201005250156280.Lusaka cattle presentation 23 March

advertisement

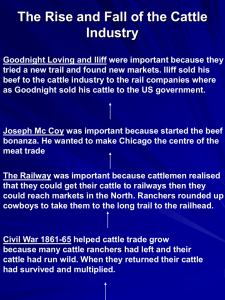

What Would it Take for Zambia’s Cattle Industry to Achieve its Potential? Sunil Sinha Prepared for the Job, Prosperity and Competitiveness Project Supported by the World Bank, African Development Bank, and DFID 1 Huge Potential of Cattle 2 Substantial Grazing Land, Good Conditions • 4 times more grazing than arable land • 3 agricultural zones suited to livestock • If Zambia = Kenya : additional asset value of US$4.5 billion. Grazing Area 90 80 70 60 50 Grazing area 40 30 20 10 0 Zambia Botswana RSA Zimbabwe Kenya Domestic Market: Potential for Fast Growth • Consumption of beef and dairy products rises fast when incomes increase. • Zambians consume very little beef and dairy products. Meat & Milk Consumption Per Capita Beef (Kg/C) Milk (Ltr/C) 82.3 75.8 54.1 19.24 18.48 12.32 Botswana South Africa Kenya 17.1 8.96 Zimbabwe 6.03 7.4 Zambia 4 Zambia could export more beef & Dairy products to neighbours • Namibia and Botswana supply beef to RSA and export to Europe. RSA is a net importer. Exports to DRC, Angola. Beef main exporters US$ ‘000 Botswana 111,207 23,665 RSA 10,557 727 Namibia 38,487 Beef main importers (2007) US$ ‘000 RSA Zimbabwe • Botswana, RSA, Tanzania, Malawi import dairy products. Milk main importers (2007) US$ ‘000 Milk main exporters (2007) US$ ‘000 Botswana 15,242 RSA 2,223 RSA 6,823 885 Angola 5,387 Zimbabwe Tanzania 1,611 Kenya 778 5 International Markets Huge & Very Competitive • World Beef and Dairy Trade = $50 billion+. • Slow growth, Prices falling in real terms. 6 Cattle: Key To Reducing Rural Poverty • Livestock owned by most rural households • Higher proportion of household incomes than crops (c 40%). • Cattle industry: 310,000 (c 25%) of households • Cattle is the largest asset (US$1-1.5 billion) Million heads Cattle Sheep Goats Pigs Poultry 3.1 0.485 0.746 0.704 9.9 Under Performing, Uncompetitive 8 Small Cattle Population, Concentrated In 4 Provinces. Cattle/grazing ha 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 Zambia Zambia potential RSA Botswana Zimbabwe Kenya 9 Underperforming In Beef & Dairy Country Comparison: Beef & Milk Beef Production (000'T) Raw Milk (000'T) 3672 3,000 805 58 Zambia 65 31 RSA 106 Botswana 250 390 97 Zimbabwe Kenya • Production is not much higher than1990, negligible exports... 10 Currently, Not Competitive In Beef Zambia Kenya Namibia RSA Argentina Brazil UK USA Live weight (US$/kg) 1.29 1.11 1.19 1.57 1.26 0.99 2.26 1.98 Dressed weight (US$/kg) 3.69 2.16 2.13 2.8 2.7 2.04 4.19 3.81 Source: FAOSTAT, year 2007, Zambia figure: consultants’ calculation Competitive in live weight, not in dressed weight. 11 Nor In Dairy Farm Gate Producer’s Price, US$/Litre 2008 2009 Zambia 0.68 0.6 South Africa 0.4 0.4 Kenya 0.2 0.3 Source: FAOSTAT, Heifer International, Zambia figure: consultants’ calculation Cost of raw milk is high because of scarcity, still importing powder to reconstitute as milk. 12 Why Not Fulfilling Its Potential? Small Market, But Now Growing Incomes low outside formal employment Prices: higher than neighbours, 10% of food expenditure But market for beef now growing 5%-7%, Dairy c. 10% p.a. But constraint in Lusaka. Driven by: higher urban incomes, urbanisation changing lifestyles, changing food consumption patterns 14 3 Systems: Motives, Opportunities & Constraints Cattle Population (000) Farmer Type 450 Traditional Emergent Commercial Calving rate 30%-50% in-btn 70%-80% Calving mortality 30%-40% in-btn 1%-2% Adult deaths 5%-10% Lower Lowest Off-take rates 8%-9% 10%-15% 17%-18% Live Weight 200-250 250 300 Milk yields 1-2 ltrs 8-10 ltrs 17-23 ltrs Low growth Dynamic Dynamic 165 2,455 Traditional Emergent Commercial Characteristic 15