Managerial Economics & Business Strategy

advertisement

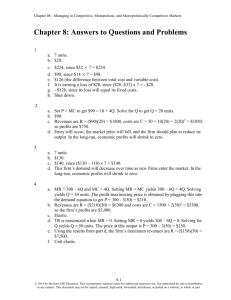

Managerial Economics & Business Strategy Chapter 8 Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets Optimal Advertising Decisions • Advertising is one way for firms with market power to differentiate their products. • But, how much should a firm spend on advertising? Advertise to the point where the additional revenue generated from advertising equals the additional cost of advertising. profit-maximizing level of advertising occurs where the advertisingto-sales ratio equals the ratio of the advertising elasticity of demand to the own-price elasticity of demand. EQ, A A R EQ, P Can we do it?? • Number 8 • The elasticity of demand for a firm’s product is -2 and its advertising elasticity of demand is 0.1. Determine the firm’s optimal advertising-to-sales ratio If the firm’s revenues are $50,000, what is the profit-maximizing level of advertising? EQ , A A 0.1 0.05 R EQ ,P 2 A EQ, A A 0.1 A .05$50, 000 $2,500 R EQ,P $50, 000 2 Maximizing Profits: A Synthesizing Example • C(Q) = 125 + 4Q2 • Determine the profit-maximizing output and price, and discuss its implications, if You are a price taker and other firms charge $40 per unit; You are a monopolist and the inverse demand for your product is P = 100 - Q; You are a monopolistically competitive firm and the inverse demand for your brand is P = 100 – Q. Marginal Cost • C(Q) = 125 + 4Q2, • So MC = 8Q. • This is independent of market structure. Price Taker • MR = P = $40. • Set MR = MC. • 40 = 8Q. • Q = 5 units. • Cost of producing 5 units. • C(Q) = 125 + 4Q2 = 125 + 100 = $225. • Revenues: • PQ = (40)(5) = $200. • Maximum profits of -$25. • Implications: Expect exit in the long-run. Monopoly/Monopolistic Competition • MR = 100 - 2Q (since P = 100 - Q). • Set MR = MC, or 100 - 2Q = 8Q. Optimal output: Q = 10. Optimal price: P = 100 - (10) = $90. Maximal profits: • PQ - C(Q) = (90)(10) -(125 + 4(100)) = $375. • Implications Monopolist will not face entry (unless patent or other entry barriers are eliminated). Monopolistically competitive firm should expect other firms to clone, so profits will decline over time. In Summary… • Firms operating in a perfectly competitive market take the market price as given. Produce output where P = MC. Firms may earn profits or losses in the short run. … but, in the long run, entry or exit forces profits to zero. • A monopoly firm, in contrast, can earn persistent profits provided that source of monopoly power is not eliminated. • A monopolistically competitive firm can earn profits in the short run, but entry by competing brands will erode these profits over time. Chapter 8 Homework Numbers 1, 5, 10, and 13 Chapter 8 Appendix How does all this relate to my other business classes??? Show me the money • Basic financial statements learned in BE 140 shows a company Where the money came from Where the money went Where the money is now • Focus on three main financial statements Balance sheet Income statement Cash flow statement • All of this information WE have been using in our theory, graphs, and problems What were those financial statements? Balance Sheet Income Statement Statement of Cash Flows Three primary financial statements. We will use a corporation to describe these statements. What were those financial statements? Balance Sheet Income Statement Statement of Cash Flows Describes where the enterprise stands at a specific date. What were those financial statements? Balance Sheet Income Statement Statement of Cash Flows Depicts the revenue and expenses for a designated period of time. What were those financial statements? Revenues result in positive cash flow. Expenses result in negative cash flow. Either in the past, present, or future. What were those financial statements? Balance Sheet Income Statement Statement of Cash Flows Net income (or net loss) is simply the difference between revenues and expenses. What were those financial statements? Balance Sheet Income Statement Statement of Cash Flows Depicts the ways cash has changed during a designated period of time. For our purpose…the income statement is where the money is!! • Income statement Years ago…called Profit or Loss statement “Sexy” portion of the financial statement • Includes things such as revenue, net income, earnings per share • Shows – How much money a company brought in Revenue – How much money the company spent Costs – The difference between the two Profit or Loss Terms of importance • Revenue Proceeds that come from the sale of the product to consumers • Cost of Goods Sold (COGS) Cost of production to make the good • Gross Profit Revenue – COGS • Operating Expenses Administration and marketing expenses not directly connected to the cost of “producing” the product