FHA Updates Overview (PowerPoint)

advertisement

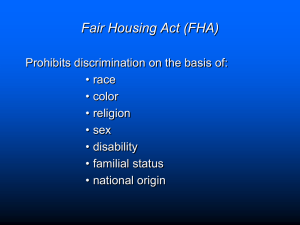

Overview of the recent… FHA UPDATES Offered by… FIRST MORTGAGE CORPORATION May 15, 2014 Desktop Underwriter is a registered trademark of Fannie Mae. Loan Prospector is a registered trademark of Freddie Mac. This presentation is a summary and is not complete. This information is for mortgage professionals only and should not be distributed to or used by consumers or other third-parties. Information is accurate as of the date shown below and is subject to change without notice. 05/15/2014 AGENDA Introduction FHA Updates ML 2014-02 (January 21, 2014) Reminders • ML 2013-24, 2013-26 (August 15, 2013) FMC’s Manual Overlays FAQ’s and Resources… FMC Support FHA UPDATES - Understanding new FHA Mortgagee Letters INTRODUCTION to First Mortgage Corporation • First Mortgage Corporation is an independent residential Mortgage Banking firm with branch offices located throughout the west. • Founded in 1975, FMC is a direct-lending mortgage banker approved as a lender and/or loan servicer by the Federal Housing Administration (FHA); the Veterans Administration (VA); the Federal National Mortgage Association (Fannie Mae); the Government National Mortgage Association (Ginnie Mae); the National Homebuyers Fund (NHF); and many other major secondary market institutions. First Mortgage Corporation is currently rated the #3 FHA Lender in CA; Top 50 in the Nation! • Having funded in excess of $20 billion in residential real estate loans, FMC has assisted thousands of families with their mortgage needs. FMC enables families to enjoy the American Dream of Homeownership…“it’s the only thing we do.” • FMC has a longstanding tradition of providing unparalleled customer service and a reputation built on adding value to the home loan process. That’s why FMC should be considered…“YOUR FIRST LENDING RESOURCE”. FHA UPDATE – Understanding FHA Mortgagee Letters Clarification of Mortgagee Letter… 2014-02 MORTGAGEE LETTER FHA UPDATES - Understanding new FHA Mortgagee Letters Manual Underwriting Mortgagee Letter 2014-02 Manual Underwriting Explains maximum qualifying ratios for all manually underwritten loans based on the minimum decision credit score Revises and clarifies the compensating factors that must be cited in order to exceed FHA’s standard qualifying ratios for manually underwritten loans Explains the new reserve requirement for manually underwritten loans involving 1-2 unit properties ML is not applicable to: Non-credit qualifying FHA to FHA Streamline refinance loans. FHA UPDATE – Understanding FHA Mortgagee Letters Definition: Manually Underwritten Loans Definition Manually Underwritten loans include: Loans involving borrowers without a credit score; not scored against FHA’s TOTAL Scorecard Loans receiving a Refer recommendation from FHA’s TOTAL Scorecard Loans receiving an Accept recommendation from FHA’s TOTAL Scorecard, but which have been downgraded to a Refer by the underwriter Loans with an Accept recommendation that is downgraded to a Refer, must be underwritten in accordance with all provisions of this ML FHA UPDATE – Understanding FHA Mortgagee Letters Definition: Minimum Decision Credit Scores Definition Minimum Decision Credit Score: HUD 4155.1 Chapter 4, Section A.1.j states that: If 3 scores are available, use the middle score If 2 scores are available, use the lesser of the two scores If 1 score is available, that one score is used If multiple borrowers exist Determine the minimum decision score for each borrower Use the lowest minimum decision score for all borrowers If multiple borrowers exist, and one or more borrowers have zero scores (using alternative/non-traditional tradelines) Use the lowest minimum decision score of the borrower(s) with credit score(s) to determine the maximum ratios For pricing purposes, use the lowest known middle score of all borrowers (N/A vs 0) FHA UPDATE – Understanding FHA Mortgagee Letters Definition: Reserves Definition Reserves: Sum of verified and documented borrower funds; MINUS Sum the borrower is required to pay at closing, including the cash investment, closing costs, prepaid expenses, any payoffs that are a condition of loan approval, and any other expense required to close the loan; BUT NOT INCLUDING The amount of cash taken at settlement in cash-out transactions or incidental cash received at settlement in other loan transactions, gift funds in excess of the amount required for the cash investment and other expenses, equity in another property, and borrowed funds from any source FHA UPDATE – Understanding FHA Mortgagee Letters NEW: RESERVE REQUIREMENT Reserve Requirement – NEW All manually underwritten loans must meet or exceed the following minimum reserve requirements: 1-2 Unit Properties: Reserves must equal or exceed ONE total monthly mortgage payment 3-4 Unit Properties: Reserves must equal or exceed THREE total monthly mortgage payments *** This new policy replaces the current 2-month minimum reserve requirement for one and two unit properties for borrowers with insufficient credit. FHA UPDATE – Understanding FHA Mortgagee Letters NEW: MAXIMUM QUALIFYING RATIOS Maximum Qualifying Ratios – NEW For borrowers with Minimum Credit Decision Credit Scores below 580 or with Non-Traditional or Insufficient Credit: Total monthly mortgage payment may not exceed 31% of gross effective monthly income (33% for EEM), and Total monthly fixed payment may not exceed 43% of gross effective monthly income (45% for EEM) *** Ratios above may not be exceeded regardless of whether they meet one or more compensating factors. *** Qualifying ratios for insufficient credit borrowers are computed using income only from borrowers occupying the property and obligated on the loan. FHA UPDATE – Understanding FHA Mortgagee Letters NEW: MAXIMUM QUALIFYING RATIOS Insufficient Credit Borrowers Qualifying ratios for insufficient credit borrowers are computed using income only from borrowers occupying the property, and obligated on the loan. Non-occupant co-borrower income may not be included. *** Income from non-occupant co-borrowers may be included in the ratios for non-traditional credit borrowers. FHA UPDATE – Understanding FHA Mortgagee Letters NEW: MAXIMUM QUALIFYING RATIOS Maximum Qualifying Ratios – NEW Borrowers with Minimum Decision Credit Scores of 580 or more and “NO” compensating factors: Total monthly mortgage payment may not exceed 31% of gross effective monthly income (33% for EEM), and Total monthly fixed payment may not exceed 43% of gross effective monthly income (45% for EEM) FHA UPDATE – Understanding FHA Mortgagee Letters NEW: MAXIMUM QUALIFYING RATIOS Maximum Qualifying Ratios – NEW Borrowers with Minimum Decision Credit Scores of 580 or more provided they meet “ONE” of the comp factors below: Total monthly mortgage payment may not exceed 37% of gross effective monthly income, and Total monthly fixed payment may not exceed 47% of gross effective monthly income Acceptable Compensating factors are limited to the following: Verified and documented cash reserves that equal or exceed “3” total monthly mortgage payments (1-2 units), or that equal or exceed “6” monthly mortgage payments (3-4 units); New total monthly mortgage payment is not more than $100 or 5% higher than previous total monthly housing payment, whichever is less, and there is a documented 12-month housing payment history with no more than 1x30 day late payment. In cash-out transactions, all payments on the mortgage being refinanced must have been made within the month due for the previous 12-months Residual Income (see Residual Income slide) FHA UPDATE – Understanding FHA Mortgagee Letters NEW: MAXIMUM QUALIFYING RATIOS Maximum Qualifying Ratios – NEW Borrowers with Minimum Decision Credit Scores of 580 or more provided they meet “TWO” of the comp factors below: Total monthly mortgage payment may not exceed 40% of gross effective monthly income, and Total monthly fixed payment may not exceed 50% of gross effective monthly income Acceptable Compensating factors are limited to the following: Verified and documented cash reserves that equal or exceed “3” total monthly mortgage payments (1-2 units), or that equal or exceed “6” monthly mortgage payments (3-4 units); New total monthly mortgage payment is not more than $100 or 5% higher than previous total monthly housing payment, whichever is less, and there is a documented 12-month housing payment history with no more than 1x30 day late payment. In cash-out transactions, all payments on the mortgage being refinanced must have been made within the month due for the previous 12-months Verified and documented significant additional income that is not considered effective income; and Residual Income (see Residual Income slide) FHA UPDATE – Understanding FHA Mortgagee Letters NEW: MAXIMUM QUALIFYING RATIOS Maximum Qualifying Ratios – NEW Borrowers with Minimum Decision Credit Scores of 580 or more (with established credit lines in their own name open for at least 6-months with No Discretionary Debt (housing payment is only account with an outstanding balance and borrower can document that revolving credit has been paid off in full monthly for at least the previous 6-months): Total monthly mortgage payment may not exceed 40% of gross effective monthly income, and Total monthly fixed payment may not exceed 40% of gross effective monthly income *** For borrowers meeting this criteria, no other compensating factors are required. FHA UPDATE – Understanding FHA Mortgagee Letters NEW: MATRIX FHA Maximum Qualifying Ratio Matrix Effective 4.21.2014 FHA UPDATE – Understanding FHA Mortgagee Letters NEW: Recording Compensating Factors Recording Compensating Factors – NEW Compensating factors cited to support the underwriting decision must be recorded in the Underwriters Comments section on the LT – FHA Loan Underwriting and Transmittal Summary Documentation supporting the compensating factors cited must be included in the file; if applicable, a worksheet attached to the LT reflecting the calculation of residual income FHA UPDATE – Understanding FHA Mortgagee Letters NEW: Energy Efficient Homes Energy Efficient Homes – NEW Current policy allows borrowers who are manually underwritten with homes such as Energy Efficient Mortgages to exceed the 31/43 ratios (33/45). These borrowers may be eligible for ratios in excess of the 33/45 stretch ratios but NOT exceeding 37 and/or 47, ONLY if they have a minimum decision credit score of 580 or higher and meet at least any one of the compensating factors specified on slide 13. Ratios exceeding 37/47 (not to exceed 40 and/or 50) may be approved ONLY if they have a minimum decision credit score of 580 or higher AND meet at least any two of the compensating factors specified on slide 14. Eg: Borrower with a credit score of 570 purchasing an EEM home is capped at 33/45. Eg: Borrower with a credit score of 590 and one comp factor purchasing an EEM home can go up to 37/47 max ratios. FHA UPDATE – Understanding FHA Mortgagee Letters NEW: Documenting Comp Factors CASH RESERVES Documenting Acceptable Compensating Factors – NEW CASH RESERVES: Verified and documented cash reserves may be cited as a compensating factor subject to the following requirements: Reserves are equal to or exceed (3) total monthly mortgage payments on 1-2 units; or Reserves are equal to or exceed (6) total monthly mortgage payments on 3-4 units FHA UPDATE – Understanding FHA Mortgagee Letters NEW: Documenting Comp Factors CASH RESERVES cont’d… Documenting Acceptable Compensating Factors – NEW CASH RESERVES: Funds and/or “assets” that are NOT to be considered as cash reserves include: Gifts Equity from another property Borrowed funds Cash received at closing in a cash-out refinance or incidental cash received at closing in a loan transaction FHA UPDATE – Understanding FHA Mortgagee Letters NEW: Documenting Comp Factors CASH RESERVES cont’d… Documenting Acceptable Compensating Factors – NEW CASH RESERVES: May use a portion of a borrower’s retirement account (IRA, Thrift Savings Plan, 401k, and Keogh accounts) to calculate reserves, subject to the following conditions: Use only 60% of the vested amount in the account, less any outstanding loans (to account for withdrawal penalties and taxes). Document the existence of the account with the most recent depository or brokerage account statement. Evidence must be provided that the retirement account allows for withdrawals under conditions other than in connection with the borrower’s employment termination, retirement, or death If withdrawals can be made only in connection with employment termination, retirement, or death, the retirement account may NOT be used to calculate the borrower’s cash reserves. If any of these funds are also to be used for loan settlement, that amount must be subtracted from the amount included as reserves FHA UPDATE – Understanding FHA Mortgagee Letters NEW: Documenting Comp Factors MINIMAL INCREASE IN HOUSING Documenting Acceptable Compensating Factors – NEW MINIMAL INCREASE IN HOUSING: A minimal increase in housing payment may be cited as a compensating factor subject to the following requirements: The new total monthly mortgage payment does not exceed the current total monthly housing payment by more than $100 or 5%, whichever is less; and There is a documented twelve month housing payment history with no more than 1x30 day late payment. o In cash-out transactions, ALL payments on the mortgage being refinanced must have been made within the month due for the previous 12-months. If the borrower has no current housing payment, cannot cite this as a compensating factor FHA UPDATE – Understanding FHA Mortgagee Letters NEW: Documenting Comp Factors NO DISCRETIONARY DEBT Documenting Acceptable Compensating Factors – NEW NO DISCRETIONARY DEBT: “No discretionary debt” may be cited as a compensating factor subject to the following requirements: The borrower’s housing payment is the only open account with an outstanding balance that is not paid off monthly; The credit report shows established credit lines in the borrower’s name open for at least 6-months; and The borrower can document that these accounts have been paid off in full monthly for at least the past 6-months. Borrowers who have no established credit other than their housing payment, no other credit lines in their own name open for at least 6-months, or who cannot document that all other accounts are paid off in full monthly for at least the past 6months, do not qualify under this criterion. Credit lines not in the borrower’s name but for which he or she is an authorized user do not qualify under this criterion FHA UPDATE – Understanding FHA Mortgagee Letters NEW: Documenting Comp Factors SIGNIFICANT ADDITIONAL INCOME Documenting Acceptable Compensating Factors – NEW SIGNIFICANT ADDITIONAL INCOME NOT REFLECTED IN GROSS EFFECTIVE INCOME: Additional income from bonuses, overtime, part-time or seasonal employment that is not reflected in gross effective income can be cited as a compensating factor subject to the following requirements: Must verify and document that the borrower has received this income for at least 1-year, and it will likely continue; and The income, if it were included in gross effective income, is sufficient to reduce the qualifying ratios to not more than 37/47. Income from non-borrowing spouses or other parties not obligated for the mortgage may not be counted under this criterion. This compensating factor may be cited ONLY in conjunction with another compensating factor when qualifying ratios exceed 37/47 but are not more than 40/50. FHA UPDATE – Understanding FHA Mortgagee Letters NEW: Documenting Comp Factors RESIDUAL INCOME Documenting Acceptable Compensating Factors – NEW RESIDUAL INCOME: Residual income may be cited as a compensating factor provided it can be documented and it is at least equal to the applicable amounts for household size and geographic region found on the Table of Residual Incomes by Region found in the VA Pamphlet 26-7 (see separate slide). FHA has modeled the calculation of residual income on underwriting guidance provided by VA. FHA is also using tables from the VA guidelines for the determination of whether residual income is sufficiently high to qualify as a compensating factor. FHA UPDATE – Understanding FHA Mortgagee Letters Calculating Residual Income Calculating Gross Monthly Income Calculating Monthly Expenses Residual Income Table RESIDUAL INCOME FHA UPDATES - Understanding new FHA Mortgagee Letters NEW: RESIDUAL INCOME Calculating Residual Income: Residual Income is calculated as follows: Calculate the total gross monthly income for all occupying borrowers. Deduct the following items from the gross monthly income: Residual Income, Deductions from Gross Monthly Income State Income Taxes Federal Income Taxes Municipal or other Income Taxes Retirement or Social Security Proposed total monthly fixed payment Estimated maintenance and utilities Job related expenses (eg., child care) Subtract the sum of the deductions from the table above from the total gross monthly income of all occupying borrowers. The balance is residual income. FHA UPDATE – Understanding FHA Mortgagee Letters NEW: RESIDUAL INCOME cont’d… Calculating Gross Monthly Income: Gross monthly income should be calculated for the occupying borrowers ONLY!!! Do not include bonus, part-time, or seasonal income that does not meet the requirements for effective income Do not include income from non-occupying co-borrowers, cosigners, non-borrowing spouses, or other parties not obligated on the mortgage. Because taxes are taken into account in the calculation of residual income, non-taxable income may NOT be “grossed up”. FHA UPDATE – Understanding FHA Mortgagee Letters NEW: RESIDUAL INCOME cont’d… Calculating Monthly Expense: If available, use Federal and state tax returns from the most recent tax year to document state and local taxes, retirement, Social Security and Medicare. If tax returns are not available, rely upon pay stubs For estimated maintenance and utilities in all states, multiply the living area of the property (square feet) by $.14. Eg., 1,500 square feet x .14 $210.00 per month FHA UPDATE – Understanding FHA Mortgagee Letters NEW: RESIDUAL INCOME cont’d… Using Residual Income as a Compensating Factor: To use residual income as a compensating factor, count all members of the household of the occupying borrowers without regard to the nature of their relationship and without regard to whether they are joining on title or the note. Exception: As stated in the VA Guidelines, you may omit any individuals from “family size” who are fully supported from a source of verified income which is not included in effective income in the loan analysis. These individuals must voluntarily provide sufficient documentation to verify their income to qualify for this exception. From the table on the next slide, select the applicable loan amount, region and household size. If residual income equals or exceeds the corresponding amount on the table, it may be cited as a compensating factor. FHA UPDATE – Understanding FHA Mortgagee Letters NEW: RESIDUAL INCOME cont’d… FHA UPDATE – Understanding FHA Mortgagee Letters NEW: RESIDUAL INCOME cont’d… FHA UPDATE – Understanding FHA Mortgagee Letters Clarification of Mortgagee Letters… ML 2014-24 & ML 2014-25 ML 2014-26 MORTGAGEE LETTER FHA UPDATES - Understanding new FHA Mortgagee Letters ML 2013-24 & ML 2013-25 Mortgagee Letter 2013-24 and 2013-25 (TOTAL) Handling of Collections, Judgments, Disputed Accounts Amends guidance on collection and disputed accounts Clarifies guidance on judgments Effective for Case #’s assigned on or after October 15, 2013 Affects all FHA mortgage programs Excludes non-credit qualifying streamline refinances and HECM’s Excludes medical collections and medical charge-offs FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-24 & ML 2013-25 Lender Requirements Expanded Lender Requirements = Credit Analysis: Manually underwritten loans • Disregard for financial obligations • Inability to manage debt • Extenuating circumstances • Borrower must provide LOE and supporting documentation Capacity Analysis: • Effect of collections and judgments on ability to repay o Payment in full o Payment arrangements – Document proof of pay arrangement o No payment arrangements – 5% payment in DTI o Include non-purchasing spouse collections in Community Property States Downgrade to manual may be required FHA UPDATE – Understanding FHA Mortgagee Letters Capacity Analysis: COLLECTIONS With/ DU APPROVAL Cumulative total < $2,000: no additional requirements Cumulative balances totaling => $2,000: Include actual payment, or payment equal to 5% of cumulative outstanding balances With/ MANUAL Underwriting Cumulative balances totaling => $2,000 must either be: Paid in full prior to or at closing with satisfactorily source funds, or Enter into payment arrangement and qualify with the monthly payment, or • “Approve/Eligible”: no additional requirements Qualify with a monthly payment equal to 5% of the total outstanding balances • “Refer”: downgrade to manual underwrite Collections of non-purchasing spouse in a community property states must be included in cumulative balance unless excluded by state law May not pay down below $2,000 to qualify May not pay down below $2,000 to qualify FHA UPDATE – Understanding FHA Mortgagee Letters Capacity Analysis: JUDGMENTS With/ DU APPROVAL Required to be paid in full With/ MANUAL UNDERWRITING Required to be paid off, except if the borrower has entered into a payment agreement: Provide evidence of the payment agreement, and Evidence paid as agreed for 3-months PRIOR to credit approval Pre-payment of scheduled payments is NOT allowed Judgments of non-purchasing spouse in a community property state must be paid in full, or meet the exception guidance for judgments above, unless excluded by state law FHA UPDATE – Understanding FHA Mortgagee Letters Capacity Analysis: DISPUTED ACCOUNTS Mortgagee Letter 2013-24 Disputed derogatory credit accounts – INCLUDE in the $1,000 cumulative total • Disputed charge-off accounts • Disputed collection accounts • Disputed accounts with lates in the last 24 months Non-derogatory disputed accounts – EXCLUDE from the $1,000 cumulative total • Disputed accounts with zero balance • Disputed accounts with late payments aged 24+months • Disputed accounts that are current and paid as agreed Non-purchasing spouse in community property states – exclude from cumulative $1,000 benchmark Disputed accounts not indicated on credit report - exclude FHA UPDATE – Understanding FHA Mortgagee Letters Capacity Analysis: ‘DEROGATORY’ DISPUTED ACCOUNTS With/ DU APPROVAL Cumulative total < $1,000: No additional requirements With/ MANUAL Underwriting Cumulative total => $1,000: Downgrade to manual Letter of explanation from borrower with supporting documentation Determine if resulting from: Derogatory account no longer disputed: Same as manual • Disregard for financial obligations • Inability to manage debt • Extenuating circumstances Derogatory account no longer disputed: Obtain new credit report with dispute removed Re-run through TOTAL FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 BACK TO WORK Initiative Mortgagee Letter 2013-26 Back to Work Initiative Intended for borrowers who have experienced an Economic Event as a result of the recent recession: • Loss of employment, or • Loss of income, or • Combination of both which resulted in: At least a 20% reduction in household income For at least 6 months minimum FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 Cont’d… Mortgagee Letter 2013-26 Back to Work – Extenuating Circumstances Recognizes effect of recent recession on borrower’s ability to meet their previous financial obligations Continues FHA’s mission to strengthen communities by supporting access to affordable mortgage finance programs Establishes requirements to assist borrowers to become homeowners Available for Purchase money loans only Effective for case #’s assigned on or after August 15, 2013 through September 30, 2016 FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 Eligibility Back to Work - Eligibility To be eligible for the program, borrowers must document: 1. Experienced an “Economic Event” resulting in loss of employment, or a 20% reduction in household income was beyond their control, and 2. Demonstrate full recovery from the event, and re-established satisfactory credit for the most recent 12-months, and 3. Completion of housing counseling through a HUD-approved counseling agency, or combination of homeownership education and counseling, provided by state housing agencies, approved intermediaries or their sub-grantees, or through an on-line course FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 Household Income vs. Member Household Income: • Gross Income of the borrower and all household members for purposes of evaluating loss of income • Only the income from the borrower (not Household Income) may be used to qualify for the new loan • Household Member: • Individual residing at the borrower’s primary residence at the time of the economic event, AND who was a co-borrower on the borrower’s previous mortgage • Non-occupant co-borrowers are excluded • Household members not going on the new loan must still provide authorization to verify loss of employment/income • Must document occupancy of household members if not readily available FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 Qualifying Requirements Borrowers may be considered for an FHA-insured mortgage (1yr seasoning only) if we can document: Default was due to an economic event beyond the borrower’s control • Loss of employment, or • Loss of income, or • Combination of both which resulted in at least a 20% reduction in household income for a minimum of 6 months o 6-mos is counted from Month of Loss to re-establishment of satisfactory credit for a minimum of 12 months Satisfactory re-established credit for recent 12 months Borrower completes housing counseling FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 Clarifications Economic Event – occurrence beyond the borrower’s control resulting in Loss of Employment Loss of Income • Includes Overtime, Bonus Income, PT Income, 2nd Job, • Must have 2-yr history of getting it before the event Combination of both resulting in reduced household income Household income reduction Reduction of 20% or more for a period of at least 6-months or more Covered individuals Borrowers and Co-borrowers on the loan, AND Must be a household member (non-occupant co-borrowers are excluded) Covered extenuating circumstances (standard requirement) Bankruptcies (2yr seasoning) Foreclosures (3yr seasoning) Deed in Lieu (3yr seasoning) Short Sales (3yr seasoning unless they meet ML 2009-52) Collections/Judgments (affects credit analysis and may require payoff) FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 Loss of Employment Loss of Employment must be verified and documented with: A written Verification of Employment (VOE) evidencing the termination date. In cases where the prior employer is no longer in business: Written termination notice, or Other publicly available documentation of the business closure, and Documentation of receipt of unemployment income FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 Loss of Household Income Loss of Household Income must be verified and documented with: A written Verification of Employment (VOE) evidencing prior income; or Signed tax returns or W-2’s evidencing prior income Seasonal Income Loss: 2-yr history of seasonal employment in same field just prior to loss of income plus documentation requirement above Part-Time Income Loss: 2-yr history of continuous part-time employment just prior to the loss of income plus documentation requirement above Note: Household members not going on the current loan should still be analyzed (employment/income) to document reduction in household income at the time of the event FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 Satisfactory Credit Requirement Satisfactory Credit Requirement is met if: Credit history shows no current late housing payments or installment debts, and no major derogatory credit issues on revolving accounts in the last 12-months Any open mortgage is current and shows 0x30 within the last 12-months • Mortgages have been brought current through loan modification (may be temporary or permanent) as long as payments have been made per the modification agreement Borrower’s with non-traditional credit history must document NTC covering 12-months including: • NO lates on rental housing payments, and • NO more than 1x30 day late on payments due other creditors, and • NO collections/court records reporting (other than medical and/or identity theft) FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 Credit Analysis 1. Analyze and document: All delinquent/derogatory credit including collections, judgments, BK’s, FC’s, DIL’s, SS’s, and other credit problems to determine if the associated credit deficiencies were because of the • Economic event, or • Inability to manage debt, or • General disregard for managing financial obligations 2. Determine if the derogatory credit was the result of an Economic Event. Determine that: a) Borrower had satisfactory credit PRIOR to the event onset, b) Derogatory credit occurred AFTER the event onset, and c) Borrower has re-established satisfactory credit for minimum of 12-months FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 Seasoning Requirements Foreclosures or Deed-In-Lieu: Minimum of 12-months have elapsed since the date of FC/DIL, and Foreclosure or Deed-in-lieu was the result of the economic event Short Sale: Minimum of 12-months have elapsed since the date of sale, and Short Sale was the result of the economic event Chapter 7 Bankruptcy: Minimum of 12-months have elapsed since date of discharge, and BK was the result of the economic event Chapter 13 Bankruptcy – verify and document that: Chapter 13 was discharged prior to application and all required payments were made on time, or For open Chapter 13s, at least 12-mos have elapsed and all required payments were made on time. If the BK wasn’t discharged prior to application, written permission is required from BK court to proceed with new loan, and BK was the result of the economic event Collections and Judgments Verify and document all collections and judgments were due to economic event FHA UPDATE – Understanding FHA Mortgagee Letters ML 2013-26 Counseling Requirements Housing Counseling Requirements Housing Counseling - Borrower must: • Receive homeownership counseling or a combination of homeownership education and counseling • Each participant must receive at a minimum ONE HOUR of one-on-one counseling from a HUD approved counseling agency. For a list of HUD approved agencies Go to http://www.hud.gov/ or call (800) 569-4287 • Must be completed no less than 30 days, but no more than 6months prior to the date of the application • May be in person, via telephone, via internet • Housing Counseling Fees apply FHA UPDATE – Understanding FHA Mortgagee Letters FMC’s Manual Overlays Pending Guidance Resources including FAQ’s FMC Support MISCELLANEOUS FHA UPDATES - Understanding new FHA Mortgagee Letters FMC’s Manual Overlays Effective: May 1, 2014 FHA UPDATE – Understanding FHA Mortgagee Letters FMC’s Manual Overlays Effective: May 1, 2014 FHA UPDATE – Understanding FHA Mortgagee Letters FMC’s Manual Overlays Effective: May 1, 2014 FHA UPDATE – Understanding FHA Mortgagee Letters Pending Guidance Seller Concessions – Proposed changes were published in Federal Register Discusses reducing the maximum seller concession to 3% or $6,000, whichever is greater Limiting seller concessions to closing costs, prepaids, discount points, UFMIP, and interest rate buy down, no condo, HOA fees or interest payments FHA UPDATE – Understanding FHA Mortgagee Letters RESOURCES & FAQ’s • • HUD Website • www.hud.gov • 4155.1 – Mortgage Credit Analysis • Mortgagee Letters FHA Loan Limits • • FHA Approved Condos – • • http://entp.hud.gov/idapp/html/hicostlook.cfm https://entp.hud.gov/idapp/html/condlook.cfm FHA FAQ • www.hud.gov/answers FHA UPDATE – Understanding FHA Mortgagee Letters FMC SUPPORT WEB SITE Go to our FMC websites for: 1. RATE SHEET 2. TRAINING MATERIALS 3. GUIDELINES 4. FORMS 5. CALCULATORS 6. TOOLS 7. MARKETING TRAININGS First Mortgage offers FREE Weekly ONLINE Trainings See June Training schedule at FMC websites for upcoming trainings Trainings for May 2014: • 5/6 – Product Overview • 5/7 • 5/13 –VA Training • 5/15 – FHA Updates • 5/20 – Point Training (FMC Employees ONLY) CHF Platinum SUPPORT Retail: Contact Loan Help Wholesale/Correspondent: Contact your FMC A/E For help with your: • Scenarios • Pricing / Fees • Guidelines • Loan Submissions • Trainings FHA UPDATE – Understanding FHA Mortgagee Letters THANK YOU FOR YOUR BUSINESS… On behalf of First Mortgage, thank you for joining today’s training and we hope the information provided will help you build your business! The main purpose of First Mortgage Corporation’s (FMC) training documents is to assist real estate and mortgage professionals in developing entry-level competence with loan programs. While FMC staff, employees, contractors and contributors take care to ensure the accuracy of the content of training documents, FMC makes no warranties as to the accuracy of the information contained within these materials. Furthermore, every user of this material uses it understanding that he or she must still conduct his or her own original legal research, analysis and drafting. In addition, every user must refer to the relevant legislation, case law, administrative guidelines, rules and other primary sources. FMC specifically disclaims any liability for any loss or damage any user may suffer as a result of information contained within this training material. While the information contained in FMC’s training material addresses guidelines and issues surrounding mortgage programs, these materials do not constitute legal advice. All non-legal professionals are urged to seek legal advice from a lawyer. FHA UPDATE – Understanding FHA Mortgagee Letters