Datastream Request Table Template 5.0

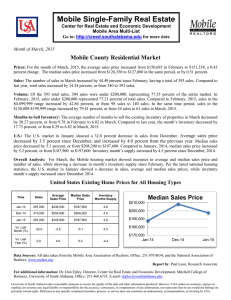

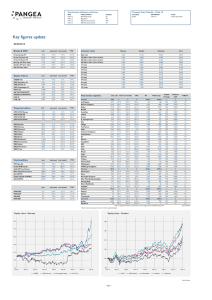

advertisement

Key Economic Indicators and Events: Company Event Calendar - Week 12 Date Indicator/Event Country Company Date/Month Event 18-Mar-15 18-Mar-15 19-Mar-15 19/20-Mar-2015 FOMC rate announcement FOMC economic projections Norges Bank rate announcement EU Summit US US NOR EU Atrium Ljungberg 16-Mar-15 Annual report 2014 Key figures update 16/03/2015 Bonds & CDS Last Last week Last month YTD Interest rates Norway Sweden Denmark Euro iTraxx Europe 5Y 49.64 1.9 % -12.3 % -22.0 % Repo rate 1.25% -0.10% 0.05% 0.05% iTraxx Crossover 5Y 252.09 0.4 % -15.7 % -28.1 % 1M (Nibor, Stibor, Cibor, Euribor) 1.28% 0.01% -0.31% -0.01% iTraxx Fin Senior 5Y 56.01 2.9 % -12.6 % -17.2 % 3M (Nibor, Stibor, Cibor, Euribor) 1.30% 0.05% -0.20% 0.02% Norway 10Y Govt. index 1.5 % -9.2 % 17.1 % -4.2 % 6M (Nibor, Stibor, Cibor, Euribor) 1.24% 0.09% -0.03% 0.07% Sweden 10Y Govt. index 0.6 % -26.3 % 25.0 % -33.8 % 1Y swap 1.11% 0.01% -0.10% 0.08% UK 10Y Govt. index 1.7 % -13.1 % 2.9 % -1.8 % 2Y swap 1.05% 0.06% 0.11% 0.09% 3Y swap 1.12% 0.20% 0.21% 0.13% 4Y swap 1.24% 0.34% 0.31% 0.20% 5Y swap 1.38% 0.49% 0.41% 0.28% 6Y swap 1.51% 0.64% 0.50% 0.34% Equity indices Last Last week Last month YTD 611 -1.1 % -0.8 % 6.2 % 7Y swap 1.62% 0.77% 0.58% 0.42% OMX Stockholm 30 1,665 0.2 % 1.4 % 13.7 % 8Y swap 1.70% 0.88% 0.67% 0.49% OMX Helsinki 25 3,519 1.2 % 4.2 % 17.8 % 9Y swap 1.79% 0.98% 0.75% 0.56% 907 2.3 % 12.9 % 21.9 % 10Y swap 1.86% 1.06% 0.82% 0.63% 19,254 1.5 % 7.5 % 10.3 % OSEBX Oslo OMX Copenhagen 20 Nikkei 225 S&P 500 COMPOSITE 2,053 -0.9 % -2.1 % NASDAQ COMPOSITE 4,872 -1.1 % -0.5 % 2.9 % DAX 30 11,902 3.0 % 8.6 % 21.4 % FTSE 100 6,741 -2.5 % -1.9 % 2.7 % Property indices Last -0.3 % Last week Last month YTD Real estate equities Last Last week Sweden SEK % ALM Equity 133.0 Atrium Ljungberg 124.6 Balder 134.2 Besqab 109.3 Last month YTD % % -1.3 % 4.7 % 14.4 % -2.3 % -5.7 % 8.6 % -2.8 % 1.5 % 21.7 % 0.7 % 14.4 % 25.6 % Implied leverage Dividend yield SEKm % % x 2,336 1,714 27% 0.00% 2.1 28,502 16,599 42% 2.65% 1.4 47,392 25,470 46% 0.00% 1.8 1,671 1,695 -1% n.a. 2.5 EV Market cap SEKm P/Book* GPR 250 PSI Europe 19.5 -0.2 % -0.7 % 13.7 % Castellum 131.0 -1.7 % -5.1 % 7.3 % 40,932 22,533 45% 3.51% 1.7 GPR 250 PSI US 29.0 2.3 % -3.2 % 1.6 % Catena 124.0 0.8 % 7.8 % 17.3 % 6,438 3,180 51% 2.42% 1.6 GPR 250 PSI UK 18.9 -2.0 % -1.5 % 7.1 % Corem 29.8 -5.4 % -8.3 % 3.8 % 9,192 3,610 61% 2.68% 1.5 GPR 250 PSI Global 15.1 1.0 % -2.1 % 3.8 % D. Carnegie & Co 58.0 -0.9 % 8.9 % 27.8 % 11,680 3,793 68% 0.00% 1.2 Diös 70.0 -0.4 % 5.3 % 21.2 % 12,825 5,231 59% 3.29% 1.6 Pangea Real Estate Indices (PREX) PREX Sweden 720.6 -1.3 % -4.0 % 12.3 % Fabege 119.7 1.0 % -5.5 % 19.0 % 39,847 19,797 50% 2.72% 1.4 PREX Norway 251.4 -1.5 % 4.4 % 19.6 % FastPartner 122.3 -6.0 % -9.4 % 12.4 % 14,977 7,341 51% 2.86% 2.2 PREX Denmark 224.5 -0.3 % 0.1 % 21.9 % Heba 93.3 -2.6 % -4.4 % -4.1 % 5,486 3,849 30% 1.39% 1.4 PREX Finland 249.6 -3.5 % 0.2 % 16.1 % Hemfosa Fastigheter 192.0 0.3 % -0.8 % 16.4 % 27,784 12,618 55% 3.13% 1.5 PREX Office 369.2 -0.5 % -2.5 % 14.2 % Hufvudstaden 114.7 0.9 % -3.2 % 12.9 % 29,924 24,857 17% 2.53% 1.5 PREX Retail 669.5 -2.9 % 0.6 % 19.4 % JM 285.0 0.2 % -4.6 % 14.5 % 20,579 21,970 -7% 2.81% 4.7 PREX Residential 1,065.2 -2.5 % -2.7 % 7.6 % Klövern 9.4 -3.1 % -11.0 % 14.0 % 34,029 13,822 59% 3.21% 1.4 PREX Construction 362.0 -0.2 % -2.0 % 18.5 % Kungsleden 62.8 0.0 % -6.7 % 11.1 % 21,659 11,421 47% 2.39% 1.3 PREX Mixed 362.0 -0.2 % -2.0 % 18.5 % NP3 40.2 0.5 % -6.1 % 16.2 % 3,532 1,948 45% 1.24% 1.3 PREX Warehouse 641.3 -1.9 % -2.7 % 13.8 % NCC 281.6 -0.2 % -3.2 % 14.1 % 36,842 30,536 17% 4.26% 3.5 PREX Total 40.4 -5.5 % -9.6 % 4.6 % Peab 67.4 -2.5 % 0.0 % 22.7 % 25,927 19,954 23% 3.34% 2.5 Platzer 37.0 -4.4 % -1.1 % 10.4 % 8,302 3,543 57% 2.03% 1.2 Sagax 56.0 -13.5 % -18.2 % 26.7 % 19,240 10,835 44% 1.43% 2.4 Skanska 199.7 -0.3 % -2.7 % 18.9 % 77,210 83,860 -9% 3.38% 3.9 Tribona 38.0 -2.1 % -7.1 % -1.6 % 4,372 1,849 58% 1.32% 1.0 9.7 -6.8 % 7.8 % 55.6 % 4,893 1,080 78% 0.00% 0.7 135.5 -2.8 % -5.9 % 4.5 % 38,057 23,035 39% 1.66% 1.8 1.8 Commodities Last Last week Last month YTD WTI Spot ($) 44.9 -9.5 % -14.8 % -16.0 % Wallenstam Crude Oil-Brent ($) Victoria Park 55.2 -8.0 % -9.0 % -1.1 % Wihlborgs Fastigheter 162.5 -1.2 % -6.3 % 13.8 % 26,566 12,489 53% 2.92% Gold (U$/Troy Ounce) 1,153.6 -1.9 % -6.4 % -2.8 % Norway NOK % % % SEKm SEKm % % x Silver (Cents/Troy ounce) 1,986.0 0.0 % 0.0 % 0.0 % AF Gruppen 93.0 1.1 % 3.3 % 17.7 % 8,907 8,745 2% 5.38% 6.3 Alu (U$/MT) 1,769.5 -1.6 % -2.6 % -1.9 % Entra 83.5 Copper (Grade A U$/MT) 5,882.0 2.0 % 2.2 % -7.6 % Norwegian Property Zink (U$/MT) 2,000.5 0.0 % -6.6 % -7.7 % Olav Thon Eiendomsselskap Currencies NOK/USD NOK/EUR -0.3 % -0.6 % 9.2 % 33,361 16,259 51% 3.47% 1.8 10.9 0.5 % 0.9 % 7.4 % 16,055 6,306 61% 0.00% 1.1 166.0 -3.5 % 7.8 % 32.3 % 36,231 18,726 48% 0.96% 1.3 Selvaag Bolig 28.8 1.1 % 22.6 % 43.3 % 5,243 2,862 45% 4.17% 1.2 Storm Real Estate 11.0 0.0 % -0.9 % -12.0 % 266 224 16% 14.55% 3.5 Veidekke 89.5 3.2 % 5.3 % 21.4 % 14,338 12,682 12% 3.91% 5.0 Finland EUR % % % SEKm SEKm % % x 3.0 -2.8 % -0.6 % 17.6 % 29,936 16,455 45% 4.94% 1.4 4.1 -4.5 % 4.3 Last Last week Last month YTD 8.2 4.7 % 7.3 % 9.8 % Citycon 8.6 1.0 % -0.3 % -4.5 % Sponda -1.0 % 14.1 % 24,038 10,687 56% 4.60% 0.9 SEK/EUR 9.1 -0.6 % -5.1 % -3.9 % Technopolis -4.0 % 6.7 % 15.4 % 11,569 4,157 64% 3.51% 0.9 NOK/SEK 94.3 1.4 % 4.4 % -1.8 % Denmark DKK % % % SEKm SEKm % % x Jeudan 673.0 -0.3 % 0.0 % 21.9 % 23,974 9,144 62% 0.00% 1.6 3.4 % 30.8 % 27.1 % 3,765 40 n.a. n.a. Nordicom 2.7 Note: For comparison reasons, we have chosen to have a single currency on Market Cap and EV n.a. Source: Reuters * Based on latest company reports and current market capitalization figures Equity chart - Norway Equity chart - Sweden 180 200 170 180 160 160 150 140 140 130 120 120 110 100 100 Source: Reuters 80 90 60 Mar-13 Jun-13 Sep-13 OSEBX Dec-13 PREX Norway Mar-14 Jun-14 Norwegian Property Sep-14 Dec-14 Mar-15 80 Mar-13 Olav Thon Jun-13 Sep-13 OMX Dec-13 PREX Sweden Mar-14 Hufvudstaden Jun-14 Castellum Sep-14 Dec-14 Mar-15 Wallenstam Source: Reuters – Page 1 – Interest rate term structure – Nordic Sight deposit rates - Nordic 2.0 % 2.5 % 2.0 % 1.5 % 1.5 % 1.0 % 1.0 % 0.5 % 0.5 % 0.0 % 3m 1Y swap 2Y swap 3Y swap 4Y swap 5Y swap 7Y swap 0.0 % 2010 10Y swap 2011 2012 2013 2014 2015 -0.5 % -0.5 % Norway Sweden Denmark Norway Euro Sweden Denmark Euro Source: Reuters Short term interest rates - Nordic Long term interest rates (5y swaps) - Nordic 3.5 % 4.5 % 3.0 % 4.0 % 2.5 % 3.5 % 2.0 % 3.0 % 1.5 % 2.5 % 1.0 % 2.0 % 0.5 % 1.5 % 1.0 % 0.0 % Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 -0.5 % 0.5 % -1.0 % 0.0 % Mar-10 NIBOR STIBOR CIBOR Mar-11 Mar-12 Norway EURIBOR Mar-13 Sweden Denmark Mar-14 Mar-15 Euro Source: Reuters Yield gap – Oslo office Yield gap – Stockholm office 8.0 % 7.5 % 7.0 % 6.5 % 6.0 % 5.5 % 5.0 % 4.5 % 4.0 % 3.5 % 3.0 % 2.5 % 2.0 % 1.5 % 1.0 % Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 10Y swap Oslo office yields Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 0.5 % Mar-08 Mar-09 Mar-10 Mar-11 10Y swap Mar-12 Mar-13 Mar-14 Mar-15 Stockholm office yields Source: Pangea Property Research Recent transactions – Norway and Sweden Norway Seller Buyer Type Helsfyr Panorama, Helsfyr Mar-15 Date Catella Real Estate AG Bryn Eiendom Office Rolf Olsens vei 30-32, Lillestrøm Mar-15 Lambertsson Norge Ragde Eiendom / Ola Heggset Industrial Sanitetsveien 1 in Laghaugmoen Næringspark Mar-15 Anthon B Nilsen(60 %)/KGJ Real Estate(40 %) Syndicate Combination Lagårdsveien 78-80, Stavanger Mar-15 Local investor Castelar Investment Mgmt. et al. Office Commercial section of Ullevål Stadium, Oslo Feb-15 DNB Livsforsikring Oslo Pensjonsforsikring Office, retail, hotel 75 % of Bryggerikvartalet, Lillehammer Feb-15 Smedvig Eiendom Consortium Storgata 10 A/B, Oslo Feb-15 Haraldsen Eiendom Eiendomsspar Property Estimated value (NOKm) n.a. 86 Size (Sqm) Adviser 18,000 CBRE Atrium (sell-side) 5,000 n.a. n.a. 9,200 n.a. ~250 19,000 n.a. ~1,100 58,000 Union (sell-side) Retail 300 30,000 DNB Næringsmegling (sell-side) Retail n.a. 8,600 n.a. Sweden Property Date Estimated value (SEKm) Size (Sqm) Adviser Seller Buyer Type 737 apartments (13 properties), Gävle Mar-15 IHF Bostad Gävlegårdarna Residential 468 53,500 NAI Svefa (sell-side) Hilton 7 (part of Järva 4:11), Solna Mar-15 Peab Vasakronan Undeveloped land, office building rights 58 16,000 n.a. Högvakten 6, Malmö Mar-15 Wihlborgs Cityfastigheter Office 91 3,600 n.a. Rölunda 1:6, Bergklacken 5 & 6, Stockholm Mar-15 Altira Stendörren Public sector, industrial n.a. 23,200 n.a. Nova Lund (Företaget 7, 13, 14), Lund Mar-15 TIAA Henderson Real Estate Unibail-Rodamco Retail 1,635 25,900 Catella (sell-side), PwC (buy-side) Brynäs 18:6 (Philipssontomten), Gävle Mar-15 CA Fastigheter HSB Undeveloped land, residential building rights n.a. 20,000 Catella (sell-side) Päronet 8, Solna Mar-15 Humlegården Union Investment Real Estate Office 650 21,400 n.a. Source: Pangea Property Research Contact details STOCKHOLM Pangea Property Partners KB Visiting: Norrlandsgatan 15, 7th floor Postal: Box 7740, 103 95 Stockholm Tel +46 8 545 25 780 www.pangeapartners.se OSLO Pangea Property Partners AS Tjuvholmen Allé 3-5, 8th floor N-0250 Oslo Tel +47 21 95 80 70 www.pangeapartners.no – Page 2 –