File - LPS Business DEPT

advertisement

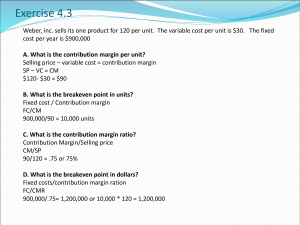

Ani spends £1000 on hiring a hall and disco. She sells 200 tickets at £6.00 each. Has she made a profit or a loss? Bradley buys a second hand bike on ebay for £200, he spends £50 doing it up and then sells back on ebay for £300. Has he made a profit or a loss? Wendy bakes 150 cupcakes using £300 worth of ingredients. She sells only 100 of them at £3.00 each. Has she made a profit or a loss? What would have happened if Wendy sold all her stock? TOPIC B.1 UNDERSTAND THE PLANNING TOOLS BUSINESSES USE TO PREDICT WHEN THEY WILL START TO MAKE A PROFIT TOPIC B.1 UNDERSTAND THE PLANNING TOOLS BUSINESSES USE TO PREDICT WHEN THEY WILL START TO MAKE A PROFIT By the end of this topic you will be able to: Define breakeven Interpret a breakeven chart Calculate breakeven Analyse and explain the importance of breakeven analysis Analyse and explain the risk of not completing a breakeven analysis Present information on a breakeven chart Analyse the effect of changes to breakeven BREAKEVEN Breakeven is when a business has enough revenue from sales to cover the costs of making the products The point at which a business is not making a profit or a loss i.e. it is just breaking even Therefore at this point total costs must be the same as total revenue TR > TC TR = TC TR < TC Can you explain these emotions? BREAKEVEN CHARTS Breakeven can be calculated by plotting the lines on a breakeven chart This makes it easy to see where the breakeven point is i.e. where Total Costs = Total Revenue Breakeven point is expressed as a number of units e.g. 2000 T-shirts BREAKEVEN CHARTS – THE BUILD UP Fixed costs stay the same and are therefore a ___________ ___________ line. £ No of items Variable costs change in relation to the number of items produced and therefore start at ____ and slope __________. £ No of items Total Costs are fixed costs plus variable costs and therefore start at the point of ______ ____and then slope upwards at the same gradient as __________ _____. £ No of items BREAKEVEN CHARTS – THE BUILD UP Total Revenue increases with the amount of units sold and therefore starts at ______ and slopes ________ . £ No of items We now have to put our cost and revenue lines together to find the breakeven point. The important 2 lines being total costs (TC) and total revenue (TR). BREAKEVEN CHARTS – THE BUILD UP TR TC Costs and revenues £ VC FC 0 Units BREAKEVEN CHARTS TR TC Costs and revenues £ Breakeven point FC 0 Units BREAKEVEN CHART Break Even Chart for T-shirts 40000 35000 30000 £ 25000 Fixed Costs Variable Costs 20000 Total Costs Revenue 15000 10000 5000 0 0 1000 2000 No of units 1. 2. 3. 4. 5. What are the fixed costs at 2000 units? What are the variable costs at 2000 units? What are the total costs at 1000 units? What is the total revenue at 3000 units? What is the breakeven level of output? 3000 USING A BREAKEVEN CHART As well as identifying costs, revenues and break even a breakeven chart can also be used to: Identify the margin of safety the difference between actual output and breakeven output Actual output – breakeven output = margin of safety BREAKEVEN CHARTS TR TC Costs and revenues £ FC 0 Units BREAKEVEN CHART Break Even Chart for T-shirts 40000 35000 30000 £ 25000 Fixed Costs Variable Costs 20000 Total Costs Revenue 15000 10000 5000 0 0 1000 2000 3000 No of units 1. What is the breakeven level of output? 2. Actual output is 3000 units. What is the margin of safety? USING A BREAKEVEN CHART As well as identifying costs, revenues, breakeven and margin of safety a breakeven chart can also be used to: Calculate profit at different levels of output Calculate loss at different levels of output BREAKEVEN CHARTS TR TC Costs and revenues £ FC 0 Units BREAKEVEN CHARTS £ TR TR3 TR3 >TC3 = Profit TC TC3 TC2 = TR2 = BEP TC1 TC1>TR1 = Loss TR1 Q1 Q2 No of items Q3 BREAKEVEN CHART Break Even Chart for T-shirts 40000 35000 30000 £ 25000 Fixed Costs Variable Costs 20000 Total Costs Revenue 15000 10000 5000 0 0 1000 2000 3000 No of units 1. 2. 3. 4. At 1500 units will the business make a profit or a loss? At 2500 units will the business make a profit or a loss? If they sell 1000 units how much profit or loss is made? If they sell 3000 units how much profit or loss is made? BREAKEVEN Why might a start-up business be satisfied if it breaks even in its first year? Statement Fixed cost is a horizontal straight line Total cost line starts at zero Breakeven point is where total revenue is equal to variable costs If TC is less than TR a business has passed breakeven point Margin of safety is to the right of breakeven If fixed costs go up and everything else stays the same breakeven point will rise True or false Explain your answer CALCULATING BREAKEVEN Breakeven can be calculated using the following formula: fixed costs selling price per unit – variable cost per unit In the examination the formula will be given to you. CALCULATING BREAKEVEN fixed costs selling price per unit – variable cost per unit A business manufactures computer desks. Fixed costs = £10 000 Variable cost per desk = £22 Selling price = £47 How many desks do they need to sell to breakeven? CALCULATING BREAKEVEN fixed costs selling price per unit – variable cost per unit A business manufactures computer desks. Fixed costs = £10 000 Variable cost per desk = £22 Selling price = £47 How many desks do they need to sell to breakeven? Step 1: £10 000 £47 - £22 Step 2: £10 000 £25 Step 3: 400 desks DRAWING A BREAKEVEN CHART A business manufactures computer desks. Fixed costs = £10 000 Variable cost per desk = £22 Selling price = £47 Draw a break even chart Step 1: Complete the table below Desks 0 200 400 600 FC VC TC TR Step 2: plot the total cost and total revenue line on graph paper Step 3: label the breakeven point QUESTION TIME 1 MARK fixed costs selling price per unit – variable cost per unit A business manufactures rocking horses. The table shows their predicted figures for the next year. £ Selling price per rocking horse 100 Variable cost per rocking horse 40 Fixed costs 12 000 How many rocking horses do they need to sell to breakeven? rocking horses BREAK EVEN Kristen runs a small business making balloon decorations for weddings, birthday and corporate events. She sells an average of 100 displays per month at a price of £90. Each balloon display costs £20 to make. She delivers them to venues costing her £1000 per month, pays an assistant a wage of £900 per month and advertises in a local paper for £150 per month. As a sole trader Kristen does not pay herself any money but is hoping to be able to take money out of the business if it makes a profit. Question time 1. What is meant by the term ‘breakeven’? (2 marks) 2. Calculate Kristen’s breakeven point. (4 marks) 3. Will Kristen be able to take some money out of the business? Justify your answer. (3marks) IMPORTANCE OF BREAKEVEN ANALYSIS TO BUSINESSES WHEN PLANNING FOR SUCCESS Prior to trading an entrepreneur may draw a break even chart or calculate breakeven to help see if their proposal is feasible i.e. how many units will they need to sell to breakeven This can then be compared to predicted sales estimated from market research If predicted sales is greater than breakeven point they may then consider by how much Help identify and track costs Identify where costs can be reduced e.g. change suppliers Can calculate predicted profit or loss Can help make decisions about what price to charge RISK OF NOT COMPLETING BREAKEVEN ANALYSIS Will not know how many items need to be sold to breakeven Difficult to set targets Will not know margin of safety Costs may be higher than revenue May be hard to raise finance, a bank manager may want a business to prove it can reach break even point Decisions re price may be wrong as ill informed VARIABLES CHANGE! A breakeven chart shows costs and revenues but what happens if theses change? What variables might change? Fixed Costs Variable Costs Landlord puts rent up Bank changes interest rates Management want pay increase Raw materials change in price Minimum wage is increased Utility companies change price Selling Price New competition therefore forced to lower price Positive word of mouth puts demand up Work in pairs to explain what would happen to breakeven in each instance. BREAKEVEN CHARTS – CHANGING VARIABLES – WHAT WOULD HAPPEN IF FIXED COSTS ROSE? TR TC Costs and revenues £ FC 0 Units BREAKEVEN CHARTS – CHANGING VARIABLES – RISE IN FIXED COSTS TR TC Costs and revenues £ FC 0 Units BREAKEVEN CHARTS – CHANGING VARIABLES – WHAT WOULD HAPPEN IF VARIABLE COSTS FELL? TR TC Costs and revenues £ FC 0 Units BREAKEVEN CHARTS – CHANGING VARIABLES – VARIABLE COSTS FALL TR TC Costs and revenues £ FC 0 Units BREAKEVEN CHARTS – CHANGING VARIABLES – WHAT WOULD HAPPEN IF THERE WAS A NEW COMPETITOR AND PRICE WAS LOWERED? TR TC Costs and revenues £ FC 0 Units BREAKEVEN CHARTS – CHANGING VARIABLES – LOWER PRICE TR TC Costs and revenues £ FC 0 Units TOPIC B.1 UNDERSTAND THE PLANNING TOOLS BUSINESSES USE TO PREDICT WHEN THEY WILL START TO MAKE A PROFIT You have now completed this topic, are you able to? Be able to define breakeven Interpret a breakeven chart Calculate breakeven Analyse and explain the importance of breakeven analysis Analyse and explain the risk of not completing a breakeven analysis Present information on a breakeven chart Analyse the effect of changes to breakeven Try the test yourself quiz number 3