Dairy Business Management – Week 3

advertisement

1

Recap on last week

Cash and Profit

Benchmarking

Assessment

2

Previous Session:

◦ Be able to calculate gross margins and net margins for an enterprise

◦ Know how to categorise receipts and expenditure for an enterprise

Enterprises

Costs (Variable, Fixed, Capital)

Depreciation

Receipts (Enterprise, Sundry, Capital)

Margins (Gross and Net)

Cash – Can you pay your bills?

Profit – Can you fund private drawings and business

growth?

3

Cashflow Budget

Planning

A forecast of money going into and out of a

business over a specific period of time

Control

Compare actual payments with expected

4

Layout of a Cash Flow Budget

Jan

CASH IN

Cash sales

Loans

Total receipts

Variable Costs

Materials

Wages

Total variable costs

Other Costs

Drawings

Hire of tractor

Repairs

Utilities

Loan Repayments

Bank interest

Accountant & Ins

Feb

Mar

Apr

May

Jun

Total

200

20,000

350

871

6,391

5,800

2,786

16,398

20,000

20,200

350

871

6,391

5,800

1,193

555

1,535

767

1,193

555

1,535

767

0

0

4,050

600

600

100

600

600

100

600

1,000

4,000

200

100

600

1,581

964

600

2,786 36,398

4,050

0

263.5

160.6

50

263.5

160.6

50

300

263.5

160.6

300

50

263.5

160.6

300

50

263.5

160.6

50

150

263.5

160.6

Total fixed costs

1,024

1,174

1,674

Capital expenditure

Buildings

Equipment

Total cap expend

1,474

1,074

1,624

8,045

15,000

5,000

20,000

0

0

0

0

0

15,000

5,000

20,000

Net Cash flow

-2,017

-1,379

-2,338

4,150

4,726

1,162

4,303

Cumulative CF

-2,017

-3,396

-5,734

-1,584

3,142

4,303

5

Thousands

0

Jan Feb Mar Apr May Jun

-10

Jul

Aug Sep Oct Nov Dec

Overdraft not being repaid

-20

-30

-40

-50

-60

-70

-80

7

80000

80000

60000

60000

40000

40000

20000

20000

0

0

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

-20000

-20000

-40000

-40000

-60000

-60000

-80000

-80000

8

80000

80000

60000

60000

40000

40000

20000

20000

0

0

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

-20000

-20000

-40000

-40000

-60000

-60000

-80000

-80000

9

Not reinvesting in the business or selling

assets

Low drawings

◦ Off farm income reducing the need for drawings to

fund family expenses

Borrowing money

Not paying bills

10

An expanding business with increasing assets,

but few sales

High withdrawals for family living

Repaying debt rapidly

Buying next year’s inputs from this years cash

◦ e.g. prepay on fertiliser

Increase in creditors

◦ have not been paid yet for product sold

11

Vital to plan and review bank borrowing

A means of adjusting the timing of payments and

income

Shows if it is feasible to continue or develop the

farm business

12

How financially viable is the farm business?

What information do you use to make

management decisions?

Individual enterprise performance

BENCHMARKING is a tool to assess

performance

13

CASH

PROFIT

£

Sales

+150,000

£

Sales

+150,000

Variable costs

-75,000

Variable costs

-75,000

Business overheads

-30,000

Business overheads

-30,000

Telephone bill

-3,000

Telephone bill (2/3rds to

farm)

-2,000

Machinery purchased (no

loan)

-50,000

Depreciation (buildings &

machinery)

-15,000

Drawings & tax paid

-20,000

CASH SURPLUS/

DEFICIT

(after drawings & tax)

-£28,000 PROFIT

£28,000

14

Purpose of tax accounts - to calculate the farm business

profit, which determines the amount of tax due

Purpose of management accounts – to measure

efficiency of individual farm enterprises and whole farm

Neither tax or management accounts include VAT

15

“Helps farmers to assess

their own business

performance and

compare their physical

and financial results with

other similar farms”

16

Collect data

Analyse data

Compare your results

Identify reasons for variation

*Formulate action plan*

*Implement plan*

17

Enterprise reports on Physical performance

◦

Look at individual enterprises

Enterprise reports on Financial performance

◦

Look at individual enterprise but can build to a

whole farm report – based on profit not cash

18

Output

Variable costs

◦ Costs associated with production that vary depending on scale

Gross margin – (Output – Variable costs)

◦ how efficient you are with raw materials needed for the enterprise

◦ e.g., feed, fertiliser, vet & med and other variable costs

Overhead Costs – costs that do not vary with scale

◦ looking at the whole business. What is needed after variable costs. The

biggest variation between farms is the amount spent on overhead costs

Gross Margin – Overhead costs = Net Margin (Profit)

19

Physical performance is a measure of the quantity and quality of

what you produce on your farm.

These will differ between enterprises, e.g.:

◦

◦

◦

◦

◦

Average milk yield/cow

Butterfat and Protein percentage

Calving interval

Average meal fed/cow

Stocking rate/ha

21

Financial performance is a measure of the costs of production

in relation to the value of output.

Financial performance is broken down into output, variable

costs, overhead costs and capital costs.

These will produce various performance indicators e.g.:

◦

◦

◦

◦

◦

◦

◦

Individual costs /cow

Gross margin/cow

Gross margin/ha

Total overhead costs

Overhead costs/cow

Total cost of production/litre

Margin over concentrate (MOC)

22

Farmer records data throughout the year

Data Collector gathers data once per year

Data processed

Reports generated and delivered

Local adviser helps interpret report and plan

for change

23

Dairy cows report 2013/2014

Accounts

2 years ago

1 year ago

This year 2013/2014

Average all

£/Cow

£/Cow

£/Cow

£/Ha

1,890

140

-225

1,600

100

-350

2,040

130

-380

3,672

233

-684

31.38

1.99

-5.85

2,300

142

-212

1,805

1,350

1,790

3,221

27.53

2,229

0.00

2.62

10.54

0.92

0.04

0.76

14.88

151

683

41

29

84

988

PPL

£/Cow

Output

Milk Output

Calves

Less Replacements

Total Output

Variable Costs

Forage Costs

Concentrates

Vet/Medicine

Breeding Costs

Sundry Costs

Total Variable Costs

Gross Margin

Overhead Costs

Machinery depreciation

Machinery running costs

Fuel costs

Contractor charges

Building depreciation

Property repairs

Electricity

Water & Rates

Business admin costs

Miscellaneous Costs

Total common overhead costs

Total common costs

Net Margin

Paid Labour

Conacre

Finance

Total Overhead Costs*

Total Costs*

Net Profit*

*excl. Family labour

110

515

60

6

25

716

160

600

20

5

50

835

170

685

60

3

50

967

0

306

1,233

108

5

89

1,741

1,089

515

822

1,480

12.65

1,241

0.00

3.38

0.85

1.08

0.38

1.54

0.16

0.38

0.23

0.46

0.08

8.54

23.43

85

52

44

76

93

32

31

11

25

10

459

1,447

250

35

65

20

40

40

25

18

25

10

528

1,244

225

36

80

25

40

40

20

15

12

0

493

1,328

220

55

70

25

100

10

25

15

30

5

555

1,523

0

396

99

126

44

180

19

45

27

54

9

1,000

2,741

561

22

267

480

4.10

782

45

15

27

615

1,331

60

10

0

563

1,398

0

6

0

561

1,528

0

10

0

1,010

2,751

0.00

0.09

0.00

8.63

23.51

33

48

16

556

1,544

474

-48

261

470

4.02

685

24

Simplified Financial Report

Dairy cows report 2013/2014

This year

2013/2014

£/Cow

Average all

2,040

130

-380

2,300

142

-212

1,790

2,229

Variable Costs

Forage Costs

Concentrates

Vet/Medicine

Breeding Costs

Sundry Costs

Total Variable Costs

170

685

60

3

50

967

151

683

41

29

84

988

Gross Margin

822

1,241

Overhead Costs

Machinery and building depreciation

Machinery running costs, contractor

Property repairs

Electricity, Water Rates

Business admin costs

Paid Labour

Conacre

Finance

Miscellaneous Costs

Total Overhead Costs

320

150

10

40

30

0

6

0

5

561

178

172

32

42

25

33

48

16

10

556

Net Margin

261

685

Accounts

£/Cow

Output

Milk Output

Calves

Less Replacements

Total Output

25

Gross Margin

This year

2013/2014

£/Cow

Average all

2,040

130

-380

2,300

142

-212

1,790

2,229

Variable Costs

Forage Costs

Concentrates

Vet/Medicine

Breeding Costs

Sundry Costs

Total Variable Costs

170

685

60

3

50

967

151

683

41

29

84

988

Gross Margin

822

1,241

Dairy cows report 2013/2014

Accounts

£/Cow

Output

Milk Output

Calves

Less Replacements

Total Output

26

Net Margin

Overhead Costs

Machinery and building depreciation

Machinery running costs, contractor

Property repairs

Electricity, Water Rates

Business admin costs

Paid Labour

Conacre

Finance

Miscellaneous Costs

Total Overhead Costs

320

150

10

40

30

0

6

0

5

561

178

172

32

42

25

33

48

16

10

556

Net Margin

261

685

No family labour included

27

Simplified Physical Report

Dairy Cows

Physical performance

This year

2013/2014

Average all

2013/2014

120

1.82

103.00

67.13

43

28

119

2.16

87.28

55.47

30

25

31.30

33.10

6,518

662

1,203

7,334

1,616

3,386

1,200,194

4.16

3.15

206

54

692,183

4.04

3.24

246

33

Meal Fed Per Cow (Kg)

Meal Fed Per Litre (Kg)

Margin over Concentrate (£/cow)

2,635

0.40

1,348

2,573

0.34

1,724

Margin over Concentrate (ppl)

21.00

23.61

STOCK and LAND

Cow Number

Stocking Rate (CE/ha)

Total Farm Size

Land Used for Dairy Cows

Replacement Rate (%)

Culling Rate %

MILK

Milk price

(ppl sold * transport cost deducted)

Annual Production/Cow (Litres)

Milk From Forage/Cow (Litres)

Milk From Forage/Hectare (Litres)

Milk Per Labour Unit (Litres)

ButterFat %

Protein %

Average SCC ('000/ml)

Average Bactoscan ('000/ml)

CONCENTRATE FEED

28

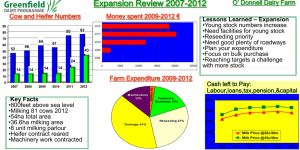

Discuss the benchmark report

Compare to average figures

What are the positives?

What are the negatives?

What could be improved?

29

• Assess your own current performance

• Allocate ALL production costs

•

Gross margin is a good starting point

•

Control overhead costs

•

Identify strengths and weaknesses

• Feeds into whole farm management accounts

• Information for farm planning and decision

making

30

A process to help farmers assess their own business

performance

◦ Physical performance

◦ Financial performance

Benchmarking will identify areas for improvement

No action, No benefit

31