Bonds Lecture PowerPoint

advertisement

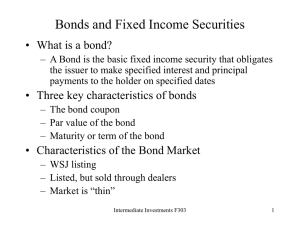

Personal Finance Bennie Waller wallerbd@longwood.edu 434-395-2046 Longwood University 201 High Street Farmville, VA 23901 Bennie D Waller, Longwood University Bonds Bennie D Waller, Longwood University BONDS Used to raise capital instead of giving up ownership Generally lower return, but also lower risk Source of steady income Price of bond - credit quality and duration Provide diversification Safe investment if held to maturity Interest rate risk Purchasing power risk (inflation) Default or business risk Liquidity risk Call risk (investopedia.com) Bennie D Waller, Longwood University BONDS Bond - A debt investment in which an investor loans money to an entity (corporate or governmental) for a given period at fixed rate. Bonds are used by companies, municipalities, states and U.S. and foreign governments to raise capital (money). Par Value (Face Value) –The dollar amount assigned to a security when first issued. Generally $1,000 for corporate issues. Coupon – interest to be paid and stated on a bond when it's issued. It is called a "coupon" because some bonds literally have coupons attached to them. This is less common today as more records are kept electronically. Coupon Rate = Coupon Payment / Par Value Maturity Date - The date on which principal is to be repaid Bennie D Waller, Longwood University (Investopedia.com) BONDS Example: 10% annual coupon bond with 30 year maturity 1 -1000 100 2 3 100 100 4 100 Bennie D Waller, Longwood University 28 29 30 100 100 100 +1000 BONDS Bond Prices are inversely related to interest rates Bonds sell at par when: coupon rate = market rate Bonds sell below par when: coupon rate < market rate Bonds sells above par when: coupon rate > market rate Premium Bond - If a bond's price is higher than its par value it is selling at a premium; this occurs because the bond’s interest (coupon) rate is higher than current market rates Discount Bond - A bond that is currently trading for less than its par value. The term "discount" means that the price is par. This occurs when the coupon rate is less than current market rate. Bennie D Waller, Longwood University Bonds Because bonds are contractual in nature, changes in the interest rate will impact their value prior to the bond’s maturity. A 10% annual coupon bond with 30 year maturity was purchased 5 years ago It has 25 years remaining. If the bond were to be sold, its value is dependent upon current interest rates (assuming the companies credit worthiness remains constant). Value of bond if current market rate is same as coupon rate Bennie D Waller, Longwood University Time Value of Money PV = 1000 FV = 1000 N = 25 I = 10 PMT= 100 Bennie D Waller, Longwood University Time Value of Money Value if market rates increase to 12% PV = 843.13 FV = 1000 N = 25 I = 12 PMT= 100 Bennie D Waller, Longwood University Time Value of Money Value if market rates decrease to 8% PV = 1213.50 FV = 1000 N = 25 I = 12 PMT= 100 1213.50 Bennie D Waller, Longwood University BONDS Coupon rate > market rate, so bond will sell at premium Coupon rate = market rate Coupon rate < market rate, so bond will sell at discount Source:bogleheads.org/wiki/Bond_Pricing Bennie D Waller, Longwood University Bonds Another example Bennie D Waller, Longwood University Time Value of Money Example: A $1,000 par value bond pays interest of $35 each quarter and will mature in 10 years. If your nominal annual required rate of return is 12 percent with quarterly compounding, how much should you be willing to pay for this bond? PV = 1115.57 FV = 1000 N = 40 I = 12/4=3 PMT= 35 Bennie D Waller, Longwood University BONDS Example Assume that you are considering the purchase of a $1,000 par value bond that pays interest of $70 each six months and has 10 years to go before it matures. If you buy this bond, you expect to hold it for 5 years and then to sell it in the market. You (and other investors) currently require a nominal annual rate of 16 percent, but you expect the market to require a nominal rate of only 12 percent when you sell the bond due to a general decline in interest rates. How much should you be willing to pay for this bond? Example Bennie D Waller, Longwood University BONDS 5 years of semi-annual coupon payments at $70. 5 10 -1000 12% $1,000 rate in 5 years This is a two step problem. First we solve for the value of the bond in 5 years, when we plan to sell it. We know that the bond will be worth 1,000 at maturity, we know the coupon payment is $70 every six months and we know there will be 5 years (10 periods) until the bond matures (5 years from now) and we know that market rates are expected to be 12% annually when we sell. Value of Bond in 5 years If the above assumptions are correct, I should be able to sell the bond for 1073.60 in five years. Calculator Example Bennie D Waller, Longwood University Time Value of Money PV = 1073.60 FV = 1000 N = 10 I = 12/2=6 PMT= 70 Bennie D Waller, Longwood University BONDS 5 years of semi-annual coupon payments at $70. 5 Price of Bond today 16% required rate to invest 10 $1,073.60 – Value in 5 years Next we determine the price (value) of the bond given, our current required return of 16% and the expected selling price of $1,073.60 in five years. Calculator Example Bennie D Waller, Longwood University Time Value of Money PV = 966.99 FV = 1073.60 N = 10 I = 16/2=8 PMT= 70 Bennie D Waller, Longwood University BONDS Zero-coupon bond - A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value. Example: A 30 year, zero coupon bond that sold for 231.38 today would yield a 5% return, if purchased today and held until maturity. Example Bennie D Waller, Longwood University Time Value of Money PV = 231.38 FV = 1000 N = 30 I =5 PMT= 0 Bennie D Waller, Longwood University BONDS Current yield – ratio of the annual interest payments over price Yield to Maturity –is the rate earned by an investor who buys the bond and holds it until maturity. Yield to maturity is simply the discount rate at which the sum of all future cash flows from the bond are equal to the price of the bond. Yield to call - The yield of a bond or note if you were to buy and hold the security until the call date. This yield is valid only if the security is called prior to maturity. The calculation of yield to call is based on the coupon rate, the length of time to the call date and the market price. Bonds that are called typically will pay a call premium. Why would a company call their bonds? For the same reason that people refinance their homes when rates go down? Bennie D Waller, Longwood University BONDS Example: Palmer Products has outstanding bonds with an annual 8 percent coupon. The bonds have a par value of $1,000 and a price of $865. The bonds will mature in 11 years. What is the yield to maturity on the bonds? Bennie D Waller, Longwood University BONDS Example A corporate bond matures in 14 years. The bond has an 8 percent semiannual coupon and a par value of $1,000. The bond is callable in five years at a call price of $1,050. The price of the bond today is $1,075. What are the bond’s yield to maturity and yield to call? Bennie D Waller, Longwood University Time Value of Money Yield To Maturity or YTM I = 3.57x2=7.14 FV = 1000 N = 28 PV = -1,075 PMT= 80/2=40 Bennie D Waller, Longwood University Time Value of Money Yield To Call or YTC I = 3.52x2=7.05 FV = 1050 N = 10 PV = -1,075 PMT= 80/2=40 Bennie D Waller, Longwood University Bonds Treasury Bonds Risk free (default) Not callable Lower rate (but lower risk) Most are exempt from taxes Municipal Bonds Issued by states, counties, public agencies Junk Bonds (High yield) – bonds with agency rating BB or below. This bonds are very risky, may be considered speculative. Bennie D Waller, Longwood University Bonds Bond Ratings – measure of financial stability Moody’s and Standard & Poor’s provide ratings on corporate and municipal bonds. Ratings involve a judgment about a bond’s future risk potential. The poorer the rating, the higher the rate of return demanded by investors. Safest bonds receive AAA, D is extremely risky. Bennie D Waller, Longwood University Bonds Bennie D Waller, Longwood University Mutual Funds Mutual fund—an investment that raises from investors, pools the money, and invests it in stocks, bonds, and other investments. Each investor owns a share of the fund proportionate to his/her investment. A mutual fund pools money from investors with similar financial goals. You are investing in a diversified portfolio that’s professionally managed according to set goals. Investment objectives are clearly stated. Bennie D Waller, Longwood University Mutual Funds Advantages of mutual funds: Professional management Minimal transaction costs Liquidity Flexibility Service Avoidance of bad brokers Disadvantages of mutual funds: Lower-than-market performance Costs Risks You can’t diversity away a market crash Taxes Bennie D Waller, Longwood University Stock Mutual Funds • Aggressive growth funds • Small company growth funds • Growth funds • Growth-and-income funds • Sector funds • Index funds • International funds Bennie D Waller, Longwood University Balanced Mutual Funds • Tries to balance objectives of long-term growth, income, and stability • Hold both common stock and bonds and sometimes preferred stock • Aimed at those needing income to live on and moderate stability in their investment • Less volatile than stock mutual funds Bennie D Waller, Longwood University Bond Funds • Mutual funds that invest primarily in bonds • Fluctuate in value with market interest rates • Use for small amounts of money, to keep investments liquid • Otherwise, use individual bonds where there is no professional management or fees Bennie D Waller, Longwood University Thank You Bennie D Waller, Longwood University