rbrvs - Washington Paraoptometric Section

advertisement

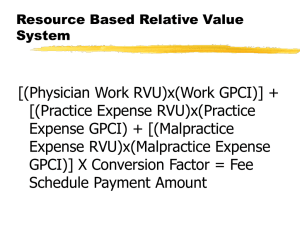

Understanding RBRVS What is RBRVS RBRVS to Discover & Set Fees RBRVS to Choose Procedure Code (Resource Based Relative Value Scale) 1 What is RBRVS? It is how 3rd parties pay RVU x CF = Payment 2 What is RBRVS? RVU = Relative Value Unit All procedures assigned “relative value” Based on resources needed to deliver procedure 3 types of resources 3 What is RBRVS? 3 types resources: Physician Work (PW) Practice Expense (PE) Malpractice (MP) 4 What is RBRVS? Each type resource assigned a “relative value” 5 What is RBRVS? PW RVU PE RVU MP RVU 6 What is RBRVS? 3 resources totaled = PW RVU + PE RVU + MP RVU = Total RVU 7 What is RBRVS? 8000 CPT codes 8000 = Relative Value Scale, ie (total) RVUs Resource-Based Relative Value Scale (RBRVS) 8 Examples of RVUs RVU range 0 to 470.33 RVU of 0? 9 Things Assigned “0” RVU Category 3 CPT 0207T (evacuation meib gland) (Lipiflow) S codes (HCPCS Level 2) S0620 (exam + ref, routine, new) (TOS handout) After hours office visits Routine Exam “Dump” codes 92499 99050 10 (unlisted ophthal service/proced) Examples of RVUs RVU of 470.33? CPT 37227 Revascularization of femoral artery (for occlusive disease) X 34.023 = $16,002 (2013) 11 Examples of RVUs Eye Codes 92004 = 4.45 (x 34.023 = $151.40) 92015 = 0.58 ($19.73) 65600 = 12.07 ($410.66) (tattoo) 92950 = 9.05 ($307.91) (2013) 12 Facility vs. Non-Facility RVU Facility RVU < Non-facility RVU, ie Provider: Facility $$ < Non-facility $$ Facility: Facility & provider split pay 13 Facility vs. Non Facility Non-Facility: Physician office Patient home Freestanding imaging center Independent pathology lab 14 Facility vs. Non Facility Facility: Hospital Ambulatory surgical center (ASC) Skilled nursing facility (SNF) 15 GPCI Geographic Practice Cost Index Alters RVU for local economy Separate GPCI for each economic area (PW x GPCI) + (PE x GPCI) + (MP x GPCI) = total RVU (for specific area) 16 GPCI Geographic Practice Cost Index Medicare – Uses GPCI Non-Medicare – May or may not use 17 What is RBRVS? RVU x CF = Payment 18 Conversion Factor Converts RVU to payment 3rd parties choose CF Usually one CF, sometimes more 2013 Medicare CF 34.023 19 Yearly RVU & CF Change 20 Yearly RVU Change RVU data updated yearly; Up & down GPCIs may change 21 Adopt RVU Change Medicare January 1 Adopts new RVUs & GPCIs 22 Adopt RVU Change Non-Medicare Anytime Year of RVU Any year GPCI Used or not 23 Adopt RVU Change Non-Medicare 10 sets RVUs in past 5 years 24 Yearly CF Change Medicare CF changes Jan 1: budget neutrality Published Nov 1 Fed. Register 25 Yearly CF Change Non-Medicare Pick their CF: market forces Often higher than Medicare Occurs anytime 26 Examples RVU x CF = Payment 27 Examples 92004 Medicare 2013 4.45 x 34.023 = $151.40 28 Examples 92015 Medicare 2013 0.58 x 34.023 = $19.73 29 Examples 65600 Medicare 2013 12.07 x 34.023 = $410.66 30 Examples 92950 Medicare 2013 9.05 x 34.023 = $307.91 31 Understanding RBRVS What is RBRVS RBRVS to Discover & Set Fees RBRVS to Choose Code 32 Set Medical Fees Obtain pay schedule, all contracted plans Or calculate with RVU x CF = Payment Identify highest payer Set office fees above highest plan RVU x CF = Office Fee 33 Set Medical Fees Choose your CF Twice-yearly re-assess Fees accurate, reasonable Not good when insurance pays your charge 34 Set Medical Fees Medical fees already determined Insurance defines value 35 Set Routine Fees Market-driven Routine service unrelated to Medical Routine fees unrelated to Medical RBRVS unrelated 36 Control Accounts Receivable GOAL Collect all patient portion on day of service 37 Control Accounts Receivable 3 Parts A. Prepare Payment Schedules B. Verify Insurance C. Day of Service – Collect Patient Portion 38 Control Accounts Receivable A. Prepare Payment Schedules Spreadsheet, common codes (40) Columns 1st – U&C 2nd – Insurance Maximum Allowed 3rd – Write Off 4th - Insurance Due 5th - Patient Due (spreadsheet example) 39 Control Accounts Receivable file://localhost/Users/alanhomestead/Docu ments/My Documents B 3-813/Adventures 11-3-12/1 AccuFee/2013/AccuFee 2013 Files XLSX/1 AccuFee 2013 15.4.xlsx 40 Control Accounts Receivable A. Prepare Payment Schedules One spreadsheet per insurance (8 - 10) If more than one plan, One spreadsheet per plan (1 – 2) 41 Control Accounts Receivable B. Verify insurance Before patient arrival Beginning of month, employer paid premium? Ask Deductible, Co-Pay, Co-Insurance % 42 Control Accounts Receivable B. Verify insurance Co-Pay, Co-Insurance may vary with office call surgery test specialty 43 Control Accounts Receivable B. Verify insurance Deductible Amount Amount not met 44 Control Accounts Receivable B. Verify insurance Medicare – application allowing access to Medicare claim and eligibility information. Deductible balance If Medicare Advantage (can see pending claims) 45 Control Accounts Receivable B. Verify insurance Medicare, claim & eligibility information Noridian – Endeavor: online (Jursdctn F-WA,OR,ID,MT,ND,SD,WY,AK,UT,AZ,CA,HI,NV) Novitas – IVR: Interactive Voice Response 855-252-8782 (Jursdctn L-DE,NJ,PA,MD,DC, Arlington & Fairfax county, city of Alexandria) Palmetto – OPS: Online Provider Services, or IVR (Jursdctn 11/M-WV,VA,NC,SC) 46 Control Accounts Receivable B. Verify insurance Medicare, claim & eligibility information CGS – CSI: (online) Claim Status Inquiry, or IVR (Jursdctn 15-OH,KY) WPS – C-SNAP: (online) CMS Secure Net Access Portal, or IVR (Jursdctn 8-IN,MI) 47 Control Accounts Receivable C. Day of Service – Collect Patient Portion Deductible – Co-Pay – found before patient arrive found on insurance card Co-Insurance - found on spreadsheet at checkout 48 Control Accounts Receivable C. Day of Service Write off un-collectable A/R very accurate 49 Control Accounts Receivable C. Day of Service Patient portion of A/R = small fraction of monthly production 50 Catch Mistakes Check daily production sheet No 2nd write off, unless explained (eliminate double write-offs) Insurance paid wrong? Office prediction wrong? 51 Weekly Meeting Short stand-up review of A/R Review Patient-Portion, 30 + 60 + 90 days How did account get on A/R 52 Results Firmly controlled A/R Few statements Refund checks Cash flow optimal 53 Understanding RBRVS What is RBRVS RBRVS to Discover & Set Fees RBRVS to Choose Code 54 Office Visit 99 or 92 How many codes? Ophthalmic – 4 EM – 10 7 New, 7 Established 55 Office Visit 99 or 92 Ophthalmic vs EM New Patient (2013) 99205 5.99 $217.89 92004 4.45 $151.40 92002 2.44 $83.02 99204 4.84 $176.49 99203 3.18 $116.77 99202 2.19 $80.85 99201 1.29 $47.91 56 Office Visit 99 or 92 Ophthalmic vs EM Established Patient (2013) 99215 4.2 $153.68 92014 3.71 $126.23 92012 2.57 $87.44 99214 3.14 $115.25 99213 2.14 $78.74 99212 1.29 $47.91 99211 0.6 $22.54 57 Office Visit 99 or 92 MEDICARE New Est 99205 99215 99204 92014 92004 99214 99203 92012 92002 99213 99202 99212 99201 99211 58 Office Visit 99 or 92 Choose office visit: The one that pays the most 59 Office Visit 99 or 92 Choose office visit: Note: 92012 > 92002 ! 60 Office Visit Billed Level 5? 61 99 Codes file://localhost/Users/alanhomestead/Docu ments/My Documents B 3-813/Adventures 11-3-12/O S/Presentations/Repository of My PowerPoints/1 Topic Modules/99/99 Aug 13.ppt 62