2012 WINDY CITY

SUMMIT

I N T E R E S T R AT E S WA P S

P R E S E N TAT I O N

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

I N T E R E S T R AT E S W A P S

Table of Contents

• Derivatives Overview

– Derivatives and Interest Rate Risk

• The Interest Rate Swap

– What is it?

– Purpose and Functionality

• Swaps and Me…

– Why should today’s borrower consider it?

• Other Types of Protection

– Caps and Collars

• Where’s the Crystal Ball?

– Historical and expected rates

• Q&A

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

2

D E R I VAT I V E S

OVERVIEW

I N T E R E S T R AT E S W A P S

Derivatives—What are They?

– Derivatives are financial instruments whose value is derived from

another "underlying" financial security.

– An interest rate derivative gains or loses value based on the movements

of a specific interest rate index (U.S. Dollar Prime, LIBOR, Fed Funds,

Treasury yields, etc.).

• There are two broad categories of derivative products:

– Exchange-traded products

– Often used by traders & speculators (and dealers looking to balance

their books)

– Standardized contract sizes & terms

– Not typically used for customized hedging solutions

– Over-the-counter (OTC) products

– Developed to meet hedging demand by companies & investors

– Customized contracts between 2 counterparties

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

4

I N T E R E S T R AT E S W A P S

Derivatives—Growth in the OTC Market

Source: BIS

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

5

I N T E R E S T R AT E S W A P S

Derivatives—Why? One word—RISK!

• Example of interest rate exposure on a $100 million, 10-year

financing. The present value

of every basis point change in interest

10 YEAR UST

rates prior to locking the rate

is worth

June 1995

- Current about $82,000!

8.00%

Increase of $10.4mm in interest

cost in six weeks (127bps * $82k)

7.00%

6.00%

5.00%

4.00%

3.00%

Decrease of $12.1mm in interest

cost in four months (148bps * $82k)

2.00%

0

1

2

3

4

5

0

1

2

3

4

95

96

97

99

95

96

97

98 998

99

00

00 /2 00

00 /2 00

00 /2 00

00 /2 00

00 /2 00

19

19

19

1

19

19

19

19

19

19

2

2

2

2

2

2

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

6

4

3

2

1

15

13

12

11

10

6/9 12/8

6/8 12/7

6/7 12/6

6/6 12/5

6/4 12/3

6/3

6/1 12/

6/1 12/

6/1 12/

6/1 12/

6/1 12/

Source: Chatham Financial

10-Year UST

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

6

I N T E R E S T R AT E S W A P S

Interest Rate Markets

Term Structure of Interest Rates:

• When you hear “interest rates moved lower today” – which

rates are being discussed??

– Short-term deposit rates?

– Intermediate maturity rates?

– Long-term mortgage rates?

• Interest rates differ across the maturity spectrum due to:

– Liquidity

– Market expectations

• Concept known as the “Yield Curve”

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

7

I N T E R E S T R AT E S W A P S

Source: Wintrust Financial

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

8

THE INTEREST

R AT E S W A P

I N T E R E S T R AT E S W A P S

What is an OTC Interest Rate Swap?

• An agreement between two parties in which one party agrees

to pay a fixed rate of interest and the other agrees to pay a

floating rate of interest on an agreed upon notional amount

– No principal changes hands, simply an exchange (“swap”) of interest

payments for a set period of time

– Swap rate is derived from market expectations

– The FIXED rate is the Present Value of Expected Future FLOATING

rates

– LIBOR is the foundation of the swap market

Fixed Rate

Party B

Party A

LIBOR

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

10

I N T E R E S T R AT E S W A P S

How Does an Interest Rate Swap Work?

• Overview: Interest rate swaps allow borrowers to effectively

lock-in an interest rate on an existing or future variable rate

financing

• Method: Separate contract from the loan that effectively fixes

the rate by creating a stream of cash flows that perfectly offsets

any rise in rates

• Cost: There are no incremental fees associated with the

interest rate swap

Fixed Rate

Borrower

Floating Rate

Bank

Floating Rate

Loan

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

11

I N T E R E S T R AT E S W A P S

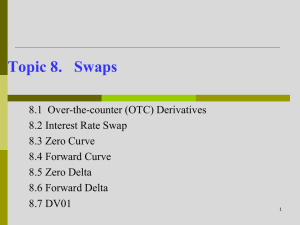

How are Swap Rates Determined?

• How does the market demand what the proper fixed rate is for

an interest rate swap?

• A swap is simply an exchange of cash flows: therefore, the

party paying a fixed rate should demand a rate that is, on a

present value basis, the average of the market’s expected

floating rate settings over the term of a particular swap

contract.

• One mechanism for predicting the future path of rates is by

observing the interest rate futures market.

– In general, 3-month LIBOR serves as a baseline rate for calculating

an interest rate swap’s fixed rate.

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

12

I N T E R E S T R AT E S W A P S

LIBOR is the Foundation of the Swap Market

London Inter-Bank Offered Rate:

– Rate at which banks lend to one another for various terms

– Resets each day at 11:00 a.m. (London time) based on average of

16 contributor banks

– 3-Month LIBOR = Fed Funds + 0.25%* (historical avg.)

– Prime = 3-Month LIBOR + 2.75%* (historical avg.)

– Any variations in OTC structures (1-month LIBOR, Prime, etc.) are

taken into account by calculating a specific spread, or “basis”, to the

3-month LIBOR futures market

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

13

I N T E R E S T R AT E S W A P S

How is the Fixed Swap Rate Determined?

• Fixed rates are derived from the present value average of the market’s expectation of future floating

rates over a given term

• If the market’s prediction of rates is CORRECT, there is no difference between paying fixed or

paying floating on the same notional

• If the market’s prediction of rates is NOT CORRECT, the swap will gain or lose value

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

14

I N T E R E S T R AT E S W A P S

• Valuation of an Interest Rate Swap

• At inception, the swap has no value because the swap rate

represents the average of what the market believes variable

rates will be over the life of the swap

• As rates change, the swap will begin to take on or lose value

• If the swap holder needs to break the contract before maturity,

it may be subject to breakage provisions:

– Rates Rise: Replacement Swap Rate > Actual Swap Rate, swap is

an asset to the swap holder. The swap holder will receive payment

from the Counterparty for the value of the swap.

– Rates Fall: Replacement Swap Rate < Actual Swap Rate, swap is a

liability to swap holder. The swap holder will make a payment to the

Counterparty for the value of the swap.

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

15

S WA P S A N D M E …

I N T E R E S T R AT E S W A P S

• What are the Benefits of an Interest Rate Swap?

– Flexibility:

• All or a portion of the term

• All or a portion of the notional

– Duration:

• Longer term financing available

– Certainty:

• Known debt service costs

– Bi-lateral Prepayment:

• Retain benefit if rates rise

• Prepayment often less than traditional yield maintenance if rates fall

– Core-Competency:

• Swaps allow borrowers to focus on their “line of business” and not fluctuations in the

interest rate markets

– Current Rate Environment:

• Swaps allow borrowers to take advantage of below-market rates when compared to

traditional fixed loan rates

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

17

I N T E R E S T R AT E S W A P S

• What Types of Debt can be Hedged?

• Over-the-counter Interest Rate hedging products are

customized contracts

– Provide great flexibility to borrower

– Loan amortization characteristics can be matched in a derivative

hedge contract:

•

•

•

•

•

•

Construction loans

Forward Starting

Irregular/ uncertain draw schedule

Permanent financing

Monthly, quarterly, or semi-annual payments

Mortgage, Hybrid, Straight-line, I/O, Custom amortization

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

18

OTHER TYPES OF

PROTECTION

I N T E R E S T R AT E S W A P S

• Other Types of Hedging Products

• An interest rate CAP will:

– Guarantee the borrower a maximum fixed rate, yet allow the

borrower to retain the properties of a floating rate loan under a

specific strike rate

– Cost the borrower a premium to purchase, paid upfront

– Be most cost-effective for terms under 5 years and/or when

providing “worst case” disaster protection at a high cap strike rate

• An interest rate COLLAR will:

– Guarantee the borrower a maximum fixed rate, yet also require the

borrower to pay a certain minimum rate (even if market rates fall

below this pre-determined floor strike rate)

– Help or fully offset the cost of a cap by borrower selling a floor to

Bank

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

20

I N T E R E S T R AT E S W A P S

• What is an Interest Rate Cap?

• Example of a $5MM Cap struck at 1.25%

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

21

W H E R E ’ S T H E C R Y S TA L

BALL?

I N T E R E S T R AT E S W A P S

Source: WSJ

Historical Average (since 1989) = 3.9219%

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

23

I N T E R E S T R AT E S W A P S

Source: Wintrust Financial

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

24

I N T E R E S T R AT E S W A P S

Source: FRB

Historical Average (since 2000) = 3.8737%

Copyright 2012 Wintrust Financial Corporation. All Rights Reserved.

25

QUESTIONS?