Notes

advertisement

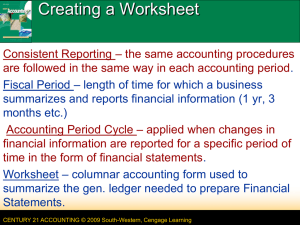

LESSON 8-1 Recording Adjusting Entries Accounting Period Cycle: When a company prepares a work sheet at the end of each fiscal period to summarize the general ledger. Adequate Disclosure: When financial statements are prepared from information on the work sheet. Adjusting Entries – journal entries recorded to update general ledger accounts at the end of the fiscal period. These entries are recorded on the NEXT JOURNAL PAGE!!! CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 2 ADJUSTING ENTRY FOR SUPPLIES 1 3 2 page 202 1. Write the heading. 2. Write the date. 3. Write the title of the account debited. Record the debit amount. 4. Write the title of the account credited. Record the credit amount. 4 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-1 3 ADJUSTING ENTRY FOR PREPAID INSURANCE page 204 1. Write the date. 2. Write the title of the account debited. Record the debit amount. 3. Write the title of the account credited. Record the credit amount. 1 2 3 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-1 4 TERM REVIEW page 205 adjusting entries CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-1 5 Lesson 8-2 Recording Closing Entries Permanent Accounts – accounts used to accumulate information from one fiscal period to the next “Real accounts” = assets, liabilities, owner’s Capital The ending balances for one fiscal period are the beginning account balances for the next fiscal period. Temporary Accounts – accounts used to accumulate information until it is transferred to the owner’s capital account. “Nominal Accounts” = Revenue, Expenses, Owner’s Drawing & Income Summary Show changes in the owner’s capital for a single fiscal period (transfer ending balances to capital and begin the next fiscal period with a zero balance) CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-2 LESSON 8-2 Closing Entries – journal entries used to prepare temporary accounts for a new fiscal period by reducing their balances to zero. - A closing entry merely transfers the balance of one account to another account - The procedure for closing an account includes entering an amount equal to the account balance on the side opposite its balance. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 7 NEED FOR THE INCOME SUMMARY ACCOUNT page 207 Income Summary – a temporary account that is used to summarize the closing entries for revenue and expenses. DOES NOT HAVE A NORMAL BALANCE SIDE. Closed at the end of a fiscal period when the Net Income or Net Loss is recorded. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-2 8 Closing Entries Four closing entries are made: 1. Close income statement accounts with credit balances (debit sales, credit income summary) 2. Close income statement accounts with debit balances (debit income summary with total expenses; credit all of your expenses individually) 3. Record Net Income or Net Loss in Owner’s Capital account (debit Income Summary; credit Capital) OR (debit Capital; credit Income Summary for loss) 4. Close owner’s drawing account (Debit Capital; Credit Drawing) CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-2 9 CLOSING ENTRY FOR AN INCOME STATEMENT ACCOUNT WITH A CREDIT BALANCE page 208 (Debit to close) 1 2 3 4 1. Write the heading. 2. Write the date. 3. Write the title of the account debited. Record the debit amount. 4. Write the title of the account credited. Record the credit amount. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-2 10 CLOSING ENTRY FOR INCOME STATEMENT ACCOUNTS WITH DEBIT BALANCES 1. 2. 3. 4. page 209 Date Income Summary Credit Debit amount (Credit to close) 1 2 4 3 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-2 CLOSING ENTRY TO RECORD NET INCOME OR LOSS AND CLOSE THE INCOME SUMMARY ACCOUNT 11 page 210 1. Date 2. Debit 3. Credit (Capital: credit to record net income) (Income Summary: debit to close) 1 2 3 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-2 12 CLOSING ENTRY FOR THE OWNER’S DRAWING ACCOUNT page 211 1. Date 2. Debit 3. Credit (Credit to close) 1 2 3 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-2 13 TERMS REVIEW page 212 permanent accounts temporary accounts closing entries CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-2 LESSON 8-3 Preparing a Post-Closing Trial Balance Post-closing trial balance – a trial balance prepared after the closing entries are posted CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning GENERAL LEDGER ACCOUNTS AFTER ADJUSTING AND CLOSING ENTRIES ARE POSTED CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 15 page 213 LESSON 8-3 16 Post Closing Trial Balance Write this down on the bottom of your notes page…. 1. Any account that has a Zero Balance from Closing Entries has a line drawn through the debit and credit column. 2. Only general ledger accounts with balances are included on a postclosing trial balance (Assets, Liabilities, and Owner’s Capital). 3. The total of all Debits must equal the total of all Credits. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-3 17 POST-CLOSING TRIAL BALANCE 4 1 3 2 6 5 7 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 216 1. Heading 2. Account titles 3. Account balances 4. Single rule 5. Compare totals 6. Totals 7. Record totals 8. Double rule 8 LESSON 8-3 18 TERMS REVIEW page 219 Accounting cycle – the series of accounting activities included in recording financial information for a fiscal period CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-3 19 ACCOUNTING CYCLE FOR A SERVICE BUSINESS 1 2 8 3 7 4 6 5 page 217 1. 2. 3. 4. 5. Analyzes transactions Journalize Post Prepare work sheet Prepare financial statements 6. Journalize adjusting and closing entries 7. Post adjusting and closing entries 8. Prepare post-closing trial balance CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 8-3