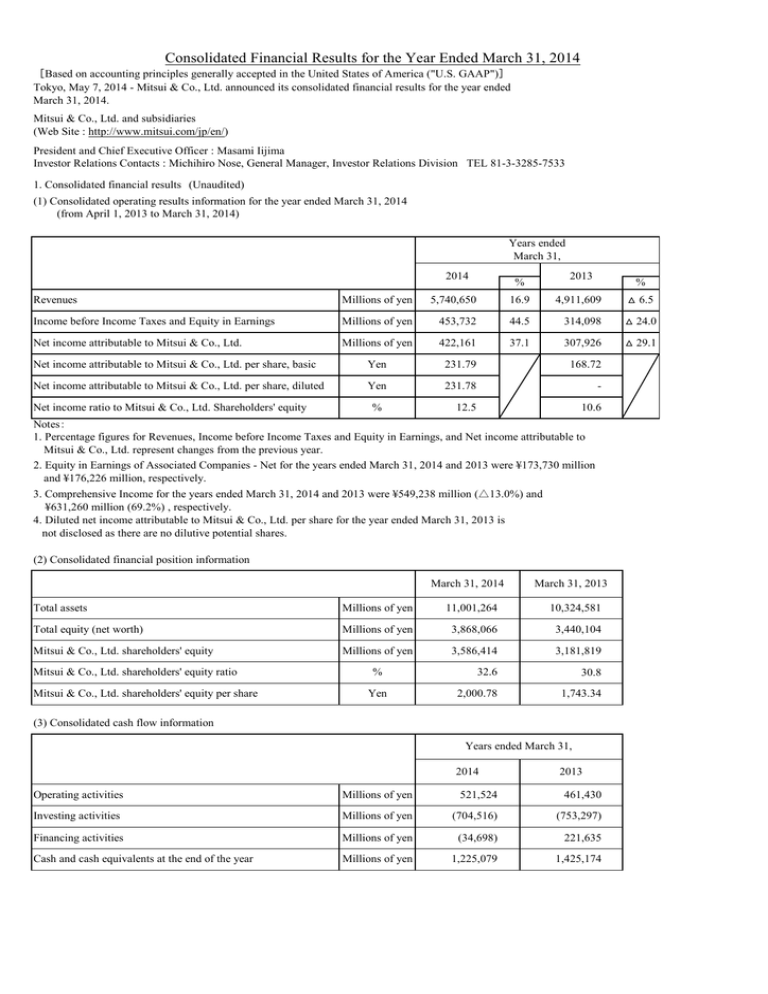

Consolidated Financial Results for the Year Ended March 31

advertisement