The Exchange Paradox -A Failure of Intuition

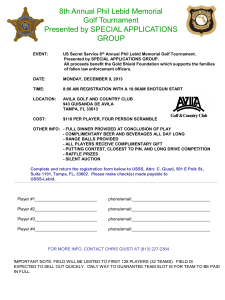

advertisement

The Psychological Basis of

Rationality:

Examples from Games

and Paradoxes

Richard M. Shiffrin

• Claim:

• Rationality is a cognitive, not an

axiomatic, concept, and is defined both

individually and socially, in the context

of particular problems and decisions

What is rational in the end is

determined by a sufficiently large

consensus of thinkers judged to be

sufficiently clear reasoners

Backward Induction

• Example: Game of Nim

20 marbles on table. Players A (first) and B take

turns taking one or two marbles. Player taking last

marble(s) wins.

How should A play? Hard to reason— E.g. A takes

1, B takes 2, A takes 2, etc. => Many possibilities.

Use backward induction:

• Start at end: Player facing 1 or 2 wins.

But player facing 3 loses. So A should try

to see that B faces 3. But the same

applies if B faces 6, because whatever B

does, A can give B 3. Similarly for 9, and

all multiples of 3. Hence if A can give B a

multiple of 3, A will win. Hence A takes 2

at start, giving B 18. Each time A gives B

the next lower multiple of 3, until A wins.

• This is an example of

backward induction.

But backward induction can fail -Centipede Game

• Two players take turns, either ‘stopping’ or

‘playing’. ‘STOP’ ends the game for both

players. ‘PLAY’ causes the player to lose $1 (to

the bank), the other player to get $10 (from the

bank), and the turn moves to the other player.

There are 20 turns, if no one stops first.

• Goal is to maximize personal profit, not beat the

other player.

• Seems nice– both players gain a lot by playing

many turns.

• BUT, assume purely ‘rational’ players. The

player with the last turn will surely STOP,

because PLAY loses $1, and the game

ends. Knowing this, the player on trial 19

will STOP, because playing loses $1, with

no gain following. Knowing this, the player

on trial 18 will STOP, etc. Hence by

backward induction, the player with the

first move will STOP, and end the game

with both players getting nothing.

• This may seem as irrational to you as it

does to me. Both players have a lot to gain

by playing as many trials as possible, so

how can it be rational to not play at all?

Even if one of the players should stop near

the end, both would have received much

money by then.

• Of course there are problems with the

reasoning. The player on trial n STOPS

because that player is sure the other will

STOP on trial n+1. But the only way the

game could have reached trial n is if the

other player PLAYED on the preceding

trial. Hence the player cannot be sure the

other player will STOP on the next trial.

• This helps justify PLAY on early trials, but

doesn’t give a way to play when the end

approaches.

• So consider a two-trial game. A gets the

first turn, B the second. If B gets a turn,

the game then ends.

A and B get $0

STOP

A

STOP

PLAY

A loses $1, B gains $10

B

PLAY

A gains $9, B gains $9

B will STOP at turn 2, to keep all $10. This will cause A to

lose $1, so A will STOP at turn 1, and A and B get $0.

Is this rational? Note that both can get $9 if both play.

• Game theory, economic theory, subjective

expected utility theory, and many more, all

say A should STOP. Is this rational?

• I argue that there is no axiomatic definition

of rationality, that one must decide what is

rational in the context of a given game.

• When two rational players decide what to

do, they must not only decide what to do,

but what is ‘rational’ in that game setting.

• Here I suggest it is rational for both

players to play. Why? There are only three

strategies to consider: {STOP}, {PLAY,

STOP}, and {PLAY, PLAY}. But {PLAY,

STOP} cannot be the rational strategy,

because then A would not PLAY.

• This leaves only {STOP} and {PLAY,

PLAY}. {STOP} gives both players $0;

{PLAY, PLAY} gives both players $9.

Clearly the second is the rational choice.

• Some people can’t accept this. They argue

that B, at turn 2, will ‘defect’ and stop. But

if this is rational, then A knows it, and A

will not play at turn 1. Hence B should

PLAY at turn two, if both players are

rational.

• I know some of you will not like this

reasoning, because ‘defection’ seems very

seductive. But we are discussing rational

decision making, not emotional feelings.

• The problem with traditional reasoning is

the failure to take into account that the two

decisions are correlated. Imagine that the

correlation was perfect, in the sense that

Player 1’s decision to play always

occurred with Player 2’s to play (of course

if Player 1 stops, Player 2 is irrelevant). In

this case everyone would play when

Player 1.

• But why should one assume correlation? I

will provide a few lines or argument.

• Suppose the players must lay out their

irrevocable strategies (not known to the

other player) before knowing who will be

the first player. The first player will be

determined by a later coin flip.

• A could choose to defect on trial 2, if A is

the second player, and stop on trial 1, if

the first player. Is this rational? If so, it is

likely both players will choose this, and

both will get $0.

• Note that this reasoning violates an

‘axiom’ of game theory, that one plays on

the last trial whatever is best at that point,

regardless of how that point is reached. I

say this is wrong: In a one trial game, B

would of course STOP, to save $1. In a

two trial game at the same point B PLAYS,

because this allows B to get $9 rather than

$0.

• Why does the strategy change? Because

what B does affects how A plays. A knows

B’s ‘rational’ decision before the first play,

just as does B.

• Perhaps you remain unconvinced, so let

me give what could be a scenario that is

more personally convincing.

• Suppose there are N players, each playing one trial of the

centipede game against him or herself. They do this under

the drug Midazolam that leaves reasoning intact but

prevents memory of what decision had been made at the

first decision point. Each player is told to adopt a Player 1

strategy that will maximize the number of times they get a

Player 1 payoff better than the other people when they are

Player 1. Similarly each player adopts a Player 2 strategy to

maximize the number of times they get a Player 2 payoff that

is better than the other people when they are Player 2.

• IMPORTANT: When you are Player 2, you must decide what

you will do before you know whether you will get the

opportunity to play--You must make a conditional decision: If

I get to play what will I do? It could well be that you would

decide not to play when Player 1, so you might never get a

chance to give a Player 2 decision.

• So what strategies do you choose? When

1, you can get -1, 0, or 9. If you play when

Player 1, and also cooperate when Player

2, then you will get 9 and at least tie for

best.

• However, if you think you will decide to

defect when Player 2 you would be best

off not playing at all (-1 would tie for

worst).

• When Player 2 you can get 0,9, or 10. If you get

a chance to play you can cooperate and get 9 or

defect and get 10. If you cooperate you will lose

to those who play at step 1 and defect at step 2.

•

• But which other players would do that? Players

who think defection is rational will not play at

step 1. Thus how can you lose by cooperating?

• You can reason this before playing as Player 1,

and hence can confidently play, and be

reasonably certain you will later cooperate.

• What is about playing one’s self that makes

cooperation at step 2 seem rational? The key is

the correlation between the decisions made at

both steps. You are able to assume that

whatever you decide before play 1 about what

you will later decide as Player 2 will in fact come

to pass.

• The assumption of rational players makes this

correlation even stronger—if a set of decisions is

rational all rational players will adopt them.

• It is of course just this correlation between

decisions of multiple players that is

ignored when arriving at Nash equilibria,

and other seemingly irrational decisions.

• Thus when we say all players are

assumed rational (not very satisfactory if

we have not defined rationality), we are

more importantly saying that the decisions

of the players are positively correlated.

• There are many reasons why decisions

could and should be correlated—social

norms, (playing one’s self), group

consensus, reliance of experts, and so on.

• Interestingly, if the expert community

defines rationality in a way that makes

defection rational, then assuming the

opponents to be rational would lead to

defection, not cooperation. Perhaps this

occurred in the early days of game theory.

Another lesson to take home:

• Rationality is ‘locally defined’ and ‘context

bound’

• Further, there is room for disagreement

– Colman in his recent BBS article discusses

the Centipede game and concludes there is

nor resolution and no rational way to play.

– Others would not like the resolution I

suggested. Even others argue an initial STOP

is the rational play in the centipede game.

Newcomb’s Paradox

• (My version). A is given two envelopes and told

they contain the same amount of money, either

(1,1) or (1000,1000). A’s goal is to maximize

gain, and A can choose either: ONE envelope,

or BOTH envelopes.

• Before the game a psychologist predicts whether

A will choose ONE or BOTH. If the prediction is

ONE, 1000 is placed in both. If the prediction is

BOTH, 1 is placed in both.

• Strangely the prediction is quite accurate.

How is this possible? A actually plays the

game twice, but is given the drug

Midazolam, which leaves reasoning intact,

but prevents learning. Once an interruption

occurs, what has occurred before is

completely forgotten (dentists use this

stuff).

• Whatever A chooses the first time, the

psychologist predicts A will do again. A is

told about Midazolam, about both trials,

and is told that exactly the same

information is provided on both trials.

• Trial 1: Either: {1,1} or {1000,1000}

-- A chooses BOTH or ONE

• A forgets

Trial 2:

{1,1}

or

{1000,1000}

Should A choose BOTH or ONE?

• P tells A both times that much testing shows that

the prediction is 95% accurate in the general

population: When people choose BOTH, 95% of

the time the envelopes contain 1; when people

choose ONE, 95% of the time, the envelopes

contain 1000 – i.e. people tend to make the

same decision in the same situation.

• A complains that A doesn’t know if this is the first

or second test; if it is the first, he should choose

ONE so there will be 1000 in the envelopes on

test two.

• However, P says the goal is to maximize gain

only on the present trial, however many trials

may have preceded it.

What should A choose?

• Argument 1: Whatever is in the envelopes, it is too late

to do anything about it, so it only makes sense to choose

BOTH and double the gain.

• Argument 2: A should choose ONE, because A tends

95% of the time to make the same decision. Choosing

ONE makes it likely that 1000 is in both envelopes.

• Rejoinder: How can what one chooses now affect what

is in the envelopes? They have already been filled!

• Rejoinder: That is a good way to get $2, and lose

$1000. Obviously the ONE choosers tend to get $1000.

• The best human minds cannot decide

what is right. That is, people are quite

often sure they are right, but they

disagree. Roughly 1/3 of the people say

BOTH, 1/3 say ONE, and 1/3 say it cannot

be decided. There are many published

articles defending each alternative.

• What does this say about ‘rationality’?

• Rationality is what people say it is, but

which people? And what proportion of

them?

• I believe there the rational decision is

ONE, but how does one convince those in

the other two camps that this is right?

• Because rationality is a ‘cognitive’

phenomenon, we can try ‘reframing’ the

problem to convince others. Of course the

recipient of the reframed problem must

also be convinced that the new problem

retains the critical elements of the original.

• I’ll try this out with a few examples.

• Scenario 1:

• B watches A decide. Whatever A gets, B gets

also. B knows people fall into two classes, those

choosing ONE and those choosing BOTH. B

would very much want A to be someone who

chose ONE last time. Therefore B wants A to

choose ONE this time– i.e. to be a ONE chooser

type.

• Suppose A chooses, but before the envelopes

are open, B can sell the profit. If A’s choice was

ONE, B expects 1000, so would sell for

something like 900. If A’s choice was BOTH, B

expects 2, so would sell for something like 5.

• How is this thinking different for A, the

chooser? After a choice, but before

opening the envelopes, how much would

A sell the (unknown) profit for? The sales

prices would be similar to those demanded

by B. E.g. following a BOTH choice by A,

A knows herself to be a BOTH chooser,

and expects to get $2. Following a ONE

choice by A, A knows herself to be a ONE

chooser, and expects $1000.

• Why should A wait to notice this? Why not

choose ONE and ‘produce’ $1000?

• Scenario 2:

• A and B are together, each discussing the

choice they are about to make for their own sets

of envelopes. They know they were together on

trial 1 also. They argue– A says BOTH, B says

ONE; neither can convince the other.

• Just before the choice B pulls a knife and forces

A to choose ONE, saying “I won’t let your

foolishness cost you money”.

• What does A now expect to get? If on trial 1, B

had also forced A at knifepoint to choose ONE,

then A expects to get 1000.

• Why should A need a knife to choose ONE? A

can choose ONE freely, with the same result.

• Perhaps these ‘reframings’ make you

reconsider your answer. But what is wrong

with the argument that one’s choice now

can’t change what is in the envelopes?

This seems like ‘backward causality’.

• This is a confusion of causality and

correlation. The two choices are

correlated, but neither causes the other.

Rather, both are caused by the ‘thinking

processes’ used by A to decide. Given no

memory, these thinking processes tend to

repeat most of the time.

• Scenario 3: At the time A makes her

choice, the envelopes are empty. A is told

the envelopes will be filled on the basis of

the next choice A will make (under

midazolam, without memory, with identical

instructions). A is told to maximize present

gain. She chooses, forgets, makes a

subsequent choice, and later gets the

payoff determined by the subsequent

choice. Should she choose ONE or

BOTH?

• A good case can be made that the forward

and backward versions are identical in

structure. Yet most people believe that

backward causality doesn’t apply in the

forward case, and most people faced with

the forward case see good reason to

choose ONE. They reason: “If I choose

ONE now, I will likely do so again,

because the choice situation is identical”.

• Why is anything different in the backward

case?

Scenario 4:

Non-intuitive Information

• Suppose A is having trouble deciding, and

is told: “If you like, you can open the

envelopes, look at the contents, and then

decide. I gave you this same option the

previous time you participated.”

• Should A look?

• Strangely, A should decline the offer.

Why?

• If A looks, A will certainly choose BOTH,

whatever is found. A does not have to look

at the contents to know this. Hence a

decision to look is just a decision to

choose BOTH.

• If A now chooses to look, A would have

likely chosen to look the previous time,

making an outcome of $2 very likely.

• In general, the more A knows about the

likely contents of the envelopes, the more

A would want to choose BOTH.

Scenario 5: Height

• The psychologist does not use a previous

trial to fill the envelopes. Instead, he tells A

that much research has shown that height

is a reliable predictor of choice, enabling

the psychologist to predict choice correctly

52% of the time (for reasons unknown).

• The envelopes have been filled on the

basis of A’s height.

• A does not know whether being tall or short

causes $1000 to be in the envelopes.

• Whatever size A is, if A chooses ONE, it makes

that height more likely to be the height

associated with $1000, and conversely for a

choice of BOTH.

• Hence A should choose ONE, if the payoff

difference is large enough.

• In the earlier versions, A’s decision processes

were the causative agent producing the contents

of the envelopes on both occasions. In this

version, A’s height is the causative agent.

• Scenario 6: Symmetry of Decisions

• Some people are bothered by the

Midazolam scenarios becomes it seems

there is an infinite regress of past (or

future) decision situations required.

• So let there be exactly two trials under

Midazolam, the payoff for trial A

determined by B, and vice versa, these

facts known at both trials.

• There are more reframings of this sort, but

this gives you the idea. I have found that

even the most fervent BOTH choosers

either change their position, or at least

express uncertainty, when given these and

other problem reframings.

• Like the centipede game, the resolution I

argue for is based on the correlation

between the two different decisions, a third

factor being the cause that produces the

correlation.

• Regardless of the ‘answer’, we see once

again that rationality is what people say it

is. There is no guarantee people will

agree, producing an disturbing situation.

• Connecting Newcomb’s, Backward Induction, and

Prisoner’s Dilemma

• A ‘prisoner’s dilemma’ has two players, A, B, each of

whom has a decision option E that will guarantee them a

better outcome, regardless of what the other player

does. However, if both players choose this dominating

strategy, they each will get a poor outcome:

B

For both A and B, 8 is better

than 5 and –5 is better than

-10, so both prefer E and

both get –5. But if both

choose D, both get +5!

D

E

D

A, B

(5, 5)

A, B

(-10, 8)

E

A, B

(8, -10)

A

A, B

(-5, -5)

• The centipede game argument would

imply that two known rational players

would both choose D, the ‘cooperate

strategy’.

• But what would a ‘real’ player do? Doug

Hofstadter once ran a test in Scientific

American– he thought his bright friends

would cooperate; however, they defected.

• But what would a ‘real’ player do playing

against him- or herself?

• Have a player make a choice under

midazolam, ‘twice’. Knowing that the

opponent is oneself, would a player

cooperate? Would it matter if the choice is

the first or second one made, as long as

there is no memory?

• The choices are symmetric so the choice

order seems irrelevant, but suppose your

current choice is second. Whatever you

chose the other time, you know you will do

better by defecting this time. Should you

cooperate nonetheless? This is

Newcomb’s in another guise. You can

make yourself a ‘cooperative’ person.

• In all these cases, what is rational is not

defined absolutely, by rule, or by axiomatic

system. What is a rational decision is a

cognitive process, context dependent, and

subject to some sort of general agreement

by thoughtful humans.

The Exchange Paradox

• (In economic circles, known as Nalebuff’s

Paradox (1988, and related to Siegel’s

Paradox in foreign exchange, 1972)

• One envelope has 10 times the money of

another (i.e. M and 10M).

• The player (P) chooses an envelope and

chooses to keep the contents (X), or

irrevocably exchange for the other.

{$D

{$10D

$10D}

$D}

The Strategy

• P reasons the other envelope has half a

chance of having 10X, and half a chance

of having (1/10)X. The expected value for

exchanging is then:

• E(V) = (1/2)(1/10)X + (1/2)(10)X =5.05X

• This is larger than X, so P exchanges.

The Puzzle

• This reasoning applies regardless of X.

• Hence P should always exchange.

• But if P always exchanges, why even look at the

contents of the first envelope? Why not save a

step and just take the second? But then the

same reasoning says one should switch back.

• More critically, since P chooses randomly, and

always exchanges, symmetry requires that the

amounts rejected have the same probability

distribution as those accepted.

The Paradox

• How can P gain by exchanging, and yet

not gain at all?

Resolution Number One

• The savvy among you notice that it

matters how the envelopes are filled. One

needs to know what are the amounts X

and what probabilities they have. The

problem doesn’t say. It might be that once

we know exactly how the envelopes are

filled, the paradox will disappear.

• Do you think this is the case?

An Algorithm for Filling

• We fill as follows: Flip a coin until the first

heads appears, on the n-th flip. Then put

10n-1 and 10n in the two envelopes.

• E.g. with prob ½ a heads comes up on flip

1, so we put 1 and 10 in the envelopes.

With probability ¼ a heads comes up first

on the second flip, so we put in 10 and

100. Etc.

Paradox Not Solved

• If we observe X > 1,

P([1/10]X, X) = 2P(X,10X)

• So P(other envelope has 1/10 X) = 2/3

and P(other envelope has 10X = 1/3.

• Hence E(V) = (2/3)(1/10)X + (1/3)(10X) =

102/30 = 3.4X > X, so exchange.

• If X = 1, exchanging gains 9, for sure.

• So, always exchange.

But

• By symmetry, distribution of amounts

rejected and accepted have to be identical

(same reasoning as before). How can we

gain and not gain simultaneously?

• This game is easy to program on your PC.

One can verify that exchanging produces

3.4X, and also that the amounts rejected

and accepted have the same distribution.

Paradox Resolution Number 2

The even savvier among you will notice that

this game has infinite expectation– the gains keep

going up by a factor of 10, but the probabilities

keep going down by a factor of ½.

E(G) = (.5)1101 + (.5)2102 + (.5)3103 + … =

∞

Everyone knows we can’t compare gains

when both lines of play have infinite

expectation. One infinity can’t be larger

than the other (e.g. another example some

of you may know is called the St.

Petersburg Paradox).

Perhaps this explains the paradox: Perhaps

such a paradox couldn’t appear in a finite

game.

• Most writers think this, and stop here.

Can we make the game finite?

• Make the game finite by terminating the coin

flips with a heads if a very large number Z of

consecutive tails occurs.

• A possible strategy would then be: exchange

always, except when X =10Z, in which case

STAY, because this is the largest possible.

• (This is still paradoxical, but I’ll return later to this

point).

• But this loses some paradoxical essence,

because P does not ALWAYS exchange.

Always Exchange in a Finite Game

• Ask someone to choose a largest limit N,

vastly smaller than Z, but still vast. This is

easy to do if Z is something like 10100000.

• If N coin flips come up tails, then one

stops anyway, and pretends the last flip

was a heads.

• One way to get the number N:

• Ask a friend to fill a sheet of paper with

digits. Permute these, and the result is N.

• There are only so many digits that can fit

on a sheet of paper, so N is obviously

finite, though unknown.

• For any number X observed, P has an

infinitesimally small chance, c, of guessing

correctly that this is the largest possible.

• I.e. How likely is it that X is the number N,

rather than any number smaller than N?

• For exchanging, E(V|X) =

(1-c)(3.4X) + (c)(.1X) =~ 3.4 X

>X

Unfortunately, this means the paradox returns in

a finite game: One should always exchange.

But how can this be sensible?

Paradox Made Worse?

• Instead of P choosing an envelope at

random, someone examines the two and

hands P the largest with probability .8, and

the smallest with probability .2.

• P(other is larger) is:

(.5)Q(.2)/[(.5)Q(.2)+Q(.8)] = 1/9

• E(V) = (8/9)(1/10)X + (1/9)10X = 1.2X > X

• So always exchange.

This is bad news

• If P always exchanges, then P will

exchange the larger for the smaller .8 of

the time. Further, the distribution of

rejected numbers strictly dominates those

accepted.

• If one exchanges one gets, and rejects:

• Amount P(Gets) P(Rejects) P(G):P(R)

1

.4

.1

4:1

|

|

|

10n (½)n-1(.6) (½)n-1(.9)

6:9

|

|

|

10N-1 (½)N-1

(½)N-1

1:1

10N (½)N-1(.2) (½)N-1(.8)

2:8

• Exchanging gets 1 more often, and every

other outcome less often!

• Another way to look at things: Suppose

you are handed the .8 and .2 envelopes,

but don’t open the .8 one. You clearly

would want the .8 envelope, since it is 4

times more likely to have the larger

amount. However, once you open it, you

seem to want to exchange for the .2,

regardless of what you find.

• This probably makes you uneasy.

• If you see X, the contents of the .8

envelope, you want to exchange.

• If you see X*, the contents of the .2

envelope, you also want to exchange, only

you expect to gain more than the first

case.

• Given this, why exchange a .8?

• This might make you feel uneasy.

What a good empiricist would do

• P, a scientist, carries out a test: P

programs this game on his PC, always

exchanges, and tables the outcomes for

many thousands of trials.

• Now P will learn if P is winning or losing!

• (No more worries about poor reasoning

abilities or bad mathematical derivations).

P gets an answer or two

• For X =1, P gains 9

• For all other X, P gains ~.2X (the larger

the number of simulation trials, the closer

is the convergence to .2X).

• Case closed.

• But..

Another answer

• P tables the results accepted and rejected:

• Amount P(Accepted) P(Rejected)

•

1

.4

.1

•

10n

(½)n-1(.6)

(½)n-1(.9)

•

10N-1

(½)N-1

(½)N-1

•

10N

(½)N-1(.2)

(½)N-1(.8)

• Oops: P is rejecting larger amounts.

• If one exchanges one gets (G), and rejects (R):

Amount

P(G):P(R)

1

4:1

|

|

10n

6:9

|

|

10N-1

1:1

10N

2:8

The empirical ratios get closer to the ones listed above, the

more simulations are run.

MOST IMPORTANT: THE NUMBERS COME FROM THE

SAME TABLE SHOWING GAINS FOR EXCHANGING

Failure of empirical testing

• So, is P winning or losing?

• It is tempting to think the second test is

better– more money is piling up in the

rejected envelopes. P might therefore

decide never to exchange.

• But, surely P would exchange for X = 1!

• So P should decide to exchange for X =1

only? But exchanging on 1 and 10 would

be even better!

Egads!

• So exchanging on all X’s up to K is

dominated by the strategy of exchanging

on all X’s up to K+1!

• So P should always exchange!

• But this loses money!

• Help!!

Paradox Resolved

• Both answers are correct. The problem is that

the goal is ambiguous. Maximizing expected

gain has several interpretations:

1) Expected gain on the present trial,

given X [E|X]

2) Expected gain for playing the game,

given one uses a strategy S, where

S specifies the X at which one stops

exchanging and starts STAYING [EG|X]

• A few remarks:

• As noted E|X is higher for exchanging, for every X.

• But EG|X for the strategy ‘always exchange’ is exactly

the same as for the strategy ‘never exchange’. How is

this? The amount lost when one exchanges the highest

possible number balances the gains for all smaller

numbers to produce equality.

• But of course some strategies produce higher EG|X than

others. E.g. EG|1 is clearly not as good as EG|10: It is

obviously better to exchange a 1 for the certain gain of 9.

• Most people have a strong intuition that

the expected value of this game will be

maximized if one makes the decision for

each observed X that maximizes expected

gain for that trial.

• That this is not the case is seen in this

paradox, but is hard to believe.

• Perhaps the case is clearer in a simplified

example.

Simplified example 1

• Consider a version of the St. Petersburg

Paradox. One starts with $1, and flips a

coin. HEADS causes the current total to

triple. TAILS causes all the money to be

lost, and the game ends.

• One can play as long as one wants.

• The goal is to ‘maximize expected gain’.

• There is one exception to the above.

• Exception: The game has an upper limit,

N, unknown but chosen to be vastly

smaller than a very large number U (such

as 10**100). If the current total = U, and

the decision is made to PLAY, then

regardless of the coin flip all money is lost

and the game ends.

• The probability of guessing that the current

total is U is infinitesimally small, so the

expected value for playing stays about

1.5X.

• Hence A will always play, for every X. But this

strategy maximizes conditional expected gain on

the current trial. It minimizes expected gain for

the game, because it guarantees with probability

1.0 that all money will be lost (eventually U will

be reached).

• Clearly there the decision to exchange for each

X gives a positive expected gain for each X, but

the strategy to exchange for all X produces a

total game return of 0. It is surprisingly easy to

confuse these different expectation quantities.

– Note: Choosing a strategy to maximize expected

return for the game is a very complex matter.

• The exchange paradox presents a similar

confusion.

• Perhaps partly due to such a confusion,

some people have concluded one should

exchange always, others to conclude one

should not, others to conclude it does not

matter, and yet others to conclude no

rational strategy exists.

• Thus the exchange paradox reveals yet

another facet of the general claim that

rationality is a cognitive process, subject to

reinterpretation and reanalysis in the

context of a given problem.

• Given this, it is not too surprising that

persuasive arguments for the rationality of

one or another decision are heavily

weighted by problem framing, and by

examples.

• The finite exchange paradox also reveals

a difference that a number of researchers

have noted between ‘uncertainty’ and

‘vagueness’. The highest number N is

vague. There is no Bayesian prior we can

place on N that makes ‘sense’. If we

specify a prior it is easy to calculate a

number Y at which one would not

exchange.

• But having done so, if Y were reached,

one would not believe that stopping was

the best strategy.

• Joe Halpern (for example) has argued that

for vaguely specified situations, one might

have a set of priors that are possible,

without probabilities one can assign to

them. Then one can use some minimax

type strategy (e.g. protect against the

worst outcome) to choose which prior to

assume.

• This would not work here (stopping at 1 is

not a good idea), but it seems to be the

case that vague problems produce vague

optimization.

The ‘surprise exam’

• On day one of a twenty lecture course, the

teacher tells the class that there will be

one surprise exam, but that the class

members will not be able to predict with

certainty the occurrence of the exam on

the morning before it will occur.

• Backward Induction leads to a

contradiction: The class reasons that the

exam cannot occur on the last day,

because the exam occurrence could be

predicted. If so, then it cannot occur on the

second to last day, for the same reason.

Backward Induction continues until every

day is ruled out. Ruling out every day

seems to imply that the teacher has lied.

• But the exam does occur on, say, lecture

seven, and indeed the class is ‘surprised’.

• Indeed, ruling out every day seems to

guarantee ‘surprise’. But is this because

the teacher might have lied?

• With a little thought, both teacher and

students can see that the statement is

true, as long as some exam day ‘in the

middle’ is chosen.

• However not everyone agrees. Russ

Lyons (math here at IU) looks at the case

of one….

• “Do you agree that the number of days is

irrelevant? If so, let's take just one day. The

setter says "I will give you an exam today but

you won't know whether I will do that". If this is

false, he lies. If this is true, then it must be

because he might not give an exam today (so he

might be lying), and the truth is unknown (since

it deals with the future) or because the student is

confused/stupid/doesn't speak English/etc. If he

does give the exam, then it becomes true,

otherwise false. Of course, an alternative is that

the statement is neither true nor false. That's

probably the best; it's like saying "let S be the

set of all sets". That's meaningless as there is no

such S.“

• But is it the case that ‘truth’ is unknown?

• ‘Truth’, like ‘rationality’ may be a cognitive

construct, and socially reified.

• When the number of lectures is very large

(say 10**100 if you like), and the instructor

says the surprise exam will be on a day

vastly short of the end of the course, then

it seems clear to both instructor and

student that the statement is ‘true’, and

must be so.

• But for one lecture, there is a contradiction, and

perhaps no truth value.

• How about two lectures? Three? Four?

• At what point does the truth value change from

‘uncertain’ to ‘true’?

• Lyons would say the truth value is always

uncertain. I am less dogmatic. I see truth

ultimately being decided by the real universe we

live in. In this universe, for large N, the

statement seems true by all sensible measures.

• But at what N the transition occurs, I’m unsure.

‘Sleeping Beauty Paradox’

• (Seems to have grown from an earlier set of

paradoxes introduced by Piccione and

Rubinstein in 1995: On the interpretation of

decision problems with imperfect recall).

• One version: A coin is flipped. HEADS means

sleeping beauty (SB) is awakened Monday and

asked to estimate the probability that a HEADS

had been flipped. TAILS means SB is awakened

on both Monday and Tuesday, without memory

of any other awakenings, and asked the same

query both days.

• What should SB answer?

• Opinions seem sharply split with

vociferous defenders of both 1/2 and 1/3.

• As with Newcomb’s, many people find the

question ridiculous, but they disagree on

the answer. Other people are unsure.

• More generally, the ‘thirders’ believe that if

TAILS produces N awakenings, the

answer is 1/(N+1) for P(HEADS).

• In a slight variant, HEADS causes SB to

awaken in Room A once, and be queried.

TAILS causes SB to be awakened in

Room B twice, without memory, and be

queried each time.

• The ‘thirders’ believe that the probability of

Room A is 1/3.

• I think there is a ‘surreal’ aspect to this.

• Suppose SB is told there will be a prize of

$1,000,000 if a tails occurs and she is in Room

B, awarded if SB requests it when awoken. SB

may request whatever number of awakenings in

room B she desires, up to say, 100.

• SB thinks: This is terrific; I can increase my odds

of getting the million to 100/101 by requesting

100 wake ups.

• If this seems strange, perhaps the thirders can

argue that there is a 50% chance of the million,

but once an awakening occurs the conditional

probability of a tails is then 100/101 (sic). If so,

then SB ought to be willing to turn down an offer

of say $900,000 for her potential winnings.

• Dave Chalmers gives the following as his

argument for 1/3: The query is either Mon

or Tue. Given Monday, P(H|M) = .5. Given

Tuesday, P(H) = 0. P(H) = P(M)P(H|M) +

P(T)P(H|T) = P(M)P(H|M) + 0 = (1/2)P(M).

• Since P(M) is between 0 and 1, P(H) must

be less than .5.

• What do you think of this?

• Of course the condition changes from the

beginning to the end of this argument. At

the outset Dave says P(H|M) = ½ because

there is an equal probability of a query on

Mon following a Heads and a Tails (Heads

always produces a Monday query, and

Tails always produces a Monday query.)

But this implies P(M|H) = P(M|T) = 1.0.

Thus P(M) = 1.0. Thus the last equation

from Chalmers implies P(H) = ½.

• Of course Chalmers argues P(M) is less

than 1.0, because he considers that SB

might awaken Tuesday.

• This means we are selecting from events

on the Tails side. For this condition, the

probability of Monday given Tails is 1/2

(whereas P(M|Heads) stays at 1.0). This

means that p(H|M) = 2/3, not 1/2.

• So far, Chalmers and Terry Horgan,

among others, steadfastly believe that the

answer is 1/3 (and have written journal

articles saying so). What then is the

rational answer?

The Absent-Minded Driver

• Perhaps Sleeping Beauty is not such a paradox

(social consensus notwithstanding), but Piccione

and Rubinstein raise a more interesting issue.

• A driver is in a bar about to set off for home.

There are two exits and then a long drive to a

distant city. The driver lives at exit 2. Exit 1 is

dangerous. If he passes 2, he must take a motel

for the night in the distant city. However he is

forgetful and when reaching any exit does not

remember whether he has passed any exits

already.

• His payoff for taking exit 1 is 0, for exit 2 is

4, and for going past 2, is 1. What should

he plan to do? If he cannot choose a

probabilistic plan, he should decide to

always go, getting 1 rather than 0.

Suppose he so decides. He now finds

himself at an exit. Knowing he decided to

keep driving, he guesses there is a

probability of ½ that this is exit 2. He

therefore changes his mind and decides to

exit (for an expected gain of 0/2 + 4/2 = 2).

• Of course, this is circular. Once he

decides to change his mind, he knows he

would have changed his mind at exit 1, so

this must be exit one, so he should not

exit.

• The issue is less silly when he can decide

to exit with some probability, p. A simple

calculation shows p = 1/3 maximizes

expected gain, if applied consistently. E(G)

= (1/3)0 + (2/3)(1/3)4 + (2/3)(2/3)1 = 4/3.

• However, having chosen this strategy, he now

finds himself at an exit. He now forms an

estimate, e, of the probability that this is exit 1,

knowing his strategy. He then adjusts his

strategy. This leads to various forms of circular

adjustments and possible convergence on some

strategy.

• Strangely, a good case can be made for

deciding at an exit to exit with p = 5/9, even

though if used consistently this strategy gives a

lower E(G) than 1/3. The local decision is

sensible even the global outcome is not.

• The original article and replies and counterreplies are worth a look.

FINI