Classifying Costs

advertisement

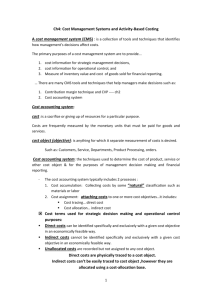

Classifying Costs (a) By Element Material Labour Expense By Traceability Direct Indirect Classification by element Material Labour The Product Expense Classification of Costs by Traceability Direct Costs Indirect Costs Costs that can Costs cannot be easily and conveniently traced to a unit of product or other cost object. Examples: Direct material Direct labor be easily and conveniently traced to a unit of product or other cost object. Example: Manufacturing overhead Direct and Indirect Costs Direct costs Indirect costs Costs that can be Costs that must be easily and conveniently traced to a product or department. Example: cost of paint in the paint department of an automobile assembly plant. allocated in order to be assigned to a product or department. Example: cost of national advertising for an airline is indirect to a particular flight. Classification by element or traceability Materials Labour Current Direct Indirect Expenses Direct Indirect Product costs = Materials+Labour+Expenses Direct Indirect Or Direct costs + Indirect costs Classifications of Costs in Manufacturing Companies Manufacturing costs are often combined as follows: Direct Material Direct Labour & Direct Expenses Prime Cost Manufacturing Overhead Conversion Cost Classifying Costs (b) By Function Product Period Manufacturing Cost Flows Costs Balance Sheet Inventories Material Purchases Raw Material Direct Labor Work in Process Manufacturing Overhead Selling and Administrative Finished Goods Period Expenses Income Statement Expenses Cost of Goods Sold Selling and Administrative Cost Classification by Function Product costs Include expenditures that are necessary and integral to finished products. Capitalized on the balance sheet until sold. Cost of Good Sold Inventory Period costs Include expenditures identified more with a time period than with finished products. Expensed on the income statement. Expense Sale Balance Sheet Income Statement Income Statement Classification of Costs by Function Product Costs Period Costs Direct materials Selling Direct labor General and Overhead administrative expenses Classifying Costs (c) By Behaviour Fixed Variable Semi-fixed Semi-variable Cost Classifications by Behaviour Cost Behaviour How a cost will react to changes in the level of business activity. Total variable costs change when the level of activity changes. Total fixed costs remain unchanged when the level of activity changes. Total Variable Cost Total Long Distance Telephone Bill A variable cost is one that changes in total in proportion to changes in the volume of activity. Your total long distance telephone bill is based on how many minutes you talk. Minutes Talked Variable Cost Per Unit On a per unit basis, a variable cost remains constant over a wide range of activity. Per Minute Telephone Charge The cost per long distance minute talked is constant. For example, 10 cents per minute. Minutes Talked Cost Behaviour Merchandisers Service Organizations Cost of Goods Sold Supplies and travel Examples of variable costs Manufacturers Direct Material, Direct Labor, and Variable Manufacturing Overhead Merchandisers and Manufacturers Sales commissions and shipping costs Total Fixed Cost A fixed cost is one that remains constant in total even when the volume of activity changes. Monthly Basic Telephone Bill Your monthly basic telephone bill probably does not change when you make more local calls. Number of Local Calls Fixed Cost Per Unit On a per unit basis, a fixed cost changes as the volume of activity changes. Monthly Basic Telephone Bill per Local Call The average cost per local call decreases as more local calls are made. Number of Local Calls Cost Behaviour Examples of fixed costs Merchandisers, manufacturers, and service organizations Real estate taxes Insurance Sales salaries Depreciation Advertising Cost Classifications for Predicting Cost Behavior Summary of Variable and Fixed Cost Behavior Cost In Total Per Unit Variable Total variable cost is proportional to the activity level within the relevant range. Variable cost per unit remains the same over wide ranges of activity. Fixed Total fixed cost remains the same even when the activity level changes within the relevant range. Fixed cost per unit goes down as activity level goes up. Fixed Costs and Relevant Range Rent Cost in Thousands of Dollars The company’s normal operating range 90 60 30 00 Relevant Range Total cost doesn’t change for a wide range of activity. It then jumps to a new higher cost for the next higher range of activity. 1,000 2,000 3,000 Rented Area (Square Feet) Fixed Costs and Semi-fixed (or Step-Wise or Step-Variable) Costs How does this type of fixed cost differ from a step-variable (or stepwise) cost? Step-variable (or step-wise) costs can be adjusted more quickly and . . . The width of the activity steps is much wider for the fixed cost. Semi-fixed Costs (or Step-Variable or Step-Wise) Cost Total cost increases to a new higher cost for the next higher range of activity. Total cost remains constant within a narrow range of activity. Activity Semivariable Cost Total Utility Cost Slope is variable cost per unit of activity. Variable Utility Charge Fixed Monthly Utility Charge Activity (Kilowatt Hours) Curvilinear Cost Total Cost Curvilinear Cost Function Relevant Range Activity A straight-Line (constant unit variable cost) closely approximates a curvilinear line within the relevant range. Relevant Information Information is relevant to a decision problem when . . . It has a bearing on the future, It differs among competing alternatives. Identifying Relevant Costs and Benefits Sunk costs Costs that have already been incurred. They do not affect any future cost and cannot be changed by any current or future action. Sunk costs are irrelevant to decisions. Relevant Costs Relevant costs are those costs and/or benefits that differ between alternatives. Costs that can be eliminated (in whole or in part) by choosing one alternative over another are avoidable costs. Avoidable costs are relevant costs. Unavoidable costs include: Sunk costs. Future costs that do not differ between the alternatives. Unavoidable costs are never relevant. Incremental Costs Add or Drop a Product S ales K eep D r op W atch W atch $ 500,000 Less var iable expenses: Mfg. expenses Fr eight out C om m issions Total var iable expenses C ontr ibution m ar gin Less fixed expenses: G ener al factor y over head S alar y of line m anager D epr eciation Adver tising - dir ect R ent - factor y space G ener al adm in. expenses Total fixed expenses N et loss $ - D iffer ence $ (500,000) 120,000 5,000 75,000 200,000 300,000 60,000 90,000 50,000 100,000 70,000 30,000 400,000 $ (100,000) 60,000 50,000 30,000 140,000 $ (140,000) 120,000 5,000 75,000 200,000 (300,000) 90,000 100,000 70,000 260,000 $ (40,000) Summary S u m m ar y C o n tr ib u tio n m ar g in lo st if d ig ital w atch es ar e d r o p p ed $ (300,000) L ess fixed co sts th at can b e avo id ed S alar y o f th e lin e m an ag er $ 90,000 Ad ver tisin g - d ir ect 100,000 R en t - facto r y sp ace N et d isad van tag e 70,000 260,000 $ (40,000) DECISION RULE Swick should drop the digital watch segment only if its fixed cost savings exceed lost contribution margin. Marginal Costs and Average Costs The extra cost incurred to produce one additional unit. The total cost to produce a quantity divided by the quantity produced. Marginal and average costs are largely a function of cost behavior -- variable and fixed costs. Costs and Benefits of Information Costs Benefits More information does not mean more benefits if information overload results.