High Tech Processing

advertisement

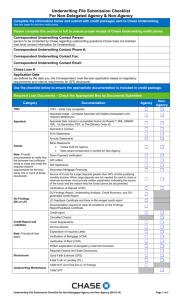

High Tech Processing: From Application to Policy Issue Presented by Keith Hoeffner February 16, 2011 Agenda High Tech Processing – present challenges Electronification of application fulfillment Wide Open Possibilities Available Now What’s next? Process Challenges Obtaining a complete and legible application Part 1 Part 2 Cycle Time Paramedical exam and lab EKG scan APS Piece meal delivery Discretionary requirements 30+ days Legal and compliance adoption of process improvements Life Insurance Application Process Don’t Be Trapped In A Paradigm Wide Open Possibilities Straight through processing Plus data mining Real-time transactions Workflow improvements Predictive modeling Straight Through Processing Pre-App E-Sign Application UW Requirements Ordered Drop Ticket Exam Scheduled Data, Results Delivered Part 1 Interview Part 2 Interview Policy Underwritten (multiple carriers) End-to-End Life Insurance Application Workflow Reduces Cycle Time by 14+ Days What do we do with the data? Automated underwriting Import application data directly into underwriting system – eliminate data entry Workflow tools and business rules order medical requirements Rules based decisions Routing of more complex cases to the right underwriter at the right time Paving the Cow Path Nothing wrong with paving the cow path when the cow path indicates a desire line that leads to process efficiency. Until you are ready for the super highway How Do You Make a Difference? Stage 1 Integrate external data into straight through process Prescription history MIB MVR Eliminate contradictions Take an underwriting file from IGO to IRGO In REALLY Good Order How? The Advent of Real-Time Transactions Real-time transactions are made possible through Web Services – a method of communication between two electronic devices over the web Web services describes a standardized way of integrating Web-based applications using − UDDI to list the services − WSDL to describe the services − SOAP to transfer the data over the Internet − XML to tag the data Real-Time Transactions Web services Used primarily as a means for businesses to communicate with each other and with clients Web services allow organizations to communicate data without intimate knowledge of each other's IT systems behind the firewall Web services allow different applications from different sources to communicate with each other without timeconsuming custom coding Because all communication is in XML, Web services are not tied to any one operating system or programming language Real-Time Transactions Web services (continued) Java can talk with Perl, Windows applications can talk with UNIX applications, etc. Web services do not require the use of browsers or HTML Web services are sometimes called application services How Do You Make More of a Difference? Stage 2 Process improvements Expand the data set − New field technology to capture more data • Digital ECG’s • Laptop Improve workflow − Real-time exam scheduling − Voice signatures and e-signatures − Laptop and call center integration How Do You Really Make a Difference? Stage 3 Predictive modeling – the next step beyond automated underwriting What is predictive modeling? Predictive modeling is the process by which a model is created or chosen to try to best predict the probability of an outcome In many cases the model is chosen on the basis of detection theory to try to guess the probability of an outcome given a set amount of input data Discerning between information bearing data and noise Look very closely at the next animated slide… Which way was the woman whirling? How To Take It To The Next Level MIB, prescription history, MVR Relevant lifestyle data Exercise Diet Demographic: population density, medical care index Personal: gender, age, occupation, education, marital status Finances: assets, income, credit history How do you mine this data? Consumer Data – Grocery Loyalty Card Age and gender Tobacco use Alcohol use Occupation Neighborhood Hobbies and interests ATM use (noise or informational data) Brands (or noise or more informational data) What Do You Do With It? Correlations? Cause and effect? Sea temperatures and hurricane frequency Education and earnings Height and weight Marital status and mortality Type of neighborhood and longevity Lifestyle and mortality Predictive Underwriting – Paul Hately, Swiss Re Predictive Underwriting – Paul Hately, Swiss Re Maybe I’m just not smart enough to figure all this out. Are you? Olny srmat poelpe can raed this. I cdnuolt blveiee that I cluod aulaclty uesdnatnrd what I was rdanieg. The phaonmneal pweor of the hmuan mnid, aoccdrnig to a rscheearch at Cmabrigde Uinervtisy, it deosn't mttaer in what oredr the ltteers in a word are, the olny iprmoatnt tihng is that the first and last ltteer be in the rghit pclae. The rset can be a taotl mses and you can still raed it wouthit a porbelm. This is bcuseae the huamn mnid deos not raed ervey lteter by istlef, but the word as a wlohe. Amzanig huh? yaeh and I awlyas tghuhot slpeling was ipmorantt! if you can raed this psas it on!! Current Predictive Modeling Activity BioSignia – Mortality Assessment Technology (MAT) ExamOne RiskIQ CRL – SmartScore Heritage Labs – Risk Score Challenges of Predictive Underwriting Data may be predictive but also meet public acceptance thresholds and legal requirements Anti-selection by agents Reinsurance attitudes Pricing – risk classification comparisons to traditional underwriting Benefits of Predictive Underwriting Improved underwriting efficiency…and much, much more Consumer, demographic, personal and financial data less expensive and more readily available than traditional underwriting tests Smarter APS ordering Fast – decisions in minutes or hours vs. weeks or months Cheap – data is cheap, knowing how to use it may be another story Premium growth – increased sales Reduced process time increases placement ratios Attract new producers Target marketing – consumer data Conclusion Evolution not revolution Continue to make incremental process improvements within the parameters of your organization Be cautious to avoid anti-selection pitfalls Continue to stay tuned into advancements by reinsurers RGA Re Swiss Re The End! Additional reference: Predictive Modeling Comes to Life by Bary T. Ciardiello, David W. McLeroy