IAS 16 Property Plant Equipment

advertisement

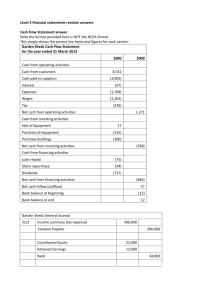

IAS 16 Property Plant Equipment 1. Non-Current Assets Statement of Financial Position • The recognition of assets (Cost) • The determination of their carrying amounts (NBV) • The depreciation charges and any losses relating to them. 2. Accounts • • • • • NCA Cost Account Disposals Account Depreciation Account Revaluation Reserve Account Bank Account 3. IAS 16 • Consistent principles applied to the initial measurement of the asset • Determination of their carrying value is consistent • Depreciation is calculated consistently and recognised • Sufficient disclosure for users 4. Initial Recognition - Cost • 2 Condition for recognition – Future economic benefit will flow from the item to the business – The cost can be measured reliably Purchase Price – import duties, tax, construction, professional fees Cost of Purchase – delivery, installation, assembly COST Cost of dismantle – disposal, site restoration Borrowing Cost – interest on purchase, construction Expenses rather than cost • Cannot include – cost of storage while waiting to use NCA – Initial operating losses as a result of asset output – Cost of business relocation – Design errors – Wastage – Industrial disputes 5. Capitalisation • Including items other than purchase price of the asset • Don’t debit the expense account (SP&L) • Debit the asset account (SFP) • If they were to be written off as an expense in one year it would not reflect the substance of the transaction Paul Boyle incurs the following costs in relation to the construction of a new factory and the introduction of its products to the local market. How much of the costs should be capitalised? COSTS CAPITALISED - ANSWER €’000 Site preparation costs 240 €’000 Site preparation costs 240 Materials used 1,500 Materials used 1,500 Labour costs, including €90,000 incurred during an industrial dispute. No construction occurred during the period of the dispute. 3,190 Labour costs, 3190 – 90 3,100 Testing of various processes in factory 150 Testing of various processes in factory 150 Consultancy fees re installation of equipment 220 Consultancy fees re installation of equipment 220 Relocation of staff to new factory 110 Relocation of staff to new factory - General overheads 500 General overheads - Costs to dismantle the factory at end of its useful life in 10 years time 100 Costs to dismantle the factory at end of its useful life in 10 years time 100 Enhancement costs • Enhancement costs which significantly enhance the economic benefits by increasing the capacity, improving the quality of output, extending the economic life of the asset or by reducing the operating costs of the assets can be capitalised. • The replacement costs of major components and overhaul costs which improve the economic benefit that can be generated can also be capitalised. • Where NCA consists of a number of assets of different economic lives, it may be appropriate to recognise and account for each component separately for depreciation and inclusion of subsequent expenses. • The component approach is also applied where regular major inspections of an asset are a condition of continuing to use it. The cost of each inspection is treated as a separate item (replacement), provided recognition criteria are satisfied. Any remaining carrying amount in respect of the previous inspection is derecognised. 6 Measurement subsequent to initial recognition • IAS 16 sets out two models for measuring PPE subsequent to its initial recognition as an asset. These are the ‘cost model’ and the ‘revaluation model’ Cost Revaluation • Cost less any accumulated depreciation and any accumulated impairment losses. • Revalued amount, being fair value less accumulated depreciation and impairment losses. • IAS 16 defines fair value as ‘the amount for which an asset could be exchanged between knowledgeable, willing parties in an arm’s length transaction’. • Where an item is revalued, all other assets in the same class should also be revalued. • Revaluations should be carried out regularly 7 Depreciation • Depreciation begins when the asset is available for use and continues until the asset is derecognised – even if idle • The depreciation amount should be allocated systematically over its useful economic life • Depreciation method should reflect the patter in which the economic benefits of the assets are consumed. • Depreciation for accounting period = expense • Depreciation for the period + Accumulated Dep Depreciation Methods • Straight line • Reducing balance 8 De-recognition • When an asset is removed from the books – Disposal – No further economic benefit • Gain or loss on disposal = Net sale – NBV Recognised in Stmt of P&L 9. Disclosure For each class of property, plant and equipment the following should be disclosed: – – – – Basis for measuring the carrying amount (cost) Depreciation method used Useful life or depreciation rate Reconciliation of the carrying amount at the beginning and end of the period • • • • • Additions Disposals Revaluation Movement Depreciation Any other Movements – Restrictions on title – Expenditures to construct – Commitments to acquire Disclosure on Revaluation • Additional disclosure requirements for revaluation – Date of revaluation – Independent valuer involved – Methods and assumptions used – Carrying amount under the cost model – The revaluation surplus 10 Impairment • IAS 36 • An asset is impaired when its carrying amount exceeds its recoverable amount 2. Accounts • • • • • NCA Cost Account Disposals Account Depreciation Account Revaluation Reserve Account Bank Account Disposal 1. 2. 3. 4. 5. Credit Cost A/C Debit Acc Depreciation A/C Post Sale Price to Debit Bank A/C Double entries in Disposals A/C Balance on Disposal = Profit & Loss Q • • • • Bank balance 120,000 Plant & Equip cost 840,000 Acc Dep 370,000 Plant cost 100,000 with a NBV 40,000 sold for 45,000 on 1/12/xx • New plant purchased 180,000 on 1/10/xx • 10% depreciation PA straight line with proportionate charge on year of acquisition and none on year of disposal Depreciation • 840,000 – 100,000 = 740,000 x 10% = • 180,00 x 10% 18,000 pa / 2 = 74,000 9,000 83,000 Plant & Equipment Cost A/C 1/4/xx Balance 840,000 1/12/xx 1/10/xx Bank 180,000 Disposals 100,000 Plant & Equipment Acc Depreciation A/C 1/12/xx Disposals 60,000 1/4/xx 31/12/xx Balance 370,000 P&L (10%) 83,000 Acc Dep 60,000 Bank 45,000 Disposal A/C 1/4/xx Cost 31/12/xx P&L (profit) 100,000 1/12/xx 5,000 1/12/xx Bank A/C 1/4/xx Balance 1/12/xx Disposal 200,000 1/10/xx 45,000 P&Equip 180,000 Revaluation 1. 2. 3. 4. Debit/Credit Cost A/C Giving it current value Debit Acc Dep A/C Reducing Dep to zero Double entry in Revaluation Reserve A/C Balance = SFP Equity: Revaluation Reserve SCI Profit/Loss on Revaluation Upward Revaluation • Cost 500,000 • Depreciation 100,000 • Revaluation 700,000 • Dr Cost • Dr Dep • Cr Rev Res Plant & Equipment Cost A/C 31/12/xx Balance 500,000 31/12/xx 31/12/xx Revaluation Reserve 200,000 Balance c/d 700,00 Plant & Equipment Acc Depreciation A/C 31/12/xx Revaluation Reserve 100,000 31/12/xx Balance c/d 100,000 Buildings 200,000 Acc Dep 100,000 Revaluation Reserve A/C 31/12/xx Balance c/d 300,000 31/12/xx 31/12/xx Statement of Comprehensive Income (extract) Statement of financial position (extract) Property, plant and equipment 700,000 Other Incomes Gain on Revaluation 300,000 Equity: Revaluation Surplus 300,000 Downward Revaluation • Buildings cost 500,000 • Depreciation 100,000 • Revaluation 460,000 • Cr Cost • Dr Dep • Dr/Cr Rev Res Plant & Equipment Cost A/C 31/12/xx Balance 500,000 31/12/xx Revaluation Reserve 40,000 31/12/xx Balance c/d 460,000 Plant & Equipment Acc Depreciation A/C 31/12/xx Revaluation Reserve 100,000 31/12/xx Balance c/d 100,000 Acc Dep 100,000 Revaluation Reserve A/C 31/12/xx Building 40,000 31/12/xx 31/12/xx Balance c/d 60,000 Statement of Comprehensive Income (extract) Statement of financial position (extract) Property, plant and equipment 460,000 Other Incomes: Gain on Revaluation 60,000 Equity: Revaluation balance 60,000