2010-2013 Revenue and Net Profit

advertisement

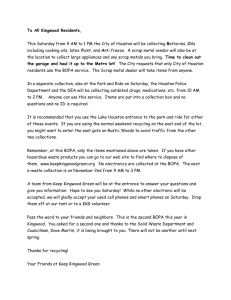

Green Seal Holding 4Q2013 Results #1 BOPA Manufacturer in China, BOPA is A Green Material Safe Harbor Disclaimer This presentation contains “ forward-looking” statements, including statements about business outlook and strategy, and statements about historical results that may suggest trends for our business. These statements are based on estimates and information available to us at the time of this presentation and are not guarantees of future performance. Actual results could differ materially from our current expectations as result of many factors, including: our financial performance, including our net revenue, cost of revenue, operating expenses and ability to sustain profitability; our planned capital expenditures; our liquidity and working capital requirements; our ability to expand our customer base; our ability to expand our product and service offerings; our efforts to make our business more vertically integrated; our ability to develop additional adjacent lines of business; our international expansion plans, our ability to secure adequate facility space; our ability to retain and hire necessary employees, including seasonal personnel, and appropriately staff our operations; the impact of seasonality on our business; our ability to remediate the material weaknesses and significant deficiencies in our internal control over financial reporting; our ability to stay abreast of modified or new laws applying to our business; and our spending of the net proceeds from this offering. These and other risks and uncertainties associated with our business are described in our IPO prospectus. 2 Green Seal (1262.TT) Highlights http://www.greenseal-group.com/ Found in 2009, Taiwan Stock Exchange Listing on January 16, 2014, Stock Ticker 1262 Market Capitalization NT$30.98 Billion (2014/3/14 closing); IPO priced at NT$17.01 Billion ( NT$126 per share) #1 Leader in China BOPA with 36% market share Veteran management team leading 634 employees with 60+ R&D Only BOPA Chinese BOPA manufacturer with selfdeveloped reaction agents Product portfolio increased as a result Customized products percentage increased quarter over quarter, contributing to margin expansion Command key processing know-how to reach 99% yeild Highest production line run rate per line in the industry Wasted material 100% recycled Highest even area (75%) among peers 360 90 2013 Results(Pro-Forma) Revenue:NT$5.171 Billion Gross Margin:33% Net Profit:NT$1.132 Billion Earning Per Share (based on 120m shares):10.22 3 4Q2013 Financial Highlights Unit: NT$000 Revenue 4Q2013 4Q2012 4Q2013 Over 4Q2012 3Q2013 4Q2013 Over 3Q2013 1,412,918 1,245,601 1,341,663 167,317 71,255 35% 31% 33% +4% +2% 73,703 56,309 82,436 17,394 -8,733 Operating Income 414,958 327,710 367,487 87,248 47,471 Operating Margin 29% 26% 27% +3% +2% Non Operating Items -13,991 -22,011 -15,965 8,020 1,974 Pretax Profit 400,967 305,699 351,522 95,268 49,445 Net Profit 338,829 258,064 296,704 80,765 42,125 21% 22% +3% +2% +305 +250 Gross Margin Operating Expense Net Margin 24% EPS (元) 2.82 2.63 2.47 4.791890 4.684971 4.782558 9,442 9,137 9,192 RMB/NTD Exchange Rate Shipment (Tons) NT$35.57億 Note 1: Numbers above are pro-forma based Note 2: 3Q2013 and 4Q2013 EPS are calculated based on 120,000,000 shares outstanding Note 3: 4Q2012 EPS is based on 97,978,000 shares 4 2010-2013 Solid Growth Indicators Unit: NT$000 Revenue 2010 2011 2012 2013 1,086,421 100% 3,556,581 100% 5,577,804 100% 5,170,768 100% Gross Profit 363,451 33% 825,469 23% 1,478,920 27% 1,716,463 33% Operating Profit 319,381 29% 689,810 20% 1,268,648 23% 1,414,314 27% Pretax Profit 290,918 27% 654,904 19% 1,133,246 20% 1,344,711 26% Net Profit 212,374 20% 551,839 16% 953,458 17% 1,131,852 22% Earning Per Share 2.17 Shipment (Tons) 7,027 NT$35.57億5.63 22,529 9.73 10.22 37,279 35,813 Note 1: Numbers above are pro-forma based Note 2:2012 and 2013 Financial Reports are based on IFRS reporting while 2010 and 2011 are based on ROC reporting 5 Consistent Growth in Revenue and Net Profit 2010-2013 Revenue and Net Profit (NT$Billion) 5.578 5.171 3.557 Revenue 营业收入 1.086 2010 0.953 0.552 0.212 1.132 2011 2012 2013 2010-2013 Earning Per Share 15 10 5 9.73 10.22 5.63 2.17 0 2010 2011 2012 2013 Note 1:2010~2012 EPS are calculated based on pro-forma 97,978,000 shares Note 2: 2013 EPS is calculated based on weighted average of the year, 110,769,000 shares 6 税后纯益 Net Profit BOPA Applications Food Household Products Energy Saving Electronics Pharmaceuticals 7 Revenue Breakdown by Key Product Applications 2013 Revenue Breakdown by Products 8 Monthly Revenue and Margin Trends 600,000 50% 45% 500,000 40% 35% 400,000 30% 300,000 25% 20% 200,000 15% 10% 100,000 5% NT$35.57億 - 0% Revenue (NT$000) 營業收入(新臺幣千元) 9 Gross Margin Gross Margin 營業毛利率 Balance Sheets and Key Indices Unit : NT$000 Current Assets 2010 2011 2012 2013 1,389,348 44% 2,234,512 45% 2,351,815 42% 3,676,095 46% Cash 211,122 7% 109,487 2% 189,562 3% 1,681,382 21% Account Receivables 371,762 12% 1,056,382 21% 1,411,934 25% 1,388,072 17% Inventories 138,184 4% 406,658 8% 156,565 3% 159,913 2% Non Current Assets 1,768,124 56% 2,743,919 55% 3,313,523 58% 4,374,260 54% Total Assets 3,157,472 100% 4,978,431 100% 5,665,338 100% 8,050,355 100% Current Liabilities 1,108,062 35% 1,776,627 35% 2,686,268 47% 1,718,686 21% Non Current Liabilities 1,642,573 52% 2,175,667 44% 1,053,369 19% 731,963 9% Total Liabilities 2,750,635 87% 3,952,294 79% 3,739,637 66% 2,450,649 30% 406,837 13% 1,026,137 21% 1,925,701 34% 5,599,706 70% Shareholders Equity Return on Asset Return on Equity 8% 85% NT$35.57億 15% 20% 18% 77% 65% 30% A/R Turnover Days 85 74 82 99 Inventory Turnover Days 47 37 26 17 Current Ratio 125% 126% 88% 214% Quick Ratio 97% 84% 70% 194% Note:2012 and 2013 Financial Reports are based on IFRS reporting while 2010 and 2011 are based on ROC reporting 10 Cash Flows Unit: NT$000 2010 2011 2012 2013 Cash Flow from Operations 110,647 330,075 986,216 1,639,247 Cash Flow from Investments -1,430,302 -1,156,693 -1,052,115 -1,040,760 Cash Flow from Financing 1,578,742 647,979 181,144 841,703 Exchange Rate Effect on Cash -54,080 77,004 -35,170 51,630 Cash Increase 205,007 NT$35.57億 -101,635 80,075 1,491,820 6,115 211,122 109,487 189,562 211,122 109,487 189,562 1,681,382 Beginning Balance Ending Balance Note:2012 and 2013 Financial Reports are based on IFRS reporting while 2010 and 2011 are based on ROC reporting 11 China CPL Supply and Demand (BOPA Upstream) Unit:10,000 tons 250 90% 82% 200 80% 70% 71% 60% 150 51% 50% 40% 41% 100 35% 30% NT$35.57億 20% 50 10% 0 0% 2009 2010 Demand 需求量 2011 Capacity 產量 12 2012 Import 進口量 China Self-sufficient Rate 自給率 2013 Rapid CPL Expansion Brought Down PA6 Price Quote 45,000 40,000 BOPA銷售價格 35,000 30,000 25,000 PA6採購價格 20,000 NT$35.57億 15,000 2010 avg 2011 avg 2012 avg 13 2013 avg 2014 avg 2015 avg Confidential Green Seal Strategy o Green Seal is dedicated only to BOPA thin film o Given its superior characteristics compared to other thin films, BOPA has great growth potentials Industry Leader Superior Characteristics High Growth Application Industries o Developing High ASP/High end products (Import Substitution, Price, 2-4x of standard product ASP) o Higher end products leads the industry (only Chinese manufacturer to procure the equipment o Upstream environment is favorable to Green Seal margins as CPL price is trending down o #1 Market Share o Processing know-how and scales surpass Chinese peers o Deep-rooted ground work done on developing Food, Household Products, Pharmaceutical and Electronics industries o High Growth Momentum High Margin Business Model 14 o o In-house developed reaction agents Efficiency Improvements (Industry Leader) Direct Sale Expanding Product Portfolio to Higher End BOPA Developed Simultaneous Process Developed In-house Reaction Agents leading to Different BOPA Products From Standard BOPA 15цm to 12/20/25цm Differentiated BOPA Developing High Insulation Hybrid Products (BOPA+EVOH) Developed Reaction Agents for: High separability, High insulation, Ultra thin, Bubble hood etc. In Development Processes: M-Nylon, Book Cover Film, Linear Tear Film, Ultra Ray Resistance, Winter Only, Summer Only, EVOH Hybrid etc. 2012 2013 15 After relocation of Wuxi Line to Xiamen and after production line alteration to simultaneous process, Green Seal’s product portfolio is now complete. When 5-layer production line 6, 7, 8 is ready, Green Seal will migrate into higher end hybrid products such as BOPA+EVOH and BOPA+MXD 2014 Capacity Expansion Plan for Next 2 Years Via new equipment purchase and M&A opportunities, Green Seal obtained the necessary capacity combined with its improved process know-how to emerge as the #1 manufacturer of BOPA in China Green Seal will continue to migrate to advanced process and processes to maintain its industry leadership position 80,000 10 9 9 8 75,600 8 70,000 60,000 7 50,000 6 40,000 5 5 30,000 35,400 3 20,000 10,000 6 1 5,500 32,500 5 35,400 40,900 41,600 51,600 63,600 7 6 5 4 產能(噸) Capacity (Tons) 3 Number of 生產線數量 2 17,900 1 - 0 16 Production Lines Equipments, Capacity and Product Types Production Lines Plant Location Production Date Machine Width (M ) Line 1 Xin Yang 2010.11 4.2 Line 2 Xin Yang 2010.11 4.2 Line 3 Dong Fu 2011.08 5.1 Line 4 Dong Fu 2011.10 Line 5 Dong Fu Line 6 Annual Capacity (Tons) Equipment Vendor Machine Layers Product Types Bruckner 3 Layers Standard, Customized Bruckner 3 Layers Standard, Customized 8,400 Bruckner 3 Layers Standard, Customized 5.1 8,400 Bruckner 3 Layers Standard, Customized 2013.06 4.2 6,200 Mitsubishi 3 Layers Standard, Customized Relocation from Wuxi and Process Alteration Dong Fu 2013.10 4.2 6,200 Bruckner 3 Layers Standard, Customized Relocation from Wenzhou and Equipment Upgrade Line 7 Dong Fu 2014Q4 5.1 NT$35.57億 10,000 Bruckner 5 Layers Standard, Customized & Hybrid Line 8 Dong Fu 2015Q2 6.6 12,000 Bruckner 5 Layers Standard, Customized & Hybrid Line 9 Dong Fu 2015Q4 Total Capacity (Tons) 6,200 6,200 6.6 12,000 Bruckner 75,600 17 5 Layers Standard, Customized & Hybrid Note Current Capacity: 41,600 Tons Confidential Q&A Yilin Yan, CEO Email: yilin.yan@chang-su.com.cn 18