PowerPoint for Chapter 19

advertisement

Chapter 19

Normal,

Log-Normal Distribution,

and

Option Pricing Model

By

Cheng Few Lee

Joseph Finnerty

John Lee

Alice C Lee

Donald Wort

Outline

2

•

19.1 The Normal Distribution

•

19.2 The Log-Normal Distribution

•

19.3 The Log-Normal Distribution and It’s

Relationship to the Normal Distribution

•

19.4 Multivariate Normal and Log-Normal

Distributions

•

19.5 The Normal Distribution as an Application to

the Binomial and Poisson Distributions

•

19.6 Applications of the Log-Normal Distribution in

Option Pricing

Outline

3

•

19.7 THE BIVARIATE NORMAL DENSITY

FUNCTION

•

19.8 AMERICAN CALL OPTIONS

•

19.8.1 Price American Call Options by the Bivariate

Normal Distribution

•

19.8.2 Pricing an American Call Option: An

Example

•

19.9 PRICING BOUNDS FOR OPTIONS

•

19.9.1 Options Written on Nondividend-Paying

Stocks

•

19.9.2 Option Written on Dividend-Paying Stocks

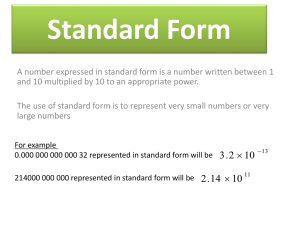

19.1 The Normal Distribution

• A random

variable X is said to be normally

distributed with mean and variance 2if it has

the probability density function (PDF)

1 x

(

1

f ( x)

e 2

2

)2

0.

(19.1)

*Useful in approximation for binomial distribution

and studying option pricing.

4

• Standard

PDF of

Z

g ( z)

X

1

2

is

e

z2

2

(19.2)

• This

is the PDF of the standard normal and is

independent of the parameters

2

•

and .

5

• Cumulative

•

•

distribution function (CDF) of Z

*In many cases, value

P(Z z) N ( z)

N(z) is provided by

(19.3)

software.

•

• CDF

P( X x) P(

X

of X

x

) N(

x

).

(19.4)

6

• When

X is normally distributed then the Moment

generating function (MGF) of X is

M x (t ) e

• *Useful

7

t t 2 2 2

(19.5)

in deriving the moment of X and moments

of log-normal distribution.

19.2 The Log-Normal Distribution

• Normally

of

and

distributed log-normality with parameters

2

• *X

Y log X

(19.6)

8

has to be a

• positive random

• variable.

• *Useful in studying

• the behavior of

• stock prices.

• PDF for

log-normal distribution

g ( x)

1

2 x

e

1

2

2

(log

x

)

2

, x 0.

(19.7)

•

•

9

*It is sometimes called the antilog-normal distribution,

because it is the distribution of the random variable X.

*When applied to economic data, it is often called “CobbDouglas distribution”.

• The rth

moment of X is

r E( X r ) E(e rY ) e

r 2 2

r

2

.

(19.8)

• From

equation 19.8 we have:

E( X ) e

2

2

,

2

(19.9)

2

Var( X ) e e [e

10

2

1].

(19.10)

The CDF of X

P( X x) P(log X log x) N (

log x

),

(19.11)

The distribution of X is unimodal with the mode

at

mode( X ) e

11

( 2 )

.

(19.12)

Log-normal distribution is NOT symmetric.

• Let x be

the percentile for the log-normal

distribution and z be the corresponding percentile

for the standard normal, then

P( X x ) P(

log x

log X

log x

) N(

z

implying

x e

.

• Also that median( X ) e , as z 0.5 0.

• so z

log x

).

(19.13)

,

(19.15)

(19.14)

• Meaning

that

median( X ) mode( X ).

12

19.3 The Log-Normal Distribution and Its

Relationship to the Normal Distribution

• Compare

PDF of normal distribution and

PDF of log-normal distribution to see that

f ( y)

f ( x)

x

• Also

from (19.6), we can see that

dx xdy

13

(19.16)

(19.17)

• CDF for

the log-normal distribution

F (a) P r(X a) P r(logX log a)

log X log a

P r(

)

(19.18)

N (d )

• Where

d

log a

(19.19)

*N(d) is the CDF of standard normal distribution

which can be found from Normal Table; it can also be

obtained from S-plus/other software.

•

14

• N(d)

can alternatively be approximated by the

following formula:

N (d ) a0 e

d2

2

(a1t a2t a3t )

2

3

(19.20)

1

1 0.33267d

a0 0.3989423, a1 0.4361936, a2 0.1201676, a3 0.9372980

•

Where

•

In case we need Pr(X>a), then we have

t

Pr(X a) 1 Pr(X a) 1 N (d ) N (d )

(19.21)

15

•

Since for any h, E( X h ) E(e hY ), the hth moment of X, the

following moment generating function of Y, which is

normally distributed.

1

t t

M Y (t ) e

2

2

2

(19.22)

For example,

X E( X ) E(eY ) M Y (1) e

E ( X ) E (e ) M Y (h) e

h

•

hY

E ( X ) ( EX ) e

16

1

2

h t 2 2

(19.23)

Hence

2

X

•

1

2

t 2 2

2

2

2 2 2

e

2 2

e

2 2

2

(e 1)

(19.24)

Fractional and negative movement of a log-normal

distribution can be obtained from Equation (19.23)

•

Mean of a log-normal random variable can be

defined as

0

2

2

(19.25)

If the lower bound a > 0; then the partial mean of x

can be shown as

•

xf ( x)dx e

0

xf ( x)dx

log( a )

f ( y)e dy e

y

2

2

N (d )

Where

(19.26)

•

17

This implies that

• partial mean of a log-normal

• = (mean of x )( N(d))

d

log(a)

19.4 Multivariate Normal and LogNormal Distributions

The normal distribution with the PDF given in

Equation (19.1) can be extended to the p-dimensional

case. Let X X 1 , , X p be a p × 1 random vector. Then

we say that X ~ N , , if it has the PDF

•

p

p

f ( x ) 2

2

1

2

1

exp x 1 x

2

• is the mean vector and

(19.27)

is the covariance matrix

which is symmetric and positive definite.

18

• Moment

generating function of X is

M x (t ) E e tx e

• Where

t t1 , , t p

1

t t t

2

(19.28)

is a p x 1 vector of real values.

• From Equation (19.28), it can be shown that

E (X ) and Cov(X )

If C is a q p matrix of rank q p.

Then CX ~ Nq C , CC. Thus, linear

transformation of a normal random vector is also

a multivariate normal random vector.

19

(1)

X (1)

X ( 2 ) ( 2 )

X

Let

,

and , where X (i ) and

(i )

are pi 1 , p1 p2 p , and ij = pi p j

The marginal distribution is also a multivariate

normal with mean vector and covariance matrix

that’s X(i) ~ N p (i) , ii . The conditional

distribution of X (1) with givens where

11

12

21

22

i

1 2 (1) 12 22 1 x (2) (2)

and

1

11 2 11 12 22 21

That is,

20

X (1) X ( 2 ) x ( 2 ) ~ N p1 1 2 , 11 2

(19.29)

(19.30)

• Bivariate

•

version of correlated log-normal

distribution.

1 11

Y1 log X 1

~

N

Y log X

,

2

2

2 21

12

22

Let

• Joint PDF of X 1and X 2 can be obtained from the

joint PDF of Y1 andY2by observing that

dx1dx2 x1 x2 dy1dy2

(19.31)

• (19.31)

is an extension of (19.17) to the bivariate

case.

• Hence, joint PDF of X𝟏 and X𝟐 is

g x1 , x2

21

1

1

exp log x1 , log x2 1 log x1 , log x2

2 x1 x2

2

(19.32)

• From

• Hence,

the property of the multivariate normal

distribution, we have

Yi ~ N i , ii

𝑿𝐢 is log-normal with

E( X i ) e

Var( X i ) e

2 i

i

ii

ii

2

,

e [e

(19.33)

ii

1].

(19.34)

22

• By

the property of the movement generating

for the bivariate normal distribution, we

have

1

2

Y Y

E X 1 X 2 Ee

1

e

exp

2

E X 1 E X 2

1

2

2

11

11 22

22

12

(19.35)

the covariance between X1 and X2 is

Cov X 1 , X 2 E X 1 X 2 E X 1 E X 2

• Thus,

E X 1 E X 2 exp 11 22 1

1

exp 1 2 11 22 exp 11 22 1

2

(19.36)

23

• From

the property of conditional normality of

𝑌1 given 𝑌2 =𝑦2 , we also see that the

conditional distribution of 𝑌1 given 𝑌2 =𝑦2 is

log normal.

Y

Y

,

,

Y

• When

where Yi log X i .

1

p

If Y ~ N p ,

where μ and ij . The joint PDF of

X 1 , , X p can be obtained from Theorem 1.

1

24

p

Theorem 1

• Let

•

the PDF of Y1 ,, Yp be f ( y ,, y ), consider the

• p-valued functions

1

p

xi xi ( y1,, y p ), i 1,, p.

(19.37)

• Assume

transformation from the y-space to

• x-space is one to one with

• inverse transformation

yi yi ( x1,, xp ), i 1,, p.

25

(19.38)

•

If we let random variables X1 ,, X pbe defined by

X i xi (Y1,,Yp ), i 1,, p.

(19.39)

Then the PDF of X1 ,, X p is

g( x1,, x p ) f y1 ( x1,, x p ),, y p ( x1,, x p )J ( x1,, x p )

•

Where J(𝑥1 ,.., 𝑥𝑝 ) is Jacobian of transformations

y1

x1

J ( x1 ,, x p ) m od

y p

x1

•

26

(19.40)

y1

x p

y p

x p

“Mod” means modulus or absolute value

(19.41)

When applying theorem 1 with

f ( y1,, y p ) being a p-variate normal and

J ( x1 ,, x p ) mod

1

x1

0

0

0

1

x2

0

1

xp

0

g ( x1 ,, x p )

(2 )

p

2

p

2

p

(

i 1

We have joint PDF of

p

1

i 1 xi

(19.42)

X1,...,X p

*when p=2, Equation (19.43) reduces to the

bivariate case given in Equation (19.32)

27

1

1

) exp log x1 , , log x p 1 log x1 , , log x p

xi

2

(19.43)

Yjij

The first two moments are

E( X i ) e

i

ii

2

,

(19.44)

Var( X i ) e 2i e ii [e ii 1].

Cor X , X exp

i

j

(19.45)

*Where ij is the correlation between Yi and Y j

28

1

ii jj exp ij ii jj 1

i j

2

(19.46)

19.5 The Normal Distribution as an

Application to the Binomial and

Poisson Distribution

• Cumulative

normal density function tells

us the probability that a random

variable Z will be less than x.

29

Figure 19-1

• *P(Z<x)

30

is the area under the normal curve

from up to point x.

• Applications

of the cumulative normal

distribution function is in valuing stock

options.

• A call

option gives the option holder the right

to purchase, at a specified price known as the

exercise price, a specified number of shares of

stock during a given time period.

• A call

31

option is a function of S, X, T, 2 ,and r

• The

binomial option pricing model in Equation

(19.22) can be written as

T

T!

k

T k

C S[

p ' (1 p ' ) ]

k m k!(T k )!

T

X

T!

k

T k

[

p

(

1

p

)

]

T

(1 r ) k m k!(T k )!

X

SB(T , p ' , m)

B(T , p, m),

T

(1 r )

*C= 0 if m>T

32

(19.47)

S = Current price of the firm’s common stock

T = Term to maturity in years

m = minimum number of upward movements in

stock price that is necessary for the option

to terminate “in the money”

Rd

uR

p

and 1 p

ud

ud

X = Exercise price (or strike price) of the option

R= 1+r = 1+ risk-free rate of return

u = 1 + percentage of price increase

d = 1 + percentage of price decrease

u

p' p

R

33

n

B(n, p, m) n C k p k (1 p) nk

k m

•

By a form of the central limit theorem, in Section

19.7 you will see T , the option price C

converges to C below

C SN(d1 ) XRT N (d 2 )

•

(19.48)

C = Price of the call option

d1

S

)

t

Xr 1 t

2

t

log(

d 2 d1 t

N(d) is the value of the cumulative standard

normal distribution

• t is the fixed length of calendar time to expiration

and h is the elapsed time between successive stock

price changes and T=ht.

•

34

• If

future stock price is constant over time,

2

then 0

It can be shown that both N (d1 ) and N (d 2 ) are

equal to 1 and that that Equation (19.48)

becomes

C S Xe

rT

(19.49)

*Equation (19.48 and 19.49) can also be

understood in terms of the following steps

35

Step 1: Future price of the stock is

constant over time

• Value

of the call option:

X

CS

.

T

(1 r )

(19.50)

X= exercise price

• C= value of the option (current price of stock –

present value of purchase price)

•

*Equation 19.50 assumes discrete compounding of

interest, whereas Equation 19.49 assumes continuous

compounding of interest.

36

*We can adjust Equation 19.50 for continuous

compounding by changing

1

(1 r) T

to

e rT

And get

C S Xe

rT

(19.51)

37

Step 2: Assume the price of the stock

fluctuates over time (St )

• Adjust

Equation 19.49 for uncertainty

associated with fluctuation by using the

cumulative normal distribution function.

•

• Assume

St from Equation 19.48 follows a log-

normal distribution (discussed in section 19.3).

38

Adjustment factors N (d1 ) and N (d 2 )in BlackScholes option valuation model are adjustments

made to EQ 19.49 to account for uncertainty of the

fluctuation of stock price.

•

Continuous option pricing model (EQ 19.48)

vs

• binomial option price model (EQ19.47)

N (d1 ) and N (d 2 ) are cumulative normal density

functions

while B(T , p, m) and B(T , p' , m) are

complementary binomial distribution functions.

•

39

Application Eq. (19.48) Example

• Theoretical

value: As of November 29, 1991, of

one of IBM’s options with maturity on April

1992.

In

this

case

we

have

X

=

$90,

S

=

$92.50,

= 0.2194, r = 0.0435, and T= =0.42 (in years).

Armed with this information we can calculate

the estimated 𝑑1 and 𝑑2 .

x

{ln(

92.5

1

) [(.0435) (.2194) 2 ](.42)}

90

2

0.392,

(.2194)(.42)

1

2

1

2

x t x (0.2194)(0.42) 0.25.

40

Probability of Variable Z between 0 and x

Figure 19-2

*In Equation 19.45, N (d1 ) and N (d1 )are the probabilities that a

random variable with a standard normal distribution takes on a value

less than d1 and a value less than d 2, respectively. The values for

the probabilities can be found by using the tables in the back of the

book for the standard normal distribution.

41

• To

find the cumulative normal density

function, we add the probability that Z is less

than zero to the value given in the standard

normal distribution table. Because the standard

normal distribution is symmetric around zero,

the probability that Z is less than zero is 0.5, so

P( Z x) P ( Z 0) P (0 Z x)

•=

42

0.5 + value from table

•

From

N (d1 ) P(Z d1 ) P( Z 0) P(0 Z d1 )

P(Z .392) .5 .1517 0.6517

N (d 2 ) P(Z d 2 ) P(Z 0) P(0 Z d 2 )

P(Z .25) .5 .0987 0.5987

•

The theoretical value of the option is

C (92.5)(.6517) [(90)(.5987)]/ e(.0435 )(.42)

60.282 53.883/ 1.0184 $7.373.

•

43

The actual price of the option on November

29,1991, was $7.75.

19.6 Applications of the Log-Normal

Distribution in Option Pricing

Assumptions of Black-Scholes formula :

No transaction costs

No margin requirements

No taxes

All shares are infinitely divisible

Continuous trading is possible

Economy risk is neutral

Stock price follows log-normal distribution

44

Sj

S j 1

exp[K j ]

*Is a random variable with a log-normal

distribution

S = current stock price

𝑆𝑗 = end period stock price

𝐾𝑗 = rate of return in period and random variable

with normal distribution

45

2

• Let Kt have the expected value k and variance k

for each j. Then K1 K 2 ... K t is a normal random

2

variable with expected value t k and variance t k .

Thus, we can define the expected value (mean) of

St

exp[K 1 K 2 ... K t ] as S

t 2

S

E(

t

S

) exp[t k

k

2

].

(19.52)

Under the assumption of a risk-neutral investor,

S

the expected return E ( S ) becomes exp(rt ) ( where r is

the riskless rate of interest). In other words,

t

k r

46

k2

2

(19.53)

In risk-neutral assumptions, call option price C

can be determined by discounting the expected

value of terminal option price by the riskless rate

of interest:

C exp[rt ]E[Max(ST X ,0)]

(19.54)

T = time of expiration and X = striking price

Max( S T X ,0) ( S (

0

ST X

)), for

S

S

for

ST

X

S

S

ST

X

S

S

(19.55)

47

Eq. (19.54) and (19.55) say that the value of the call

option today will be either St X or 0, whichever is

greater.

• If the price of stock at time t is greater than the

exercise price, the call option will expire in the money.

• In other words, the investor will exercise the call

option. The option will be exercised regardless of

whether the option holder would like to take physical

possession of the stock.

•

48

Two Choices For Investor

1.Own

Stock

St X

49

• Since

the price the investor paid (X) is lower

that the price he or she can sell the stock for

(𝑆𝑡 ), the investor realizes an immediate the

profit of St X .

• If the price of the stock (𝑆𝑡 ) the exercise price

(X), the option expires out of the money.

• This occurs because in purchasing shares of the

stock the investor will find it cheaper to

purchase the stock in the market than to

exercise the option.

50

• Let

ST

S

be log-normally

distributed with

2

t k

2

2

parameters tr 2 and t k . Then

X

C exp[rt ]E[ Max( S t X )]

X

exp[rt ]X S[ x ]g ( x)dx

S

S

exp[rt ]S X

S

• Where

of

51

X

xg ( x)dx exp[rt ]S

S

X

S

g ( x)dx

(19.56)

g(x) is the probability density function

St

Xt

S

2

2

2

tr

t

/

2

,

t

• By substituting

k

k and

Into eq. (19.18) and (19.26), we get

X

S

xg ( x)dx e N (d1 )

rt

(19.57)

X

S

X

a

S

g ( x)dx N (d 2 )

(19.58)

where

t

X

S

1

tr k2 log( )

log( ) (r k2 )t

2

S t

X

2

d1

k

t k

t k

(19.59)

S

1 2

log( ) (r k )t

X

2

d2

d1 t k

t k

52

(19.60)

• Substituting

eq. (19.58) into eq. (19.56), we get

C SN(d1 ) X exp[rt ]N (d 2 )

(19.61)

• This

53

is also Eq.(19.48) defined in Section 19.6

• Put

option is a contract conveying the right to sell

a designated security at a stipulated price.

• The relationship between a call option (C) and a

out option (P) can be shown as

C Xe rt P S

(19.62)

• Substituting

Eq. (19.33) into Eq. (19.34), the put

option formula becomes

P Xert N (d 2 ) SN(d1 )

(19.63)

*where S, C, r, t, 𝑑1 , 𝑑2 , are identical to those defined in the

call option model.

54

19.7 The Bivariate Normal Density

Function

• A joint

distribution of two variables is when in

correlation analysis, we assume a population where

both X and Y vary jointly.

• If both X and Y are normally distributed, then we

call this known distribution a bivariate normal

distribution.

55

• The

PDF of the normally distributed random

variables X and Y can be

f (X )

f (Y )

1

X

1

Y

( X X )

exp

, X

2

2

2 X

(Y Y )

exp

, Y

2

2

2 Y

(19.64)

(19.65)

X and Y are population means for X and Y,

respectively; X and Y are population standard

deviations of X and Y, respectively; 3.1416 ;and

exp represents the exponential function.

• Where

56

• If

represents the population correlation between

X and Y, then the PDF of the bivariate normal

distribution can be defined as

f ( X ,Y )

1

2 X Y 1 2

exp(q / 2), X , Y

(19.66)

• Where X 0, Y 0

1 X X

q

2

1 X

2

and 1 1,

X X

2

X

Y Y

Y

X Y

Y

2

(19.67)

57

•

It can be shown that the conditional mean of Y, given X, is

linear in X and given by

Y

E (Y | X ) Y

X

( X X )

(19.67)

This equation can be regarded as describing the population

linear regression line.

• Accordingly, a linear regression in terms of the bivariate

normal distribution variable is treated as though there were

a two-way relationship instead of an existing causal

relationship.

• It should be noted that regression implies a causal

relationship only under a “prediction” case.

•

58

• It

is also clear that given X, we can define the

conditional variance of Y as

(Y | X ) (1 )

2

Y

2

(19.68)

• Eq.

(19.66) represents a joint PDF for X and Y.

• If 0 , then Equation (19.66) becomes

f ( X , Y ) f ( X ) f (Y )

• This

(19.69)

implies that the joint PDF of X and Y is equal

to the PDF of X times the PDf of Y. We also know

that both X and Y are normally distributed.

Therefore, X is independent of Y.

59

Example 19.1

Using a Mathematics Aptitude Test to

Predict Grade in Statistics

• Let

X and Y represent scores in a mathematics

aptitude test and numerical grade in elementary

statistics, respectively.

• In addition, we assume that the parameters in

Equation (19.66) are

X 550 X 40 Y 80 Y 4

60

.7

• Substituting

this information into Equations (19.67)

and (19.68), respectively, we obtain

E (Y | X ) 80 .7(4 / 40)( X 550) 41.5 .07X

(19.70)

(Y | X ) (16)(1 .49) 8.16

2

(19.71)

61

•

If we know nothing about the aptitude test score of

a particular student (say, john), we have to use the

distribution of Y to predict his elementary statistics

grade.

95% interval 80 (1.96)(4) 80 7.84

is, we predict with 95% probability that John’s

grade will fall between 87.84 and 72.16.

• That

62

•

Alternatively, suppose we know that John’s

mathematics aptitude score is 650. In this case, we

can use Equations (19.70) and (19.71) to predict

John’s grade in elementary statistics.

E (Y | X 650) 41.5 (.07)(650) 87

And

2 (Y | X ) (16)(1 .49) 8.16

63

• We

can now base our interval on a normal

probability distribution with a mean of 87 and a

standard deviation of 2.86.

95% interval 87 (1.96)(2.86) 87 5.61

is, we predict with 95% probability that John’s

grade will fall between 92.61 and 81.39.

• That

64

• Two

things have happened to this interval.

1. First, the center has shifted upward to take into

account the fact that John’s mathematics aptitude

score is above average.

2. Second, the width of the interval has been

narrowed from 87.84−72.16 = 15.68 grade points

to 92.61-81.39 = 11.22 grade points.

• In this sense, the information about John’s

mathematics aptitude score has made us less

uncertain about his grade in statistics.

65

19.8 American Call Options

• 19.8.1

Price American Call Options by the

Bivariate Normal Distribution

• An

option contract which can be exercised only on

the expiration date is called European call.

• If the contract of a call option can be exercised at

any time of the option's contract period, then this

kind of call option is called American call.

66

• When

a stock pays a dividend, the American call is

more complex.

• The valuation equation for American call option

with one known dividend payment can be defined

as C(S , T , X ) S x [ N1(b1) N 2(a1,b1; t T )]

Xert [ N 1(b2)e r (T t ) N 2(a 2,b2; t T )] Dert N 1(b2)

• where

S

ln

X

a1

x

Sx

ln *

St

b1

67

1 2

r

T

2

, a 2 a1 T

T

1 2

r

t

2

, b 2 b1 t

t

(19.72a)

(19.72b)

(19.72c)

S x S De rt

(19.73)

x

• S represents the correct stock net price of the

present value of the promised dividend per share

(D);

• t represents the time dividend to be paid.

*

• St is the exdividend stock price for which

C(St* , T t ) St* D X

(19.74)

X, r, 2, T have been defined previously in this

chapter.

• S,

68

•

Following Equation (19.66), the probability that is less

than a and that is less than b for the standardized

cumulative bivariate normal distribution

'2

' '

'2

' '

2

x

2

x

y

y

'

'

P ( X a, Y b)

exp

dx dy

2

2

2(1 )

2 1

1

x

'

•

69

x x

a

,y

'

b

y y

Where

and p is the correlation

x

y

between the random variables x’ and y’.

• The

first step in the approximation of the bivariate

normal probability N 2 (a, b; ) is as follows:

5

5

(a, b; ) .31830989 1 2 wi w j f ( xi' , x 'j )

i 1 j 1

(19.75)

where

f ( xi' , x 'j ) exp[a1 (2xi' a1 ) b1 (2x 'j b1 ) 2 ( xi' a1 )(x 'j b1 )]

70

• The

pairs of weights, (w) and corresponding

abscissa values (x ' ) are

i, j

1

2

3

4

5

71

w

0.24840615

0.39233107

0.21141819

0.033246660

0.00082485334

x'

0.10024215

0.48281397

1.0609498

1.7797294

2.6697604

• and

the coefficients 𝑎1 and 𝑏1 are computed using

a1

• The

a

2(1 2 )

b1

b

2(1 2 )

second step in the approximation involves

computing the product ab𝜌; if ab𝜌 ≤ 0, compute

the bivariate normal probability, N 2 (a, b; ) , using

certain rules.

72

• Rules:

• (1)

•

then N 2 (a, b; ) (a, b; ) ;

• (2)

•

If a ≥0, b ≤0, and 𝜌 >0,

then N 2 (a, b; ) N1 (b) (a, b; ) ;

• (4)

•

If a ≤0, b ≥0, and 𝜌 >0,

then N 2 (a, b; ) N1 (a) (a, b; ) ;

• (3)

•

If a ≤0, b ≤0, and 𝜌 ≤0,

If a ≥0, b ≥0, and 𝜌 ≤0,

Then N 2 (a, b; ) N1 (a) N1 (b) 1 (a, b; ) .

(19.76)

73

• If

ab𝜌 > 0, compute the bivariate normal

probability,N 2 (a, b; ) ,as

N 2 (a, b; ) N 2 (a,0; ab ) N 2 (b,0; ab )

(19.77)

the values of N 2 () on the right-hand side are

computed from the rules, for ab𝜌 ≤ 0

• where

ab

( a b)Sgn(a)

a 2ab b

2

2

ba

1 Sgn (a ) Sgn (b)

4

•

a 2 2ab b 2

1

Sgn( x)

1

N1 (d ) is the cumulative univariate normal

probability.

74

( b a)Sgn(b)

x0

x0

19.8.2 Pricing an American Call Option

• An American

call option whose exercise price is

$48 has an expiration time of 90 days. Assume the

risk-free rate of interest is 8% annually, the

underlying price is $50, the standard deviation of

the rate of return of the stock is 20%, and the stock

pays a dividend of $2 exactly for 50 days.

(a) What is the European call value?

(b) Can the early exercise price predicted?

(c) What is the value of the American call?

75

(a)

The current stock net price of the present value of

the promised dividend is

S 50 2e

x

0.08(50

365

)

48.0218

The European call value can be calculated as

C (48.0218 ) N (d1 ) 48e

0.08 ( 90

365

)

N (d 2 )

where

[ln(48.208/ 48) (0.08 0.5(0.20) 2 )(90 / 365)]

d1

0.25285

.20 90 / 365

d 2 0.292 0.0993 0.15354.

76

• From

standard normal table, we obtain

N (0.25285) 0.5 .3438 0.599809

N (0.15354) 0.5 .3186 0.561014.

• So

77

the European call value is

C = (48.516)(0.599809) − 48(0.980)(0.561014)

= 2.40123.

(b) The present value of the interest income that

would be earned by deferring exercise until

expiration is

X (1 er (T t ) ) 48(1 e0.08(9050) / 365 ) 48(1 0.991) 0.432.

Since d = 2> 0.432, therefore, the early exercise is

not precluded.

78

S t*= 46.9641. An Excel program used to calculate this value is presented in Table 19-1.

(c) The value of the American call is now calculated

as

C 48.208[ N1 (b1 ) N 2 (a1 ,b1; 50 90)]

48e 0.08(90 / 365 ) [ N1 (b2 )e 0.08( 40 / 365 ) N 2 (a2 ,b2 ; 50 / 90)]

2e 0.08(50 / 365 ) N1 (b2 )

(19.78)

since both and depend on the critical exdividend

stock price , which can be determined by

C(St* ,40 / 365;48) St* 2 48

using trial and error, we find thatS t* = 46.9641.

An Excel program used to calculate this value is

presented in Table 19-1.

• By

79

S t*

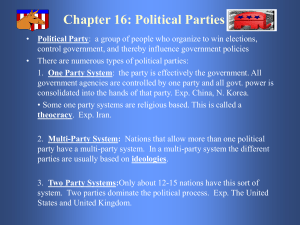

Table 19-1 Calculation of St*

• St*

80

(Critical ex-dividend stock price)

S*(critical exdividend

stock price)

46

46.962

46.963

46.9641

46.9

47

X(exercise price of option)

48

48

48

48

48

48

r(risk-free interest rate)

0.08

0.08

0.08

0.08

0.08

0.08

volalitity of stock

0.2

0.2

0.2

0.2

0.2

0.2

T-t(expiration date-exercise date)

0.10959

0.10959

0.10959

0.10959

0.10959

0.10959

d1

−0.4773

−0.1647

−0.1644

−0.164

−0.1846

−0.1525

d2

−0.5435

−0.2309

−0.2306

−0.2302

−0.2508

−0.2187

D(divent)

2

2

2

2

2

2

c(value of European call option to

buy one share)

0.60263

0.96319

0.96362

0.9641

0.93649

0.9798

p(value of European put option to

sell one share)

2.18365

1.58221

1.58164

1.58102

1.61751

1.56081

C(St*,T−t;X) −St*−D+X

0.60263

0.00119

0.00062

2.3E−06

0.03649

−0.0202

Caculation of St*(critical ex-dividend stock price)

Column C*

1*

2

3

4

5

6

7

8

S*(critical ex-dividend

46

stock price)

X(exercise price of

48

option)

r(risk-free interest

0.08

rate)

volatility of stock

0.2

T-t(expiration date=(90-50)/365

exercise date)

d1

=(LN(C3/C4)+(C5+C6^2/2)*(C7))/(C6*SQRT(C7))

9

d2

=(LN(C3/C4)+(C5-C6^2/2)*(C7))/(C6*SQRT(C7))

10

D(divent)

2

11

c(value of European

12 call option to buy one

share)

p(value of European

13 put option to sell one

share)

14

15 C(St*,T-t;X)-St*-D+X

81

=C3*NORMSDIST(C8)-C4*EXP(-C5*C7)*

NORMSDIST(C9)

=C4*EXP(-C5*C7)*NORMSDIST(-C9)C3*NORMSDIST(-C8)

=C12-C3-C10+C4

Sx = 48.208,X =$48 and St* into

Equations (19.72b) and (19.72c), we can calculate

a1, a2, b1, and b2:

a1 = d1 =0.25285.

a2 = d2 =0.15354.

• Substituting

48.208

0.2 2 50

ln(

) (0.08

)(

)

46.9641

2 365 0.4859

b1

(.20) 50 365

b2 = 0.485931–0.074023 = 0.4119.

82

• In

addition, we also know

• From

50 90 0.7454.

the above information, we now calculate

related normal probability as follows:

N1(b1)= N1(0.4859)=0.6865

N1(b2)= N1(0.7454)=0.6598

83

• Following

Equation (19.77), we now calculate the

value of N2(0.25285,−0.4859; −0.7454)and N2

(0.15354, −0.4119; −0.7454)as follows:

abρ > 0 for both cumulative bivariate normal

density function, therefore, we can use Equation N2

(a, b;ρ)= N2(a, 0;ρab)+ N2(b, 0;ρba)-δ

• Since

calculate the value of both N2(a, b;ρ)as

follows:

• to

84

ab

ba

[(0.7454)(0.25285) 0.4859](1)

(0.25285) 2(0.7454)(0.25285)(0.4859) (0.4859)

2

2

[(0.7454)(0.4859) 0.25285](1)

(0.25285) 2(0.7454)(0.25285)(0.4859) (0.4859)

2

2

0.87002

0.31979

δ =(1−(1)(−1))/4 = ½

N2(0.292,−0.4859; −0.7454)=N2(0.292,0.0844)+N2

(−0.5377,0.0656)− 0.5 = N1(0)+ N1(−0.5377)−Φ

(−0.292, 0; − 0.0844)−Φ(−0.5377,0; −0.0656)−0.5 =

0.07525

85

• Using

a Microsoft Excel programs presented in

Appendix 19A, we obtain

• N2(0.1927,

• Then

−0.4119; −0.7454)= 0.06862.

substituting the related information into the

Equation (19.78), we obtain C=$3.08238 and all

related results are presented in Appendix 19B.

86

19.9 Price Bounds for Options

19.9.1 Options Written on Nondividend- Paying

Stocks

• To

derive the lower price bounds and the put–call

parity relations for options on nondividend-paying

stocks, simply set

cost-of-carry rate (b) = risk-less rate of interest (r)

• Note that, the only cost of carrying the stock is

interest.

87

• The

lower price bounds for the European call and

put options are

c(S , T ; X ) max[0, S XerT ]

p(S , T ; X ) max[0, XerT S ]

(19.79a)

(19.79b)

respectively, and the lower price bounds for the

American call and put options are

rT

C(S , T ; X ) max[0, S Xe

rT

P(S , T ; X ) max[0, Xe

respectively.

88

]

(19.80a)

S]

(19.80b)

• The

put–call parity relation for nondividend-paying

European stock options is

c(S , T ; X ) p(S , T ; X ) S XerT

(19.81a)

and the put–call parity relation for American options

on nondividend-paying stocks is

S X C(S , T ; X ) P(S , T ; X ) S XerT

• For

(19.81b)

nondividend-paying stock options, the

American call option will not rationally be

exercised early, while the American put option may

be done so.

89

19.9.2 Options Written on DividendPaying Stocks

• If

dividends are paid during the option's life, the

above relations must reflect the stock's drop in

value when the dividends are paid.

• To manage this modification, we assume that the

underlying stock pays a single dividend during the

option’s life at a time that is known with certainty.

• he dividend amount is D and the time to exdividend

is t.

90

• If

the amount and the timing of the dividend

payment are known, the lower price bound for the

European call option on a stock is

c(S , T ; X ) max[0, S Dert XerT ]

(19.82a)

• In

this relation, the current stock price is reduced by

the present value of the promised dividend.

• Because a European-style option cannot be

exercised before maturity, the call option holder has

no opportunity to exercise the option while the

stock is selling cum dividend.

91

• In

other words, to the call option holder, the current

value of the underlying stock is its observed market

price less the amount that the promised dividend

contributes to the current stock value, that is, S Dert.

• To

prove this pricing relation, we use the same

arbitrage transactions, except we use the reduced

stock price S Dert in place of S. The lower price

bound for the European put option on a stock is

p(S ,T ; X ) max[0, XerT S Dert ]

(19.82b)

92

• In

the case of the American call option, for

example, it may be optimal to exercise just prior to

the dividend payment because the stock price falls

by an amount D when the dividend is paid.

• The lower price bound of an American call option

expiring at the exdividend instant would be 0 or ,

whichever is greater.

• On the other hand, it may be optimal to wait until

the call option’s expiration to exercise.

93

• The

lower price bound for a call option expiring

normally is (19.82a). Combining the two results,

we get

rt

C(S , T ; X ) max[0, S Xe , S De

rt

rT

Xe

]

(19.83a)

• The

last two terms on the right-hand side of

(19.83a) provide important guidance in deciding

whether to exercise the American call option early,

just prior to the exdividend instant.

• The second term in the squared brackets is the

present value of the early exercise proceeds of the

call.

94

• If

the amount is less than the lower price bound of

the call that expires normally, that is, if

S Xe rt S De rT Xe rt

(19.84)

the American call option will not be exercised just

prior to the exdividend instant.

• To see why, simply rewrite (19.84) so it reads

D X [1 e r (T t ) ]

• In

(19.85)

other words, the American call will not be

exercised early if the dividend captured by

exercising prior to the exdividend date is less than

the interest implicitly earned by deferring exercise

until expiration.

95

•

Figure 19-3 depicts a case in which early exercise could

occur at the exdividend instant, t. Just prior to exdividend,

the call option may be exercised yielding proceeds St D X,

where 𝑆𝑡 , is the exdividend stock price.

•

An instant later, the option is left unexercised with value

c(𝑆𝑡 ,T –t; X), where c is the European call option formula.

Thus, if the exdividend stock price, 𝑆𝑡 is above the critical

exdividend stock price where the two functions intersect, 𝑆𝑡∗ ,

the option holder will choose to exercise his or her option

early just prior to the exdividend instant.

∗

• On the other hand, if 𝑆𝑡 ≤ 𝑆𝑡 , the option holder will choose

to leave her position open until the option’s expiration.

•

96

Figure 19-3 *Early exercise may be optimal.

Figure 19-4 *Early exercise will not be optimal.

97

• Figure

19-4 depicts a case in which early exercise

will not occur at the exdividend instant, t.

• Early exercise will not occur if the functions, 𝑆𝑡

+ 𝐷 − 𝑋 and c(𝑆𝑡 ,T-t,X) do not intersect, as is

depicted in Figure 19-4. In this case, the lower

r (T t )

S

Xe

boundary condition of the European call, t

,

lies above the early exercise proceeds, 𝑆𝑡 + 𝐷 − 𝑋 ,

and hence the call option will not be exercised

early. Stated explicitly, early exercise is not rational

if

r (T t )

St D X St Xe

98

• This

condition for no early exercise is the same as

(19.84), where 𝑆𝑡 is the exdividend stock price and

where the investor is standing at the exdividend

instant, t.

• In words, if exdividend stock price decline, the

dividend is less than present value of the interest

income that would be earned by deferring exercise

until expiration, early exercise will not occur.

• When condition of Eq. (19.85) is met, the value of

American call is the value of corresponding

European call.

99

• In

the absence of a dividend, an American put may

be exercised early.

• In the presence of a dividend payment, however,

there is a period just prior to the exdividend date

when early exercise is suboptimal.

• In that period, the interest earned on the exercise

proceeds of the option is less than the drop in the

stock price from the payment of the dividend.

• If t 𝑛 represents a time prior to the dividend payment

at time t, early exercise is suboptimal, where

( X S )e

100

r ( t tn )

( X S D)

• Rearranging,

𝑡𝑛 and t if

early exercise will not occur between

D

ln(1

)

X S

tn t

r

(19.86)

• Early

exercise will become a possibility again

immediately after the dividend is paid. Overall, the

lower price bound of the American put option is

P(S , T ; X ) max[o, X (S Dert )]

(19.83b)

101

• Put–call

parity for European options on dividendpaying stocks also reflects the fact that the current

stock price is deflated by the present value of the

promised dividend, that is

c(S , T ; X ) p(S , T ; X ) S Dert XerT

(19.87)

• That

the presence of the dividend reduces the value

of the call and increases the value of the put is

again reflected here by the fact that the term on the

right-hand side of (19.87) is smaller than it would

be if the stock paid no dividend.

102

•

Put–call parity for American options on dividendpaying stocks is represented by a pair of inequalities,

that is

rt

rt

rT

S De X C(S , T ; X ) P(S , T ; X ) S De Xe

(19.88)

•

To prove the put–call parity relation (19.88), we

consider each inequality in turn. The left-hand side

condition of (19.88) can be derived by considering the

values of a portfolio that consists of buying a call,

selling a put, selling the stock, and lending X + 𝐷𝑒 −𝑟𝑡

risklessly. Table 19-2 contains these portfolio values

103

•

•

•

•

•

In Table 19-2, if all of the security positions stay open until

expiration, the terminal value of the portfolio will be positive,

independent of whether the terminal stock price is above or below

the exercise price of the options.

If the terminal stock price is above the exercise price, the call option

is exercised, and the stock acquired at exercise price X is used to

deliver, in part, against the short stock position.

If the terminal stock price is below the exercise price, the put is

exercised. The stock received in the exercise of the put is used to

cover the short stock position established at the outset.

In the event the put is exercised early at time T, the investment in the

riskless bonds is more than sufficient to cover the payment of the

exercise price to the put option holder, and the stock received from

the exercise of the put is used to cover the stock sold when the

portfolio was formed.

In addition, an open call option position that may still have value

104

Table 19-2 Arbitrage Transactions for Establishing

Put–Call Parity for American Stock Options

S Dert X C(S , T ; X ) P(S , T ; X )

ExDividend

Day(t)

Position

Buy American Call

Sell American Put

Sell Stock

Lend D e rt

Lend X

Net Portfolio Value

105

Initial Value

Put Exercised

Early(γ)

Intermediate

Value

Put Exercised

normally(T)

Terminal Value

~

ST X

~

−C

0

C

~

P

S

−D

Dert

−X

−C+P+S

Dert −X

D

~

(X S )

(X ST )

~

~

S

~

ST X

~

ST X

0

~

ST

ST

XerT

XerT

X (e rT 1)

X (e rT 1)

Xer

0

~

C X (e r 1)

• In

other words, by forming the portfolio of

securities in the proportions noted above, we have

formed a portfolio that will never have a negative

future value.

• If the future value is certain to be non-negative, the

initial value must be nonpositive, or the left-hand

inequality of (19.88) holds.

106

Summary

•

In this chapter, we first introduced univariate and multivariate normal distribution

and log-normal distribution.

•

Then we showed how normal distribution can be used to approximate binomial

distribution.

•

Finally, we used the concepts normal and log-normal distributions to derive Black–

Scholes formula under the assumption that investors are risk neutral.

•

•

In this chapter, we first reviewed the basic concept of the Bivariate normal density

function and present the Bivariate normal CDF.

•

The theory of American call stock option pricing model for one dividend payment

is also presented.

•

The evaluations of stock option models without dividend payment and with

dividend payment are discussed, respectively.

•

Finally, we provided an excel program for evaluating American option pricing

model with one dividend payment.

107