Global Trends – Underwriting &

Claims

LADUCA Wellington

3 April 2013

Chris Healey

Michael Renny

Head of Life and Health Claims

Head of Life and Health Underwriting

Agenda

Then and now

Global Trends

Best Practice

2

The Swiss Re Team

Western Europe: Zurich,

Amsterdam, Milan, Rome,

Paris, Madrid & Tel Aviv

Northern/Eastern Europe:

Munich, Warsaw, Moscow

& Copenhagen

Asia:

Hong Kong,

Beijing, Tokyo,

Seoul,

Singapore,

Sydney, Mumbai

& Bangalore

The Americas:

Armonk, Toronto,

Fort Wayne,

Mexico City &

Bogota

The UK/South Africa:

London, Cape Town

3

Mortality

Critical Illness

Disability

Insurance

Medical

insurance

LTC

Insurance products

4

Then and Now

5

Underwriting and Claims

THEN

NOW

Adviser Relationships

End Customer

SLAs weeks/months

SLAs hours/days

Back Office

Market Differentiation

Back Logs

Segmentation and

Portfolio Management

Medical Approach

Alt Underwriting &

Durations Management

6

Global Trends

7

Cause

Effect

Ageing Population

• Demographics, Mortality & Morbidity

• Product Design

• Underwriting & Claims Approach

Environment and Economy

• Consumer Behaviours & Expectations

• Changing Employment & Personal

Finance Practices

• Age of technology

• Regulatory Challenges

Product Trends

• Critical Illness

8

Cause

Effect

Ageing Population

• Demographics, Mortality & Morbidity

• Product Design

• Underwriting & Claims Approach

Environment and Economy

• Consumer Behaviours & Expectations

• Changing Employment & Personal

Finance Practices

• Age of Technology

• Regulatory Challenges

Product Trends

• Critical Illness

9

Changing Environment:

Elderly Population Growth Globally

# of people

Age 65 or older

Millions

# of people

1200

80

12

%

1000

800

600

400

8

%

10

%

Millions

%

25

20

60

15

10

0

20

0

195

0

197

5

200

0

200

201

5

0

Note : % share over total population

201

5

202

0

202

5

203

0

1950 1975 2000 2005

Source: U.S. Census Bureau

65-74

2010

2015

75-84

Age 65 or older

Millions

40

26%

35

28%

29%

30%

2020

2025

2030

23%

30

25

18%

20

%

2000

2005

20

15

10

5

0

5%

1950

Share of total

population

40

6

%

5

%

200

0

7

%

7

%

8

%

9

%

Age 65 or older

8

%

1975

2010

2015

Note : % share over total population

10

2020

2025

85+

2030

Trends in chronic disease burden

Trends in the prevalence of chronic disease over time

0%

5%

10%

15%

20%

25%

30%

45-64

Cancer

Diabetes

Emphysema

Coronary heart disease

Stroke

1987

1997

2005

Cancer

65-74

Diabetes

Emphysema

Coronary heart disease

Stroke

Cancer

75+

Diabetes

Emphysema

Coronary heart disease

Stroke

National Health Interview Survey

# of

Chronic disease prevalence

by age group

chronic

conditions 65-69 70-74 75-79

0

25.7%

18.9%

15.2%

1

20.4%

18.0%

16.0%

2

22.2%

22.5%

21.6%

3

16.0%

18.7%

19.9%

4+

15.7%

21.9%

27.3%

So What?

This impacts on:

• Demographics, Mortality and Morbidity Experience

• Product Design (Longevity products)

• Underwriting and Claims Approach

12

Cause

Effect

Ageing Population

• Demographics, Mortality & Morbidity

• Product Design

• Underwriting & Claims Approach

Environment and Economy

• Consumer Behaviours & Expectations

• Changing Employment & Personal

Finance Practices

• Age of Technology

• Regulatory Challenges

Product Trends

• Critical Illness

13

Consumer Behaviours & Expectations

• Service expectations

• Focus on personal information and privacy

• Access to insurance

14

Employment Practices

• Unemployment rates

• Self-employment and contracting

• Increasing global wealth

Suicide D eaths Am ong M en

(Individual Line of Business)

45%

Percent of SR Amount

40%

35%

30%

25%

20%

15%

10%

5%

0%

Ages 1 5 - 1 9

Ages 2 0 - 2 9

Ages 3 0 - 3 9

Ages 4 0 - 4 9

2007

2008

15

Ages 5 0 - 5 9

2009

Ages 6 0 - 6 9

ages 7 0 +

Age of Technology

•

Tele-claims to SMS

•

Rules based engines…the new STP

•

Face to Face with a difference

•

Touching all aspects of claims – treatment options & tele-consult

16

The impact of technology – Speed of

decision

Percentage of cases with final decision offered

Source: Swiss Re

Underwriting Watch 2011

17

Proportion of cases taken up

Source: Swiss Re

Underwriting Watch 2011

18

Straight through system processing

70.00%

60.00%

50.00%

40.00%

30.00%

20.00%

10.00%

0.00%

21-30% 31-40% 41-50% 51-60% 61-70% 71-80% 81-90% 91-100%

-10.00%

Life 2007/2008

CI 2007/2008

Life 2010

CI 2010

19

Changes in STP

20

Age of Technology

•

Internet

•

Mobile Devices & Distribution

•

Social Media

21

Insurance & Internet

Holland's

biggest online

comparison

website

(Independer)

has been

bought by

Holland's

biggest

insurer Eureko

22

Insurance & Internet

New

Australian

online

insurance

platform to

help people

better

understand

risk and

appreciate

insurance in

their lives

23

Insurance & mobile devices

Access anywhere

Protection quote application for mobile devices.

Supports URE's

Alternative distribution

24

Insurance & Social Media

Liberty

Mutual (US)

has launched

a campaign

on its

Facebook

page where it

will donate

$5 to a breast

cancer charity

for every life

insurance

quote.

25

Insurance & Social Media

More and more insurance companies are using Social Media sites to

detect insurance fraud. Consumer organisations and lawyers have

argued that scouring social networking sites to find evidence of

insurance fraud, is an invasion of privacy. But insurance companies

and their attorneys argue that they only use public available

information on social media profiles and do not invade any privacy.

26

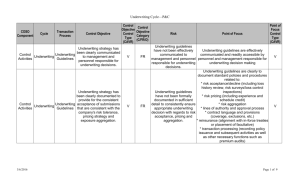

Regulatory challenges

Started with HIV and genetics

Spilled over to family history

– tests regarded as having a genetic component

Challenges pre-dominantly from Europe but is spreading:

– EU directives on gender, age and disability

– EU access to electronic health records

– UK: Treating Customers Fairly (TCF)

– Singapore: mental illness

– US: travel ratings

– Globally: push for non-contestability clauses

27

Regulatory challenges:

The three issues

Discrimination

Insurers may be unable to

rate on the basis of

discrimination in the

areas of race, gender,

sexual orientation, age,

health, genetic make-up

and travel, or may be

required to justify any

ratings they apply

The key test may be one

of proportionality

Consumer Needs

Insurers may be unable

to make certain types of

enquiry into confidential

information from

applicants

They may also face rules

around the way such

information is stored or

to whom information

may be passed

Entitlement

There may be the view

that access to insurance

is a basic human right for

all citizens to enjoy

28

Germans ethics council:

The right not to know

“It should not be permissible, for the purposes of an insurer’s risk assessment, to

require medical examinations and tests directed towards the identification of risks

unknown to the proposer himself. These constitute a disproportionate encroachment

on the proposer’s personal rights; in particular, they call into question his right to

ignorance”

“Forcing such knowledge on a proposer is distressing, particularly if disorders that are

neither avoidable nor treatable are diagnosed or predicted. Such knowledge may

adversely affect the self-conception of the individual concerned, his future behaviour

and possibly the planning of the entire course of his life”

German National Ethics Council, 2008

29

The ECJ ruling on gender:

A sexless future?

Can we still ask gender questions in underwriting?

Can we differentiate medical tests by gender?

Can we rate based on different lab reference ranges?

How do we approach

– gender specific diseases

– family history

– diseases with greater prevalence in one gender

30

Underwriting:

Born 18th century; died 2011

Cause of Death: Fatal blow from a Gender Directive

Identification of the assailant: Believed to be unisex

31

Cause

Effect

Ageing Population

• Demographics, Mortality & Morbidity

• Product Design

• Underwriting & Claims Approach

Environment and Economy

• Consumer Behaviours & Expectations

• Changing Employment & Personal

Finance Practices

• Motivation for Fraud

• Regulatory Challenges

Product Trends

• Critical Illness

32

Critical Illness Cover

Limited to 6 key Illnesses.

Benefits / Cover restricted to actual costs.

Insurance

view

Clients

view

Good Marketing

Good overlap

Focus on Life style changes or financial impact.

Not a sickness or medical benefit.

Key man critical illness cover was launched in the

late 1980s.

33

But…

34

And now…

Changing purpose…

Medical advances

General information

Media

Public perception

Legal framework

Environment

State-provided medical services

Partial payments

Lifestyle cover?

Lottery?

Insurance

view

Swiss Re & China Pacific Life Insurance

Decrease of overlap

Co. Ltd – Partnership

Client

view

Increased risk of litigation

Diagnosis VS. the required medical

treatment. Protection according to

treatment needs.

35

Definitions

Melanoma

Past definition – "We will pay for a Malignant melanoma which is Clark

Level 3 or 1.5 mm Breslow thickness".

Present definition – "We will pay for a Malignant melanoma which is

ulcerated, or at least a Clark Level 3 or 1.5 mm in depth invasion". Partial

payment for less than this criteria.

Heart attack

Past definition – "or a rise of Troponin I above 2.0ng/ml or Troponin T

above 0.6 ng/ml".

Present definition – "or typical rise and/or fall of cardiac biomarkers". No

reference to Troponin levels.

36

Best Practice

37

What are the best companies doing?

Thought

leadership and

strategic

decision

makers

People

capability,

recruitment

and retention

focus

Overcoming (or

don’t have)

legacy issues

Building a culture of

continuous

improvement

Balancing

customer

service

delivery with

risk

management

Application of

technology

38

Thank you

Legal notice

©2013 Swiss Re. All rights reserved. You are not permitted to create any

modifications or derivatives of this presentation or to use it for commercial

or other public purposes without the prior written permission of Swiss Re.

Although all the information used was taken from reliable sources, Swiss Re

does not accept any responsibility for the accuracy or comprehensiveness of

the details given. All liability for the accuracy and completeness thereof or

for any damage resulting from the use of the information contained in this

presentation is expressly excluded. Under no circumstances shall Swiss Re

or its Group companies be liable for any financial and/or consequential loss

relating to this presentation.

40