Notes

advertisement

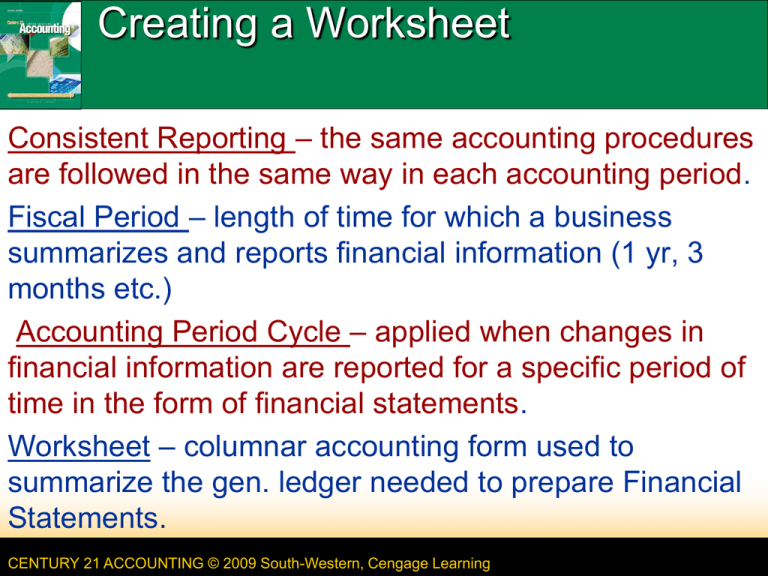

Creating a Worksheet Consistent Reporting – the same accounting procedures are followed in the same way in each accounting period. Fiscal Period – length of time for which a business summarizes and reports financial information (1 yr, 3 months etc.) Accounting Period Cycle – applied when changes in financial information are reported for a specific period of time in the form of financial statements. Worksheet – columnar accounting form used to summarize the gen. ledger needed to prepare Financial Statements. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 2 PREPARING THE HEADING OF A WORK SHEET 1 2 page 153 Name of Company Name of Report 3 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning Date of Report LESSON 6-1 3 TRIAL BALANCE - A proof of the equality of debits and credits in a general ledger 2 1 3 5 1. Write the general ledger account titles. 2. Write the general ledger debit account balances. Write the general ledger credit account balances. 3. Rule a single line across the two Trial Balance columns. 4 4. Add both the Trial Balance Debit and Credit columns. 5. Write each column’s total below the single line. 6. Rule double lines across 6 both Trial Balance columns. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-1 4 TERMS REVIEW page 155 Trial Balance – CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-1 5 Do Now: Take out 6.1 OYO Why do we create a Trial Balance? Why is it important? CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-2 Planning Adjustments on a Worksheet -Example: You purchase supplies in August. -You use some supplies throughout the month and some are left for September. -Only the value of the supplies used in August should be reported as expenses in August. CONCEPT: Matching Expenses with Revenue Amounts that helped earn revenue for a period must be reported as expenses in the same period. Changes must be made on the worksheet to account for those supplies used and to determine how much is left in the supplies account. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 7 Adjustments – Changes recorded on a worksheet to update all general ledger accounts Each time supplies are bought we debit the Supplies account. Supplies on hand are items of value owned by a business until the supplies are used. The value of supplies that are used becomes an expense to the business. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-2 Transaction: On August 31, Ms. Park counted the supplies on hand and found that the value of supplies still unused on that date was $310.00. Beg. Balance 8/31: $1,025 8 Ending Balance 8/31 $310.00 1. Write the debit amount. 2. Write the credit amount. 3. Label the two parts of this adjustment. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-2 9 On August 31, Ms. Park checked the insurance records and found that the value of insurance coverage remaining was $1,100. The value of the insurance coverage used during the fiscal period is: 2 3 1 1. Write the debit amount. 2. Write the credit amount. 3. Label the two parts of this adjustment. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-2 10 PROVING THE ADJUSTMENTS COLUMNS page 160 OF A WORK SHEET 1 2 1. Rule a single line. 2. Add both the Adjustments Debit and Credit columns. Write each column’s total. 3. Rule double lines. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 3 LESSON 6-2 11 PREPARING A WORK SHEET page 160 C 1. Write the heading. 2. Record the trial balance. 3. Record the supplies adjustment. 4. Record the prepaid insurance adjustment. 5. Prove the Adjustments columns. 6. Extend all balance sheet account balances. 7. Extend all income statement account balances. 8. Calculate and record the net income (or net loss). 9. Total and rule the Income Statement and Balance Sheet columns. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-2 12 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-2 13 1 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-2 14 1 2 496400 10000 15000 10000 102500 120000 6 (a) (b) 71500 10000 20000 5000 500000 4 62500 356500 356500 21300 (b) 10000 (a) 71500 2800 30000 Net Income 8 20000 5000 500000 3 62500 11000 881500 881500 10000 31000 110000 81500 21300 10000 2800 7 30000 71500 5 11000 81500 146600 356500 734900 525000 209900 209900 356500 356500 734900 734900 9 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-2 15 TERM REVIEW page 161 adjustments CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-2 LESSON 6-3 Extending Financial Statement Information on a Work Sheet Balance Sheet - a financial statement that reports assets, liabilities, and owner’s equity on a specific date Income Statement - a financial statement showing the revenue and expenses for a fiscal period CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 17 EXTENDING BALANCE SHEET ACCOUNT page 162 BALANCES ON A WORK SHEET 2 1. Debit balances without adjustments 2. Debit balances with adjustments 3. Credit balances without adjustments CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 1 3 LESSON 6-3 18 EXTENDING INCOME STATEMENT ACCOUNT BALANCES ON A WORK SHEET page 163 1 2 3 1. Sales balance 2. Expense balances without adjustments 3. Expense balances with adjustments CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-3 19 Net Income Net Income – the difference between total revenue and total expenses when total revenue is greater If Income Statement’s Credits are greater than Debits there is a NET INCOME CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-3 20 RECORDING NET INCOME, AND TOTALING AND RULING A WORK SHEET 4 1. Single rule 2. Totals 3. Net income 3 4. Extend net income 5. Single rule CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 6 page 164 1 2 7 5 6. Totals 7. Double rule LESSON 6-3 21 Net Loss Net Loss - the difference between total revenue and total expenses when total expenses are greater If Income Statement’s Debits are greater than Credits, there is a NET LOSS CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-3 22 CALCULATING AND RECORDING A NET LOSS ON A WORK SHEET page 165 1 3 1. 2. 3. 4. Single rule Totals Net loss Extend net loss 6 5. Single rule 6. Totals 7. Double rule CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 5 4 7 2 LESSON 6-3 23 TERMS REVIEW page 166 balance sheet income statement net income net loss CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-3 LESSON 6-4 Finding and Correcting Errors on the Work Sheet CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 25 CORRECTING AN ERROR IN POSTING TO page 168 THE WRONG ACCOUNT 2 Correct entry 1 Incorrect entry 1. Draw a line through the entire incorrect entry. Recalculate the account balance and correct the work sheet. 2. Record the posting in the correct account. Recalculate the account balance, and correct the work sheet. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-4 26 CORRECTING AN INCORRECT AMOUNT page 169 2 1 3 1. Draw a line through the incorrect amount. 2. Write the correct amount just above the correction in the same space. 3. Recalculate the account balance, and correct the account balance on the work sheet. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-4 27 CORRECTING AN AMOUNT POSTED TO THE WRONG COLUMN page 169 2 1 3 5 4 6 4. Draw a line through the incorrect item in the account. 5. Record the posting in the correct amount column. 6. Recalculate the account balance, and correct the work sheet. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 6-4