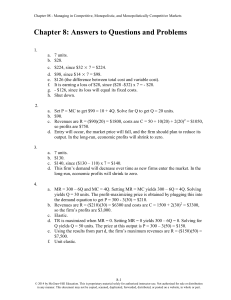

Chapter 8: Answers to Questions and Problems

advertisement

Chapter 08 - Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets Chapter 8: Answers to Questions and Problems 1. a. 7 units. b. $28. c. $224, since $32 × 7 = $224. d. e. f. g. h. $98, since $14 × 7 = $98. $126 (the difference between total cost and variable cost). It is earning a loss of $28, since ($28 -$32) x 7 = - $28. - $126, since its loss will equal its fixed costs. Shut down. 2. a. Set P = MC to get $90 = 10 + 4Q. Solve for Q to get Q = 20 units. b. $90. c. Revenues are R = ($90)(20) = $1800, costs are C = 50 + 10(20) + 2(20)2 = $1050, so profits are $750. d. Entry will occur, the market price will fall, and the firm should plan to reduce its output. In the long-run, economic profits will shrink to zero. 3. a. b. c. d. 7 units. $130. $140, since ($130 – 110) x 7 = $140. This firm’s demand will decrease over time as new firms enter the market. In the long-run, economic profits will shrink to zero. 4. a. MR = 300 – 6Q and MC = 4Q. Setting MR = MC yields 300 – 6Q = 4Q. Solving yields Q = 30 units. The profit-maximizing price is obtained by plugging this into the demand equation to get P = 300 - 3(30) = $210. b. Revenues are R = ($210)(30) = $6300 and costs are C = 1500 + 2(30)2 = $3300, so the firm’s profits are $3,000. c. Elastic. d. TR is maximized when MR = 0. Setting MR = 0 yields 300 – 6Q = 0. Solving for Q yields Q = 50 units. The price at this output is P = 300 – 3(50) = $150. e. Using the results from part d, the firm’s maximum revenues are R = ($150)(50) = $7,500. f. Unit elastic. 8-1 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Chapter 08 - Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets 5. a. A perfectly competitive firm’s supply curve is its marginal cost curve above the minimum of its AVC curve. Here, 𝑀𝐶𝑖 = 58 − 12𝑞𝑖 + 3𝑞𝑖2 and 𝐴𝑉𝐶𝑖 = 58𝑞𝑖 −6𝑞𝑖2 +𝑞𝑖3 𝑞𝑖 = 58 − 6𝑞𝑖 + 𝑞𝑖2 . Since MC and AVC are equal at the minimum point of AVC, set MCi = AVCi to get 58 − 12𝑞𝑖 + 3𝑞𝑖2 = 58 − 6𝑞𝑖 + 𝑞𝑖2 , or qi = 3. Thus, AVC is minimized at an output of 3 units, and the corresponding AVC is 𝐴𝑉𝐶𝑖 = 58 − 6(3) + (3)2 = 49. Thus the firm’s supply curve is described by the equation 𝑀𝐶𝑖 = 58 − 12𝑞𝑖 + 3𝑞𝑖2 if P ≥ $49; otherwise, the firm produces zero units. b. A monopolist produces where MR = MC and thus does not have a supply curve. c. A monopolistically competitive firm produces where MR = MC and thus does not have a supply curve. 6. a. Q = 3 units; P = $70. b. Q = 4 units; P = $60. 1 c. 𝐷𝑊𝐿 = 2 ($70 − $40)(1) = $15. 7. a. The inverse linear demand function is P = 9 – .25Q. b. MR = 9 – .5Q and MC = –16 + 2Q. Setting MR = MC yields 9 – .5Q = –16 + 2Q. Solving for Q yields Q = 10 units. The optimal price is P = 9 – .25(10) = $6.50. c. Revenues are R = ($6.50)(10) = $65. Costs are C = 124 – 16(10) + (10)2 = $64. Thus the firm earns $1. d. In the long run entry will occur and the demand for this firm’s product will decrease until it earns zero economic profits. 8. a. The optimal advertising to sales ratio is given by b. 𝐴 𝑅 = 𝐸𝑄,𝐴 −𝐸𝑄,𝑃 ⇒ 𝐴 $40,000 = 0.2 2.5 𝐴 𝑅 = 𝐸𝑄,𝐴 −𝐸𝑄,𝑃 = 0.2 2.5 = 0.08. ⇒ 𝐴 = (0.08)($40,000) = $3,200. 9. a. Since the inverse demand is P = 150 – 3Q1 – 3Q2, marginal revenue is MR(Q) = 150 – 6Q1 – 6Q2. b. Solving these two equations simultaneously yields Q1 = 5 and Q2 = 15. 150 – 6Q1 – 6Q2 = 6Q1 150 – 6Q1 – 6Q2 = 2Q2 c. Given Q1 = 5 and Q2 = 15, P = 150 – 15 – 45 = $90. 10. a. Based on a price elasticity of demand of -4, the monopolist’s marginal revenue is 1−3 2 𝑀𝑅 = 𝑃 ( −3 ) = 3 ∗ 𝑃. 8-2 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Chapter 08 - Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets b. Since the monopolist maximizes profits where MR = MC, the profit-maximizing price can be obtained by solving the following equation: (2/3)×P = 20, so P = $30. 11. Chastise the manager. Profit maximization requires producing where MR = MC. 12. Since you are a perfectly competitive firm, the price you charge is determined in a competitive market. The two events summarized will result in a decrease in market supply and an increase in the market demand, resulting in a higher market price (from P0 to P1 in the graphs below). Your profit-maximizing response to this higher price is to increase output. This is because you are a price taker (hence P = MR = the demand for our product) and the increase in price from P0 to P1 means that MR > MC at your old output. It is profitable to increase output from q0 to q1, as shown below. P r ice MC M ark e t P ric e S1 P1 S0 P0 D1 P1 P0 D0 M ark et Q u a n tity q0 q1 F ir m ’ s O u tp u t 13. It competes in a monopolistically competitive market. Short run profits may be earned by introducing new products more quickly than rivals. Over time, other firms will innovate too, so in the long run Pizza Hut earns zero economic profits. 14. Profit maximization requires equating MR and MC. Since 𝑀𝑅 = 𝑃 ( 1−2 1+𝐸 𝐸 )= $1.50 ( −2 ) = $0.75 and MC = $0.50, MR > MC. This means your firm can increase profits by reducing price in order to sell more pills. 15. Notice that MR = 1,200 – 8Q, MC1 = 12Q1 and MC2 = 6Q2. In order to maximize profits (or minimize its losses), the firm equates MR = MC1 and MR =MC2. Since Q = Q1 + Q2, this gives us 1200 – 8(Q1 + Q2) = 12Q1 1200 – 8(Q1 + Q2) = 6Q2 Solving yields Q1 = 33.33 units and Q2 = 66.67 units. The optimal price is the amount consumers will pay for the Q1 + Q2 = 100 units, and is determined by the inverse demand curve: P = 1200 – 4(100) = $800. At this price and output, revenues are R = ($800)(100) = $80,000, while costs are C1 + C2 = (8,000 + 6(33.33)2) + (6,000 + 3(66.67)2) = $34,000. The firm thus earns profits of $46,000. 8-3 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Chapter 08 - Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets 16. College Computers is a monopolistically competitive firm and faces a downward sloping demand for its product. Thus, you should equate MR = MC to maximize profits. Here, MR = 400 – Q and MC = 4Q. Setting 400 – Q = 4Q implies that your optimal output is 80 units per week. Your optimal price is P = 400 – 0.5×80 = $360. Your weekly revenues are R = ($360)(80) = $28,800 and your weekly costs are C = 1200 + 2(80)2 = $14,000. Your weekly profits are thus $14,800. You should expect other firms to enter the market; your profits will decline over time and you will lose market share to other firms. 17. Your average variable cost of producing the 10,000 units is $750 (depreciation is a fixed cost). Since the price you have been offered ($800) exceeds your average variable cost ($750), you should accept the offer; doing so adds $50 per unit (for a total of $500,000) to your firm’s bottom line. 18. Note first that overhead costs are irrelevant, as they are a fixed cost. Second, the explicit (accounting) MC is $2.75. Third, we must consider opportunity cost: By producing Type A bolts we lose the opportunity to produce type B bolts. Since each Type B bolt produced would net $4.75 - $2.75 = $2, the implicit MC is $2. Thus, the relevant MC is the sum of these explicit and implicit costs, or $2.75 + $2 = $4.75. To determine the profit-maximizing level of Type A bolts to produce, we must compare MR and MC. Given the marketing data, we can compute the MR as shown in the accompanying table. As shown in the table, MR > MC up to 3 units, so to maximize profits the firm should produce 3 units of Type A bolts. Quantity 0 1 2 3 4 5 19. 𝐴 𝑅 = 𝐸𝑄,𝐴 −𝐸𝑄,𝑃 Price 10 9 8 7 6 5 ⇒ 0.075 = 𝐸𝑄,𝐴 4 TR 0 9 16 21 24 25 MR 9 7 5 3 1 MC 4.75 4.75 4.75 4.75 4.75 4.75 ⇒ 𝐸𝑄,𝐴 = (0.075)(4) = 0.3 Thus, Gillette’s advertising elasticity is 0.3. Gillette’s demand is less responsive to advertising than its rivals; their higher advertising-to-sales ratio imply a greater advertising elasticity. 20. When the per-ton price of scrap steel is $140, market equilibrium is reached when P = $300 per ton and Q = 5600 tons. When the per-ton price of scrap steel is $285, market equilibrium is reached when P = $600 per ton and Q = 3,200 tons. As the market price rises, the equilibrium market quantity falls. Competition implies that at an equilibrium market price of $300 per ton each representative mini-mill produces Q = 10 tons (P = MC). As the equilibrium market price increases, the amount produced by each representative firm increases to Q = 20 tons. As the equilibrium market price rises, each representative firm supplies more to the market. The higher price of scrap 8-4 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Chapter 08 - Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets steel causes some firms to drop out of the market. Therefore, each representative mini-mill that remains in the market can produce more output. 21. When the two companies are permitted to maximize profit, the equilibrium price in each market will be €0.74 and produce 305 kilowatts per hour (MR = MC implies 1.35 – 0.004Q = 0.13). Thus, the price elasticity of demand at the profit-maximizing 1 0.74 price-quantity combination is 𝜀 = − .002 ( 305 ) = −1.21. This price elasticity of demand makes sense because a monopolist with linear demand will never maximize profit on the inelastic portion of the demand function. Prior to privatization the pricequantity combination was P = €0.13 and Q = 610 and profits are – €120 in each market. The state-owned facility is losing its fixed costs. Privatization will increase the price and reduce the amount of electricity generated in each market: P = €0.74 and Q = 305. Each firm will earn €66.05. Thus, each firm will earn €186.05 more in each market as a result of privatization; since €66.05 – (– €120) = €186.05. 22. The increase in lease expense is a fixed cost. Therefore, it should not directly affect the prices that she charges in her restaurant. If the current prices are profitmaximizing, a change in fixed costs should not persuade her to change her prices. It may, however, determine whether or not the restaurant owner decides to exit or remain in the industry in the long run. 23. Note that the information implies an advertising-to-sales ratio of 0.05, an own-price elasticity of -3 and an advertising elasticity of 4. Optimal advertising requires 𝐸𝑄,𝐴 𝐴 = 𝑅 −𝐸𝑄,𝑃 . In this case, 0.05 < 1.33. To bring this equation into equality, the firm should increase its advertising, provided that the estimated elasticities of advertising and demand are correct. 8-5 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.