deed, riders Buyer signs many documents ©2011 Cengage Learning Escrow At Close of Escrow (COE) Lien clearances Closing statements on property Preparing the HUD-1 Insurance policies: hazard flood Earthquake other types of insurance ©2011 Cengage Learning When is an escrow required, by law? Escrow is required for LIPS: L – iquor license I – mpound account involved P – robate S – ecurities transfer ©2011 Cengage Learning Who pays the expenses of escrow? Buyer pays: Seller pays: Conventional escrow fee(1/2) DVA escrow fee FHA escrow fee Documentary transfer tax Drawing the grant deed Recording fee-grant deed Beneficiary demand stmt Reconveyance fee Existing loan pay off Home warranty policy Conventional escrow fee(1/2) FHA escrow fee Documentary preparation fee Drawing the 2nd trust deed Recording fee-trust deed(s) Loan tie-in fee Loan origination fee Assumption fee Appraisal fee ©2011 Cengage Learning Who pays the expenses of escrow? Buyer pays: Seller pays: Termite: Correction Survey Unpaid liens CLTA title insurance Sub-escrow fee (1/2) Prepaid rent/taxes/assn dues Unpaid taxes/insurance Termite: Prevention Credit report Appraisal ALTA title insurance Sub-escrow fee (1/2) Preliminary Title report Assumed taxes/insurance ©2011 Cengage Learning Escrow documents Contingent upon: Memorandum Items Sale of another property Purchase of another property Loan rate not to exceed “X%” Appraised value of not less than “$X” Loan amount to be “$X” Seller carrying back a second trust deed for “$X” Personal property included in sales price Working conditions of utilities & appliances Date for transfer of physical possession Any other agreement or event outside of escrow ©2011 Cengage Learning Supplemental/Additional Escrow Requirements Foreign Investors Real Property Tax Act (FIRPTA) Additional tax assessments Preliminary Change of Ownership Report (PCOR) Smoke detector requirements Internal Revenue Code (IRC) Section 6045 (E) Revenue & Taxation Code Sections 18805 & 26131 ©2011 Cengage Learning Homeowner Association www.hoacerts.com Current Budget Balance Sheet Evidence of Fidelity Bonding and/or Directors & Officers Liability Insurance CC&Rs Articles of Incorporation By Laws ©2011 Cengage Learning Vesting Sole Ownership Co-Ownership A single man A single woman An unmarried man An unmarried woman A married man (or woman) as his (or her) sole & separate property Corporation Trust Community property Joint tenancy Tenancy in common Partnership ©2011 Cengage Learning 9.2 Statement of Information (SI) Areas: Name, birthplace, date of birth, marital status Residences for past 10 years Occupation/employment for past 10 years Former marriages or deceased spouses Signature & date Purposes: Not intended as any invasion of privacy Strictly confidential Not available for public examination Accuracy is important Not used for credit check Available in most all languages ©2011 Cengage Learning 9.3 Impound Account & Property Taxes P I T I – Principal, Interest, Taxes (Property), Insurance(s) Prorate Taxes at close of escrow Prop 13 – 1% of PCOR at close of escrow Mello-Roos Supplemental property tax bill ©2011 Cengage Learning 9.4 Title Insurance Preliminary Title Report shows: Encumbrances on subject property Easements affecting subject property Policy of Title Insurance Lenders require Special Endorsements Mineral leases Street address Street access Private road agreement All-include endorsements to protect lender Recordation of document: Deeds & Riders ©2011 Cengage Learning Title company personnel Advisory title officer (ATO) Title officer (TO) National Title desk Inner counties department Customer services department Market department Sales department ©2011 Cengage Learning Title company customer service for loan originators Farm package – information on people, geographic area, type of property Address labels – for marketing plan Property profile – recorded documents Legal and vesting – existing title holder Property information – liens, room count, lot size, CC&Rs, public record (year built) ©2011 Cengage Learning What is a Preliminary Title Report? Designed to provide interim response to an application for a title insurance policy. Identifies existing title, estate, interest and land description. Contains a list of defects, liens, encumbrances & restrictions to be excluded from coverage. ©2011 Cengage Learning 3 elements of a prelim 1. An offer to issue a title insurance policy. 2. A partial reporting of the chain of title. 3. A statement of the terms and conditions of the offer to issue a title policy. • Note: See Appendix F. ©2011 Cengage Learning Types of Title Insurance CLTA ALTA Coverage for the lender Extended Coverage Standard coverage To shield buyer from unforeseen claims To cover above standard coverage Binder When a future sale is anticipated in a short time ©2011 Cengage Learning 9.5 APPRAISAL Uniform Residential Appraisal Report (URAR) (10-0-4) Depository Institutions Deregulation & Monetary Control (DIDMCA of 1980 Regulated under Financial Institution’s Reform & Recovery Act (FIRREA) Appraisers abide by Uniform Standards of Professional Appraisal Practice (USPAP) Appraiser receives a state license ©2011 Cengage Learning Appraisal format Subject property description Neighborhood characteristics Planned unit development (PUD) Description of site and improvements Three approaches to value sections Cost approach Sales Comparison analysis Income approach ©2011 Cengage Learning Appraisal form has 5 areas: Complete visual inspection of the interior & exterior areas of subject property. Inspection of the neighborhood. Inspection of each comparable sale. Collection, confirmation & analysis of data. Recording of analysis, opinions & conclusions in the appraisal report. ©2011 Cengage Learning Appraisal Report Reconciliation may be with conditions Appraiser date – license number & signature Sketch of property exterior measurements Recorded plat map Map location with subject and comparables Disclaimer, certification & limiting conditions Photographs of subject and street view ©2011 Cengage Learning FHA Appraiser shall: Be certified by the state in which the property is located. Be certified by a nationally recognized appraisal organization. Demonstrate verifiable education in FHA appraisal requirements. ©2011 Cengage Learning Appraisal Non state licensed appraiser work: Review Appraisal Used for non-federally related or portfolio loans Used for quality control purposes Responsible for clarifications on appraisal report May add conditions or reject the appraisal report Appraisal report Used to qualify the property for LTV Used for solutions to conditions of the appraisal ©2011 Cengage Learning Appraisal Management Company (AMC) AMC specifically authorized by the lender. AMC selects, retains & provides payment of all compensation to the individual appraiser on behalf of the lender. Appraiser correctly identifies the lender as the lender/client on the appraisal report. Lender policies & procedures in place to comply with the code. ©2011 Cengage Learning Appraisal Licensing Criteria: Trainee 150 hours/education – no experience-property that supervising appraiser is permitted to appraise Residential 150 hours education – 2000 hours experience in past 12 months, 1-4 unit up to $1million & non-residential up to $250,000 Certified Residential 200 hours education – 2500 hours experience in past 30 months, 1-4 unit & non-resident up to $250,000 Certified General 300 hours education + 3000 hours experience in past 30 months w/1,500 hours must be non-residential. ©2011 Cengage Learning Lender approval for appraiser: Copy of current state license or certificate Current resume Sample work References Copy of errors & omissions insurance Sample appraisal review ©2011 Cengage Learning Conditions and Reconsideration Appraisal conditions: Reconsideration: Specific property conditions for the appraisal to be valid Loan broker, lender or appraiser may verify that condition has been met Usually work on the property May be permits or work of others: termite, survey,etc Must submit a cover letter with explanation and summary Documented closed comps or backup data must be provided ©2011 Cengage Learning