Million Bales

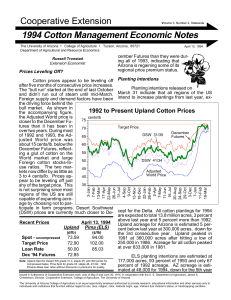

advertisement

World Real GDP Growth 6% Actual Estimate 5% 4% 3% 2% 1% 0% -1% 05 06 07 08 09 10 11 12 13 14 IMF, January 2013 NCC Acreage Survey • Distributed on Dec 18 • Responses collected through Jan 23 • Asked for acres of upland cotton, ELS cotton, corn, soybeans, wheat, Other crops in ‘12 and intentions for ’13; also asked price expectations Pre-Planting Market Signals Cotton Corn Soybeans Cot/Corn Cot/Soy 2013 78.96¢ $5.92 $12.94 13.3 6.1 2012 92.08¢ $5.65 $12.59 16.3 7.3 2011 118.08¢ $5.88 $13.31 20.1 8.9 2010 73.70¢ $4.04 $9.37 18.3 7.9 2009 51.65¢ $4.17 $8.98 12.4 5.8 2008 80.72¢ $5.36 $12.73 15.0 6.3 U.S. Cotton Area & Prices Million Acres Price Ratio 18 24 Acres Cotton/Corn Cotton/Soy 15 18 12 12.32 9 9.01 12 6 6 3 0 0 06 07 08 09 10 11 12 13 2013 Southeast Acreage 2012 Actual 2013 Intended % Change Alabama 380 320 -15.7 Florida 108 103 -4.5 1,290 1,093 -15.3 North Carolina 585 398 -32.0 South Carolina 299 265 -11.4 86 62 -28.3 2,748 2,241 -18.5 Georgia Virginia Southeast Total may not add due to rounding. 2013 Mid-South Acreage 2012 Actual 2013 Intended % Change Arkansas 595 221 -62.9 Louisiana 230 144 -37.3 Mississippi 475 199 -58.1 Missouri 350 239 -31.6 Tennessee 380 199 -47.6 Mid-South 2,030 1,003 -50.6 Total may not add due to rounding. Arkansas Crop Returns $ per Acre $400 Difference Between Corn and Cotton Returns $300 $200 $100 $0 -$100 06 07 08 09 10 11 12 13 2013 Southwest Acreage 2012 Actual 2013 Intended 56 50 -10.4 305 267 -12.3 Texas 6,550 4,910 -25.0 Southwest 6,911 5,228 -24.4 Kansas Oklahoma Total may not add due to rounding. % Change 2013 West Acreage 2012 Actual 2013 Intended % Change Arizona 200 193 -3.6 California 142 112 -21.4 46 36 -21.0 388 341 -12.2 New Mexico West Total may not add due to rounding. 2013 ELS Acreage 2012 Actual Arizona 2013 Intended % Change 3 3 -16.0 225 190 -15.6 New Mexico 2 2 -26.0 Texas 8 8 3.9 238 203 -15.0 California ALL ELS Total may not add due to rounding. % Changes in Futures Prices 8% Cotton 6% Corn Soybeans 4% 2% 0% -2% -4% -6% -8% -10% -12% 12/18 12/25 1/1 1/8 1/15 1/22 1/29 2/5 U.S. Cotton Production Million Bales 18 16 13.30 14 12.86 12 10 8 07 05 04 98 00 11 U.S. Balance Sheet Million Bales 10/11 11/12 12/13 18.10 15.57 17.01 Mill Use 3.90 3.30 3.43 Exports 14.38 11.71 12.20 Stocks 2.60 3.35 4.77 Stocks/Use 14% 23% 31% Production 13/14 Change 12.86 -4.15 Cotton’s Share of U.S. NDC 50% 48% 46% 44% 42% 40% 38% 36% 34% 32% 30% 06 07 08 09 10 11 12 13 Apparel Import Per-Unit Values 1.50 Ratio of Cotton to MMF 1.45 1.40 1.35 1.30 1.25 1.20 1.15 1.10 1.05 1.00 06 07 08 09 10 11 12 13 Net Domestic Fiber Consumption Million Bale Equivalents 35 Cotton Other 30 25 20 15 10 5 0 03 04 05 06 07 08 09 10 11 12 U.S. Balance Sheet Million Bales 10/11 11/12 12/13 18.10 15.57 17.01 12.86 -4.15 Mill Use 3.90 3.30 3.43 3.48 0.05 Exports 14.38 11.71 12.20 Stocks 2.60 3.35 4.77 Stocks/Use 14% 23% 31% Production 13/14 Change Int’l Area (Excluding China) Million Acres A Index ($/Lb) 70 $1.80 Acres 68 A Index (t-1) $1.60 66 $1.40 64 $1.20 61.8 62 59.4 60 $1.00 $0.80 58 $0.60 56 54 $0.40 52 $0.20 50 $0.00 03 04 05 06 07 08 09 10 11 12 13 Int’l Mill Use (Excluding China) Million Bales 80 67.2 70 71.0 61.8 60 50 40 30 20 10 0 03 04 05 06 07 08 09 10 11 12 13 Yarn Export Values – Cotton Price Cents per Lb 120 Pakistan India 100 80 60 40 20 0 07 08 09 10 11 12 13 Fiber Prices Cents per Lb 250 China Cotton Price China Polyester 200 A Index 150 100 50 0 08 09 10 11 12 13 Yarn Export Values – Cotton Price Cents per Lb 120 Pakistan India China 100 80 60 40 20 0 07 08 09 10 11 12 13 China Cotton Yarn Imports Thousand Bales 800 700 600 500 400 300 200 100 0 06 07 08 09 10 11 12 13 China Cotton Use Million Bales 60 Mill Use Yarn Imports 50 50.0 40 30 35.5 34.3 12 13 20 10 0 04 05 06 07 08 09 10 11 China’s Reserves: The Big Unknown Million Bales 12/13 13/14 Change Mill Use 35.5 34.3 -1.2 Production 33.5 30.7 -2.8 Gov’t Purchases 28.5 26.1 -2.4 Gov’t Sales 16.1 21.0 4.9 Stocks 40.6 43.8 3.2 33.8 38.8 5.0 12.5 6.9 -5.6 Gov’t Reserves Imports World Cotton Trade Million Bales 50 US Exports 45 Imports 38.9 40 35.9 35 30 25 20 15 10 5 0 04 05 06 07 08 09 10 11 12 13 U.S. Balance Sheet Million Bales 10/11 11/12 12/13 18.10 15.57 17.01 12.86 -4.15 Mill Use 3.90 3.30 3.43 3.48 0.05 Exports 14.38 11.71 12.20 10.61 -1.59 Stocks 2.60 3.35 4.77 3.55 -1.23 Stocks/Use 14% 23% 31% 25% Production 13/14 Change World Balance Sheet Million Bales 11/12 12/13 13/14 Change Production 124.1 118.8 110.1 -8.7 Mill Use 103.1 106.1 108.7 2.6 Trade 44.7 38.9 35.9 -3.0 Stocks 68.9 81.7 83.1 1.4 China Reserves 21.4 33.8 38.8 5.0 Other Stocks 47.5 47.9 44.3 -3.6 Cotton Trade Balance Million Bales Production less Use Outside China China Imports Difference 2010/11 17.8 12.0 5.8 2011/12 25.9 24.5 1.4 2012/13 14.7 12.5 2.2 2013/14 4.9 6.9 -2.0 Buy & Sell 4.9 4.1 0.8 Buy & Hold 4.9 11.0 -6.1 Summary Points • Resistance breaking out of recent price range – China reserves a key factor – Sustaining demand • Smaller U.S. acreage & production in ‘13 – Remember: $6 corn & $13 soybeans resulted from severe drought; markets could change quickly – ‘14 could look much different Questions Going Forward Growth in China Fiber Mill Use? Million Bales 250 Cotton Manmade Fiber 200 150 China’s 5-Year Plan 100 50 0 90 93 96 99 02 05 08 11 14 17 Shifts in Cotton Mill Use? Million Bales 100 China 90 Rest of World 80 70 60 50 40 30 20 10 0 90 93 96 99 02 05 08 11 14 17 Markets for U.S. Cotton? 100% 90% Others 80% 70% Turkey 60% Mexico 50% 40% China 30% 20% U.S. Mills 10% 0% 1998-02 2003-07 2008-12 2013-17