Introduction to Engineering Economy

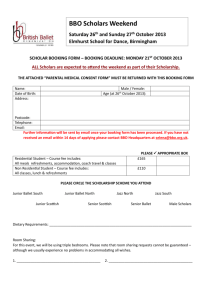

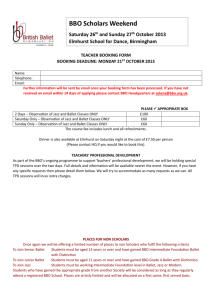

advertisement

Introduction to Engineering Economy • Engineering Economy is about making decisions • It is based on the systematic evaluation of the costs and benefits of proposed technical projects • The principles and methodology of engineering economy are utilized to analyze alternative uses of financial resources, particularly in relation to the physical assets and the operation of an organization. 1 Example 1: How BD100 a month can grow Year Interest 0% 1% 3% 6% 9% 12% 1 BD1,200 BD1,206 BD1,217 BD1,234 BD1,251 BD1,268 5 BD6,000 BD6,150 BD6,465 BD6,977 BD7,542 BD8,167 10 BD12,000 BD12,615 BD13,974 BD16,388 BD19,351 BD23,004 15 BD18,000 BD19,411 BD22,697 BD29,082 BD37,841 BD49,958 20 BD24,000 BD26,556 BD32,830 BD46,204 BD66,789 BD98,926 25 BD30,000 BD34,067 BD44,601 BD69,299 BD112,112 BD187,885 2 Example 2: When BD12K exceeds BD70K Interest Rate 12% Ahmed Start Investing Age 20 Stop Investing Age 25 Total Investment Total Accumulation at Age 60 Annual Investment BD2,000/yr for 6 years (monthly BD166.67) BD12,000 BD1,078,425 Ali Start Investing Age 26 Stop Investing Age 60 Annual Investment BD2,000/yr for 35 years (monthly BD166.66) BD70,000 BD1,014,147 3 Example 3: The Real Cost of a BD1,000 Credit Balance YOU: New Balance Month Balance Interest have a BD1,000 balance on your credit card 0 0 BD1,000 BD18.33 BD1,018. 33 BD20.37 0 1 BD997.9 6 BD18.29 BD1,016. 25 BD20.32 pay 21.99% interest rate 0 2 BD995.9 2 BD18.25 BD1,014. 17 BD20.28 0 3 BD993.8 9 BD18.21 BD1,012. 10 BD20.24 0 4 BD991.8 6 BD18.18 BD1,010. 03 BD20.20 38 10 BD80.06 BD1.47 BD81.52 BD10.00 38 11 BD71.52 BD1.31 BD72.83 BD10.00 39 0 BD62.83 BD1.15 BD63.98 BD10.00 39 1 BD53.98 BD0.99 BD54.97 BD10.00 39 2 BD44.97 BD0.82 BD45.80 BD10.00 39 3 BD35.80 BD0.66 BD36.45 BD10.00 39 4 BD26.45 BD0.48 BD26.94 BD10.00 39 5 BD16.94 BD0.31 BD17.25 BD10.00 39 6 BD7.25 BD0.13 BD7.38 BD7.38 39 7 BD0.00 BD0.00 BD0.00 BD0.00 pay the required minimum payment of 2% of the balance or BD10, whichever is greater make no new purchases How much will it take to pay off the credit card? How much will be the total amount you paid? Year Total Payments: Payment BD6,34 45 Decision Making and Problem Solving Simple Problems • Can be analyzed in one’s head without extensive analysis – Do I buy a semester parking pass, use parking meters, or buy a bicycle? – How often should I eat out? Intermediate Problems • • • (Principle subject of this course!!!) They are sufficiently important to justify serious thought and action They can’t be worked in one’s head; must be organized The economic aspects are significant component in the analysis leading to a decision Complex Problems • Represent a mixture of economic, political, and humanistic elements – Selection of a president in USA – Building a nuclear power plant 5 “Intermediate Problem” Example A student is buying a car, which costs BD12,000. He can borrow money in the bank with a 10% yearly interest rate (quarterly compounding). The dealer offers one of the two promotions: 1. Discount of BD2,000 off the price of the car 2. Financing for one year with interest 0% (4 quarterly payments, BD3,000 each) Which promotion should the student take? (Suppose inflation is 0%.) 6 “Intermediate Problem” Example Promotion 1 • Get BD2,000 and borrow BD12,000 - BD2,000 = BD10,000 with interest 10% BD2,625 (5% more than BD2,500) [?] BD2,658 (6.3% more than BD2,500) [?] car BD2,750 (10% more than BD2,500) [?] BD3,000 (20% more than BD2,500) [?] • Actual Payment: 4*BD2,658 = BD10,632 7 “Intermediate Problem” Example Promotion 2: • Borrow BD12,000 with interest 0%. car BD3,000 • Actual Payment: 4*BD3,000 = BD12,000 • Conclusion: Select the first promotion!! 8 Engineering Economic Analysis Key Questions: • Which engineering projects are worthwhile? • Which projects should have higher priority? • How the project should be designed? • How to achieve long-term financial goals? • How to compare different ways to finance purchases? • How to make short and long-term financial decisions? 9 Engineering Economic Analysis Examples of Non-Monetary Factors: • Meeting customer expectations consistently • Maximization of employee satisfaction • Maintaining flexibility to meet changing demand • Maintenance of a desired public image • Leveling cyclic fluctuations in production • Improvement of safety in operations • Reduction of pollutants 10 Rational Decision Making 1. Recognize the problem – 2. “I need a place to live this term.” Define the Goal or Objective – 3. “I’ll find a nice apartment that is not too expensive.” Assemble Relevant Data – 4. “I need information on rent, utilities, apartment age, parking, driving time to UF, driving time to shopping, the neighborhood, other amenities provided (swimming, table tennis, etc.).” Identify Feasible Alternatives – “I’ll use the Yellow Pages, information from friends, apartment finding services, information from UF, the local newspaper, and my personal experience, to look for apartments.” 11 Rational Decision Making 5. Select Criterion to Determine the Best Alternative – 6. “Most important is rent plus utilities cost. I’m also very concerned about driving time to UF, and the kind of neighborhood the apartment is in.” Construct the model – – 7. “I’ll make a spreadsheet. The rows will be the apartment choices, the columns the evaluation criteria. Then I’ll try to fill in the interactions between the apartments and the criteria.” This includes determining cash flows for engineering economic analysis!!! Predict Outcomes of Each Alternative – 8. “I’ll fill in the estimated costs for the spreadsheet and rate the amenities, driving time, etc.” Choose the Best Alternative – “Apartment C looks cheapest, but I don`t like the neighborhood. If I pay BD50 more per month for Apartment B I get a nicer neighborhood, and a 15-minute drive to UF. Maybe I’ll choose Apartment B.” 12 Rational Decision Making 9. Audit the Results – “Did I make a good choice” – “After living in Apartment B for six months, I am very happy with my choice!” – But this certainly isn’t the case every time!! 13 “Accident Car” Example Bad news – you just wrecked your car! An automobile wholesaler offers you BD2,000 for the car “as is.” Your insurance company estimates that there is BD2,000 of damage to your car. The insurance company can fix the car right away in a repair shop belonging to this company. Because you have collision insurance with a BD1,000 deductibility provision, the insurance company mails you a check for BD1,000. The odometer reading on your wrecked car is 58,000 miles. Additional Information: You have BD7,000 in savings. You can buy a newer car for BD10,000 with an odometer reading of 28,000 miles. After repairing the wrecked car, it can be sold for BD4,500. A discount repair shop charges BD1,100 and requires 1 month. A car rental for one month is BD400. 14 “Wrecked Car” Example Alternatives • Buy newer car. Sell now, but don`t repair: – Cash flow = BD3,000 - BD10,000 = -BD7,000 • Repair now. Sell, and buy the newer car: – Cash flow: = -BD1,000 + BD4,500 - BD10,000 = -BD6,500 • Repair at discount shop. Sell and buy the newer car: – Cash flow: = -BD100 + BD4,500 - BD10,000 = -BD5,600 • Repair now. Keep your car. – Cash flow: = -BD1,000 • Repair at discount shop.Rent a car, then keep your car. – Cash flow: = -BD100 - BD400 = -BD500 NOTE: Don’t forget factors such as mileage, repair shop reliability, investment opportunity for your savings et. 15