CIT vs. TAV Trust

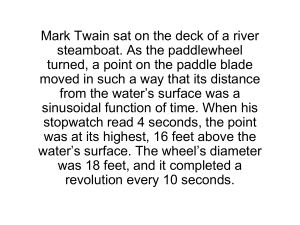

advertisement

FORMATION AND REGISTRATION OF CHARTIABLE TRUSTS OR INSTIUTUTIONS, NGOS, NPOS CA Dr. N. Suresh, B. Com, F.C.A, PhD. Basics on Formation a. b. c. d. Brief Introduction Forms of Constitutions Trust Society Section 8 Company Branch/ Liaison Office Governing Principles for selection of forms Size of the institution Legal requirement Initial cost Recurring cost Compliances required Corporate structure Number of persons required to constitute Trend Global appearance Activities Formation of a Trust a. b. c. d. Historical importance of Trust Meaning of Trust Definition of Author of Trust Governing enactments Charitable Endowment Act, 1890 Indian Trust Act, 1882 Bombay Public Trust Act, 1950 Charitable and Religious Trust Act, 1920, etc Elements to constitute a valid trust a. b. c. d. e. f. Author or Settlor of the Trust Intention to create a Trust Trust Property Trustee Beneficiaries Objects of the Trust Divesting of Property Back Ground Meaning and Concept Conditions for divesting of property Types of Trust a. Oral Trust b. Trust by Deed of Declaration c. Trust by will d. Trust by inter vivos Creation of Trust Meaning Who can create a trust? Whether Minor can create a trust? CIT vs. T.A.V Trust (1987) 166 ITR 848 (Kerala), Ajit Traders Vs.CIT (1990) 181 ITR 451 (Ker) How to create a trust? Hanmantram Ramnath v. CIT (1946) 14 ITR 716 (Bom) Court Receiver v. CIT (1964) 54 ITR 189 (Bom) Can a Trust be created by book entries? Contents of the trust deed a. b. c. d. e. f. g. h. Intention of the Author Trust Property Objects of the Trust Beneficiaries Trustees Period of the Trust Winding up of the Trust Amendment to Trust Deed Declaration of Trust Whether formal deed of trust is required? All India Spinners Association V.CIT (1944) 12 ITR 482(PC) Radhasoami Satsang Saomi Bagh v.CIT (1992) 193 ITR 321 (SC) Classification of Trust a. Trust by an act of party and Operation of law. b. Simple and Special Trust c. Ministerial and discretionary Trust d. Expressed and implied trust e. Resulting and constructive trust f. Public and Private Trust g. Precatory Trust h. Charitable or Religious Trust Public and Private Trust a. b. c. Importance Applicability of Indian Trust Act, 1882 Exemption under Income Tax Act, 1961 Taxation Formation of a Society a. b. c. Meaning Governing enactments Societies Registration Act, 1860 Religious Societies Act, 1880 Respective State Societies Registration Act Purposes for which society can be formed Formation of a Society a. b. c. Procedure for registration Filing of documents for registration Registration Fees Certificate of registration Significance of registration Executive Board – Constitution Can a Foreign National become a member of a society? Are there any restrictions under Foreign Exchange Management Act, 1999 or Foreign Contribution (Regulation) Act, 2010 for a foreign national to become a member of a society? Formation of Sec 8 Company (Sec 25 of Companies Act, 1956) a. b. c. i. ii. Meaning Purpose of constituting Sec 8 Company Conditions Procedure of incorporation of Sec 8 Company Obtain DSC Obtain DIN Name Availability Rule 8 of The Companies (Incorporation) Rules, 2014 contains the guidelines for determining the proposed name of the Company. A company cannot be registered with an undesirable name. General Circular No. 45/2011 dated 8th July, 2011 has made the rules for selecting the name – Companies (Name Availability) Rules, 2011, with effect from 24th July, 2011. Application for license- Rule 19 of The Companies (Incorporation) Rules, 2014 File application in Form INC-12 along with fees and a. Draft MOA & AOA b. Declaration in Form No.INC.14 c. Estimate of the future annual income and expenditure of the company for next three years, specifying the sources of the income and the objects of the expenditure d. Declaration by each of the persons making the application in Form No. INC.15 MOA in Form INC-13 Registration Verification of registered office – Rule 25 of The Companies (Incorporation) Rules, 2014 Declaration at the time of commencement of business – Form No. INC 21- Rule 24 of The Companies (Incorporation) Rules, 2014 Publication of name by company - Rule 26 of The Companies (Incorporation) Rules, 2014 Effect of registration - Rule 9 of The Companies (Incorporation) Rules, 2014 Revocation of License Delegation to Regional Director (RD) – yet to be notified by Official Gazette Circumstances for revocation – Sec 8(6) Opportunity of hearing Windup or amalgamate with another Sec 8 Company – Sec 8(7) Amalgamate to form single company – Sec 8(8) Differences between S 8 and S 25 Companies Scope of Sec 8 has broadened objects over Sec 25 Sec 25 can be formed as private or public company. Sec 8 can also be formed as One Person Company (OPC) or Association of Persons (AOP) For any violation of terms of license, the maximum action by Central Government was revocation of license incase of Sec 25 Company. Whereas Section 8 provides for revocation of license and also direction for winding up of the company incase affairs are being conducted fraudulently or are prejudicial to the public interest in addition to violation of terms of license. Section 8 provides for amalgamation of a Section 8 company with another Section 8 company registered with same objects. Can a Foreign National be director on the Board? Are there any restrictions under Foreign Exchange Management Act, 1999 or Foreign Contribution (Regulation) Act, 2010 for a foreign national to become a Director on the Board? Applicability of FCRA, 2010 Incase of donation in the form of Foreign Contribution Incase of share capital from Foreigner in the form of Foreign Contribution Branch/ Liaison Office a. b. c. d. Applicability for charitable objects Governing Enactments Foreign Exchange Management Act, 1999 Companies Act, 2013 Foreign Contribution Regulation Act, 2010 Income Tax Act, 1961 Registration under FEMA, 1999 Notification No.22/2000-RB dated May 3, 2000 and Master Circular No. 7/2013-14 dated July 1, 2013 issued by the Reserve Bank of India. The Master Circular is valid for a year and will stand withdrawn on July 1, 2014. Prescribed application under FNC-1 The application FNC should be signed by the authorized signatory of Foreign Company/Institution. Documents to be filed English version of the Certificate of the Incorporation/ Registration or Memorandum or Articles of Association of Company /Institution incorporated outside India. Latest audited Balance Sheet of the Foreign Company /Institution. If the Parent Company’s home country laws/regulations do not insist on auditing of accounts, an Account Statement certified by a Certified Public Accountant (CPA) or any Registered Accounts Practitioner by any name, clearly showing the net worth may be submitted Both the documents have to be attested by Notary Public and by Indian Embassy in foreign country. Bankers' Report from the Foreign Company’s banker in the host country / country of registration showing the number of years the applicant has had banking relations with that bank. Details of the activities proposed to be undertaken. Documents to be filed Details of activities carried out in the host country and other countries by the Foreign Company Expected level of funding for operations in India A report/opinion may be sought from the bankers of the Foreign Company by Government of India/Reserve Bank of India Authorisation in favour of the consultant, if any. Letter of Comfort from the Foreign Company may be required. The format is given in Annexure. Board Resolution from the Foreign Company for : Decision to open Liaison/ Branch Office in India Authorising official of the Foreign Company to sign the required documents Details about operations of proposed bank account Three years' Financial Statements of the Foreign Company incase of a Liaison Office and five years’ in case of a Branch Office. Issues Whether charitable activities can be undertaken by Branch/ Liaison Office? Renewal of permission of Liaison Office Elevation of Liaison Office to Branch Office Whether Additional activities can be undertaken? Registration under Companies Act, 2013 and Companies (Registration of Foreign Companies) Rules, 2014 Application to be made in Form FC-1 alongwith: a certified copy of the charter, statutes or memorandum and articles, of the company or other instrument constituting or defining the constitution of the company and, if the instrument is not in the English language, a certified translation thereof in the English language; the full address of the registered or principal office of the company; a list of the directors and secretary of the company containing such particulars as may be prescribed; the name and address or the names and addresses of one or more persons resident in India authorised to accept on behalf of the company service of process and any notices or other documents required to be served on the company; the full address of the office of the company in India which is deemed to be its principal place of business in India; Registration under Companies Act, 2013 and Companies (Registration of Foreign Companies) Rules, 2014 particulars of opening and closing of a place of business in India on earlier occasion or occasions; declaration that none of the directors of the company or the authorised representative in India has ever been convicted or debarred from formation of companies and management in India or abroad; and any other information as may be prescribed. The application shall also be supported with an attested copy of approval from the Reserve Bank of India under Foreign Exchange Management Act or Regulations, and also from other regulators, if any, approval is required by such foreign company to establish a place of business in India or a declaration from the authorised representative of such foreign company that no such approval is required. Time Limit for Application As required under Section 380 of the Companies Act 2013, an application to be filed within 30 days from the date of commencement of liaison office/ branch office in India. Applicability of FCRA, 2010 Foreign Contribution (Regulation) Act, 2010 will apply when the charitable trust or institution receives foreign contribution from a foreign source. Registration under Section 12A of Income Tax Act, 1961 Governing provisions for registration Mandatory requirements Documents to be furnished for making application Time Limit for application to be made Furnishing of formal trust deed is necessary? Effect on non registration Procedure for registration under Sec 12AA Scheme of procedure for registration Cancellation of registration