Class 15. The Central Limit Theorem

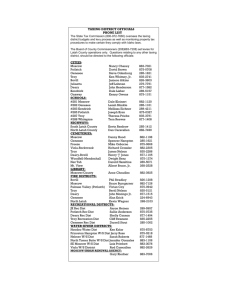

advertisement

Class 15. The Central Limit P 288 Theorem Sprigg Lane Confidence Interval for the mean If you know 𝑋𝑛 and s There is a 95% probability this interval will cover μ. 95% confidence interval for μ 𝑠 𝑋𝑛 ∓ 𝑡. 𝑖𝑛𝑣. 2𝑡(0.05, 𝑑𝑜𝑓) × 𝑛 Before Weights. Changing Counts Mean 82.36 Standard Error 0.61 Standard Deviation 5.184 Sample Variance 26.875 Count 72 t.inv.2t(.05,count-1) 1.99 Confidence Level(95.0%) 1.218 Standard error goes down with 1/ 𝑛 82.36 1.64 5.18 26.87 10 2.26 3.708 82.36 1.16 5.18 26.87 20 2.09 2.426 82.36 0.82 5.18 26.87 40 2.02 1.658 82.36 0.58 5.18 26.87 80 1.99 1.154 In this example, we kept sample mean and sample standard deviation constant. 82.36 0.16 5.18 26.87 1000 1.96 0.322 2T inv t-value goes down as dof goes up…slowly. Confidence interval gets narrower with n. Hypothesis Tests • Hypotheses about p’s – – – – Binomial (she’s guessing) Normal approximation when n is big (Wunderdog) CHI-squared goodness of fit (Roulette Wheel) CHI-squared independence (Supermarket Survey) • Hypotheses about means – – – – – One-sample z-test (IQ μ=100 with σ=15) One-sample t-test (IQ μ=100) Two-sample t-test (heights μM = μF) Two-sample paired t-test (Weight before and after) ANOVA single factor (heights for three IT groups) Using Excel function to calculate pvalues • • • • =norm.dist(X,μ,σ,true) =norm.s.dist(Z,true) =t.dist(T,dof,true) =chisq.dist(chi2,dof,true) The first four are LEFT TAIL • =t.dist.2t(T,dof) • =t.dist.rt(T,dof) • =chidist(chi2,dof) • =chisq.dist.rt(chi2,dof) The last three are RIGHT TAIL Sprigg Lane • Sprigg Lane is an Investment Company • The Bailey Prospect is the site of a potential well that has a 90% probability of natural gas. • Federal Tax laws were recently changed to encourage development of energy. • The Bailey prospect will be packaged with 9 other similar wells – Sprigg Lane plans to sell a large portion of the package to outside investors. Bailey Prospect Uncertainties • Total Well Cost – $160K +/- $5,400 (95% probability, normal) • Enough Gas there to proceed? – P=0.9 • Initial Amount in million cubic feet? – lognormal(33,4.93) • Btu content? – 1055 to 1250 with 1160 most likely (BTU per cubic feet) • Production Decline Rate multiplier – .5 to 1.75 with 1 most likely • Average Inflation (affecting costs and future gas prices) – Normal(0.035,0.005) Best-Guess Valuation Analysis Agenda • Analyze the riskiness of the baily prospect project – Replace each of the six uncertainties with a probability distribution – Find out the resulting probability distribution of NPV. • Analyze the riskiness of a 1/10th share of an investment package of ten wells. – This will be the distribution of a sample average of ten NPVs. Summary: The properties of the NPV of the Bailey prospect NPV is a random variable The mean is The standard deviation is The distribution is 𝑋𝑛 is a random variable $82,142 The same $77,430 $77,430/ 10 Weird and not normal Close to normal The probability distribution of NPV The probability distribution of 1/10th share of ten “identical” wells Central Limit Theorem P 288 In selecting simple random samples of size n from a population, the sampling distribution of the sample mean 𝑋 can be approximated by the normal distribution as the sample size becomes large. Implications of the CLT If the population (underlying probability distribution) is normal, our tests of hypotheses about means WORK FINE. If the population (underlying probability distribution) is NOT normal, our tests will still work fine if n is big (>30 is a rule of thumb).