EFFICIENCY ANALYSIS OF INSURANCE COMPANIES IN PAKISTAN

advertisement

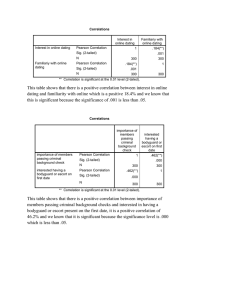

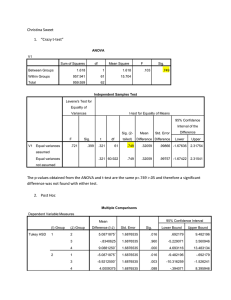

Determinants of Performance: A Case of Life Insurance Sector of Pakistan NAVEED AHMED Hailey College of Commerce, University of the Punjab, Lahore INTRODUCTION The performance of any firm not only plays the role to increase the market value of that specific firm but also leads toward the growth of the whole industry which ultimately leads towards the overall prosperity of the economy. Measuring the performance of insurers has gained the importance in the corporate finance literature because as intermediaries, these companies are not only providing the mechanism of risk transfer but also helps to channelizing the funds in an appropriate way to support the business activities in the economy. • Insurance companies have importance both for businesses and individuals as they indemnify the losses and put them in the same positions as they were before the occurrence of the loss. In addition, insurers provide economic and social benefits in the society i.e. prevention of losses, reduction in fear and increasing employment. Therefore, the current business world without insurance companies is unsustainable because risky businesses have not a capacity to retain all types of risk in current extremely uncertain environment. Financial statistics reported the phenomenal growth of Pakistani life insurance companies as these companies comprise 52% and 69% share of entire (life plus non-life) insurance market in terms of net premiums and assets (Insurance Year Book, 2007). In addition, the premium of these life insurers increased by 36% in 2007 (Insurance Year Book, 2007) shows the remarkable progress of life insurance sector of Pakistan Therefore, what determines the performance of the life insurance industry is an important discussion for the regulators and policy makers to support the sector in achieving the excellence so that desirable economic fruits could be reaped from the help of the life insurance sector of Pakistan LITERATURE REVIEW • Wessels (1988) • Chiarella et al. (1991) • Kjellman and Hansen (1995) • Rajan (1995) • Wiwattanakantang (1999) • Chen and Jiang (2001) • Miguel and Pindado (2001) • Nivorozhkin (2002) • Frank and Goyal (2003) • Cassar and Holmes (2003) • Low and Chen (2004) • Buferna et al. (2005) • Huang and Song (2006) • Daskalakis and Psillaki (2007) • Cheng and Weiss (2008) • Bhaird and Lucey (2008) • Li et al. (2009) • Chang et al. (2009) RESEARCH METHODOLOGY Sample and Data Currently, there are five life insurance companies operating in Pakistan and all these five companies are selected to measuring their performance over the period of seven years from 2001 to 2007. For this purpose, financial data has been collected from financial statements (Balance Sheets and Profit and Loss a/c) of insurance companies and “Insurance Year Book” which is published by Insurance Association of Pakistan. The following statistical analysis have been used to deduce the results of present study: Descriptive Analysis Correlation Analysis Regression Analysis Regression Model PR = β0 + β1 (LG) + β2 (TA) + β3 (SZ) + β4 (LQ) + β5 (AG) + β6 (RK) + β7 (GR) + ε Where: • PR = Performance (Net income before interest and tax divided by total assets) • LG = Leverage (Total debts divided by total assets) • SZ = Size (Log of premiums) • GR =Growth (Percentage change in premiums) • TA = Tangibility of assets (Fixed assets divided by total assets) • LQ = Liquidity (Current assets divided by current liabilities) • AG = Age (Difference b/w observation year and establishment year) • RK = Risk (standard deviation of ratio of total claims to total premiums) • ε = the error term EMPIRICAL FINDINGS Descriptive Statistics Years 2001 2002 2003 Leverage Size Mean SD Min Max Mean SD Min Max 0.80 0.21 0.45 0.99 6.02 2.12 3.06 8.93 0.81 0.20 0.47 0.99 6.21 2.11 3.29 9.07 0.82 0.19 0.51 0.99 6.50 2.08 3.57 9.20 0.79 0.24 0.38 0.99 6.68 2.09 3.56 9.31 0.83 0.21 0.47 0.99 6.95 2.03 3.96 9.53 0.84 0.20 0.49 0.99 7.21 2.02 4.24 9.68 0.79 0.30 0.26 1.00 7.51 2.06 4.50 10.03 2004 2005 2006 2007 Years Growth Mean 2001 2002 2003 SD Min Performance Max Mean SD Min Max 11.53 11.90 3.22 32.39 0.02 0.01 0.00 0.03 22.21 23.52 3.68 60.99 0.02 0.01 0.00 0.03 37.18 32.62 8.30 90.71 0.02 0.01 0.00 0.03 2004 22.20 27.93 -1.78 61.16 2005 2006 2007 0.03 0.02 0.00 0.05 31.18 10.30 24.97 48.98 0.02 0.02 0.00 0.05 31.79 26.14 3.74 72.78 0.03 0.02 0.00 0.06 9.25 22.44 45.66 0.07 0.07 0.00 0.17 34.82 Years Tangibility Mean 2001 2002 2003 SD Min Liquidity Max Mean SD Min Max 0.03 0.02 0.00 0.06 1.70 0.76 1.07 2.65 0.03 0.02 0.00 0.06 1.73 0.86 1.14 3.01 0.03 0.02 0.00 0.05 2.18 1.11 1.22 3.72 0.02 0.02 0.00 0.04 2.24 1.77 1.09 4.85 0.02 0.02 0.00 0.04 3.02 2.26 1.15 5.94 0.02 0.01 0.00 0.03 3.98 2.72 1.36 7.37 0.02 0.02 0.00 0.05 6.36 8.63 1.33 16.33 2004 2005 2006 2007 Years Age Mean 2001 2002 2003 SD Risk Min Max Mean SD Min Max 16.60 20.40 6.00 53.00 1.92 1.33 0.70 3.94 17.60 20.40 7.00 54.00 0.83 0.47 0.40 1.34 18.60 20.40 8.00 55.00 0.58 0.45 0.18 1.34 19.60 20.40 9.00 56.00 3.34 3.08 0.00 7.23 20.60 20.40 10.00 57.00 4.70 2.15 1.23 6.36 21.60 20.40 11.00 58.00 3.60 3.86 0.51 9.72 22.60 20.40 12.00 59.00 6.35 6.51 1.78 16.00 2004 2005 2006 2007 CORRELATION ANALYSIS Leverage Leverage Size Growth Tangibility Liquidity Age Pearson Correlation Sig. (2-tailed) Size Growth Tangibility Pearson Correlation Sig. (2-tailed) .000 Pearson Correlation .077 .072 Sig. (2-tailed) .661 .680 -.476** -.142** .051 .000 .000 .771 -.225** -.429* .052 .229 Sig. (2-tailed) .000 .025 .796 .250 Pearson Correlation .415* .401** -.153 -.356** .491** Sig. (2-tailed) .013 .000 .379 .000 .009 -.427* -.200 -.060 .084 .364** -.071 .012 .256 .334 .538 .000 .771 Pearson Correlation Sig. (2-tailed) Liquidity Age Risk .374** Pearson Correlation Pearson Correlation Sig. (2-tailed) REGRESSION ANALYSIS Unstandardized Coefficients Standard ized Coefficie nts Model (Constant) B .010 Std. Error .051 Beta t .204 Sig. .841 Leverage -.265 .090 -1.579 -2.940 .008* Size .038 .009 1.722 4.120 .001* Growth -4.69 .000 -.032 -.245 Tangibility .507 .367 .183 1.382 .183 Liquidity .001 .003 .058 .205 Age -.003 .003 -.235 -1.169 .257 Risk -.004 .002 -.374 1.903 .072** .809 .840 CONCLUSION The results reveal that leverage, size and risk are most important determinant of performance of life insurance sector whereas ROA has statistically insignificant relationship with age, growth, tangibility and liquidity. FUTURE RESEARCH Thanks