14. Externalities

advertisement

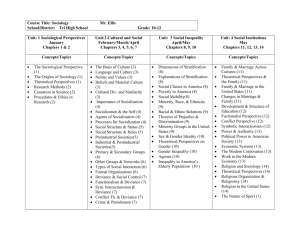

14. Externalities Varian, Chapter 33 Types of externalities • Consumption externalities – Consumption of a good by agent A has a direct impact on agent B’s utility – E.g., smoking, loud music, tidy garden, etc. • Production externalities – Actions by agent A have a direct impact on agent B’s production possibilities – E.g., bee-keeper and apple orchard, polluting firm and fisherman, etc. Missing markets wBx Person B The endowment point is not Pareto efficient. Allowing trade permits a Pareto improvement y wBy Contract curve Endowment wAy Person A wAx x Room-mates • 2 agents A and B • There are two “goods”: – Stuff – i.e., money: mA and mB : Endowments = $100 – Smoke – concentration: 0 ≤ s ≤ 1 • A is a smoker: uA(mA,s) • B is a non-smoker: uB(mB,t), where t = 1-s • Note: s + t = 1 Edgeworth box B’s money s Smoke Person A A’s money m Person B Rights and endowments B’s money Person B s If B has the right to a smoke-free environment, endowment is at Smoke Person A m A’s money $100 Smokers’ rights B’s money Person B s If A has the right to smoke as much as he wants, endowment is at Smoke Person A m A’s money $100 Neither endowment is necessarily Pareto efficient Person B B’s money s Smoke Person A m A’s money $100 Paying to smoke B’s money Person B s Allow trade, or make A pay B per unit of smoke Contract curve Smoke Person A m A’s money $100 Paying for clean air B’s money s Contract curve Smoke Person A Allow trade, or make B pay A per unit of smoke reduction m A’s money $100 Person B A and B care about who gets the property rights! B’s money s Pareto set Smoke Person A m A’s money $100 Person B Quasi-linear preferences B’s money s s* Smoke Person A Pareto set m A’s money $100 Person B The Coase Theorem • Coase Theorem: If – property rights are well-defined, – bargaining over the externality is possible • with sufficiently low transaction costs – the outcome will be efficient • When preferences are quasi-linear, the allocation of property rights has no impact on the equilibrium quantity of smoke (s*) Using demand curves • Let’s assume quasi-linear preferences • A’s utility: uA(m,s) = mA + v(s) • A’s marginal benefit from smoke is v’(s) • B’s utility: uB(mB,t) = mB + w(t) • B’s marginal benefit of less smoke is w’(t) Example: smoking • A’s utility: uA(m,s) = mA + ln(s) • mA = 50 • B’s utility: uB(mB,t) = mB + 2ln(t) • mB = 150 • What are equilibrium s, t, mA, and mB if A has the right to smoke as much as he wants? • What if B has the right to clean air? Agent A Agent B w(t) v(s) Slope = marginal utility of less smoky air Slope = marginal utility of smoky air t s w’(t) v’(s) s t Marginal costs and benefits • Pareto efficiency requires v’(s) = w’(t) A’s marginal benefit Looks like a demand curve B’s marginal cost of smoke Looks like a supply curve Pigouvian tax on smokers 0 s s* 1-s=t 1 Pigouvian tax • Definition: A tax on activities with negative externalities • Double benefit – Reduce harm from negative externalities – Fund useful government spending • Especially beneficial when Coase theorem does not apply Example: smoking • A’s utility: uA(m,s) = mA + ln(s) • mA = 50 • B’s utility: uB(mB,t) = mB + 2ln(t) • mB = 150 • ‘what sort of government tax on smoking x would lead to an efficient outcome? • What are mA and mB in this outcome? Allocating pollution amongst firms • Suppose one unit of pollution is to be allocated between two firms Firm A’s marginal benefit Firm B’s marginal benefit Pigouvian tax on pollution 0 s s* 1-s 1 Pollution permits • If A has all the permits, it sells 1-s* to B, at price p* Firm A’s marginal benefit Firm B’s marginal benefit • If B has all the permits, it sells s* to A, at p* p* • Only difference is which firm earns the profits from permit sales 0 s s* 1-s 1 Why don’t people cooperate? • Two firms could merge so as to internalize the costs they impose on each other • Room-mates can agree on smoking limits, or switch partners • But there may be transactions costs that limit agents’ ability to trade – E.g., if the market is one-sided – one polluter and many pollutees