Adjusting the Accounts

Supplies

Bal.

Pur.

100

400

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

1

“Cash” vs. “Accrual”

Cash

Revenue

Expenses

Accrual

received

paid

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

2

“Cash” vs. “Accrual”

Cash

Revenue

Expenses

received

paid

Accrual

earned

incurred

GAAP requires using the ACCRUAL basis

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

3

Why make

Adjusting Journal Entries?

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

4

Why make

Adjusting Journal Entries?

Better Financial Statements

(every adjusting entry will have

one Balance Sheet and

one Income Statement effect)

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

5

Matching Concept

Revenue

Expenses

Time (period)

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

6

I. Identifying accounts to be adjusted:

Accruals and Deferrals

A. Timing of cash changing hands:

accruals

deferrals

$

cash AFTER event cash BEFORE event

Deferrals have been recorded;

accruals have not.

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

7

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

8

I. Identifying accounts to be adjusted:

Accruals and Deferrals

B. Definitions

An ACCRUAL is an expense that has NOT

been paid or a revenue that has NOT

been received.

Examples of accruals:

Expense: salaries, interest, taxes

Revenue: services

(performed on account)

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

9

I. Identifying accounts to be adjusted:

Accruals and Deferrals

B. Definitions

A deferral is a delay of the recognition

of an expense already paid or of a

revenue already received.

Examples of deferrals:

Expense: supplies, insurance, rent

(tenant)

Revenue: subscriptions, rent (landlord)

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

10

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

11

II. Accruals

A. EXPENSES

1. Example

Salaries increase as employees work each

day, yet, for convenience, salaries are

recorded when PAID. Since the cash is paid

after the event, salaries are an example of

accrued expense.

The adjusting entry necessary when payday

and the end of the fiscal period are on

different days would be:

Salaries Expense

Salaries Payable

incurred

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

incurred

12

II. Accruals

2. Decision tree conclusion

Accrued Expense

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

13

II. Accruals

A. REVENUE

1. Example

11/15

12/31

2/28

A CPA firm is auditing a client’s records; the

engagement begins in mid-November and lasts

through the end of February. As work is being

performed each day, revenue is earned. Since the

cash will not be collected until completion of the

engagement (after the event), this is an example of

accrued revenue.

The adjusting entry necessary on the CPA’s records

at the end of the year when financial statements are

about to be prepared would be:

Accounts Receivable

Service Revenue

earned

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

earned

14

II. Accruals

2. Decision tree conclusion

Accrued Revenue

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

15

II. Accruals

C. Reversing Entries -- Appendix to Chap 4

What?

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

16

II. Accruals

C. Reversing Entries -- Appendix to Chap 4

What?

Which?

accruals

cash AFTER event

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

$

17

II. Accruals

C. Reversing Entries -- Appendix to Chap 4

What?

Which?

When?

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

18

II. Accruals

C. Reversing Entries -- Appendix to Chap 4

What?

Which?

When?

Why?

helps next year

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

19

II. Accruals

C. Reversing Entries -- Appendix to Chap 4

What?

Which?

When?

Why?

What else?

More Soon

All ACCRUALS need to be reversed.

Watch for new rule and apply it here,too.

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

20

II. Accruals

C. Reversing Entries

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

21

III. Deferrals

A. (Prepaid) EXPENSES

1. Examples from chapters 1 and 2:

supplies, insurance, rent

2. Two methods of accounting for deferred

(prepaid) expenses

a. ASSET METHOD

(Chapter 3 and homework)

b. EXPENSE METHOD

(Appendix and in class)

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

22

III. Deferrals

A. 3. Identifying method for deferred EXPENSES

a. Where was initial transaction recorded?

b. Where is the balance of the account

before adjustment?

Which method would we be using . . .

Prepayment

Asset

Expense

for insurance

_______

________

for supplies

_______

________

for rent

_______

________

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

23

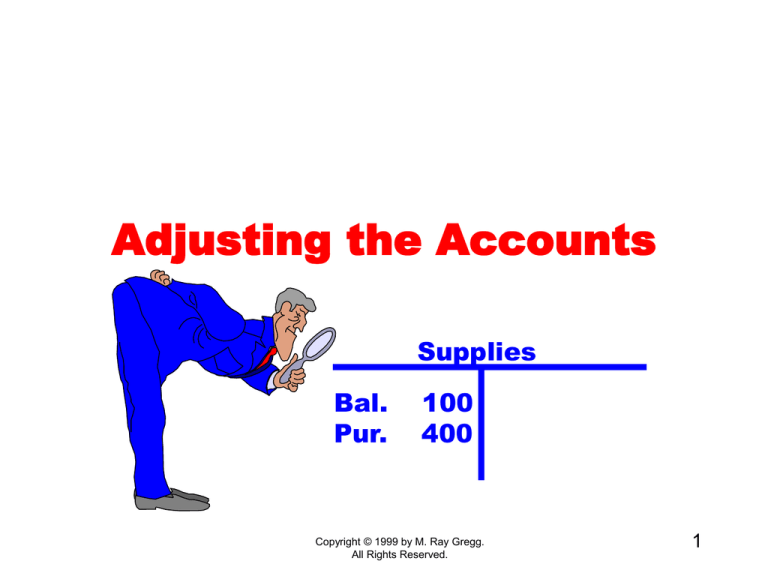

III. Deferrals

A. 4. Consider this example:

Supplies

Bal.

Pur.

Supplies Expense

100

400

Ending Inventory = $50

a. ASSET Method

Supplies Expense

Supplies

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

450

450

24

III. Deferrals

A. 4. Consider this example:

Supplies

Bal.

Pur.

Supplies Expense

100

400

450

a. ASSET Method

Supplies Expense

Supplies

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

450

450

25

III. Deferrals

A. 4. Consider this example:

Supplies

Bal.

Pur.

100

400

Supplies Expense

450

450

a. ASSET Method

Supplies Expense

Supplies

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

450

450

26

III. Deferrals

A. 4. Consider this example:

Supplies

Bal. 100

Pur. 400

Bal. = 50

450

Supplies Expense

Used

450

a. ASSET Method

Supplies Expense

Supplies

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

450

450

27

III. Deferrals

A. 4. b. Decision tree conclusion

Asset

Method

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

28

III. Deferrals

A. 5. Re-consider the example:

Supplies

Supplies Expense

Bal.

Pur.

100

400

Ending Inventory = $50

a. EXPENSE Method

Supplies

Supplies Expense

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

50

50

29

III. Deferrals

A. 5. Re-consider the example:

Supplies

Supplies Expense

Bal.

Pur.

50

100

400

50

Ending Inventory = $50

a. EXPENSE Method

Supplies

Supplies Expense

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

50

50

30

III. Deferrals

A. 5. Re-consider the example:

Supplies

Supplies Expense

Unused

Bal. 100

Pur. 400

50

50

Ending Inventory = $50

a. EXPENSE Method

Supplies

Supplies Expense

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

50

50

31

III. Deferrals

A. 4. b. Decision tree conclusion

Expense

Method

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

32

Comparison of Methods

ASSET METHOD

Supplies

Supplies Expense

Bal.

Pur.

100

400

450

exactly the

same

results

EXPENSE METHOD

Supplies

50

450

Supplies Expense

Bal.

Pur.

100

400

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

50

33

Comparison of Methods

Key to administering methods is

CONSISTENCY

JFMAMJJASOND

20x1

20x2

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

34

Comparison of Methods

Key to administering methods is

CONSISTENCY

20x1

20x2

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

35

Reversing entries necessary?

“Rule” becomes “old rule” -won’t work.

These are DEFERRALS -- not

accruals.

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

36

III. A. 6. Reversing Entries

New Rule: One rule -- two ways to say it.

a. If an ADJUSTING entry creates

(first entry in the account) the

balance in a BALANCE SHEET

account, a reversing entry would be

advantageous.

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

37

III. A. 6. Reversing Entries

New Rule: One rule -- two ways to say it.

b. If the direction of a deferral

ADJUSTING entry is BALANCE

SHEET to INCOME STATEMENT, it

should NOT be reversed.

If the direction of a deferral

ADJUSTING entry is INCOME

STATEMENT to BALANCE SHEET, it

should be reversed.

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

38

III. A. 6. Reversing Entries

Consider the SUPPLIES example...

ASSET METHOD

Supplies

Supplies Expense

Bal.

Pur.

100 AJE 450

400

NO

AJE 450 C2 450

EXPENSE METHOD

Supplies

AJE 50

YES!!

Supplies Expense

Bal. 100 AJE 50

Pur. 400 C2 450

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

39

III. A. 6. Reversing Entries

Consider the SUPPLIES example...

EXPENSE METHOD

Supplies

AJE 50

R 50

Supplies Expense

Bal. 100 AJE 50

Pur. 400 C2 450

R

50

Nature = Asset

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

40

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

41

???????????????

You should try one …

… about Prepaid Insurance

… on your own time.

Solution on class web page.

Now turn to middle of page 6

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

42

III. Deferrals

B. REVENUE

1. Examples

landlords, magazine companies, lawyers

Assume that attorneys Jones, Fraud, and

Swindle, whose year ends December 31,

received $1,200 on September 1 for one year’s

service in advance.

$1,200

1/1

9/1

12/31

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

12/31

43

III. Deferrals

B. REVENUE

1. Examples

landlords, magazine companies, lawyers

Assume that attorneys Jones, Fraud, and

Swindle, whose year ends December 31,

received $1,200 on September 1 for one year’s

service in advance.

2. Two methods of accounting for deferred

revenue

When CASH was debited, what was credited?

a. LIABILITY METHOD

b. REVENUE METHOD

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

44

III. Deferrals

B. 3. Identifying method for deferred REVENUE

a. Where was initial transaction recorded?

b. Where is the balance of the account

before adjustment?

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

45

III. Deferrals

B. 4. Consider the example of the lawyers:

Unearned Fees

Fees Earned

9/1 1,200

$1,200

4 mo

$400

earned

a. REVENUE Method

8 mo

$800

unearned

Fees Earned

Unearned Fees

800

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

800

46

III. Deferrals

B. 4. Consider the example of the lawyers:

Unearned Fees

Fees Earned

800

800

9/1 1,200

B = $400

$1,200

4 mo

$400

8 mo

$800

a. REVENUE Method

Fees Earned

Unearned Fees

800

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

800

47

III. Deferrals

B. 4. Consider the example of the lawyers:

Unearned Fees

800

Fees Earned

unearned 800

9/1 1,200

B = $400

$1,200

4 mo

$400

8 mo

$800

a. REVENUE Method

Fees Earned

Unearned Fees

800

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

800

48

III. Deferrals

B. 4. b. Decision tree conclusion

Revenue

Method

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

49

III. Deferrals

B. 5. Re-consider the example of the lawyers:

Unearned Fees

Fees Earned

9/1 1,200

$1,200

4 mo

$400

8 mo

$800

a. LIABILITY Method

Unearned Fees

Fees Earned

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

400

400

50

III. Deferrals

B. 5. Re-consider the example of the lawyers:

Unearned Fees

400

Fees Earned

9/1 1,200

$1,200

4 mo

$400

400

8 mo

$800

a. LIABILITY Method

Unearned Fees

Fees Earned

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

400

400

51

III. Deferrals

B. 5. Re-consider the example of the lawyers:

Unearned Fees

400

Fees Earned

earned

9/1 1,200

400

B=800

unearned

$1,200

4 mo

$400

8 mo

$800

a. LIABILITY Method

Unearned Fees

Fees Earned

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

400

400

52

III. Deferrals

B. 4. b. Decision tree conclusion

Liability

Method

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

53

Comparison of Methods

Liability Method

Unearned Fees

AJE 400

Fees Earned

9/1 1,200

AJE 400

exactly the

sameMethod

results

Revenue

Unearned Fees

Fees Earned

AJE 800

AJE 800

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

9/1 1,200

54

Comparison of Methods

Liability Method

Unearned Fees

AJE 400

9/1 1,200

NO

Fees Earned

C2 400

AJE 400

Revenue Method

Unearned Fees

Fees Earned

AJE 800

AJE 800 9/1 1,200

C2 400

YES!!

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

55

III. Deferrals

B. 6. Reversing Entries Necessary?

Revenue

Method

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

56

Reversing Entry

Revenue Method

Unearned Fees

Fees Earned

R 800 AJE 800

AJE 800 9/1 1,200

C2 400

R

800

Nature = Liability

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

57

???????????????

You should try one …

… about Unearned Tuition

… on your own time.

Solution on class web page.

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

58

Plant Assets

Plant Assets (long-lived assets)

are also forms of deferrals.

The remainder of the notes in the

handout are on the class web

page. Check it out.

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

59

Hopefully, you learned a great

deal today.

Use the decision tree as a

learning tool this week!

Have a great week!

Copyright © 1999 by M. Ray Gregg.

All Rights Reserved.

60