National Budget 2011/2012

advertisement

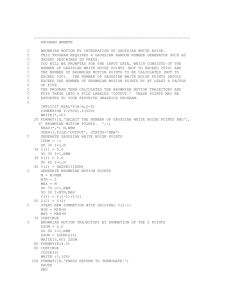

South Africa: National Budget 2011/2012 Kevin Lings Economist 23 February 2010 2 SA GDP growth (government estimate) % 6 5 4 3 5.3 5.6 5.6 4.3 4.2 2 3.2 3.1 2.1 1 2.4 4.6 4.2 2.6 2.4 3.7 2.7 4.1 4.4 3.6 3.4 2.9 2.8 1.2 0 0.0 -1.2 -1 0.5 -0.3 -1.0 -2.1 -1.7 -2 -3 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 Fixed Investment Growth (government estimate) % 17 14 11 8 14.0 14.1 12.9 10.7 5 8.2 5.7 4.8 2 -1 10.2 9.0 3.9 -0.6 -2.3 -7.4 3.9 2.8 3.5 -2.2 -5.3 -4 11.0 12.1 5.5 6.8 -3.6 -7.6 -7 -10 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 Current account (government estimate) % of GDP 7 6 5 4 3 2 1 0 -1 -2 -3 -4 -5 -6 -7 -8 -9 6 4.1 4.2 2.8 1.6 1.4 1.2 1.5 2.1 0 -1.7 -1.2 -1.5 -1.8 -0.5 -0.1 0.3 0.8 -1 -3 -3.5 -4.1 -5.3 -3.2 -4.2 -4.9 -5 -7 -7.1 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 Inflation (CPI) (government estimate) % 11 10 9 8 7 CPI forecast 6 5 9.9 4 3 7.1 6.1 5.6 4.3 2 4.9 5.2 5.5 11 12 13 3.2 2.1 1 0 -0.9 -1 -2 03 04 05 06 07 08 09 10 Open Budget Index 2010 Index out of 100 South Africa New Zealand UK France Norway Sweden US Chile Brazil South Korea Germany India Spain Czech Republic Russia Italy Portugal Turkey Argentina Ghana Namibia Mexico Botswana Kenya Thailand Malaysia Zambia Morocco Angola Nigeria Vietnam China Saudi Arabia 0 20 40 60 80 100 SA government’s budget 2011/2012 – main indicators. Consolidated budget 2010/2011 2011/2012 % change R billion R billion Revenue 755.0 824.5 9.2% Expenditure 897.4 979.3 9.1% Budget deficit -142.4 -154.8 Deficit as % of GDP -5.3% -5.3% Government expenditure & revenue as % of GDP % Fiscal years Huge increase in expenditure 35 34 Expenditure as % of GDP 33 32 31 30 29 28 27 26 Revenue as % of GDP 25 24 11/12 10/11 09/10 08/09 07/08 06/07 05/06 SA budget deficit as % of GDP Fiscal years, main budget % 2 1 -1 -2 -3 -4 -5 -6 -7 -8 -9 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 1974 1973 1972 1971 1970 1969 1968 1967 1966 1965 1964 1963 1962 1961 SA budget deficit as % of GDP (consolidated budget) % Fiscal years 3 2 1 1.7 0 -1.2 -1 -3.8 -2 -5.3 10/11 11/12 -3 -5.3 -4.8 -6.6 -4 -5 -6 -7 -8 13/14 12/13 09/10 08/09 07/08 -12 China Mexico Germany Russia Brazil Emerging economies Italy Euro Area Canada South Africa France Spain Advanced economies Britain Japan India % United States Fiscal balance as % of GDP - 2011 0 -2 -4 -6 -8 -10 Breakdown of tax revenue (20011/12) Electricity levy 0.9% Customs 4.0% Excise duties 3.4% Individuals 34.1% Fuel levy 5.0% Other 6.1% VAT 27.1% Companies 19.4% Government budget revenue overruns Rbn 45 35 25 41.2 15 5 8.2 6.5 14.9 5.2 29.5 20.9 13.3 16.6 13.4 -5.1 -5 -14.5 -15 -25 -66.4 -35 -45 -55 -65 -75 2010/11 2009/10 2008/09 2007/08 2006/07 2005/06 2004/05 2003/04 2002/03 2001/02 2000/01 1999/00 1998/99 SA budget revenue overrun in 2010/2011: R16.6bn Rbn VAT Custom duties Personal Tax Other tax revenue Fuel levy Property taxes Corporate Tax Excise duties SACU Provinces/public entities -10 -5 0 5 10 15 20 IDC Employment fund Job summit Tax incentives 16 Budget revenue increases 2011/2012 -4 Transfer duties -2 0 2 4 6 8 10 12 14 -2.7 Fuel levy 7.6 Skills development levy 8.7 Companies 8.8 9.5 Excise duties STC 9.7 TAX REVENUE 10.3 VAT 10.8 Individuals 10.9 Customs duties 13.1 After tax proposals Main tax proposals 2011/2012 Additions Rm Personal income tax Personal income tax adjustment Adjustment in monetary thresholds Business tax Dividend cession scheme -8 350 -8 100 -750 500 500 Taxes on property Adjustment in transfer duties Indirect taxes Increase in fuel levy Increase in excise duties Increase in electricity levy LOSS ON TAX PROPOSALS Subtractions Rm -750 -750 4 985 1 900 1 935 1 150 -4 115 Personal tax relief in previous tax years ● Tax relief for individuals: ● 1998/1999 R4.0bn ● 1999/2000 R5.0bn ● 2000/2001 R10.0bn ● 2001/2002 R8.0bn ● 2002/2003 R15.0bn ● 2003/2004 R13.0bn ● 2004/2005 R4.0bn ● 2005/2006 R6.8bn ● 2006/2007 R13.5bn ● 2007/2008 R8.4bn ● 2008/2009 R7.2bn ● 2009/2010 R13.0bn ● 2010/2011 R6.5bn ● 2011/2012 R8.1bn Tax reduction for individuals <65 Taxable income (rands). Tax relief of R8.1 billion in 2011/2012 60000 495 65000 495 70000 495 75000 80000 495 85000 495 90000 495 100000 120000 495 495 495 150000 1195 200000 1195 250000 1895 300000 400000 1895 2895 500000 3615 750000 4175 1000000 4175 0 500 1000 1500 2000 2500 3000 3500 4000 4500 Breakdown of Fuel Levy – R2.61 per litre Customs & Excise Levy 1.5% Road Accident Fund Levy 30.6% General Fuel Levy 67.9% Other tax issues: ● New tax bracket/threshold for people aged 75 years and older ● New tax on gambling (15% on winnings over R15 000) ● Threshold for interest income raised only fractionally (R22 300 to R22 800 for under 65, and R32 000 to R33 000 for 65 and over) ● International air passenger departure tax increased (R150 to R190 per passenger) ● Discussion on a possible carbon tax Customs union payments by SA Government Rbn 30 25 20 15 28.9 27.9 25.2 24.7 21.8 10 17.9 13.3 14.1 9.7 11/12 10/11 09/10 08/09 07/08 06/07 96/97 05/06 95/96 04/05 94/95 03/04 93/94 8.3 02/03 92/93 8.2 01/02 7.2 99/00 91/92 5.6 98/99 3.2 5.2 97/98 3.1 90/91 0 3.0 3.9 1.8 2.8 4.4 8.4 00/01 5 IDC Employment fund Job summit Tax incentives 24 Breakdown of expenditure (including interest) Other 6.9% Public Order and Safety 9.8% Defense 4.1% Economic Affairs 11.6% State debt cost 8.3% Housing and community 10.4% Education 20.7% Social Protection 16.0% Health 12.2% Budget Expenditure increases in 2011/12 Housing and community 17.1 State debt cost 15.0 Defense 13.3 Social Protection 10.7 Health 10.3 Education 10.0 Total 9.1 Public Order and Safety Economic Affairs 8.2 -6.8 -10 % -5 •Consolidated national and provincial expenditure 0 5 10 15 20 Key expenditure items % of total 1990/91 05/06 06/07 07/08 08/09 09/10 10/11 10/12 13.7 5.7 5.1 4.9 4.4 4.0 4.1 4.1 5.6 10.9 10.0 10.2 9.9 9.6 9.9 9.8 Education 20.9 18.6 18.2 19.6 20.0 19.6 20.5 20.7 Health 10.1 11.2 11.4 11.0 11.0 11.6 12.0 12.2 Social security 10.8 16.6 15.2 16.3 15.8 15.6 15.7 16.0 11.2 13.5 12.9 14.2 15.8 13.5 11.6 Defence Police, courts, prisons Economic services Social grant beneficiary numbers ● Number of people obtaining a social grant ● April 2000 2 946 618 ● April 2003 5 808 494 ● April 2004 7 941 562 ● April 2005 9 406 829 ● April 2006 10 918 263 ● April 2007 11 983 141 ● April 2008 12 374 770 ● April 2009 13 066 118 ● April 2010 13 958 894 ● April 2011 14 892 000 ● April 2012 15 713 000 ● April 2013 16 223 000 ● April 2014 16 709 000 Government salary payments: up 61.5% in past 3 years Billions Budgeted to rise by only 7.9% in 2011/12? 320 280 Grown by an average 17.3% p.a. for past 3 year 240 200 160 2011/12 2010/11 2009/10 2008/09 2007/08 South Africa’s employment problem Millions Create 5 million jobs in 10 years 19 18 17 16 15 14 13 12 11 10 2020 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 IDC Employment fund Job summit Tax incentives 31 Fiscal measures to improve employment: ● Youth employment subsidy: R5 billion over 3 years. Tax credit administered by SARS. Expected to create 178 000 new jobs ● Learnership tax incentive extended for 5 years, but will be reviewed (was due to expire in Sep 2011. Have not been widely used) ● Training layoff scheme has utilised R21.3 million in training allowances and supported 7 286 workers ● Expanded public works programme budgeted at R73 billion over next 3 years ● Jobs fund: R9 billion. Available to both private and public sector. Expected to employ 50 000 to 100 000 over the ‘medium term’ Public sector infrastructural spending Rbn R808.6bn 350 300 250 200 150 260.1 252.8 2010/11 2011/12 235.2 100 269.3 286.4 196.5 130.2 70.7 83.6 2005/06 2006/07 50 0 2013/14 2012/13 2009/10 2008/09 2007/08 IDC Employment fund Job summit Tax incentives 34 Financing the National Budget 2010/2011 Outcome 2011/12 Budget -143.36 3.15 -0.80 -141.01 -159.07 1.35 -0.15 -157.87 35.10 22.00 139.15 135.37 -2.27 5.00 Change in cash balance -30.97 -4.50 Total financing 141.01 157.87 National deficit/surplus Extraordinary receipts Extraordinary payments Net borrowing requirement Domestic short-term loans Domestic long-term loans (net) Foreign loans (net) Government net domestic long-term bonds issued Fiscal years Rbn 160 140 120 100 80 60 40 20 0 -20 13/14 12/13 11/12 10/11 09/10 08/09 07/08 06/07 05/06 04/05 03/04 02/03 01/02 00/01 99/00 98/99 97/98 96/97 95/96 94/95 93/94 92/93 91/92 90/91 89/90 Government net foreign funding Rbn Fiscal years 35 30 25 20 15 10 5 0 -5 -10 13/14 12/13 11/12 10/11 09/10 08/09 07/08 06/07 05/06 04/05 03/04 02/03 01/02 00/01 99/00 98/99 97/98 Public sector borrowing requirement Rbn Fiscal years 320 300 280 260 240 220 200 180 160 140 120 100 80 60 40 20 0 -20 13/14 12/13 11/12 10/11 09/10 08/09 07/08 Government domestic debt as % of GDP % 50 45 40 35 30 25 20 15 10 78 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 Government total loan debt as % of GDP % 55 50 45 40 35 30 25 20 15 10 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 Debt servicing as % of total spending Fiscal years % 23 21 19 17 15 13 11 9 7 5 13/14 12/13 11/12 10/11 09/10 08/09 07/08 06/07 05/06 04/05 03/04 02/03 01/02 00/01 99/00 98/99 97/98 96/97 95/96 94/95 93/94 92/93 91/92 90/91 89/90 Evaluate the budget Aims Budget should be guide to govt's intentions Budget deficit contained Spending - efficiency Revenue - no ad hoc measures - efficiency of collection Positive impact on the economy - Growth - Inflation Exchange control relaxation Encouraging private sector investment Unemployment and Job creation Law & Order, Crime and Violence Poverty relief Encourage savings Encourage small business Innovation Negative Positive Yes Yes No Yes Yes Yes No No Yes Yes No Yes No Yes? No IDC Employment fund Job summit Tax incentives 43 Thank You