20.4 Reducing Balance Loans

advertisement

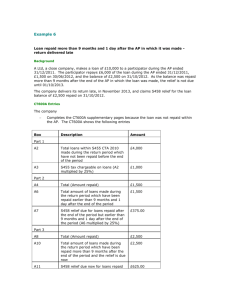

20.4 Reducing Balance Loans A reducing balance loan is a loan that attracts compound interest, but where regular payments are also made. In most instances, the amount of the loan and interest are repaid in full. Reducing balance loans Example: A loan of $12,000 is to be repaid in instalments of $2700 per year with an interest rate of 16% per annum being charged on the unpaid balance at the end of each year. After four repayments, calculate: (a) The amount still owing (b) The interest charged to date Solution: P=12,000 r=16% repayments= 2700 1st year: Interest = 12000 x (1 + 16/100)1 – 12000 = 1920 Balance = (12000 + 1920) – 2700 = $11220 (a) 2nd year: Interest = 11220 x (1 + 16/100)1 – 11220 = 1795.20 Balance = 11220 + 1795.20 – 2700 = 10,315.20 etc. End of Year Interest Repayment Balance 1 1920 2,700 $11,220 2 1795.20 2,700 $10,315.20 3 1650.43 2,700 $9265.63 4 1482.50 2,700 $8048.13 (b) The interest paid to date is calculated by summing the interest column. ie. 1920 + 1795.20 + 1650.43 + 1482.50 = 6848.13 Solution: The interest charged after 4 years is $6848.13