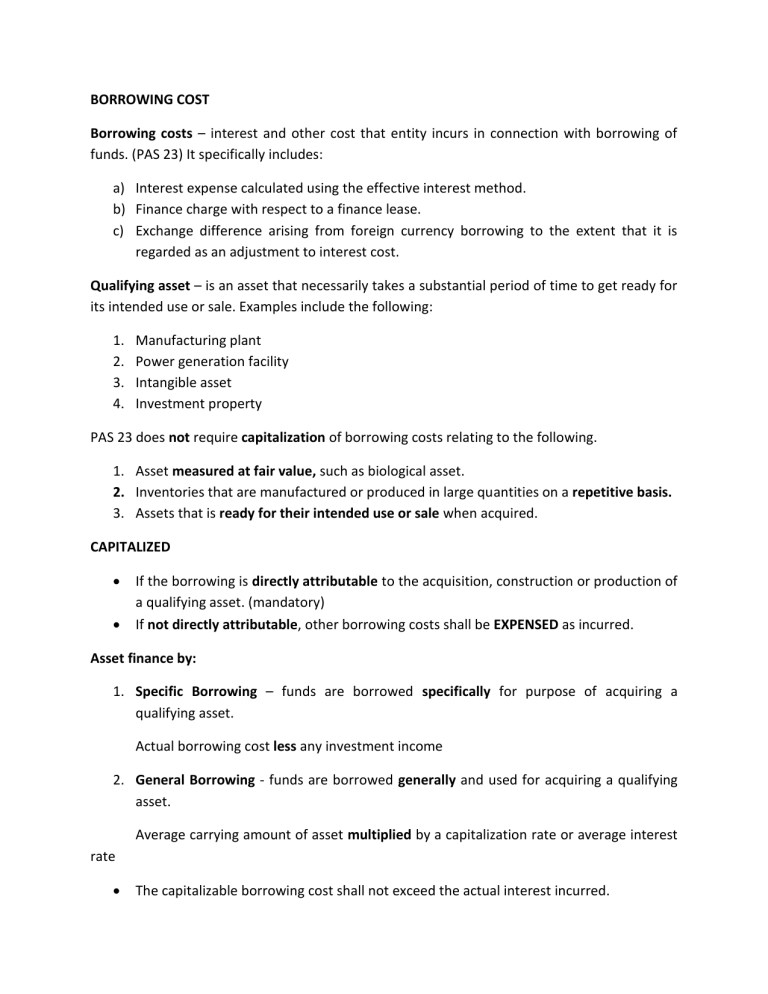

BORROWING COST Borrowing costs – interest and other cost that entity incurs in connection with borrowing of funds. (PAS 23) It specifically includes: a) Interest expense calculated using the effective interest method. b) Finance charge with respect to a finance lease. c) Exchange difference arising from foreign currency borrowing to the extent that it is regarded as an adjustment to interest cost. Qualifying asset – is an asset that necessarily takes a substantial period of time to get ready for its intended use or sale. Examples include the following: 1. 2. 3. 4. Manufacturing plant Power generation facility Intangible asset Investment property PAS 23 does not require capitalization of borrowing costs relating to the following. 1. Asset measured at fair value, such as biological asset. 2. Inventories that are manufactured or produced in large quantities on a repetitive basis. 3. Assets that is ready for their intended use or sale when acquired. CAPITALIZED If the borrowing is directly attributable to the acquisition, construction or production of a qualifying asset. (mandatory) If not directly attributable, other borrowing costs shall be EXPENSED as incurred. Asset finance by: 1. Specific Borrowing – funds are borrowed specifically for purpose of acquiring a qualifying asset. Actual borrowing cost less any investment income 2. General Borrowing - funds are borrowed generally and used for acquiring a qualifying asset. Average carrying amount of asset multiplied by a capitalization rate or average interest rate The capitalizable borrowing cost shall not exceed the actual interest incurred. Capitalization Rate = Total Annual Borrowing Cost/Total General Borrowing If asset is financed by specific borrowing but a portion is used for working capital purposes, the borrowing shall be treated as a general borrowing Commencement of capitalization The capitalization of borrowing costs as part of cost of a qualifying asset shall commence when the following three conditions are present: a) Entity incurs expenditure for the asset b) Entity incurs borrowing cost c) Entity undertakes activities that are necessary to prepare the asset for the intended use or sale. Suspension of Capitalization During extended periods in which active development is interrupted. Not suspended during a period when substantial technical and administrative work is being carried out. Not suspended temporary delay is a necessary part of the process of getting an asset ready for its intended use or sale. Cessation of Capitalization Shall cease when substantially all acivities necessary to prepare the qualifying asset for the intended use or sale are complete. (when physical construction of the asset is complete. Disclosures related to borrowing costs a. Amount of borrowing costs capitalized during the period. b. Capitalization rate used to determine the amount of borrowing costs eligible for capitalization. Reference: Intermediate Accounting Volume 1 (2020 edition) by Conrado T. Valix, Jose F. Peralta and Christian Aris M. Valix