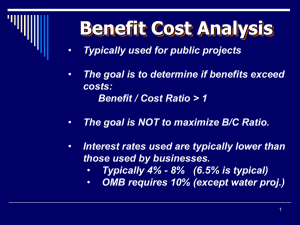

Benefit/Cost Ratio Project Evaluation: Engineering Economics

advertisement

Evaluating Projects with Benefit/Cost Ratio Method Conventional B/C Ratio with PW: B/C = PW(benefits of the proposed project) PW(total costs of the proposed project) = PW(B) I + PW(O&M) B = benefits of the proposed project I = initial investment in the proposed project O&M = operating and maintenance costs of the proposed project If B/C 1 => project is acceptable B/C < 1 => project is unacceptable Modified B/C Ratio with PW: B/C = PW(B) - PW(O&M) I B = benefits of the proposed project I = initial investment in the proposed project O&M = operating and maintenance costs of the proposed project Conventional B/C Ratio with AW: B/C = AW(benefits of the proposed project) AW(total costs of the proposed project) = AW(B) CR + AW(O&M) B = benefits of the proposed project CR = capital recovery amount = I (A/P) - S(A/F) O&M = operating and maintenance costs of the proposed project If B/C 1 => project is acceptable B/C < 1 => project is unacceptable Modified B/C Ratio with AW: B/C = AW(B) - AW(O&M) CR B = benefits of the proposed project CR = capital recovery amount = I (A/P) - S(A/F) O&M = operating and maintenance costs of the proposed project Conventional B/C Ratio with PW & Salvage Value B/C = PW(benefits of the proposed project) PW(total costs of the proposed project) = PW(B) I - PW(S) + PW(O&M) B = benefits of the proposed project I = initial investment in the proposed project S = salvage value of investment O&M = operating and maintenance costs of the proposed project Modified B/C Ratio with PW & Salvage Value B/C = PW(B) - PW(O&M) I - PW(S) B = benefits of the proposed project I = initial investment in the proposed project S = salvage value of investment O&M = operating and maintenance costs of the proposed project A city is considering extending the runways of its Municipal Airport so that commercial jets can use the facility. The land necessary for the runway extension is currently farmland, which can be purchased for $350,000. Construction costs for the runway extension are projected to be $600,000, and the additional annual maintenance costs for the extension are estimated to be $22,500. If the runways are extended, a small terminal will be constructed at a cost of $250,000. The annual operating and maintenance costs for the terminal are estimated at $75,000. Finally, the projected increase in flights will require the addition of two air traffic controllers, at an annual cost of $100,000. Annual benefits of the runway extension have been estimated as follows: $325,000 rental receipts from airlines leasing space at the facility $65,000 airport tax charged to passengers $50,000 convenience benefit for residents of Bugtussle $50,000 additional tourism dollars for Bugtussle Solution I = land cost + runway construction cost + terminal construction cost = 350,000 + 600,000 + 250,000 = 1,200,000 B = rent + tax + convenience benefit + tourism = 325,000 + 65,000 + 50,000 + 50,000 = 490,000 O&M = runway O&M + terminal O&M + controller = 22,500 + 75,000 + 100,000 = 197,500 B/C with PW Conventional B/C B/C = PW(B)/[I + PW(O&M)] B/C = 490,000 (P/A, 10%, 20)/[1,200,000 + 197,500 (P/A,10%,20)] = 1.448 > 1 Modified B/C B/C = [PW(B) - PW(O&M]/ I B/C = [490,000 (P/A, 10%, 20) 197,500 (P/A,10%,20)]/ 1,200,000 = 2.075 > 1 B/C with AW Conventional B/C: B/C = AW(B)/[CR + AW(O&M)] B/C = 490,000/[1,200,000 (A/P,10%,20) + 197,500] = 1.448 > 1 Modified B/C: B/C= [AW(B) - AW(O&M]/CR B/C = [490,000 - 197,500]/[1,200,000 (A/P,10%,20)] = 2.075 > 1 Consistency of B/C Methods The magnitude of B/C value may be different The conclusion from all methods are consistent; that is if conventional B/C with PW > 1 then modified B/C with PW, conventional B/C with AW, and modified B/C with AW will be > 1. And vice versa. If PW(B) / [ I + PW(O&M)] > 1 => PW(B) > I + PW(O&M) => PW(B) - PW(O&M) > I => [PW(B) - PW(O&M)] / I > 1 If PW(B) / [ I + PW(O&M)] > 1 => PW(B) > I + PW(O&M) => PW(B)(A/P) >[ I + PW(O&M)](A/P) => AW(B) > I(A/P) + AW(O&M) => AW(B) > I(A/P) - S(A/F) + AW(O&M) => AW(B) > CR + AW(O&M) => AW(B) / [CR + AW(O&M)] > 1 Disbenefit in the B/C ratio Disbenefits - negative consequences to the public resulting from the implementation of a publicsector project. Traditionally disbenefits is treated as negative benefits (i.e., subtract disbenefits from benefits in the numerator of the B/C ratio). Alternatively, the disbenefits could be treated as costs (i.e., add disbenefits to cost in the denominator of the B/C ratio). Conventional B/C with AW & Disbenefit B/C = AW(benefits) - AW(disbenefits) AW(costs) = AW(B) - AW(D) CR + AW(O&M) B/C = = AW(benefits) AW(costs) + AW(disbenefits) AW(B) CR + AW(O&M) + AW(D) Example By previous example, In addition to the benefits and costs, suppose that there are disbenefits associated with the runway extension project. Specifically, the increased noise level from commercial jet traffic will be a serious nuisance to homeowners living along the approach path to the Bugtussle Municipal Airport. The annual disbenefit to citizens of Bugtussle caused by this "noise pollution" is estimated to be $100,000. Given this additional information, reapply the conventional B/C ratio, with equivalent annual worth, to determine whether or not this disbenefit affects your recommendation on the desirability of this project. Disbenefits Reduce Benefits . B/C = [AW(B) - AW(D)] / [CR + AW(O&M)] B/C = [490,000 - 100,000]/[$1,200,000 (A/P,10%,20) + 197,500] B/C = 1.152 Disbenefits Treated as Additional Cost B/C = AW(B)/[CR + AW(O&M) + AW(D)] B/C = 490,000 / [1,200,000 (A/P,10%,20) + 197,500 + 100,000] B/C = 1.118 Consistency Let B = the equivalent annual worth of project benefits C = the equivalent annual worth of project costs X = the equivalent annual worth of a cash flow (either an added benefit or a reduced cost) not included in either B or C B/C = (B + X) / C > 1 => B + X > C => B > C - X => B/ (C - X) > 1 if C - X > 0 Example A project is being considered to replace an aging bridge. The new bridge can be constructed at a cost of $300,000, and estimated annual maintenance costs are $10,000. The existing bridge has annual maintenance costs of $18,500. The annual benefit of the new four-lane bridge to motorists, due to the removal of the traffic bottleneck, has been estimated to be $25,000. Conduct a benefit/cost analysis, using an interest rate of 8% and a study period of 25 years, to determine whether the new bridge should be constructed. Treating maintenance costs saving as a Reduced Cost: B / C = 25,000 / [300,000(A / P,8%,25) - (18,500 - 10,000)] B/C = 1.275 Treating maintenance costs saving as an Increased Benefit: B/C = [25,000 + (18,500 - 10,000)]/[300,000(A/P,8%,25)] B/C = 1.192 Comparison of Mutually Exclusive Projects by B/C Ratios Maximizes the B/C ratio does NOT guarantee that the best project is selected. Inconsistent Result from Conventional B/C ratio and Modified ratio. (the conventional B/C ratio might favor a different project than would the modified B/C ratio). Example The required investments, annual operating and maintenance costs, and annual benefits for two mutually exclusive alternative projects are shown below, which project should be selected? Capital investment AnnualO&M cost Annual benefit Conventional B/C: Modified B/C: Project A 110,000 12,500 37,500 1.475 1.935 Project B 135,000 i = 10% 45,000 N = 20 yrs 80,000 1.315 2.207 Incremental B/C Ratio Should Be Used Example Three mutually exclusive alternative public works projects are currently under consideration. Each of the projects has a useful life of 50 years, and the interest rate is 10 % per year. Which, if any, of these projects should be selected? A 8,500,000 B 10,000,000 C 12,000,000 Annual O&M. costs 750,000 Salvage value 1,250,000 Annual benefit 2,150,000 725,000 1,750,000 2,265,000 700,000 2,000,000 2,500,000 Capital investment PW(Costs, A) = 8,500,000 + 750,000(P/A,10%,50) - 1,250,000(P/F,10%,50) = 15,925,463 PW(Costs, B) = 10,000,000 + 725,000(P/A,10%,50) - 1,750,000(P/F,10%,50) = 17,173,333 PW(Costs, C) = 12,000,000 + 700,000(P/A,10%,50) - 2,000,000(P/F,10%,50) = 18,923,333 PW(Benefit,A) = 2,150,000(P/A,10%,50) = 21,316,851 PW(Benefit, B) = 2,265,000(P/A,10%,50) = 22,457,055 PW(Benefit, C) = 2,750,000(P/A,10%,50) = 24,787,036 B/C(A) = 21,316,851/15,925,463 = 1.3385 > 1.0 .A is Acceptable B/C(B - A) = (22,457,055 - 21,316,851)/(17,173,333 - 15,925,463) = 0.9137 < 1.0 . . Project B not Acceptable B/C(C - A) = (24,787,036 - 21,316,851)/(18,923,333 - 15,925,463) = 1.1576 > 1.0 . . Project C is Acceptable Decision: Recommend Project C Example Two mutually exclusive alternative public works projects are under consideration. Their respective costs and benefits are included in the table below. Project I has an anticipated life of 35 years, and the useful life of Project II has been estimated to be 25 years. If the interest rate is 9%, which, if either, of these projects should be selected? Project I Project II Capital investment $750,000 Annual O&M costs 120,000 Annual benefit 245,000 Useful life of project (years) 35 $625,000 110,000 230,000 25 AW(Costs, I) = 750,000(A/P,9%,35) + 120,000 = 190,977 AW(Costs, II) = 625,000(A/P,9%,25) + 110,000 = 173,629 B/C(II) = 230,000/ 173,629 = 1.3247 > 1.0 . . Project II is Acceptable B/C(I - II) = (245,000- 230,000)/(190,977 - 173,629) = 0.8647 < 1.0 . . Project I not Acceptable Select Project II Criticisms and Shortcomings of the Benefit/Cost Ratio Method Often used as a tool for after-the-fact justifications rather than for project evaluation Serious distributional inequities (i.e., one group reaps the benefits while another incurs the costs) may not be accounted for in B/C studies Qualitative information is often ignored in B/C studies Homework Page 267 Problem # 8, 12, 18