as-16 - Safe eCollege

advertisement

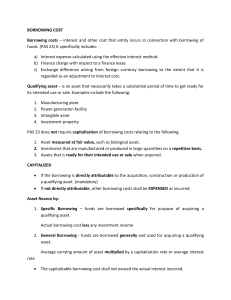

Borrowing COST AS - 16 www.SafeEcollege.com 1 1. This AS is mandatory in nature and applicable to all entities. 2. Borrowing Cost include the Following : i. ii. iii. iv. v. Interest and Commitment Charges. Amortization of Discount on Debentures. Amortization of Expenses to raise Finance. Finance Charges in case of Lease. Exchange Difference to the extent of difference between : [ Cost of local borrowing – Cost of International Borrowing] www.SafeEcollege.com 2 3. Borrowing Cost will be treated as follows : • On Qualifying asset will be transferred to cost of Qualifying asset. • On Non Qualifying asset will be transferred to P & L. Note : Borrowing Cost Capitalized can not exceed Actual Borrowing Cost. www.SafeEcollege.com 3 4. Qualifying Asset These are those assets which are being Constructed, Renovated, Installed and take Substantial Period for becoming ready to use. Note : Period of 12 month or more is considered substantial. ( For Exam purpose period is not considered) www.SafeEcollege.com 4 5. How to calculate amount to be Capitalized Step 1: Identify Qualifying Asset. Step 2: Identify Borrowing Cost. Step 3: Calculate Capitalization Rate : Borrowings Specific General (Debenture) www.SafeEcollege.com 5 Step 3: Calculate Capitalization Rate : If Borrowings are Specific : BC - Earning from idle funds = x 100 Borrowing Funds If Borrowing are General ( Debenture) : BC = x 100 Borrowing Fund www.SafeEcollege.com 6 Step 4 : Calculation of Expenditure on Qualifying Asset. Expenditure with Capitalized BC (Op. Cost) Add: Cash Expenses Add: Assets Consumed Less: Progress Payments or Subsidy Expenditure www.SafeEcollege.com 7 Step 5 : Calculate Period of Capitalization. Commencement of Capitalization in Considered, when all of following conditions are satisfied. a) b) c) Expenditure on QA is being incurred. Active development is taking place. Borrowing Cost is being incurred. Suspension of Capitalization : Whenever active development is interrupted due to abnormal reasons, than capitalization is suspended for that period. www.SafeEcollege.com 8 Cessation of Capitalisation: If any of the following condition is satisfied, than Capitalisation ceases. Borrowing Cost is not being incurred. OR Asset is ready for use wholly or Partially www.SafeEcollege.com 9 6. Disclosure Requirement 1. Borrowing Cost Capitalised should be Disclosed 2. Capitalization Policy should be disclosed. www.SafeEcollege.com 10