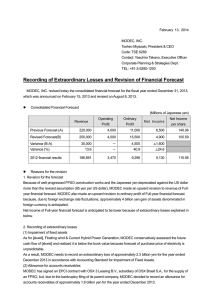

Future FPSO Projects in the Decision

advertisement

FUTURE FPSO PROJECTS IN THE DECISION-MAKING PROCESS Presentation by Jim McCaul at the Emerging FPSO Forum 25 September 2013 OUTLINE OF PRESENTATION The Pros and Cons of FPSOs Profile of FPSO use worldwide FPSO Projects in the Planning Stage Our Forecast of FPSO Orders Issues Impacting Outlook FPSO PROS AND CONS PRO CON • Has field storage and can be used in remote locations – self contained • Subsea tiebacks create higher well maintenance costs • Can operate on shallow or ultra-deepwater fields • Turret/swivel machinery complex and failure a major problem • Less weight sensitive than other types of FPSs • • Leasing transfers some risk from field operator to contractor Cost and delay surprises when converting tankers to FPSOs • Redeploying an FPSO not as easy as it may appear • Assumed residual value used as a competitive tool in leasing bids • Deck area allows flexibility in process plant layout • Surplus/aging tankers can be used for conversion • Can be modified/redeployed following field depletion • Quick disconnect turrets enable emergency relocation Source: BWO 204 FPSOs ARE IN SERVICE, AVAILABLE OR ON ORDER (number of units as of September 2013) 56 42 28 OnOrder Order On Existing Available 25 14 14 14 3 3 3 2 e a o n a a il a a d Z az fric rop Asi a/N hin ndi nea exic nad Fiel r I a C li B . A Eu M Ca No rr SE stra of o. ti e W N A u M ed ul G f 27% of FPSOs are offshore Brazil 21% are located offshore Africa 14% are off Northern Europe 12% are in Southeast Asia 7% are off China 7% are off Australia/NZ 5% are in other locations 7% are without field assignment * * * * 13 FPSOs are currently off field and looking for work 1 FPSO being built has no field assignment Note: Data exclude 4 small FPSOs used for well test in the GOM and 2 FPSOs built for emergency spill recovery 84% MORE FPSOs IN SERVICE THAN 10 YEARS AGO – WITH 123% MORE OIL PROCESSING CAPACITY Number of FPSOs in Service Total Oil Processing Capacity on FPSOs Avg. FPSO Oil Processing Capacity (000s b/d) (000s b/d) Avg. Water Depth of FPSO Installations (meters) 2003 2013 % Chg. 2003 2013 % Chg. 2003 2013 % Chg. 2003 2013 % Chg. Africa 18 38 111% 1396 4390 214% 78 116 49% 208 678 226% Australia/NZ 9 12 33% 657 979 49% 73 82 12% 152 290 91% Brazil 9 37 311% 845 3937 366% 94 106 13% 826 1075 30% Canada 1 2 100% 150 250 67% 150 125 -17% 90 105 17% China 11 13 18% 734 902 23% 67 69 4% 105 77 -27% Gulf of Mexico India 0 2 n.a. 280 n.a. 140 n.a. 1339 n.a. 0 2 n.a. 120 n.a. 60 n.a. 643 n.a. Mediterranean 5 3 -40% 174 77 -56% 35 26 -26% 228 321 41% N. Europe 19 22 16% 1783 1884 6% 94 86 -9% 167 159 -5% SE Asia 11 22 100% 401 877 119% 36 40 9% 67 137 104% Global Total 83 153 84% 6140 13696 123% 74 90 21% 227 534 135% Note: Data exclude 13 FPSOs currently without field contract, a spill recovery FPSO and 4 small FPSOs used for well test on the Mexico side of GOM. 44% OF FPSOs IN SERVICE OR ON ORDER ARE LEASED Total FPSOs Owned Units Leased Units % Leased Africa 42 23 19 45% Australia/NZ 14 9 5 36% Brazil 56 31 25 45% Canada 2 2 0 0% China 14 14 0 0% Gulf of Mexico 3 0 3 100% India 3 0 3 100% Mediterranean 3 2 1 33% N. Europe 28 16 12 43% SE Asia 25 10 15 60% Global Total 190 107 83 44% Note: Data exclude 14 existing and on order FPSOs without field contract, 2 spill recovery FPSOs and 4 small FPSOs used for well test on the Mexico side of GOM. MORE THAN 120 FPSO PROJECTS ARE IN THE VISIBLE PLANNING STAGE • These are announced discoveries where an FPSO is either planned or logical production solution given the location and field characteristics ~25% are in the bidding or final design stage ~75% are in the planning and study phase • Taking into account projects requiring multiple production units, development of the discoveries could require 135 to 140 FPSOs • Another 20+ discoveries could require an FPSO, BARGE, MOPU/FSO, SUBSEA or other system WHERE FPSO PROJECTS ARE BEING PLANNED • Brazil is clearly the major location for future FPSO projects – 51 projects in planning stage • Africa is next in line – with 13 projects in Angola, 11 Nigeria and 9 elsewhere • SE Asia is in 3rd place with 11 projects • No. Europe is in 4th place with 8 projects • In 5th place is the GOM – 6 projects, all on the Mexican side Brazil 41% 51 33 Africa 27% 14 6 GOM 5% 8 11 Other 11% SE Asia N. Europe 9% 7% Discovery Country Field Operator EXAMPLES OF FPSO PROJECTS IN THE PLANNING STAGE Estimated Production Start (meters) Africa Blk 32 -- Kaombo GG Bonga Southwest Nsiko Elephant Bobo Water Depth Angola Nigeria Nigeria Congo Nigeria Total Shell Chevron CNOOC Shell 1600 1200 1768 550 2480 2016/17 2017/19 2018/20 2020/25 2020/25 Brazil Oliva/Atlanta BS-4 Carioca BM-S-9 Carcara BM-S-8 Espadarte Module III Libra Complex Franco Leste Brazil Brazil Brazil Brazil Brazil Brazil Queiroz Galvao Petrobras Petrobras Petrobras Petrobras/ANP Petrobras 1560 2150 2027 750 2200 1800 2017/19 2016 2018 2020 2020/25 2019 Other Regions Ayatsil/Tekel El Perdido Kraken 9/2b Gohta Sea Lion Belud Bunga Dahlia/Teratai Ubah D-56 Mexico Mexico UK Norway Falklands Malaysia Malaysia Malaysia India Pemex Pemex EnQuest Lundin Premier Hess Petronas Shell BP/Reliance 115 2500-3000 100 342 450 155 65-70 1430 1743 2016/18 2018/22 2016/17 2020/25 2018/20 2015/16 2016/18 2018/20 2019-22 LOCATION AND TIMING OF VISIBLE FPSO PROJECTS Likely Production Start Number FPSOs Required Visible Projects 2014/20 2020+ 2014/20 2020+ Africa 33 17 16 17 16 Australia/NZ 1 1 0 1 0 Brazil 51 29 22 29 36 Canada 2 0 2 0 2 China 1 1 0 1 0 Gulf of Mexico 6 4 2 4 2 Mediterranean 3 3 0 3 0 N. Europe Other So. Amer 8 3 7 3 1 0 7 3 1 0 SE Asia 11 11 0 11 0 SW Asia 4 3 1 3 1 123 79 44 79 58 Global Total PROCESSING PLANT CAPACITY IN VISIBLE FUTURE FPSO PROJECTS (b/d in 000’s) <50 b/d 50-100 b/d 29 14 Gas 10 4 44 100-150 b/d • 58% require topside plants with 100,000 to 200,000 b/d oil processing capability 200+ b/d • 21% require topside plants with 50,000 to 100,000 b/d capacity • 10% involve small FPSOs with less than 50,000 b/d plants 36 150-200 b/d • 3% are mega- FPSOs with more than 200,000 b/d processing capacity • 7% are primarily gas FPSOs BREAKDOWN OF PROCESSING CAPACITY REQUIRED FOR VISIBLE FUTURE FPSO PROJECTS (b/d in 000’s) FPSOs Required Between 2014-2020 50 to 100 to 150 to <50 b/d 100 b/d 150 b/d 200 b/d 200+ b/d Africa 5 Australia/NZ 1 Brazil 2 7 2 15 9 2 FPSOs Required 2020+ Gas 50 to 100 to 150 to <50 b/d 100 b/d 150 b/d 200 b/d 200+ b/d Gas 1 5 5 4 3 3 12 21 Canada 1 1 2 China 1 Gulf of Mexico 2 Mediterranean 2 N. Europe 2 Other So. Amer 1 1 1 1 1 5 1 3 SE Asia 6 SW Asia 2 Global Total 14 2 1 2 1 19 24 11 3 8 1 0 10 20 25 1 2 WHAT WILL DRIVE THE PACE OF FUTURE FPSO ORDERS? Underlying market conditions Smaller FPSOs for marginal fields are influenced by near term oil price expectations and availability of financing Large FPSOs intended for major developments tend to be less sensitive to oil price and financing Passing the FID hurdle But even the biggest oil company has to make choices -- there are budget constraints and limits on available personnel to manage project implementation Whether an FPSO project gets into the CAPEX plan depends on its ranking in terms of expected return on investment This will be determined by the project economics – and the economics of other investment possibilities MARCH 2013 FORECAST OF FPSO ORDERS OVER THE NEXT 5 YEARS Most Likely Forecast Assumptions Forecast next 5 years 130 Actual 110 past 5 years 76 90 Global economic growth averages 3 to 4 percent annually over next few years Oil demand growth remains around 1 percent per year Mideast tensions continue, but no major oil supply interruption Oil price expectations hover in $90 to $110 range Some cost growth and delivery bottlenecks in the FPSO supply base, but not enough to slow major project starts or erode contractor profits No. Orders 2008/12 Low Forecast Most Likely High Forecast No. Orders 2013/17 No major environmental incident involving an FPSO No major impact from shale oil on deepwater investment ASSUMPTIONS UNDERLYING THE HIGH AND LOW FORECASTS Low Forecast Assumptions China and/or India economies falter, Europe/U.S. economies continue to stagnate over next few years High Forecast Assumptions Global economic rebound accelerates quickly from 2013 onward, rises to 4 %+ per year Oil demand growth tracks upward with economic growth Mideast tensions grow, oil supply interrupted World GDP growth turns downward Global oil demand growth falls as economic activity and world output slows Shale oil and/or tight oil projects meet worldwide opposition, delaying project starts Tight oil, shale oil finds grow internationally, technology advances lower cost Many unconventional onshore fuel projects encounter continuing logistics constraints Oil price expectations fall to $70 to $90 range, negating commercial viability of many visible marginal floating production projects Oil prices spike to $150+ and expectations remain above $120, making most visible marginal floating production projects commercially viable Contractors experience supply constraints, raising costs, creating delivery delays Little cost growth, few delivery constraints in the floater supply chain THE LOW END OF THE MARCH FORECAST IS NOW LOOKING MORE LIKELY • Portfolio of potential FPSO projects has been growing • But new project starts have slowed – 9 FPSOs have been ordered thus far in 2013, an average of 1 order/month • Cost growth, access to financing, market barriers, other issues seem to be creating barriers • We now see the low end of the forecast range – i.e., ~90 FPSOs – as the most likely forecast of FPSO orders ISSUES Local content requirements are Creating market entry barriers and limiting competition Raising costs – e.g., Egina FPSO $3.1 billion! Clogging the supply chain Shale oil/tight oil growth is a threat to deepwater Added supply could result in lower oil prices Shale oil projects could draw investment resources from deepwater Deepwater costs are increasing – shale oil/tight oil cost are falling Thank You If you would like to discuss any aspect of this presentation or get further details on the FPSO market, please contact Jim McCaul imaassoc@msn.com or 1 202 333 8501 Our website has further information that you may find useful. Please give us a visit. www.imastudies.com