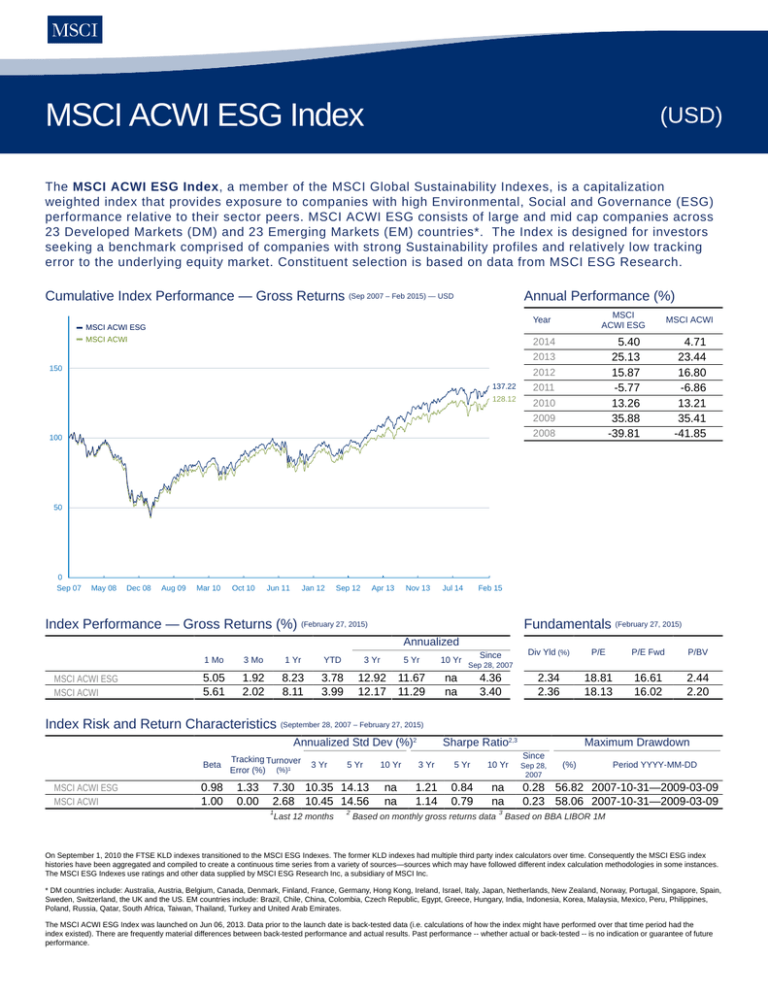

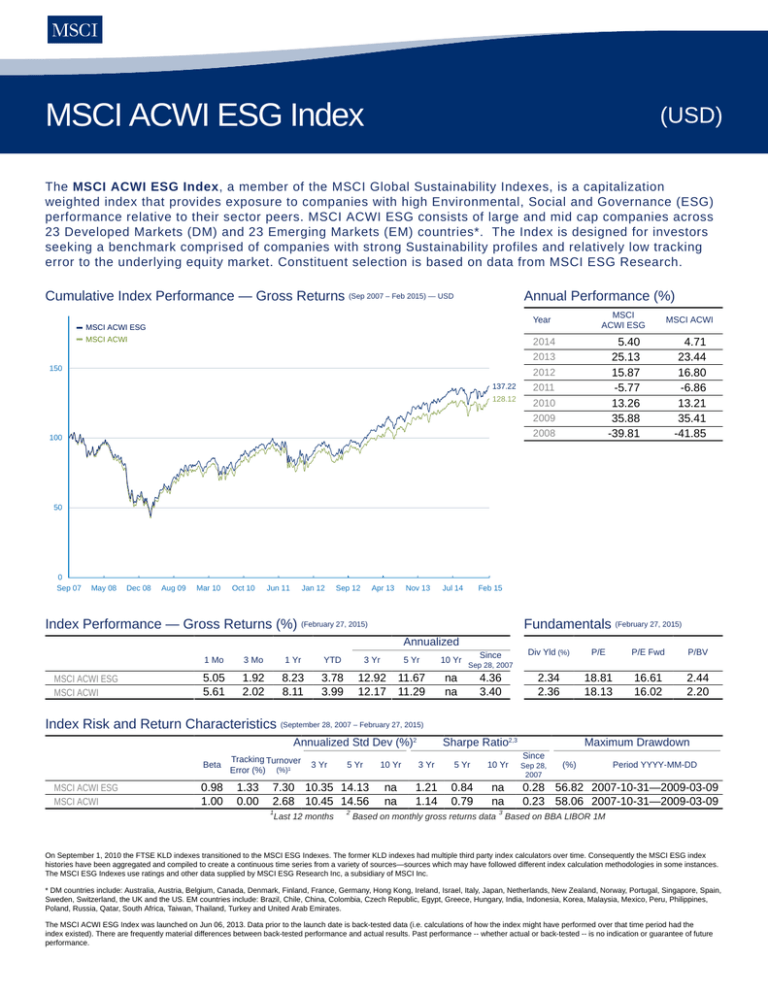

MSCI ACWI ESG Index

(USD)

The MSCI ACWI ESG Index, a member of the MSCI Global Sustainability Indexes, is a capitalization

weighted index that provides exposure to companies with high Environmental, Social and Governance (ESG)

performance relative to their sector peers. MSCI ACWI ESG consists of large and mid cap companies across

23 Developed Markets (DM) and 23 Emerging Markets (EM) countries*. The Index is designed for investors

seeking a benchmark comprised of companies with strong Sustainability profiles and relatively low tracking

error to the underlying equity market. Constituent selection is based on data from MSCI ESG Research.

Cumulative Index Performance — Gross Returns (Sep 2007 – Feb 2015) — USD

Annual Performance (%)

Year

MSCI ACWI ESG

MSCI ACWI

MSCI

ACWI ESG

MSCI ACWI

5.40

25.13

15.87

-5.77

13.26

35.88

-39.81

4.71

23.44

16.80

-6.86

13.21

35.41

-41.85

2014

2013

150

2012

137.22

2011

128.12

2010

2009

2008

100

50

0

Sep 07

May 08

Dec 08

Aug 09

Mar 10

Oct 10

Jun 11

Jan 12

Sep 12

Apr 13

Nov 13

Jul 14

Feb 15

Index Performance — Gross Returns (%) (February 27, 2015)

Fundamentals (February 27, 2015)

Annualized

MSCI ACWI ESG

MSCI ACWI

1 Mo

3 Mo

1 Yr

YTD

3 Yr

5 Yr

10 Yr

5.05

5.61

1.92

2.02

8.23

8.11

3.78

3.99

12.92

12.17

11.67

11.29

na

na

Since

Div Yld (%)

P/E

P/E Fwd

P/BV

4.36

3.40

2.34

2.36

18.81

18.13

16.61

16.02

2.44

2.20

Sep 28, 2007

Index Risk and Return Characteristics (September 28, 2007 – February 27, 2015)

Annualized Std Dev (%)2

Beta

MSCI ACWI ESG

MSCI ACWI

0.98

1.00

Tracking Turnover

Error (%) (%)1

1.33

0.00

3 Yr

5 Yr

7.30 10.35 14.13

2.68 10.45 14.56

1

Last 12 months

2

Sharpe Ratio2,3

10 Yr

3 Yr

5 Yr

10 Yr

na

na

1.21

1.14

0.84

0.79

na

na

Based on monthly gross returns data

3

Maximum Drawdown

Since

Sep 28,

2007

(%)

Period YYYY-MM-DD

0.28 56.82 2007-10-31—2009-03-09

0.23 58.06 2007-10-31—2009-03-09

Based on BBA LIBOR 1M

On September 1, 2010 the FTSE KLD indexes transitioned to the MSCI ESG Indexes. The former KLD indexes had multiple third party index calculators over time. Consequently the MSCI ESG index

histories have been aggregated and compiled to create a continuous time series from a variety of sources—sources which may have followed different index calculation methodologies in some instances.

The MSCI ESG Indexes use ratings and other data supplied by MSCI ESG Research Inc, a subsidiary of MSCI Inc.

* DM countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain,

Sweden, Switzerland, the UK and the US. EM countries include: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines,

Poland, Russia, Qatar, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

The MSCI ACWI ESG Index was launched on Jun 06, 2013. Data prior to the launch date is back-tested data (i.e. calculations of how the index might have performed over that time period had the

index existed). There are frequently material differences between back-tested performance and actual results. Past performance -- whether actual or back-tested -- is no indication or guarantee of future

performance.

MSCI ACWI ESG Index

February 27, 2015

Index Characteristics

Top 10 Constituents

MSCI ACWI ESG

Number of

Constituents

MSCI ACWI

1,163

Country

2,471

1.5

2.0

0.16 bps

8.60 bps

4.00 bps

0.08 bps

4.05 bps

1.63 bps

Parent Sector

Index

Sector

Wt. (%)

Wt. (%)

JOHNSON & JOHNSON

NOVARTIS

PROCTER & GAMBLE CO

VERIZON COMMUNICATIONS

ROCHE HOLDING GENUSS

HSBC HOLDINGS (GB)

BERKSHIRE HATHAWAY B

MERCK & CO

INTEL CORP

GOOGLE C

Total

Weight (%)

Largest

Smallest

Average

Median

Index

Wt. (%)

Sector Weights

US

CH

US

US

CH

GB

US

US

US

US

1.54

1.26

1.22

1.09

1.02

0.91

0.90

0.90

0.87

0.85

10.55

0.76

0.62

0.60

0.54

0.50

0.45

0.44

0.44

0.43

0.42

5.19

Health Care

Health Care

Cons Staples

Telecom Srvcs

Health Care

Financials

Financials

Health Care

Info Tech

Info Tech

11.4

9.4

13.4

24.6

7.6

4.0

4.0

6.7

6.5

6.3

Country Weights

9.1%

10.5%

5.55%

12.53%

3.35%

26.72%

4.1%

5.29%

7.05%

4.42%

8.23%

3.28%

13.41%

22.49%

50.55%

13.44%

United States 50.55%

Financials 22.49%

Information Technology 13.44%

Consumer Discretionary 12.53%

Materials 5.55%

Energy 5.29%

Industrials 10.5%

Health Care 13.41%

Switzerland 3.35%

Japan 8.23%

United Kingdom 7.05%

Canada 4.1%

Other 26.72%

Consumer Staples 9.1%

Telecommunication Services 4.42%

Utilities 3.28%

Index Methodology

The MSCI Global Sustainability indexes apply a Best‐in‐Class selection process to companies in the regional indexes that make up MSCI All Country World

Index (ACWI), which consists of large and mid cap securities in developed and emerging markets. The Global Sustainability Indexes target sector weights

that reflect the relative sector weights of the underlying indexes to limit the systematic risk introduced by the ESG selection process. The methodology

aims to include securities of companies with the highest ESG ratings representing 50% of the market capitalization in each sector of the Parent Index.

The regional indexes are aggregated to create the global index. Companies must have an IVA rating of 'BB' or above and an Impact Monitor score of 3

or above to be eligible. The Index is float-adjusted market capitalization weighted. The Annual Review for the MSCI Global Sustainability indexes takes

place in May. In addition, the Index is rebalanced in August, November and February.

www.msci.com | clientservice@msci.com

About MSCI

MSCI Inc. is a leading provider of investment decision support tools to investors globally, including asset managers, banks, hedge funds and pension funds. MSCI products and services include indexes, portfolio risk and performance analytics,

and ESG data and research.

1

The company's flagship product offerings are: the MSCI indexes with approximately USD 9 trillion estimated to be benchmarked to them on a worldwide basis ; Barra multi-asset class factor models, portfolio risk and performance analytics;

RiskMetrics multi-asset class market and credit risk analytics; IPD real estate information, indexes and analytics; MSCI ESG (environmental, social and governance) Research screening, analysis and ratings; and FEA valuation models and risk

management software for the energy and commodities markets. MSCI is headquartered in New York, with research and commercial offices around the world.

1

As of March 31, 2014, as reported on June 25, 2014 by eVestment, Lipper and Bloomberg.

The information contained herein (the "Information") may not be reproduced or redisseminated in whole or in part without prior written permission from MSCI. The Information may not be used to verify or correct other data, to create indexes, risk

models, or analytics, or in connection with issuing, offering, sponsoring, managing or marketing any securities, portfolios, financial products or other investment vehicles. Historical data and analysis should not be taken as an indication or guarantee of

any future performance, analysis, forecast or prediction. None of the Information or MSCI index or other product or service constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading

strategy. Further, none of the Information or any MSCI index is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. The Information is

provided "as is" and the user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. NONE OF MSCI INC. OR ANY OF ITS SUBSIDIARIES OR ITS OR THEIR DIRECT OR INDIRECT SUPPLIERS

OR ANY THIRD PARTY INVOLVED IN THE MAKING OR COMPILING OF THE INFORMATION (EACH, AN "MSCI PARTY") MAKES ANY WARRANTIES OR REPRESENTATIONS AND, TO THE MAXIMUM EXTENT PERMITTED BY LAW, EACH

MSCI PARTY HEREBY EXPRESSLY DISCLAIMS ALL IMPLIED WARRANTIES, INCLUDING WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. WITHOUT LIMITING ANY OF THE FOREGOING AND TO

THE MAXIMUM EXTENT PERMITTED BY LAW, IN NO EVENT SHALL ANY OF THE MSCI PARTIES HAVE ANY LIABILITY REGARDING ANY OF THE INFORMATION FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL

(INCLUDING LOST PROFITS) OR ANY OTHER DAMAGES EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited.

© 2015 MSCI Inc. All rights reserved.