Baroda branch, WIRC

Challenge Us

Foreign tax credit

Kalpesh Desai

Partner, BMR Advisors

November 2013

Contents

Introduction

Types of Relief

Unilateral relief

Bilateral relief

Double non-taxation

Excess foreign tax credit

Documentation

Cases where foreign tax credit not available

All rights reserved | Preliminary & Tentative

Direct Tax Code

Practical issues in foreign tax credit

Case studies

Foreign tax credit | 3

Introduction

What is Foreign Tax Credit?

Foreign tax credit (‘FTC’) – Method for elimination of double taxation

Credit for the taxes paid in the source country against the taxes to be discharged in

the residence country

Income tax systems that tax residents on worldwide income generally offer FTC to

mitigate the potential for double taxation of income

For a tax payer to be eligible for FTC, the tax payer must have

made a payment to a foreign government, and

All rights reserved | Preliminary & Tentative

the payment must be towards an income tax, or a tax in lieu of an income tax

Foreign tax credit | 5

Concept of double taxation

Jurisdictional double taxation - One and the same person is taxed on the same

income in more than one state. This may happen for one of the following reasons:

Residence in one state and source in another state

Triangular taxation

Economic Double taxation - Two separate persons are taxed on the same income

in more than one state

Foreign income taxed in the hand of overseas company distributing dividend and dividend

Taxation in source country in the hands of a partnership entity whereas in the residence

county, partners of such partnership are taxable

Foreign tax credit | 6

All rights reserved | Preliminary & Tentative

taxed in the hands of shareholder

Elimination of double taxation

Countries often provide their residents with relief from double taxation through their

domestic tax laws – Chapter IX of the Income-tax Act, 1961 (‘the Act’)

Double Taxation Avoidance Agreements (‘DTAAs’) also contain articles for the

elimination of double taxation

Relief via DTAAs may be more generous than the domestic tax laws

Relief entrenched in the DTAA also restricts a country’s ability to amend unilaterally

the double tax relief provisions in its domestic law to the detriment of tax payers

All rights reserved | Preliminary & Tentative

Residence State to provide the relief – Residence as per Article 4

Allocation of Right to Tax

Renunciation of right to tax by either state (Dependant services)

Sharing of rights (Resident state will provide Relief)

Foreign tax credit | 7

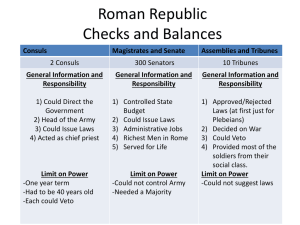

Types of Relief

Types of Relief

Under Section 91 of

the Act

Under Section 90 of the

Act

Applicable where

DTAA does not exists

Applicable where

DTAA exists

Unilateral relief

Bilateral relief

When the domestic tax system

of a state provides relief for

double taxation irrespective of

whether the other state’s tax

system provides corresponding

relief or not

All rights reserved | Preliminary & Tentative

Types of Relief

Two states negotiate an

agreement for providing

double taxation relief,

such relief is provided

through a DTAA

Foreign tax credit | 9

Unilateral relief – Illustration

Particulars

Case I

Case II

Assumptions

(INR)

(INR)

Income in India

150,000

150,000

Income in foreign country

100,000

100,000

Global income

250,000

250,000

Tax rate in India

30%

30%

Tax rate in foreign state

25%

35%

Income tax on global income

(A)

75,000

75,000

Indian tax on foreign income

(B)

30,000

30,000

Foreign tax on foreign income

(C)

25,000

35,000

Unilateral tax relief as per the Act – Lower of (B) or (C)

(D)

25,000

30,000

Tax payable in India (A) – (D)

(E)

50,000

45,000

75,000

80,000

30%

32%

Total tax outflow (B) + (E)

Effective global tax rate

Foreign tax credit | 10

All rights reserved | Preliminary & Tentative

Workings

Bilateral Relief – Methods

Methods

Exemption

Exemption with

progression

Full credit

Ordinary

Credit

Tax

sparing

Underlying

tax credit

Foreign tax credit | 11

All rights reserved | Preliminary & Tentative

Full exemption

Credit

Exemption Method

Exemption method

(1/3)

Under this method, the residence country exempts the income arising in the source

country

Income would be chargeable to tax only in the source country

Generally preferred in DTAAs between a developed country and developing country,

as the developed country would generally be exporting capital and technology to

developing country

Two variants –

Full exemption – The residence country fully exempts the income earned by its resident in

the source country. Accordingly the capital / technology exporter would not be required to

pay tax on such income which would make it attractive for the exporter to export capital/

technology to the source country (eg Article XVII of India – Greece DTAA)

Exemption with progression – The residence country exempts the source country income

but the exempt income is considered for determining the tax on the non-exempt income (eg

Article 23 of India – Austria DTAA)

Foreign tax credit | 13

All rights reserved | Preliminary & Tentative

Exemption method

(2/3)

Exemption method - concerns

Reduces the tax share of resident state

Encourages use of low-tax countries as source state

May result in Double non-taxation (explained later) where source country exempts such

All rights reserved | Preliminary & Tentative

income

Foreign tax credit | 14

Exemption method

Particulars

Assumptions

(3/3)

Full exemption

Exemption with

progression

(INR)

(INR)

Income in State R (Residence country)

60,000

60,000

Income in State S (Source country)

40,000

40,000

100,000

100,000

Rate of tax in State R

- for income up to Rs 80,000

- for income exceeding Rs 80,000 (on entire income)

25%

35%

25%

35%

Tax rate in State S

20%

20%

Tax payable in State R

60,000*25% = 15,000

60,000*35% = 21,000^

Tax payable in State S

40,000*20% = 8,000

40,000*20% = 8,000

23,000

29,000

23%

29%

Aggregate taxable income in State R

Aggregate tax

Tax on aggregate income

^The exempt income has been included for the purpose of ascertaining the applicable rate of tax (ie 60,000 + 40,000 = 100,000).

Hence, the applicable tax rate will be 35%

Exemption with progression - Level of foreign source income is relevant

Foreign tax credit | 15

All rights reserved | Preliminary & Tentative

Workings

Credit Method

Credit method

(1/7)

Under this method, the residence country exempts the taxes paid in the source country

For the residence country, the loss of revenue is generally lower in credit method,

therefore generally most DTAAs relieve double taxation only through credit method

Non-refundable tax credit – In case the tax payable in Resident state is less than the

credit available or the relevant income is exempt in Resident state, the resident would

never get refund of the excess credit for the taxes paid in Source state

Full credit – Resident state grants credit for the taxes paid in the Source State without any restriction

Ordinary credit – Tax credit is restricted to lower of the taxes to be paid in the Resident state or the

actual taxes discharged in the Source state

Tax sparing – Income exempt in the Source state. However such income is taxable in the Resident

state for which the resident state provides for deemed tax exemption or deemed tax credit

Underlying tax credit – Mechanism to eliminate a form of ‘economic double taxation’

Foreign tax credit | 17

All rights reserved | Preliminary & Tentative

Four variants

Full credit

(2/7)

Under this method, the residence country exempts the taxes paid in the source

country

OECD Model Convention

Particulars

Case I

Case II

Amount in INR

Amount in INR

Income in State R

80,000

80,000

Income in State S

20,000

20,000

100,000

100,000

Tax rate in State R

35%

35%

Tax rate in State S

20%

40%

Assumptions

Aggregate taxable income in State R

Workings

Tax payable in State R

(A)

35,000

35,000

Tax payable in State S

(B)

4,000

8,000

Total tax credit (credit for full taxes paid) (C) = (B)

(C)

4,000

8,000

Total tax after relief – (A) – (C)

(D)

31,000

27,000

Foreign tax credit | 18

All rights reserved | Preliminary & Tentative

Article 23 of India – Namibia DTAA

Ordinary credit

(3/7)

Under this method, tax credit is restricted to lower of

The taxes to be paid in the Resident state; or

The actual taxes discharged in the Source state

Particulars

Assumptions

Case I

Case II

Amount in INR

Amount in INR

Income in State R

80,000

80,000

Income in State S

20,000

20,000

100,000

100,000

Tax rate in State R

35%

35%

Tax rate in State S

20%

40%

Aggregate taxable income in State R

Workings

Tax payable in State R

(A)

35,000

35,000

Tax payable in State S

(B)

4,000

8,000

Taxes in Resident state on income from Source state^

(C)

7,000

7,000

Total tax credit - Lower of (B) & (C)

(D)

4,000

7,000

Total tax after relief – (A) – (D)

(E)

31,000

28,000

^ 20,000 * 35 % = 7,000

Foreign tax credit | 19

All rights reserved | Preliminary & Tentative

Article 25 of India – USA DTAA

Tax sparing credit

(4/7)

Income is taxable in the Resident state but it provides for deemed tax exemption or

deemed tax credit of taxes so exempted by the Source state

Domestic tax laws of countries generally do not provide for tax sparing credit

Article 25 of India – Singapore DTAA

Generally attached to income like dividend, interest, royalties, foreign branch /

permanent establishment income

However, concept of tax sparing credit leads to double non-taxation (explained

All rights reserved | Preliminary & Tentative

later)

Foreign tax credit | 20

Tax sparing credit

(5/7)

Particulars

Tax sparing –

Absent

Tax sparing –

Present

Assumptions

Amount in INR

Amount in INR

Income in State R

80,000

80,000

Income in State S

20,000

20,000

100,000

100,000

Tax rate in State R

35%

35%

Tax rate in State S (exempted 30%)

- normal rate

- special rate

30%

0%

30%

0%

Aggregate taxable income in State R

Workings

Tax payable in State R

(A)

35,000

35,000

Tax payable in State S

(B)

-

-

Tax credit (tax charged in State S)

(C)

-

-

Tax credit (tax exempted in State S) ^

(D)

-

6,000

Total tax credit (C) + (D)

(E)

-

6,000

Total tax after relief – (A) – (E)

(F)

35,000

29,000

^ 20,000* 30 % = 6,000

Foreign tax credit | 21

All rights reserved | Preliminary & Tentative

Tax sparing credit - Illustration

Underlying tax credit

(6/7)

A mechanism to eliminate a form of ‘economic double taxation’

Attached to dividend income; available only to a company

Credit is granted by Resident state not only for the taxes withheld on dividends but

also for the corporate taxes paid on the underlying profits out of which dividends has

been paid

Intended to mitigate the double taxation of corporate profits, which are taxed firstly

dividends paid by the company)

Requirement of substantial shareholding

Illustratively the following Tax treaties provide for tax credit –

Article 24 of India – UK DTAA

Comparison between Article 23 of India – Mauritius DTAA and Article 25 of India –

Singapore DTAA

Foreign tax credit | 22

All rights reserved | Preliminary & Tentative

in the hands of the company and secondly in the hands of the shareholders (on the

Underlying tax credit

(7/7)

Underlying tax credit - Illustration

Particulars

Amount in INR

Taxation of Indian Subsidiary Co of UK Holding Co In India

Profit of Subsidiary Co in source state (India)

100,000

Taxes (30%)

(30,000)

Profit after tax

70,000

Dividend distributed

50,000

Dividend paid to UK Holding Co (70% holding)

35,000

Dividend Distribution Tax on above (15%)

(A)

(5,250)

Profit of UK Holding Co in UK

200,000

Dividend income

35,000

Taxable income

235,000

Tax Rate (40%)

(B)

94,000

Underlying Tax Credit [35,000 * 30,000 / 70,000]

(C)

(15,000)

Total Tax Credit (A) + (C)

(D)

20,250

Total Tax after Relief

73,750

Foreign tax credit | 23

All rights reserved | Preliminary & Tentative

Taxation of UK Holding Co in UK

Double non-taxation

Double non-taxation

(1/2)

Double non-taxation is a situation where on account of benefits available under

DTAA, a tax payer is not liable to tax in both the Resident state as well as Source

state

Capital Gains taxability under the India – Mauritius tax treaty is a classic example of

the same

Company X

(Mauritius

resident)

Capital Gains exempt in

Mauritius as per Mauritius

tax laws

All rights reserved | Preliminary & Tentative

Mauritius

India

Sale of shares

of Indian Co

Mr X

Shares held

Indian Co

Capital Gains exempt in India for a

Mauritius resident as per DTAA

between India and Mauritius

Foreign tax credit | 25

Double non-taxation

(2/2)

As visible from the diagram, the above arrangement discharges Company X from

tax liability from both the Resident state (Mauritius) as well as Source state (India)

Some companies take undue advantage of the above arrangement by merely

incorporating subsidiaries in low-tax jurisdictions and by shifting the profits through

All rights reserved | Preliminary & Tentative

legal planning into these subsidiaries

Foreign tax credit | 26

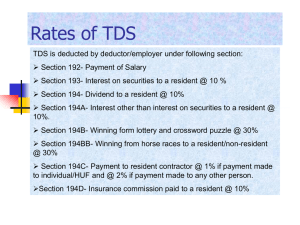

Excess FTC

Excess FTC

(1/2)

The amount of FTC that can be claimed in India is the lower of:

The amount of foreign income tax paid; or

The amount of income tax chargeable on that foreign source income in India

A taxpayer will not be able to claim full FTC in India if the amount of income tax paid

in the foreign country is higher than the amount of income tax payable in India on that

foreign source income

The DTAA’s entered by Government of India do not permit carry forward of excess

All rights reserved | Preliminary & Tentative

FTC.

Foreign tax credit | 28

Excess FTC

(2/2)

Following countries allow carry forward of excess foreign tax paid:

Carry-back

(No of

years)

Reference

Canada

10

3

Section 126(2)(a) of the Canada Income Tax Act

Japan

3

3

Code No 12007 of National Tax Agency

Singapore

No limit

-

Section 50 of the Singapore Income Tax Act

UK

No limit

3

Sections 72 to 74 of the Taxation (International

and Other Provisions) Act 2010

10

1

IRC Section 904 (c)

USA

All rights reserved | Preliminary & Tentative

FTC carry forward

(No of years)

Source: www.taxsutra.com

Foreign tax credit | 29

Documentation

Documentation required for FTC

Overseas Tax withholding certificates evidencing payment of taxes in foreign

jurisdiction

External third party confirmation

Overseas Tax Returns, if any

All rights reserved | Preliminary & Tentative

Certificate from Foreign Tax authorities, where possible

Foreign tax credit | 31

Cases where FTC is not available

Cases where FTC not available

(1/2)

Not furnishing of Permanent Account Number (‘PAN’)

In case a foreign resident does not furnish a PAN; any payment made to him shall be

subject to withholding tax at the higher of the following rates:

•

at the rate specified in the relevant provision of the Act; or

•

at the rate or rates in force; or

•

at the rate of twenty percent

If a foreign resident for the reasons mentioned above is subject to withholding tax at a

additional amount withheld on account of non furnishing of PAN; which is penal in

nature

Foreign tax credit | 33

All rights reserved | Preliminary & Tentative

higher rate than tax rate provided under the DTAA, availing FTC will be difficult on the

Cases where FTC not available

(2/2)

Foreign Account Tax Compliance Act (‘FATCA’) - US

If an Indian resident earning interest income from USA (source country) does not

comply with FATCA reporting requirements, than he may be liable to an additional

withholding tax of 30% on the interest income so earned

However, availing FTC will be difficult on the taxes withheld on this account as it is

not covered under the definition of ‘Taxes covered’ under the DTAA and are merely

All rights reserved | Preliminary & Tentative

penal in nature

Foreign tax credit | 34

Direct Tax Code

FTC under the Direct Taxes Code, 2010

Provisions similar to existing Section 90(2) and Section 91 of the Act

Available only to a ‘Resident in India’

Amount of credit restricted to:

the Indian income-tax payable in respect of income which is taxed outside India; and

the Indian income-tax payable in respect of total income of the assessee

Requirement of TRC to claim treaty benefits

Limited Treaty Override – Treaty benefits not available if General Anti Avoidance Rules or

Controlled Foreign Corporation (‘CFC’) provisions are invoked or if Branch Profit Tax is levied

Need to address issues of grant of FTC in cases where CFC provisions are

invoked

Foreign tax credit | 36

All rights reserved | Preliminary & Tentative

Government to prescribe the methods, manner and other particulars

Practical issues

Practical issues in FTC – Timing

(1/6)

April, 2012

USA return to

be filed by

April 15, 2013

US Fiscal

Year 2012

Indian

Fiscal

2012-13

US Fiscal

Year 2013

USA return to

be filed by

April 15, 2014

March, 2013

Indian Return for the fiscal year 2012-13 to be filed by July 31, 2013 / September 30, 2013

How to claim credit for the final tax liability for the period Jan-Mar 2013

in Indian tax filings for 2012-13?

Foreign tax credit | 38

All rights reserved | Preliminary & Tentative

December, 2012

Practical issues in FTC – DDT

(2/6)

Any amount declared, distributed or paid by way of dividend is subject to DDT

DDT is neither a withholding tax on dividend income nor a tax on the profits of the

company from which dividend is declared

Under the DTAAs, tax credit is typically available for tax on income (ie income-tax)

and for tax on the profits of the company from which dividend is declared (ie UTC).

Therefore, tax credit on DDT is per se not available under the DTAAs

tax or underlying tax as per its domestic law

Similar issue could arise in respect of Buy-back Distribution Tax

Foreign tax credit | 39

All rights reserved | Preliminary & Tentative

However, credit for DDT can be availed if Resident state considers DDT as income-

Practical issues in FTC – inter-country adjustment (3/6)

Indian

Company X

Country A

Tax paid

INR 20

Country B

Tax paid

INR 10

Profit of INR 100 mn

Alternative Options:

1. Whether loss in India to be adjusted against profit from Country A?

2. Whether loss in India to be adjusted against profit from Country B?

3. Whether loss in India to be adjusted proportionately against profit

from Country A and B?

Foreign tax credit | 40

All rights reserved | Preliminary & Tentative

India

Practical issues in FTC – Migration of residence

Year 1

(4/6)

Year 2

Foreign expatriate

Mr X pays tax at the time

of grant of ESOP

India

Mr X pays tax at the time

of exercise of ESOP

Double taxation as he may not be able to get FTC for taxes paid in year

of grant

Foreign tax credit | 41

All rights reserved | Preliminary & Tentative

Belgium

Practical issues in FTC – FOREX

(5/6)

Exchange Rate

Prevailing

Indian resident derives business income of USD 100

in source state

1$ = INR 45

Tax paid in source state of USD 15

1$ = INR 46

Realization of income

1$ = INR 44

All rights reserved | Preliminary & Tentative

Particulars

Which of the above exchange rate should be considered for the

purpose of calculation of the quantum of foreign taxes that are

available for FTC?

Foreign tax credit | 42

Practical issues in FTC – indirect transfers

(6/6)

Indirect transfer

•

USA

tax capital gains in accordance

with the provisions of its

domestic law

100%

•

Mauritius

Mauritius

Co

Both the countries have right to

Credit for taxes paid in India

available in the US?

•

Credit for taxes paid in India

pursuant to recently introduced

India

100%

provisions pertaining to indirect

transfers?

India Co

All rights reserved | Preliminary & Tentative

US Co

Sale of shares

held in Mauritius

entity to third

party

Case Studies

Case study 1

Facts

Company A pays Federal and State taxes in the USA

Taxes covered as per Article 2 of India – USA DTAA in the USA include ‘federal income taxes’

imposed by the Internal Revenue Code

Deduction of foreign taxes disallowed under Section 40(a)(ii) of the Act as any ‘any

taxes’ paid covered

any sum paid on account of any rate or tax levied on the profits or gains of any business or

shall not be deducted from Business income

Credit for only Federal income taxes paid is allowed as per India – USA DTAA

Question

Would Company A be eligible to claim credit of the State taxes under Section 91 in

light of Section 90(2) of the Act?

Foreign tax credit | 45

All rights reserved | Preliminary & Tentative

profession or assessed at a proportion of, or otherwise on the basis of, any such profits or gains

Case study 1

Held

In the case of Tata Sons Limited v DCIT (43 SOT 27), it has been held that the view

that State taxes cannot be allowed as a deduction and also cannot be taken into

account for giving credit is incongruous and results in a contradiction. A tax payment

which is not treated as admissible expenditure on the ground that it is payment of

income tax has to be treated as eligible for tax credit

While Section 91 of the Act allows credit for Federal and State taxes, the DTAA

beneficial to the assessee and by virtue of Section 90(2) of the Act, provisions of

Section 91 must prevail over the DTAA even though this is a case where India has

entered into a DTAA

Accordingly, even an assessee covered by the scope of the DTAA will be eligible for

credit of State taxes under Section 91 of the Act despite the DTAA not providing for

the same

Foreign tax credit | 46

All rights reserved | Preliminary & Tentative

allows credit only for Federal taxes. The result is that the Section 91 is more

Case study 2

Facts

Company A has operations in India, Country A and Country B

Income details of the branches in Country A and Country B are as follows

Income/(Loss)

Country A

Rs 1,000

Country B

(Rs 300)

Total (post set-off)

Rs 700

Question

For the purposes of relief under Section 91(1), whether income of Rs 1,000 or Rs 700

to be considered?

Foreign tax credit | 47

All rights reserved | Preliminary & Tentative

Branch

Case study 2

Held

In the case of CIT v Bombay Burmah Trading Corporation (259 ITR 423), Bombay

High Court held that Section 91 read with explanation of ‘rate of tax of the said

country’, it is evident that the section deals with granting relief calculated on income

country-wise and not on the basis of amalgamation or aggregation of income of all

foreign countries

Expression ‘doubly taxed income’ indicates that the phrase has reference to the tax

All rights reserved | Preliminary & Tentative

which the foreign income bears when it is again subjected to tax by its inclusion under

the Act

Thus, relief has to be considered country-wise

Foreign tax credit | 48

Case study 3

Facts

Assessee (Resident of India) earns income from provision of export services outside

India

Tax deducted at source on the above income

Deduction of 50% was claimed by assessee under section 10A [Entities established

in Special economic zone (’SEZ’)] of the Act while offering the above income to tax in

India

For the purposes of relief under Section 91(1) of the Act , whether FTC can be

claimed on entire taxes deducted in foreign country?

Foreign tax credit | 49

All rights reserved | Preliminary & Tentative

Question

Case study 3

Held

In the case of Dr K.L.Parikh v ITO, 1982 (14 TTJ 117), the assessee claimed that

relief from Double taxation must be allowed in respect of entire amount of taxes

deducted at source. The assesse has earned income from Iran on which taxes were

deducted. While offering the foreign sourced income to tax in India, Assessee had

claimed deduction (upto 50 percent) under section 80RRA of the Act. The

Commissioner of Income-tax (Appeals) [‘CIT(A)’] rejected the assessee’s claim and

The Tribunal rejected CIT(A) claim and declared the decision in favour of the

assessee

Foreign tax credit | 50

All rights reserved | Preliminary & Tentative

allowed relief upto 50 percent of taxes deducted

Case study 3

However, Rajasthan High Court held that the Tribunal was not justified in holding that

the assessee was entitled to credit for the entire amount of tax deducted at source in

Iran under section 91(1) of the Act, and not in proportion to the income included in the

total income of the assessee after considering the provisions of section 80RRA of the

Act and relief was granted proportionately upto 50 percent of FTC

Based on above, same principle will apply to entities established in SEZ and hence

they cannot claim tax credit on foreign taxes paid abroad in respect of incomes which

All rights reserved | Preliminary & Tentative

are exempt from tax in India

Foreign tax credit | 51

THANK YOU

For any queries please contact:

Kalpesh Desai

Partner

BMR Advisors

BMR House, 36,

Dr RK Shirodkar Marg,

Parel, Mumbai 400 012

Kalpesh.Desai@bmradvisors.com

Article 4 - Resident

1. For the purposes of this Convention, the term "resident of a Contracting State"

means any person who, under the laws of that State, is liable to tax therein by

reason of his domicile, residence, place of management or any other criterion

of a similar nature, and also includes that State and any political subdivision or

local authority thereof. This term, however, does not include any person who is

liable to tax in that State in respect only of income from sources in that State or

All rights reserved | Preliminary & Tentative

capital situated therein.

Foreign tax credit | 53

Article 23 - Methods for elimination of double taxation

Article 23A - Exemption Method

1. Where a resident of a Contracting State derives income or owns capital which, in

accordance with the provisions of this Convention, may be taxed in the other

Contracting State, the first-mentioned State shall, subject to the provisions of

paragraphs 2 and 3, exempt such income or capital from tax

2. Where a resident of a Contracting State derives items of income which, in

accordance with the provisions of Articles 10 and 11, may be taxed in the other

the income of that resident an amount equal to the tax paid in that other State. Such

deduction shall not, however, exceed that part of the tax, as computed before the

deduction is given, which is attributable to such items of income derived from that

other State

Foreign tax credit | 54

All rights reserved | Preliminary & Tentative

Contracting State, the first-mentioned State shall allow as a deduction from the tax on

Article 23 - Methods for elimination of double taxation

Article 23A - Exemption Method

3. Where in accordance with any provision of the Convention income derived or capital

owned by a resident of a Contracting State is exempt from tax in that State, such

State may nevertheless, in calculating the amount of tax on the remaining income or

capital of such resident, take into account the exempted income or capital.

4. The provisions of paragraph 1 shall not apply to income derived or capital owned by a

resident of a Contracting State where the other Contracting State applies the

All rights reserved | Preliminary & Tentative

provisions of the Convention to exempt such income or capital from tax or applies the

provisions of paragraph 2 of Article 10 or 11 to such income

Foreign tax credit | 55

Article 23 - Methods for elimination of double taxation

Article 23B – Credit Method

1. Where a resident of a Contracting State derives income or owns capital which, in

accordance with the provisions of this Convention, may be taxed in the other

Contracting State, the first-mentioned State shall allow:

a) as a deduction from the tax on the income of that resident, an amount equal to the income tax

paid in that other State;

b) as a deduction from the tax on the capital of that resident, an amount equal to the capital tax

paid in that other State

or capital tax, as computed before the deduction is given, which is attributable, as the

case may be, to the income or the capital which may be taxed in that other State.

2. Where in accordance with any provision of the Convention income derived or capital

owned by a resident of a Contracting State is exempt from tax in that State, such

State may nevertheless, in calculating the amount of tax on the remaining income or

capital of such resident, take into account the exempted income or capital

Foreign tax credit | 56

All rights reserved | Preliminary & Tentative

Such deduction in either case shall not, however, exceed that part of the income tax

Full exemption - Article XVII of India – Greece DTAA

1. The laws in force in either of the territories will continue to govern the assessment

and taxation of income in the respective territories except where express provision to

the contrary is made in this Agreement

2. Subject to the provisions of Article VI* income from sources within Greece which

under the laws of Greece and in accordance with this Agreement is subject to tax in

Greece either directly or by deduction shall not be subject to Indian tax

3. Subject to the provisions of Article VI income from sources within India which under

All rights reserved | Preliminary & Tentative

the laws of India and in accordance with this Agreement is subject to tax in India

either directly or by deduction shall not be subject to Greek tax

*Article VI – Deals with income from Shipping

Foreign tax credit | 57

Partial exemption - Article 23 of India – Austria DTAA

2 (a) Where a resident of Austria derives income which, in accordance with the provisions

of this Convention, may be taxed in India, Austria shall, subject to the provisions of

sub-paragraphs (b) and (c) exempt such income from tax

(b) Where a resident of Austria derives items of income which, in accordance with the

provisions of paragraph 2 of Articles 10 (dividend), 11 (interest), 12 (royalties),

paragraphs 4 and 5 of Article 13 (capital gains) and paragraph 3 of Article 22 may be

taxed in India, Austria shall allow as a deduction from the tax on the income of that

exceed that part of the tax, as computed before the deduction is given, which is

attributable to such items of income derived from India

(c) Where in accordance with any provision of the Convention income derived by a

resident of Austria is exempt from tax in Austria, Austria may nevertheless, in

calculating the amount of tax on the remaining income of such resident, take into

account the exempted income

Foreign tax credit | 58

All rights reserved | Preliminary & Tentative

resident an amount equal to the tax paid in India. Such deduction shall not, however,

Full credit - Article 23 of India – Namibia DTAA

1. ……………..

2. In India, double taxation shall be eliminated as follows :

Where a resident of India derives income or capital gains from Namibia, which, in

accordance with the provisions of this Convention may be taxed in Namibia, then

India shall allow as a deduction from the tax on the income of that resident an amount

equal to the tax on income or capital gains paid in Namibia, whether directly or by

All rights reserved | Preliminary & Tentative

deduction

Foreign tax credit | 59

Ordinary credit - Article 25 of India – USA DTAA

1. ……………..

2. (a) Where a resident of India derives income which, in accordance with the provisions

of this Convention, may be taxed in the United States, India shall allow as a

deduction from the tax on the income of that resident an amount equal to the incometax paid in the United States, whether directly or by deduction. Such deduction shall

not, however, exceed that part of the income-tax (as computed before the deduction

is given) which is attributable to the income which may be taxed in the United States

All rights reserved | Preliminary & Tentative

(b) ……………

Foreign tax credit | 60

Tax sparing - Article 25 of India – Singapore DTAA

4. Subject to the provisions of the laws of Singapore regarding the allowance as a credit

against Singapore tax of tax paid in any country other than Singapore, Indian tax

paid, whether directly or by deduction, in respect of income from sources within India

shall be allowed as a credit against Singapore tax payable in respect of that income.

Where such income is a dividend paid by a company which is a resident of India to a

resident of Singapore which owns not less than 25 per cent of the share capital of the

company paying the dividends, the credit shall take into account Indian tax paid in

5. For the purposes of paragraph 4 of this Article the term "Indian tax paid" shall be

deemed to include any amount of tax which would have been payable in India but for

a deduction allowed in computing the taxable income or an exemption or reduction of

tax granted for that year in question

Foreign tax credit | 61

All rights reserved | Preliminary & Tentative

respect of its profits by the company paying the dividends.

Tax sparing - Article 25 of India – Singapore DTAA

a. Section 10(4), 10(4B), 10(5B), 10(15)(iv), 10A, 10B, 33AB, 80-I and 80-IA, insofar as

these provisions were in force and have not been modified since the date of signature

of this Agreement, or have been modified only in minor respects so as not to affect

their general character

b. Any other provision which may subsequently be enacted granting an exemption or

reduction of tax which is agreed by the competent authorities of the Contracting

States to be of a substantially similar character to a provision referred to in sub-

has been modified only in minor respects so as not to affect its general character

Foreign tax credit | 62

All rights reserved | Preliminary & Tentative

paragraph (a) of this paragraph, if such provision has not been modified thereafter or

Underlying tax credit - Article 24 of India – UK DTAA

1. Subject to the provisions of the law of the United Kingdom regarding the allowance as

a credit against United Kingdom tax of tax payable in a territory outside the United

Kingdom (which shall not affect the general principle hereof):

(a) ……………..

(b) In the case of a dividend paid by a company which is a resident of India to a

company which is a resident of the United Kingdom and which controls directly or

indirectly at least 10 per cent of the voting power in the company paying the dividend,

allowed under the provisions of sub-paragraph (a) of this paragraph] the Indian tax

payable by the company in respect of the profits out of which such dividend is paid

Foreign tax credit | 63

All rights reserved | Preliminary & Tentative

the credit shall take into account in [addition to any Indian tax for which credit may be

Comparison

Article 25 of India – Singapore DTAA

1. .............

1. ……….

2. (a) …………

2. Where a resident of India derives income which, in

(b)In the case of a dividend paid

accordance with the provisions of this

by a company which is a

Agreement, may be taxed in Singapore, India

resident of Mauritius to a

shall allow as a deduction from the tax on the

company which is a resident of

income of that resident an amount equal to the

India and which owns at least

Singapore tax paid, whether directly or by

10 per cent of the shares of the

deduction. Where the income is a dividend paid

company paying the dividend,

by a company which is a resident of Singapore to

the credit shall take into

a company which is a resident of India and which

account [in addition to any

owns directly or indirectly not less than 25 per

Mauritius tax for which credit

cent of the share capital of the company paying

may be allowed under the

the dividend, the deduction shall take into account

provisions of sub-paragraph (a)

the Singapore tax paid in respect of the profits

of this paragraph] the Mauritius

out of which the dividend is paid. Such deduction

tax payable by the company

in either case shall not, however, exceed that part

in respect of the profits out of

of the tax (as computed before the deduction is

which such dividend is paid

given) which is attributable to the income which

may be taxed in Singapore

Foreign tax credit | 64

All rights reserved | Preliminary & Tentative

Article 23 of India – Mauritius DTAA