Economic Performance of Converting From a Cow/Calf/Yearling

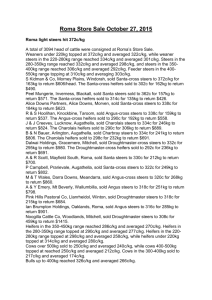

advertisement

Shane Ruff Graduate Student Department of Agricultural and Applied Economics University of Wyoming 400 cow/calf pair 280 yearlings All calves are retained in operation All 180 steers in yearling operation 100 heifers in yearling, 80 in cow/calf as replacements Calves are received in yearling operation in fall, 550 lbs. for steers and 500 lbs. for heifers Sold the following September at 977 lbs. for steers and 927 lbs. for heifers Deeded land, BLM and Forest land are used for grazing I assume in the ranch model that the cow/calf/yearling enterprise produces enough hay to feed all animals As the enterprise transitions, and there are less cows, there is extra hay to sell Pure stocker steer budget sells all hay 3 ranch models Cow/Calf/Long-Yearling Enterprise ◦ Base model to transition from ◦ 400 cow/calf pair and 280 yearlings Transition to: ◦ long-yearling enterprise Nov. 1 to Sep.1 ◦ pure stocker steer enterprise (2 types) May 1 to Sep. 1 Yearlings run Nov. 1 to Sep. 1 Cull 15% of the cows each year Translate that 15% back into yearling operation (Total AU’s) 7 year transition period Heifers in yearling operation are spayed End with 841 yearlings All hay for feeding is produced by enterprise All cattle are sold up front Revenue from cattle sales accounted for in year one of transition Pure stocker steer operation Purchased in spring, sold following fall (Sep) Steers are purchased at 600/700lbs in spring Sold at 846/946 lbs. in fall (Sep) End with 919/833 stocker steers All hay from hay enterprise is sold All models are estimated out to 7 years Culling 15% of cow/calf herd each year takes 7 years to fully transition This way they can be compared accurately over the long-run Historical calf prices and native hay prices ◦ Calf Prices 99-10 ◦ Hay Prices 83-12 @Risk simulation ◦ Simulates likelihood of these historical prices occurring ◦ Shows a range of expected profit No ownership costs are factored in ◦ ◦ ◦ ◦ Paying yourself (owner labor) Depreciation Operating Loan (interest) Taxes All enterprises include haying operation No risk of contracting brucellosis in herd Enterprise has low chance of losing money. Enterprise has a low chance of losing money (3%). Wider range of profit and lower average compared to base herd (cow/calf/yearling) Potential for higher profits, also larger loses. Lower average than base. Enterprise loses money 22% of the time (2 out of 10 years). Producer has to plan for years where there is a loss. Higher profit potential, higher loss potential. Lower average than base herd. Enterprise Cow/Calf/Yearling Yearling 600-846 lb. Steers 700-946 lb. Steers NPV $756,104.48 $640,965.54 $378,104.14 $607,126.95 Stocker Steer enterprise has potential to earn larger profit but also larger loss May have to survive one or more years of negative profit Depends on risk attitude of producer ◦ How much risk are you willing to take? High risk of brucellosis vs. low risk of brucellosis infection Preliminary results have shown early years of transition are most profitable Tax implications ◦ Raised breeding livestock Taxed as ordinary income Has potential to raise tax bracket ◦ Purchased livestock Capital gains taxes apply Tax implications of whole herd liquidation vs. culling 15% of herd each year Completed Thesis Excel document allowing producers to enter their own values in comparison to mine Extension Bulletin