2015 Open Enrollment Presentation

advertisement

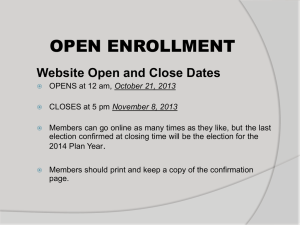

Cobb County School District 2015 BENEFITS OPEN ENROLLMENT REVIEW 1 ShawHankins Service Center- can answer questions on all benefits, including state health Available extended hours 8:30 am – 7:00 pm during open enrollment Oct 27 – Nov 14 877-373-0730 Benefit website- shawhankinsbenefits.net/ccsd 2 SHBP Changes for 2015-Carrier Options 3 carriers to choose from: BCBS of GA, United Healthcare, & Kaiser Permanente. BCBS of Georgia: 3 levels of HRA- Gold, Silver & Bronze and statewide HMO United Healthcare: High Deductible Health Plan (HDHP) and statewide HMO Kaiser Permanente: Regional HMO available to members who work or live in the 27 metro Atlanta counties. 3 SHBP Changes for 2015- Plan Highlights Health Reimbursement Arrangement (HRA) Copays will no longer apply to medical and pharmacy expenses. All services will be subject to the plan deductible and/or co-insurance. Health Maintenance Organization (HMO) Members now have the choice of enrolling in statewide or regional HMO plan that offers co-payments for certain services High Deductible Health Plan (HDHP) Members now have the option of enrolling in an HDHP. With an HDHP you are also eligible to start a Health Savings Account (HSA) to set aside pre-tax dollars for medical expenses. Out of Pocket Maximums The medical and pharmacy out of pocket maximums will now be combined Co-payments count toward the out of pocket maximums for the HMO plans 4 How the HRA Plans Works Bronze, Silver and Gold options with different levels of coverage All services are subject to the plan deductible and/or coinsurance, no copays apply for 2015 SHBP contributes HRA credits to your HRA account based on the plan option and tier of coverage you choose These credits provide first dollar coverage for medical and pharmacy expenses HRA credits left at the end of the year will roll over to the next plan year, if you remain enrolled in an HRA option If you enroll in an HMO or HDHP plan, you will forfeit any remaining 2014 credits 5 HRA Plan Features Preventive services covered at 100% After you meet your annual deductible, you pay a percentage of the cost, called co-insurance You are not required to obtain referrals from a PCP to see a Specialist The credits in your HRA account are used to help meet your deductible and out of pocket max The medical and pharmacy out of pocket maximum are combined Certain drug costs are waived if you participate in one of the DM programs- diabetes, asthma, or coronary artery disease 6 7 8 How the HDHP Works Low monthly premium Must satisfy high deductible ($3,500 individual, $7,000 family) for all medical and pharmacy expenses (except preventive care) If you have more than single coverage, the entire family deductible ($7,000) must be met before benefits are payable for any family member Eligible to establish a Health Savings Account (HSA) to set aside tax-free dollars to pay for eligible health care expenses. 9 HDHP Plan Features Preventive services covered at 100% You pay co-insurance (70% in-network, 50% out of network) after you meet the plan deductible for all medical and pharmacy expenses, until you meet the out of pocket maximum ($6,450/$12,900) Medical and pharmacy out of pocket maximums are combined No co-pays apply Eligible to contribute to Health Savings Account Contributions will not be taken through payroll deductions 10 11 12 How the Statewide HMO Works Available through BCBS or UHC Rates differ between the 2 carriers Receive covered services through in-network providers only (except emergency care) Be sure to confirm your providers are participating in the BCBS or UHC network Co-payments apply to certain services- office visits, urgent care, emergency room and prescriptions Co-payments count toward your out of pocket maximum, but not deductible Preventive services covered at 100% 13 14 15 How the Regional HMO Works Services only available through Kaiser HMO network Must select a PCP Preventive services covered at 100% Plan available for members that live or work in one of the 27 metro Atlanta counties: Barrow Coweta Gwinnett Paulding Bartow Dawson Haralson Pickens Butts DeKalb Heard Pike Carroll Douglas Henry Rockdale Cherokee Fayette Lamar Spalding Clayton Forsyth Meriwether Walton Cobb Fulton Newton 16 17 18 Wellness Healthways will continue as the Wellness vendor for the BCBS and UHC plan options with well-being resources and incentive programs All health actions must be completed between January 15, 2015 and December 15, 2015 to earn well-being incentive credits If you choose one of the HRA plans, the well-being credits will be deposited into your HRA account If you choose a statewide HMO, well-being credits will be placed into incentive accounts If you choose the HDHP plan, well being credits will be placed into an incentive account You must pay $1,300 toward your individual deductible or $2,600 toward family deductible prior to accessing these credits 19 Earning Wellness Credits 20 Wellness-Kaiser Permanente Resources Available Total Health Assessment Biometric screenings Online and onsite healthy living classes Sign up at my.kp.org/shbp and complete at least one health action to be entered in monthly drawing for an iPad and a Fit Bit: Completed biometric screening Completed online Total Health Assessment Get support to meet goals with KP wellness coach Complete one online health education class Get your annual flu shot Received a preventive Cancer Screening- Colorectal Cancer, Breast Cancer or Cervical Cancer 21 Tobacco Cessation Tobacco surcharges are included in all SHBP options Surcharge applies if you are not tobacco-free or do not complete tobacco cessation coaching program If you do not make an indication for 2015 on your tobacco usage, you will continue to be assessed the surcharge. 22 State Health Open Enrollment Open enrollment is from October 27th – November 14th myshbpga.adp.com If you do not login to enroll or make changes, you will be defaulted to your current HRA plan (without copays), coverage tier and tobacco status. If you are not currently covered and do not enroll, you will continue with no coverage. 23 State Health Open Enrollment •When making your benefit election make sure you have selected the correct option. •Verify your coverage tier (you only, you + spouse, you + child(ren) or you + family) •Confirm you have added all eligible dependents you wish to be included under your coverage. •Confirm you have answered the tobacco question correctly. •Review/Confirm your elections and click “Finish”. NOTE: If Finish is NOT clicked, your enrollment process has not been completed. •Print or save a copy of your confirmation page for your records. 24 Ancillary Benefits 25 Dental MetLife will be the dental carrier for 2015 Expansive national network, superior service All members will receive a new ID card Continue to have a Base and Plus plan option Review benefit details, as base plan copay schedule differs from 2014 26 Benefit Summary Plan Option 1- Base Plan (Copay Plan) Plan Option 2 – Plus Plan Coverage Type In-Network Out-of-Network In-Network Out-of-Network Type A – Diagnostics & Preventative See Schedule 85% of R&C Fee 100% 100% Type B – Basic See Schedule 50% of R&C Fee Type C – Major See Schedule 40% of R&C Fee Type D – Orthodontia 50% of Maximum Allowed Charge 50% of R&C Fee Deductible† In-Network Out-of-Network In-Network Out-of-Network 75% After Plan Deductible 50% After Plan Deductible 40% After Plan Deductible 75% of R&C Fee 50% of R&C Fee 40% of R&C Fee Individual N/A $50.00 $50.00 $50.00 Family N/A $150.00 $150.00 $150.00 Annual Maximum Benefit: In-Network Out-of-Network In-Network Out-of-Network Per Person $750 of Combined In-Network Covered Dental Expenses and Outof-Network Covered Dental Expenses $500 of Combined InNetwork Covered Dental Expenses and Out-of-Network Covered Dental Expenses $1,000 $1,000 Orthodontia Lifetime Maximum In-Network Out-of-Network In-Network Out-of-Network Per Person $750 $500 $1,000 1,000 27 Vision Avesis will continue as the vision carrier for 2015 Basic and Preferred Plus Option No change in plan coverage or rates 28 29 Basic Life with AD&D CCSD provides basic life coverage at no cost to you This includes a life and accidental death and dismemberment benefit Non-tobacco users receive a $13,000 benefit Tobacco users receive a $10,000 benefit Life benefit is portable, AD&D benefit is not portable 30 Contributory Basic Life with AD&D Additional term life and AD&D coverage available to purchase 2.5 times your salary $113,000 maximum Guaranteed issue for new hires. Late entrants must complete the Personal Health Application and be approved for coverage 31 Supplemental Life with AD&D Eligible to elect if you purchase the Contributory Basic Life coverage 1 times your annual salary Maximum 6 times your annual salary, to $500,000 $500,000 maximum is no longer combined with other life policies New hires guaranteed up to 2 times your salary or $100,000 without answering health questions Late entrants must complete the Personal Health Application for all amounts of coverage 32 Supplemental Life- Dependents Spouse or Dependent Children $10,000 or $25,000 in coverage 33 Short Term Disability No changes to STD benefit Choice between 2 salary replacement percentage levels- 50% or 66.67% Choose your start date for benefits, based on how many days of sick leave you have All sick leave must be exhausted prior to STD benefits beginning Late entrants or employees that wish to increase their level of coverage must submit a Personal Health Application and be approved before coverage is effective 34 STD Plan Options Benefits Start Date (from the date of Disability) Benefit Percentage Monthly Premium 1 8th calendar day 66.67% $13.53 2 15th calendar day 66.67% $11.21 3 31st calendar day 66.67% $7.35 4 61st calendar day 66.67% $7.16 5 8th calendar day 50% $9.89 6 15th calendar day 50% $8.19 7 31st calendar day 50% $5.37 8 61st calendar day 50% $5.22 35 Long Term Disability Cost paid fully by CCSD Benefit begins after you are disabled for 6 months Pays 50% of your gross monthly earnings up to a maximum of $7,500 a month 36 Flexible Spending Accounts Two separate accounts- Medical Spending Account and Dependent Care Spending Account Allows you to set aside pre-tax dollars to spend on qualified expenses, saving on your taxable income Must make new elections for 2015 If enrolling in the HDHP medical plan, you are not eligible to contribute to FSA 37 Flexible Spending Accounts Medical Spending Account Maximum contribution of $2,500 Some eligible expenses- Deductibles, copayments, dental expense, vision services and materials Dependent Care Spending Account $5,000 for married couple filing joint income tax returns, $2,500 if unmarried or married and filing separate income taxes Some eligible expenses- any care of a dependent that allows you and your spouse to work: day care, after school program, in-home care, camps New! You may rollover up to $500 left at the end of the 2014 plan year to use in 2015 for your Medical Spending Account 38 Cancer Coverage Pays a cash benefit directly to you if diagnosed with Cancer or 29 additional specified disease Coverage available for you and your family Pays based on the type of services received: inpatient care, surgery, medication 3 levels of benefits available- Economy, Standard, Deluxe Convertible to individual policy Waiver of premium after 90 days of disability 39 Critical Illness Coverage Pays a lump sum benefit to you at the time of diagnosis of a covered illness. Employee benefit: $10,000 Spouse and child benefit: $5,000 Children covered at no extra charge Some covered illnesses: Heart Attack, Stoke, Coronary Artery Bypass, Major Organ Transplant, End Stage Renal Failure Wellness Benefit: Pays you $50 benefit when you have a annual preventive screening: Ex) colonoscopy, EKG, Stress Test, Mammogram, Skin Cancer Biopsy 40 Legal Coverage In-Office Attorney Services: reviewing and preparing documents, providing legal advice and consultation, representation in court Telephonic Advice: assistance in reviewing and preparing documents, will preparation, financial education and counseling Online Resources: Guidebooks and videos, DIY Docs- state specific legal documents, online financial tools New for 2015! Identify Theft Protect- No additional cost Covers up to $1 million for expenses associated with restoring your identity Lost wallet services- cancel and reissue credit cards, driver’s license, etc Credit monitoring- monitors and informs members of changes to credit report Internet surveillance- monitors websites for your personal information being traded or sold Child monitoring- monitors your minor’s identity 41 Questions? 42